crypto blog

Liquidity has driven DeFi’s growth to date, so what’s the future outlook?

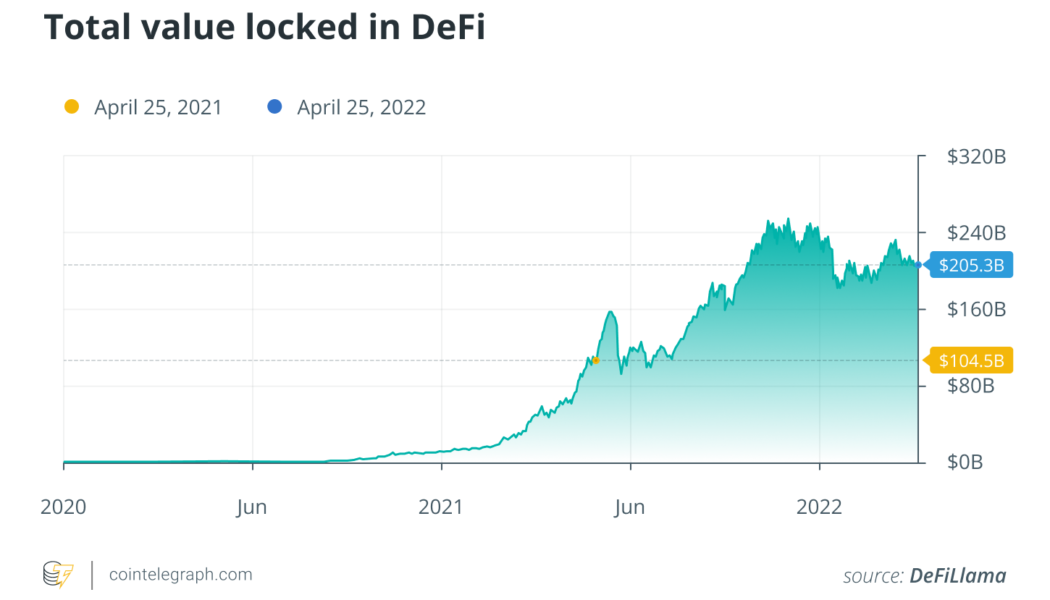

In mid-February 2020, the total value locked within decentralized finance (DeFi) applications first exceeded $1 billion. Fueled by the DeFi summer of 2020, it wouldn’t even take a year before it multiplied 20-fold to reach $20 billion and only another ten months to reach $200 billion. Given the pace of growth so far, it doesn’t seem outlandish to imagine the DeFi markets hitting a trillion dollars within another year or two. We can attribute this monumental growth to one thing — liquidity. Looking back, DeFi’s expansion can be defined in three eras, each representing another significant development in removing barriers to liquidity and making the markets more attractive and efficient to participants. DeFi 1.0 — Cracking the chicken and egg problem DeFi protocols existed prior to 2020, but ...

Price analysis 4/29: BTC, ETH, BNB, SOL, LUNA, XRP, ADA, DOGE, AVAX, DOT

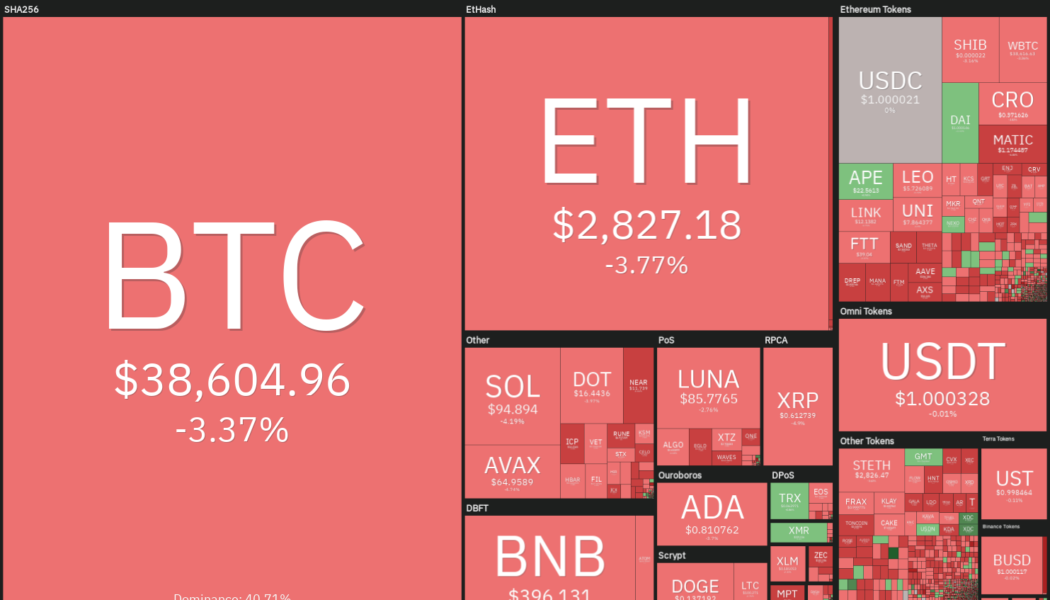

The U.S. dollar index (DXY) turned down from its 20-year high on April 29 but that has not changed the bearish price action seen in Bitcoin (BTC) and the U.S. equity markets. Equities remain under pressure and this week, Amazon stock saw its biggest intraday drop since 2014 after uncertainty over the U.S. Federal Reserve’s tightening measures placed investor sentiment back into choppy waters. If Bitcoin extends its correction, on-chain analysis platform Whalemap believes that the $25,000 to $27,000 zone may be the best place “to go all-in” on Bitcoin. Long-term investors do not appear to be panicking over the current weakness in Bitcoin and on-chain data from CryptoQuant shows that the combined BTC reserves of 21 crypto exchanges has plummeted to levels not seen since September 2...

Finance Redefined: Samson Mow’s DeFi question, Fireblocks expands to institutional and more

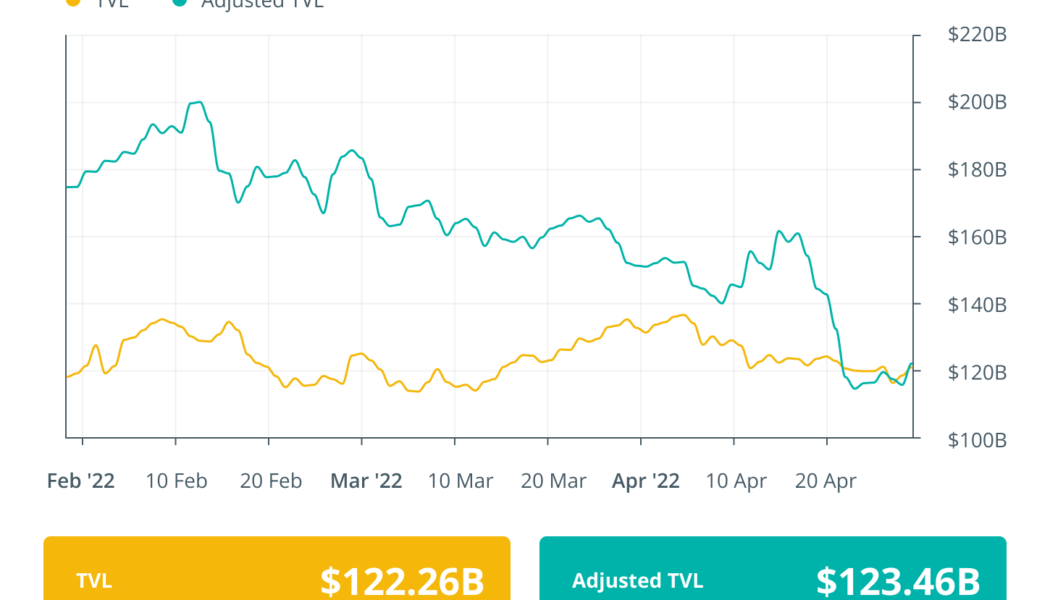

The week was filled with several new project developments and key updates from leading decentralized applications (DApps) and decentralized finance (DeFi) protocols. Fireblocks has expanded its institutional access to Terra’s DeFi ecosystem and Solana partnered with the Notifi network to improve the abysmal participation rates in governance votes. We will also look into the Cointelegraph research into the Terra ecosystem’s future and see if it can sustain the current growth. Samson Mow, the former executive at Blockstream, questions the decentralized aspect of the DeFi ecosystem. Top DeFi tokens saw another week of bearish price action despite several new developments and barring a few, the majority of the tokens in the top-100 registered double-digit losses over the past week. Fireblocks ...

Bitcoin retreats toward $38K after Friday sparks losses for ‘nearly everything’ outside China

Bitcoin (BTC) fell into the May holiday weekend after late trading saw crypto losses echo “basically everything.” BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Macro keeps BTC firmly in its place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing at $38,180 on Bitstamp to circle $38,600 on April 30. The pair had performed weakly on April 29, and this nonetheless echoed the vast majority of traditional assets — with the notable exception of Chinese equities. “Almost everything went down today besides gold, platinum, and Chinese stocks,” economist Lyn Alden summarized. With that, the S&P 500 finished on April 29 down 3.6% and the Nasdaq 100 down 4.5%. Hong Kong’s Hang Seng, on the other hand, gained 4% overall. The United States Dollar I...

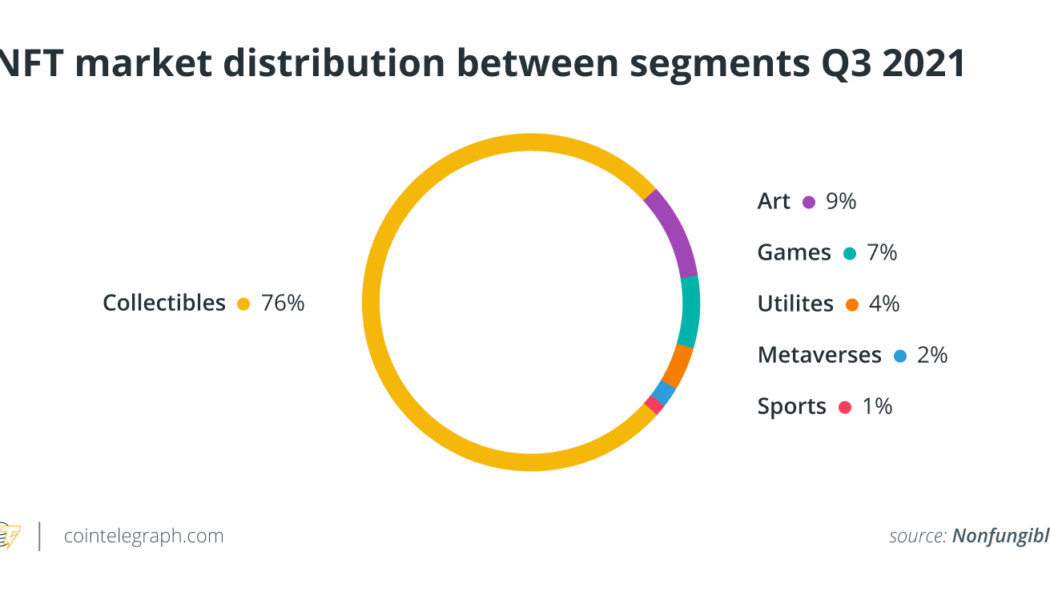

Entering NFTs: Understanding the environmental impact of digital collectibles

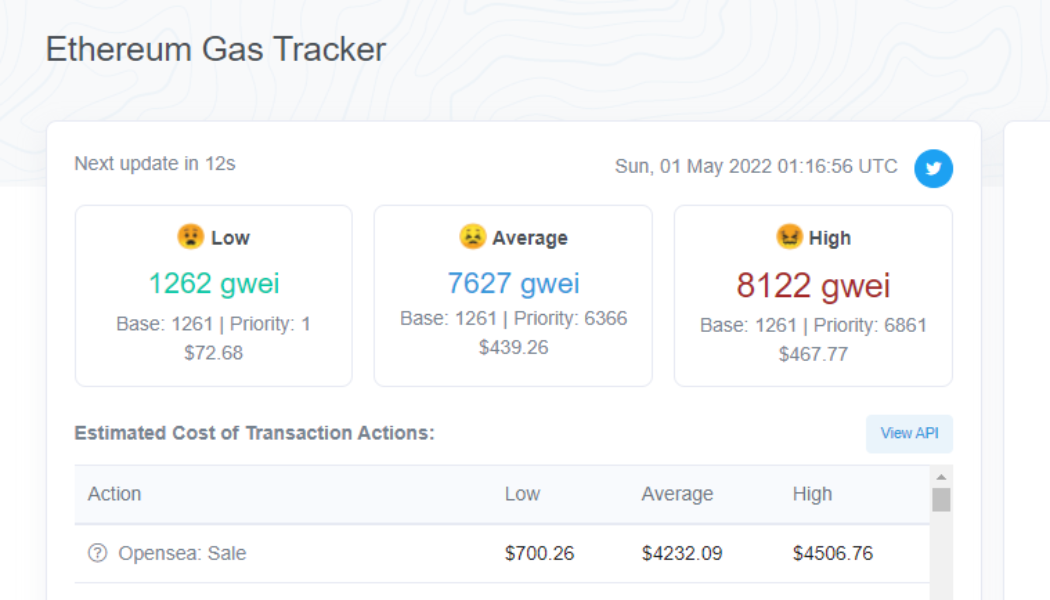

NFTs have taken pop culture by storm over the past year. On a nearly daily basis, a new celebrity announces their interest in the emerging technology — usually by dropping an NFT collection. From Quentin Tarantino’s Pulp Fiction NFTs to Snoop Dogg’s NFT music label, a wide range of notable names are beginning to realize the creative value that NFTs offer. While celebrity involvement has played a key role in raising mainstream awareness about the array of NFT use cases and investment potential, it has also drawn the ire of some fans. In the midst of the hype surrounding the NFT phenomenon, apprehensions have grown about the technology’s environmental impact. In one notable example, the popular South Korean boy band BTS faced significantpushback a few months ago in response to their plans to...

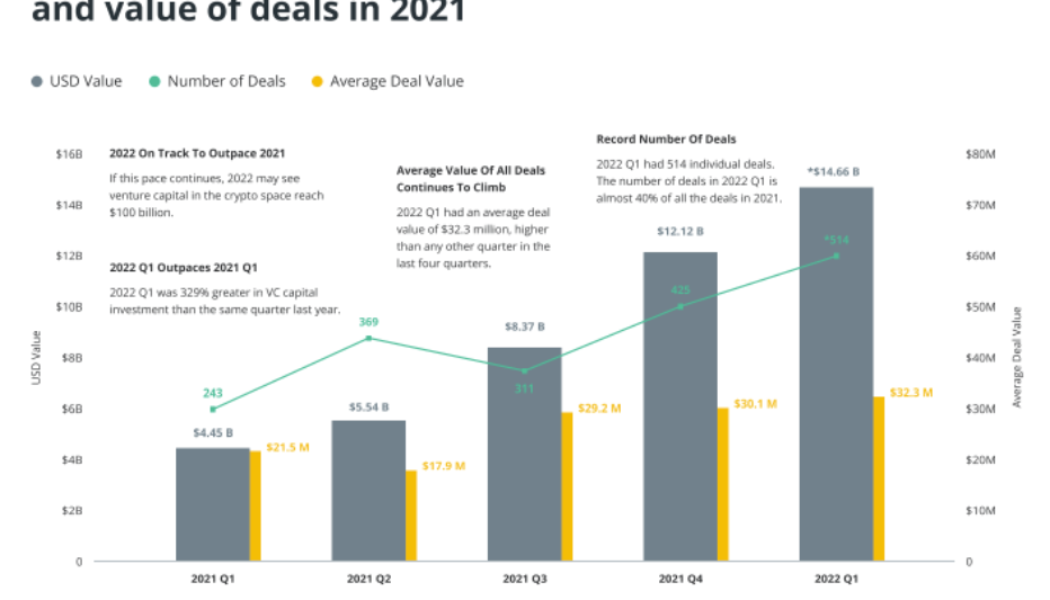

VC Roundup: Gaming, crypto fintech and blockchain infrastructure dominate venture capital rounds

Cryptocurrency markets remain caught in a macro-based downtrend, with Bitcoin (BTC) and Ether (ETH) showing further signs of weakness at the end of April. But, venture capital activity in the crypto and blockchain sectors is the strongest it has ever been, offering further evidence that major investors are looking beyond immediate price action and ignoring divisive bull/bear narratives. The latest edition of VC Roundup highlights the growing excitement surrounding Web3 gaming, decentralized finance (DeFi) and blockchain infrastructure. The first quarter of 2022 was brutal for crypto prices, but venture capital activity was the strongest ever. bloXroute secures $70M from major investors Blockchain distribution network provider bloXroute has raised $70 million in funding to continue de...

Smart money is accumulating Ethereum even as traders warn of a drop to $2.4K

The upcoming Ethereum merge is one of the most widely discussed topics in the crypto sector and analysts have a wide range of perspectives on how the transition to proof of stake could impact Ether’s price. ETH/USDT 1-day chart. Source: TradingView Whales accumulate ahead of the merge A deeper dive into the ongoing accumulation of Ether by whale wallets was provided by cryptocurrency intelligence firm Jarvis Labs, which posted the following chart looking at the percentage change in whale wallet holdings versus ET price. Ether whale holding change. Source: Twitter The color of the dots relates to the price of Ether, with the chart showing that whale wallets began decreasing their holdings when the price was above $4,000 and they didn’t start to reaccumulate unti...

Meta to launch metaverse hardware store, Elon Musk buys Twitter for $44B and ApeCoin pumps to new highs: Hodler’s Digest, April 24-30

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Elon Musk buys Twitter for $44B — crypto industry reacts Eccentric billionaire Elon Musk bought Twitter for around $44 billion this week, or $54.20 per share in cash. After the deal was accepted, Musk said he hoped that “even my worst critics remain on Twitter, because that is what free speech means.” The crypto industry’s reaction was mixed, with Dogecoin co-creator Jackson Palmer describing the acquisition as a “hostile takeover” antithetical to the idea of freedom, while Bitcoin bulls Anthony Pomplian...

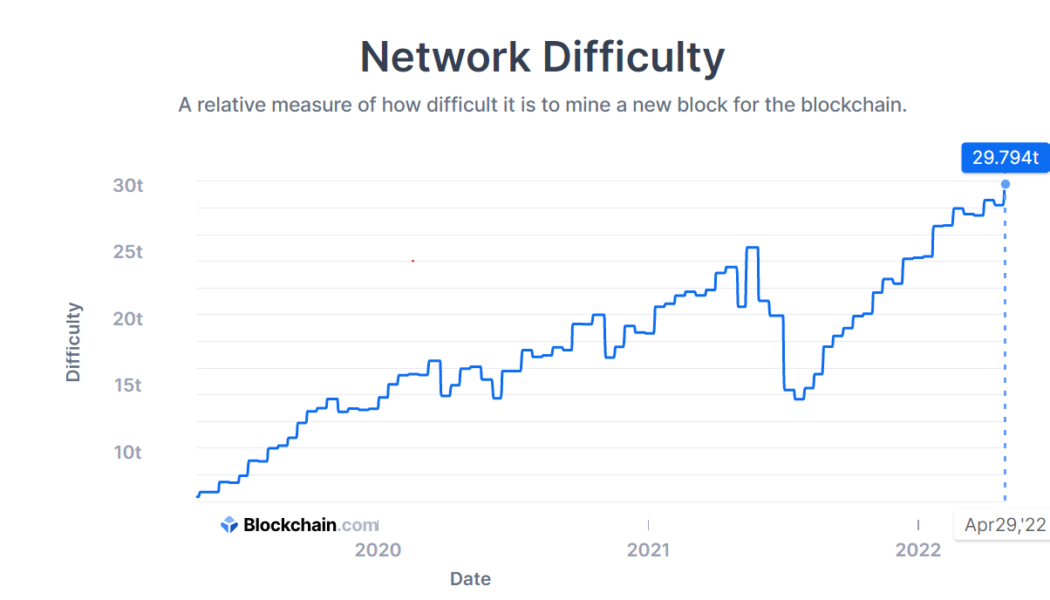

Bitcoin network difficulty breaks into a new all-time high of 29.794T

Reassuring its position as the most resilient blockchain network against attacks, the Bitcoin (BTC) network recorded a new all-time high network difficulty for the second time this month in April — jumping from its previous all-time high of 28.587 trillion to 29.794 trillion. Greater network difficulty demands greater computational power to successfully mine a BTC block, which prevents bad actors from taking over the network and manipulating transactions, also known as double-spending. As evidenced by data from blockchain.com, Bitcoin’s network difficulty has seen almost a year-long uptrend since August 1, 2021. Before that, between May and July 2021, was a timeline when BTC network difficulty fell nearly 45.5% from 25.046 trillion to 13.673 trillion — at the time raising momentary concern...

Binance to drive crypto and blockchain awareness among Indian investors

Crypto exchange Binance announced the parallel launch of three key educational initiatives to fast-track educating Indian investors and students about the cryptocurrency and blockchain ecosystem. While recognizing the importance of investors’ awareness of crypto and blockchain, Binance highlighted that Indian regulators and policymakers cite the lack of education as an area of concern, which currently hinders the widespread adoption of crypto. Primarily targeting the student demographic in India, one of the three educational initiatives launched by Binance involves the initiation of the ‘Blockchain for Good’ Ideathon, a platform for college students to come up with solutions for making crypto more accessible and inclusive. Binance also partnered with India-based crypto influencers and educ...