crypto blog

Solana suffers 7th outage in 2022 as bots invade the network

The Solana network suffered a seven-hour outage overnight between Saturday and Sunday due to a large number of transactions from the nonfungible token (NFT) minting bots. A record-breaking four million transactions, or 100 gigabits of data per second, congested the network causing validators to be knocked out of consensus resulting in Solana going dark at roughly 8:00 pm UTC on Saturday. It wasn’t until seven hours later on Sunday, 3:00 am UTC that validators were able to successfully restart the main network. Validator operators successfully completed a cluster restart of Mainnet Beta at 3:00 AM UTC, following a roughly 7 hour outage after the network failed to reach consensus. Network operators an dapps will continue to restore client services over the next several hours. https://t.co/ez...

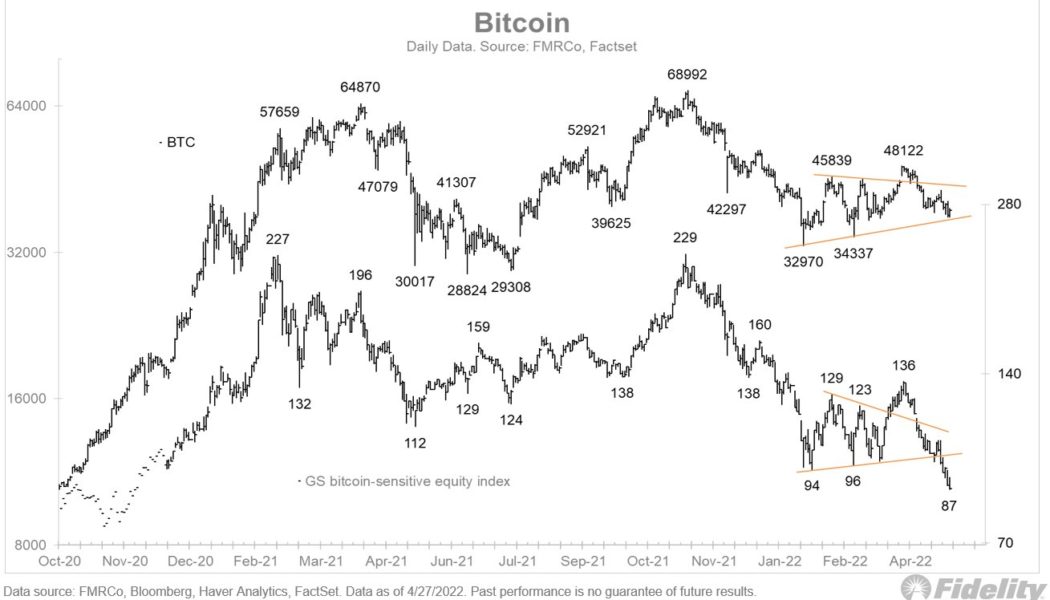

Fed ‘will determine the fate of the market’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week with much to make up for after its worst April performance ever. The monthly close placed BTC/USD firmly within its established 2022 trading range, and fears are already that $30,000 or even lower is next. That said, sentiment has improved as May begins, and while crypto broadly remains tied to macro factors, on-chain data is pleasing rather than panicking analysts. With a decision on United States economic policy due on May 4, however, the coming days may be a matter of knee-jerk reactions as markets attempt to align themselves with central bank policy. Cointelegraph takes a look at the these and other factors set to shape Bitcoin price activity this week. Fed back in the spotlight Macro markets are — as is now the standard — on edge this week as another U....

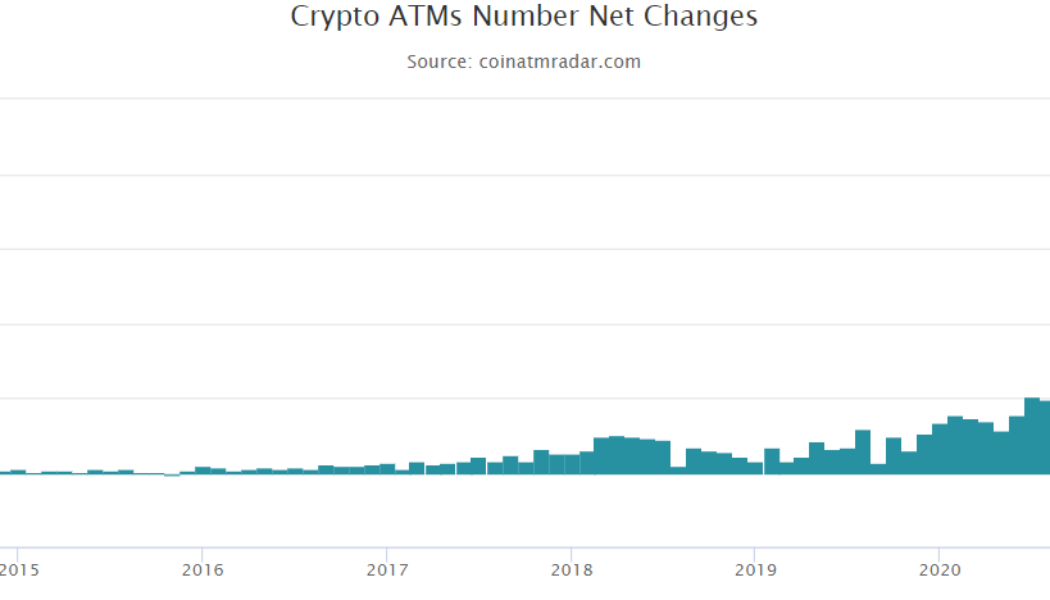

Bitcoin ATM installation slowdown continues for 4th month in 2022

April 2022 marked the fourth consecutive month of a slowdown in the installation of Bitcoin (BTC) ATMs, ever since the slowdown began at the start of the year. BTC ATMs serve a crucial purpose for the Bitcoin economy, helping users physically retrieve or deposit BTC holdings against the corresponding cash reserves. Net change of cryptocurrency machines number installed and removed monthly. Source: Coin ATM Radar Based on the data provided by Coin ATM Radar, the year 2021 saw the highest global increase in the BTC ATM installations, with August witnessing its peak of 2,037 ATMs net change. Starting in January 2022, the crypto ATM net change fell down to 1,687 from December’s high of 1,969 ATMs. Ever since, the net change in crypto ATM has maintained a downward trajectory, recording three-di...

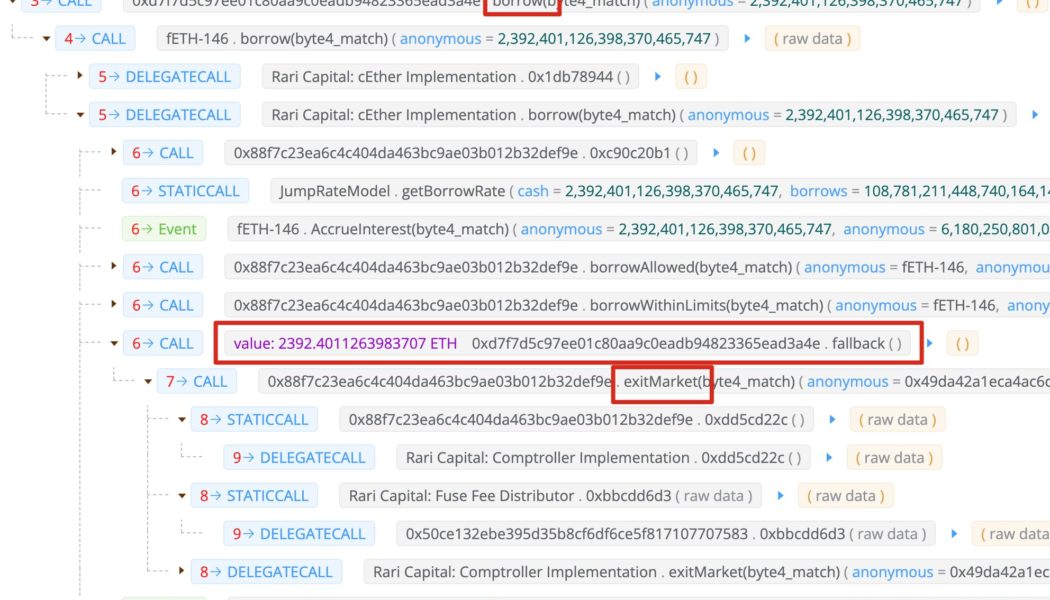

Rari Fuze hacker offered $10M bounty by Fei Protocol to return $80M loot

Decentralized finance (DeFi) platform Fei Protocol offered a $10 million bounty to hackers in an attempt to negotiate and retrieve a major chunk of the stolen funds from various Rari Fuse pools worth $79,348,385.61 — nearly $80 million. On Saturday, Fei Protocol informed its investors about an exploit across numerous Rari Capital Fuse pools while requesting the hackers to return the stolen funds against a $10 million bounty and a “no questions asked” commitment. We are aware of an exploit on various Rari Fuse pools. We have identified the root cause and paused all borrowing to mitigate further damage. To the exploiter, please accept a $10m bounty and no questions asked if you return the remaining user funds. — Fei Protocol (@feiprotocol) April 30, 2022 While the exact losses from the explo...

Top 5 cryptocurrencies to watch this week: BTC, LUNA, NEAR, VET, GMT

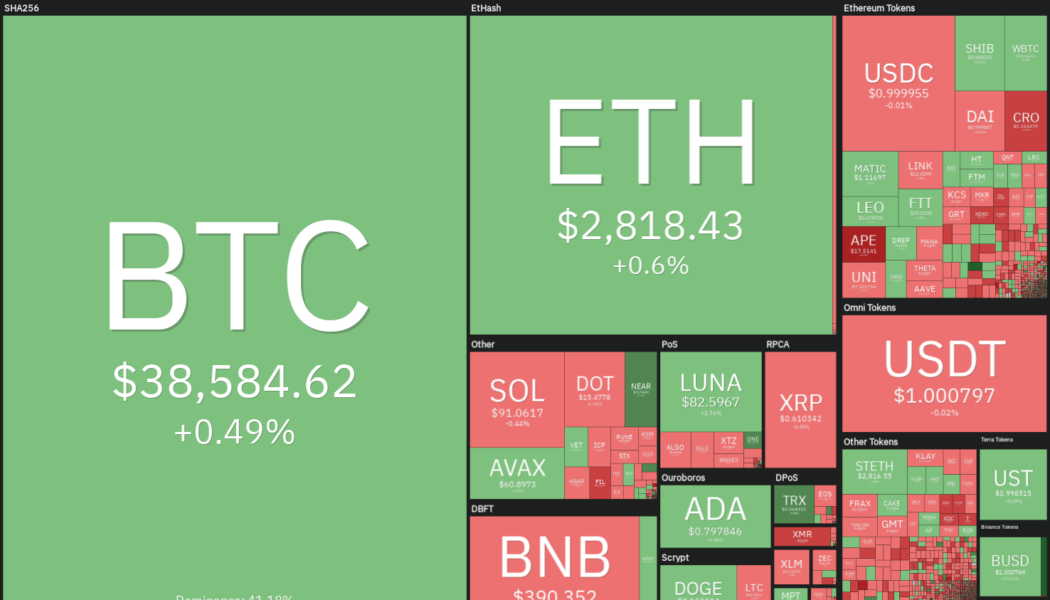

The month of April has been a forgettable one for equities and cryptocurrency investors. Bitcoin (BTC) plummeted 17% in April to record its worst ever performance in the month of April. Similarly, the Nasdaq Composite plunged 13.3% in April, its worst monthly performance since October 2008. However, a major positive for crypto investors is that Bitcoin is still above its year-to-date low near $33,000. In comparison, the Nasdaq 100 has hit a new low for 2022 while the S&P 500 is just a whisker away from making a new year-to-date low. This suggests that Bitcoin has managed to avoid a major sell-off, indicating demand at lower levels. Crypto market data daily view. Source: Coin360 Along with Bitcoin, Ether (ETH) has also managed to sustain well above its year-to-date low. Accor...

Self-custody, control and identity: How regulators got it wrong

The recent European Union proposal requiring centralized crypto exchanges and custodial wallet providers to collect and verify personal information about self-custodial wallet holders shows the dangers of recycling traditional finance (TradFi) rules and applying them to crypto without appreciating the conceptual differences. We can expect to see more of this as countries look to implement the Financial Action Task Force (FATF) Travel Rule, initially designed for wire transfers, to transfers of crypto assets. The (missing) link between self-custody, control and identity The aim of the proposed EU rules is “to ensure crypto-assets can be traced in the same way as traditional money transfers.” This assumes that each self-custodial wallet can be linked to someone’s verifiable identity and that...

NFTs, DAOs and the importance of roadmaps

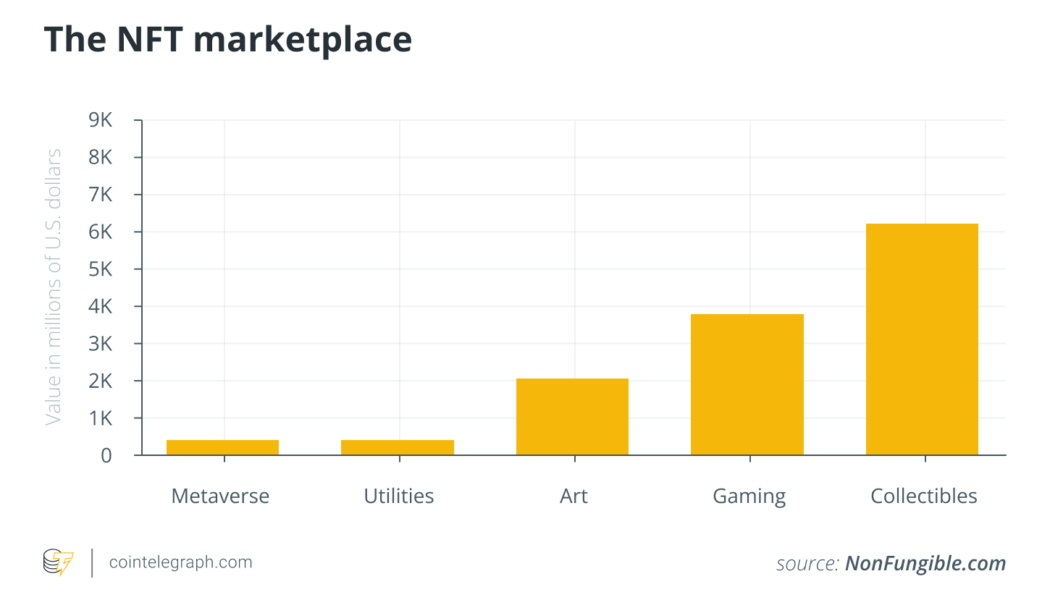

When CryptoKitties came out, it was hilarious to me. “Wait a second,” I thought. “So, you mean this JPEG can have sex with this JPEG and make a new baby JPEG? Say what?” When CryptoPunks started out in 2017, they seemed silly to many. They were just 128 X 128 pixels. Who cares about that? They weren’t really cool until Gary Vee had a mastermind call with influencers and said, “Crypto Punks are going to be huge, go get a bunch of them.” They went in and cornered the market and raised the prices. Bored Apes was right around the same time as Gary was launching his project. They got big influencers together and said, “Let’s get these.” And so they all bought those, the prices rose over time. At one time, these cost 2 Ether (ETH). That was a lot back then! Now the floor is like 80 ETH. All thes...

Go green or go home? What the NY State mining moratorium could mean for crypto industry

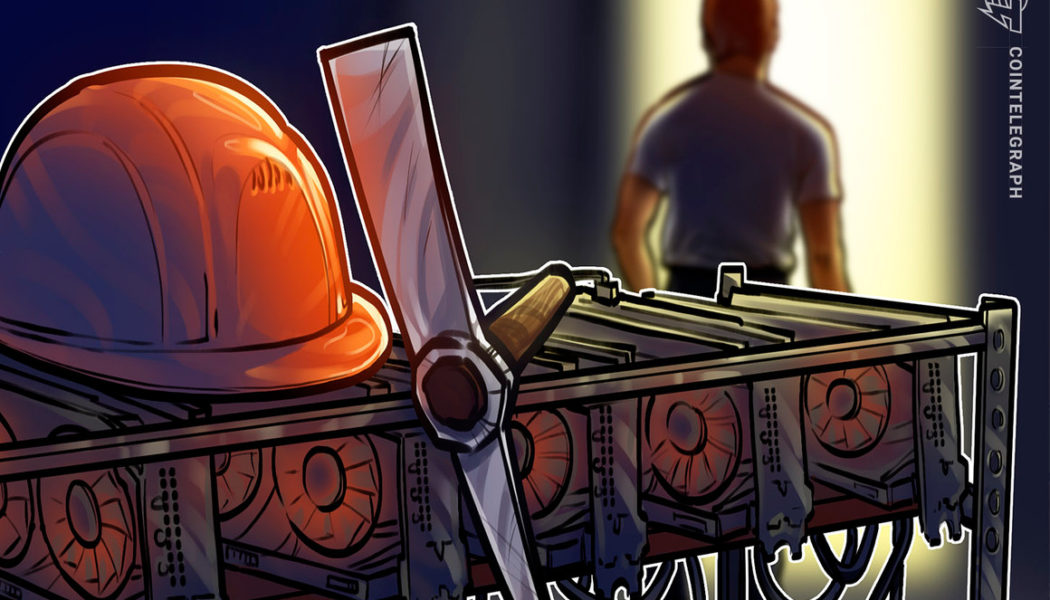

On April 26, the State of New York put itself at the forefront of the regulatory struggle with crypto, as its Assembly voted for a two-year moratorium on crypto mining operations that use energy generated by fossil-fuel power plants. Depending on how one looks at it, this development could either signal a new alarming legislative trend or a trigger that would accelerate the digital asset industry’s movement toward a more sustainable path. Moratorium with further evaluation The lower chamber of the NY state legislature, the Assembly, passed a bill that would put a two-year hold on any new mining operations using the proof-of-work (PoW) consensus mechanism, as well as on the renewal of existing permits. The bill, S6486D/A7389C, is marketed by its sponsors as a necessary act of complian...

6 Questions for Dawn Newton of Netki

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Dawn Newton, co-founder and chief operating officer of Netki — a remote digital identity verification technology provider intended to facilitate compliance with KYC/AML regulations. Dawn Newton is the chief operating officer and co-founder of Netki, the Know Your Customer and Anti-Money Laundering technology provider purpose-built for blockchain. Dawn’s work is driven by her desire to increase global access to crypto assets in a sustainable, secure and equitable manner. At Netki, Dawn has contributed to the development of OnboardID, which facilitates identity verification and onboarding for ...

Warning: Smartphone text prediction guesses crypto hodler’s seed phrase

Seed phrases, a random combination of words from the Bitcoin Improvement Protocol (BIP) 39 list of 2048 words, act as one of the primary layers of security against unauthorized access to a user’s crypto holdings. But, what happens when your “smart” phone’s predictive typing remembers and suggests the words next time you try to access your digital wallet? Andre, a 33-year-old IT professional from Germany, recently posted on the r/CryptoCurrency subreddit after discovering his mobile phone’s ability to predict the entire recovery seed phrase as soon as he typed down the first word. As a fair warning to fellow Redditors and crypto enthusiasts, Andre’s post highlighted the ease with which hackers can use the feature to drain a user’s funds just by being able to type the first word out of the B...