crypto blog

Anchor Protocol rebounds sharply after falling 70% in just two months — what’s next for ANC?

Anchor Protocol (ANC) returned to its bullish form this May after plunging by over 70% in the previous two months. Pullback risks ahead ANC’s price rebounded by a little over 42.50% between May 1 and May 6, reaching $2.26, its highest level in three weeks. Nonetheless, the token experienced a selloff on May 6 and May 7 after ramming into what appears to be a resistance confluence. That consists of a 50-day exponential moving average (50-day EMA; the red wave) and 0.786 Fib line of the Fibonacci retracement graph, drawn from the $1.32-swing low to the $5.82-swing high, as shown in the chart below. ANC/USD daily price chart. Source: TradingView A continued pullback move could see ANC’s price plunging towards its rising trendline support, coinciding with the floor near&...

The United States turns its attention to stablecoin regulation

The United States continues to be a global leader in embracing the cryptocurrency industry thanks to the work of Sen. Patrick Toomey, with the White House being at the forefront of crypto regulation. Last year, President Joe Biden signed a $1.2 trillion bipartisan infrastructure bill — and it included some new legislation that would impact the crypto sector. And more recently, the U.S. president announced a “whole-of-government” approach to regulating cryptocurrency in an across-the-board executive order directing multiple government agencies to answer specific questions on cryptocurrencies. The U.S. for the last year has clearly been seeking to help make the crypto industry more sustainable, which will make it significantly easier for cryptocurrency platforms to operate. But the Stablecoi...

Bitcoin clings to $36K as data suggests BTC price sell-off came from short-term holders

Bitcoin (BTC) found a new home at $36,000 into May 7 as volatility finally cooled into the weekend. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Terra down at least $250 million in crunch Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling the $36,000 mark overnight after losing 12% in just 72 hours. Still near its lowest levels since late February, the pair had nonetheless avoided a rematch of 2022 lows at the time of writing despite low-volume weekend market conditions. In his latest Twitter update on May 6, popular trader Anbessa highlighted the planned support level to buy Bitcoin in what he described as a “fakeout” — a zone beginning at just under $33,000. #Bitcoin Update Twitter friendly, easy words BTC support, BTC fakeou...

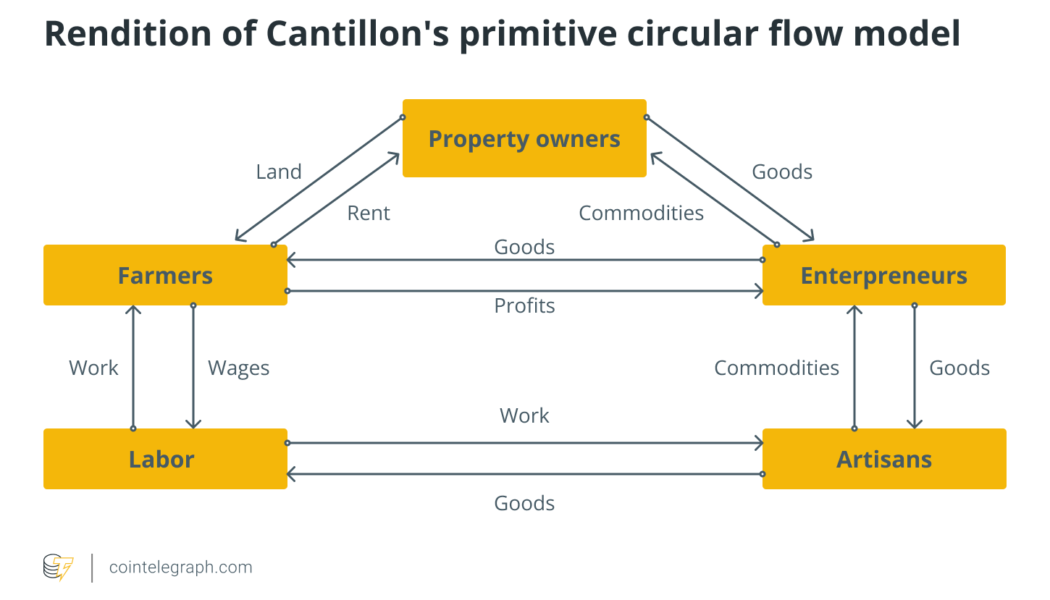

Bitcoin’s Velvet Revolution: The overthrow of crony capitalism

If Karl Marx and Friedrich Engels were somehow transported to the present day and given a newspaper, the apparent lack of class conflict would probably make the revolutionaries think they’d won. They would see a society split on all manner of subjects — from identity politics to the correct COVID-19 strategy — but virtually silent on the eternal struggle between labor and capital, the oppressors and the exploited. How different it would be if they’d returned just 10 years ago when the Occupy movement was in full swing, with tent cities springing up in protest against crony capitalism, corporate greed and a reckless, out-of-control financial sector. A decade on, the same problems persist, but they’ve become a barely discernible background hum amid the roiling, raging culture wars. The 1% ma...

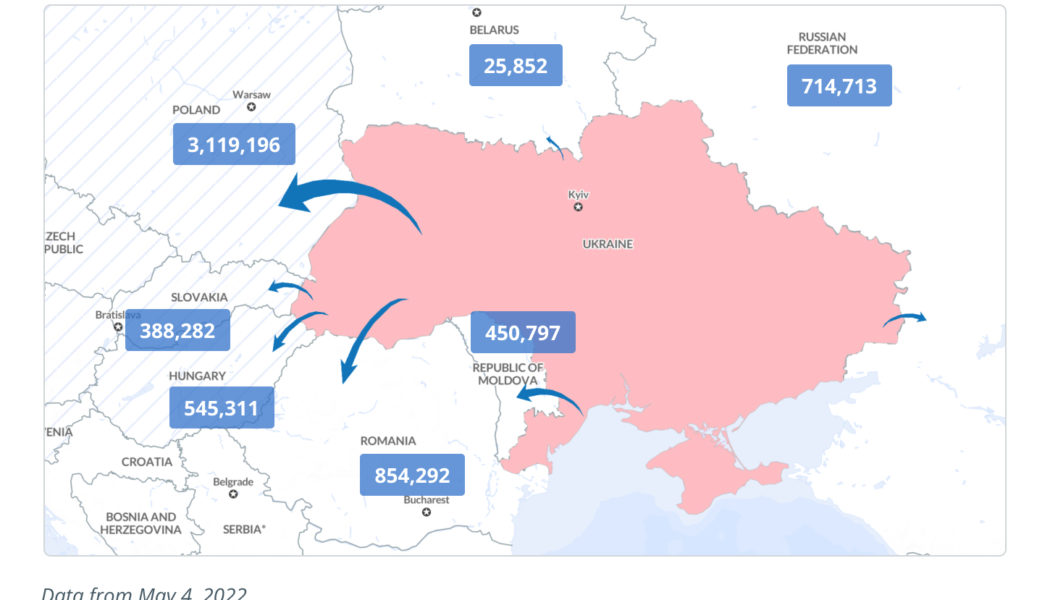

The Ukraine invasion shows why we need crypto regulation

Shortly after the Russian invasion of Ukraine began, the Ukrainian government tweeted a request for funds in the form of Bitcoin (BTC), Ether (ETH) and Tether (USDT). The total received now stands at more than $60 million, according to Michael Chobanian, founder of Kyiv-based Kuna Exchange and president of the Blockchain Association of Ukraine, who posts regular updates via his Twitter account. Unlike support being pledged by governments around the world, these funds were available to the Ukrainian military within minutes — not weeks. For individuals, cryptocurrencies can provide a potentially life-saving method of escape from crises. A computer programmer from Lviv said he had escaped the fighting thanks to Bitcoin. With cash machines heavily restricted and massive queues at the banks, he...

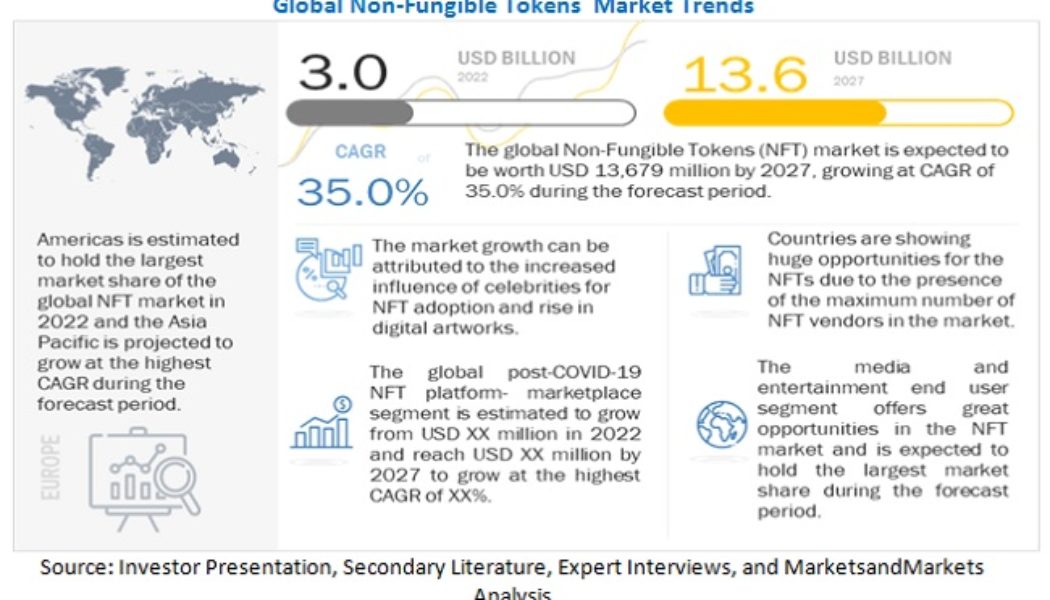

NFT market well-positioned to grow 35% into a $13.6B industry by 2027

Reflecting the growing interest in the non-fungible token (NFT) space among today’s investors, new research predicts that the existing $3 billion market size will reach $13.6 billion by the end of 2027. For the next five years, the key factors tied to the global NFT boom continue to factor in the growing involvement of mainstream influencers, gaming communities and the rising demand for digital artworks. Interestingly enough, research firm MarketsandMarkets envisions several other factors that will contribute to the explosive growth of the NFT market, including its increasing use cases in supply chain management, retail and fashion. Global NFT market trends. Source: MarketsandMarkets Some of the other catalysts well-positioned to further speed up the growth of the NFT market are metaverse ...

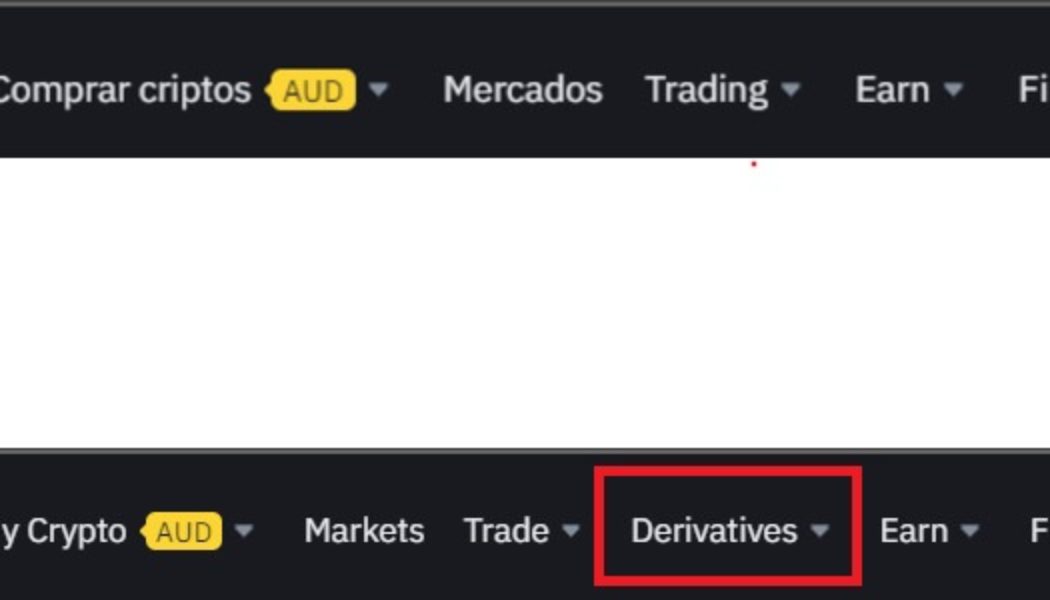

Binance reportedly halts crypto derivatives service in Spain

Binance stands as one of the most persistent crypto exchanges when it comes to gaining regulatory approval and operational licenses from regulators across the world. In this effort to operate as a fully licensed financial institution, the exchange has stopped offering it’s crypto derivatives services in Spain as it reportedly awaits approval from the Spanish regulator, Comisión Nacional del Mercado de Valores (CNMV). As evidenced by Binance’s official Spanish website, the crypto exchange removed the derivatives drop-down menu, which is still available on the global version. According to local news publication La Información, the move to hide derivatives offering in Spain comes as a way to comply with the requirements set by CNMV, a.k.a. the National Securities Market Commission....

Amid crypto hype, Google’s cloud unit creates Web3 team

Google’s cloud unit announced on Friday the formation of an internal team that will build services for blockchain developers and those running blockchain-based applications. This comes amid an explosion of interest, activity and adoption of crypto and Web3 tools from traditional sectors of the economy. Web3 infrastructure of the future Vice president at Google Cloud, Amit Zavery, reportedly told his team in an email on Friday of the aim to make the Google Cloud platform the first choice for developers in Web3. Google Cloud is the company’s suite of cloud computing services, on which all Google-related projects run. As per CNBC, his email read: “While the world is still early in its embrace of Web3, it is a market that is already demonstrating tremendous potential with many customers asking...

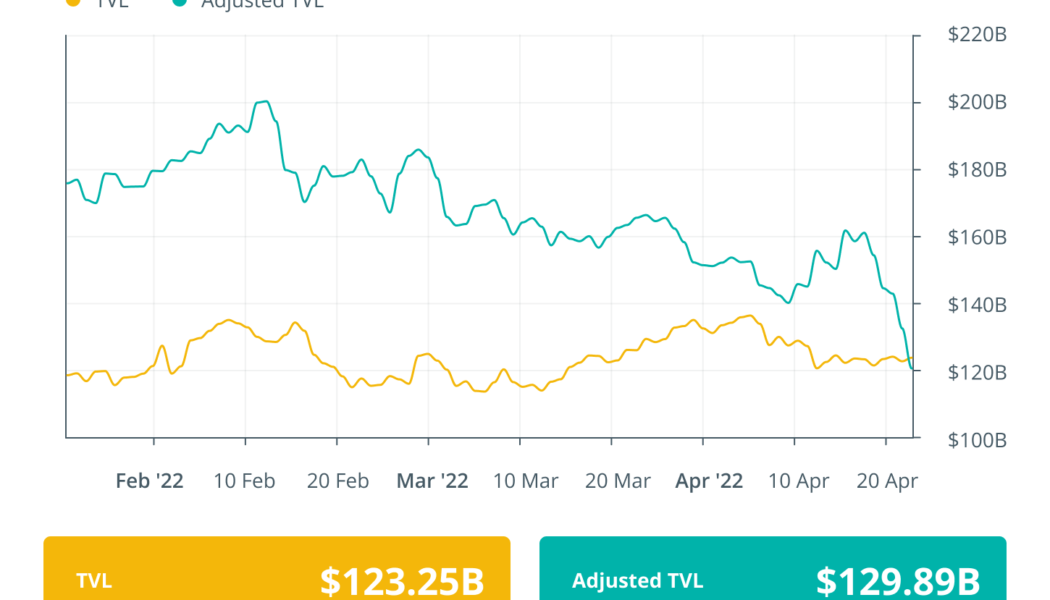

Finance Redefined: DeFi protocols lost $1.6B, EU to rethink DeFi approach, and more

The past week in the decentralized finance (DeFi) ecosystem saw many new developments from an adoption perspective and protocol developments. The European Commission added a new chapter on DeFi, showing the growing impact of the nascent ecosystem, while a county in the United States State of Virginia wants to put its pension fund in a DeFi yield. DeFi exploits became the center of attention again as recent research shows that in the first two quarters of 2022, DeFi protocols have lost $1.6 billion to various exploits. Rari Fuze hacker, who got away with $80 million worth of funds, was offered a $10 million bounty. The DeFi tokens also made a bullish comeback toward the end of the past week. However, the overall weekly performance remained in the red. European Commission report suggests ret...

Crypto mixer sanctioned by US Treasury for role in Axie Infinity hack

The United States Treasury Department Office of Foreign Assets Control (OFAC) announced Friday that it was sanctioning cryptocurrency mixer Blender.io for its role in laundering proceeds from the hacking of Axie Infinity’s Ronin Bridge. North Korean state-sponsored hackers Lazarus Group have been identified as the perpetrators of the attack. Treasury Under Secretary for Terrorism and Financial Intelligence Brian E. Nelson said in a statement: “Today, for the first time ever, Treasury is sanctioning a virtual currency mixer. […] We are taking action against illicit financial activity by the DPRK and will not allow state-sponsored thievery and its money-laundering enablers to go unanswered.” Under the sanctions, all Blender.io property in the United States or in the possession of...

Crypto Biz: The real reason crypto hodlers should care about the Federal Reserve, April 28–May 4, 2022

Wall Street’s slow embrace of crypto means we all have to start watching the Federal Reserve again. Cointelegraph parsed through the latest Federal Open Market Committee (FOMC) policy statement on Wednesday to try and uncover some nuggets of useful information. You can think of it as an exercise in financial esoterics to uncover the hidden meaning behind the Fed’s decision-making. As it turns out, the decision to raise interest rates by 50 basis points was already expected, so the actual FOMC document provided very little new information. But, Fed Chair Jerome Powell sparked a late rally in crypto and stocks on Wednesday when he said 75 basis-point increases aren’t on the table. You wanted the institutions to adopt crypto, didn’t you? Now, the asset class is trading almost in lockstep with...

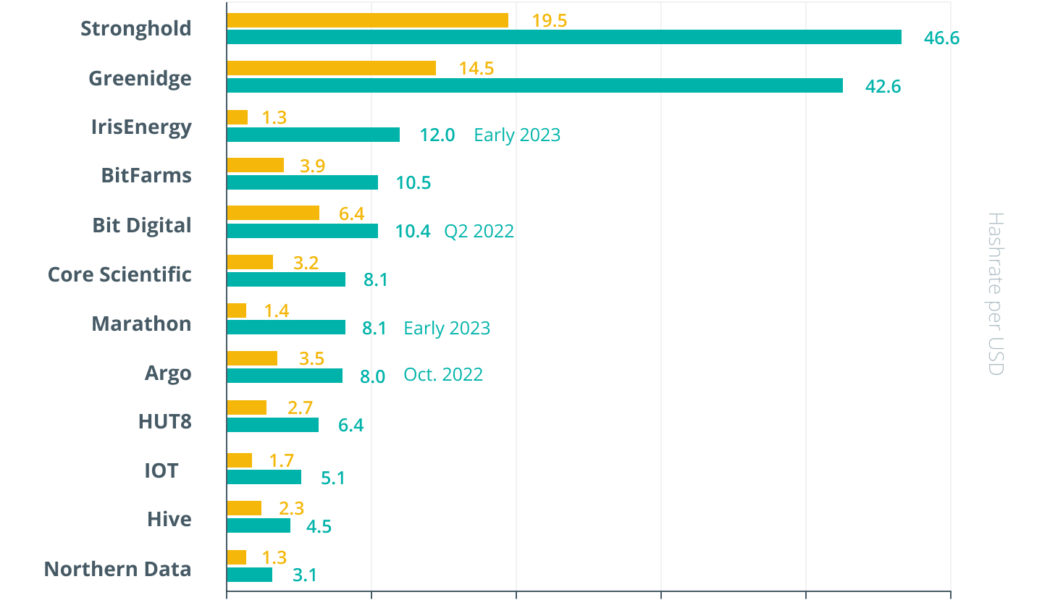

Controlling 17% of BTC hash rate: Report on publicly listed mining firms

The Cointelegraph Research Terminal, the leading provider of premium databases and institutional-grade research on blockchain and digital assets, has added a new report to its expanding library. The latest paper looks at a particular group of players in the Bitcoin (BTC) mining industry. Published by crypto consulting firm Crypto Oxygen, the report highlights the current landscape of publicly listed crypto mining companies that control approximately 17% of the total hash rate of the entire Bitcoin network. The crypto mining industry is a quickly growing and evolving sector. In January this year, a United States-based company Core Scientific went public via a special purpose acquisition company (SPAC) merger, making it the largest publicly traded crypto mining company in revenue and h...