crypto blog

US crypto adoption remains high despite global inflation fears

A quantitative analytics report published by DappRadar has unveiled a number of revelatory behavioral market indicators for the global adoption of digital assets. The blockchain data portrays a positive sentiment for the Web3 and metaverse sectors, especially in the United States; a reactionary rise in crypto interest throughout Ukraine and Russia following the outbreak of the conflict and the impact of the well-documented surge i gas prices throughout Europe on inflationary metrics. Bar chart statistics reported a high correlation between the unfavorable economic dynamics witnessed in times of currency deflation and the interest in engaging with cryptocurrencies, with the data suggesting that the latter could serve as an investment hedge. The tumultuous 217.65% deflation of the Brazilian ...

Bitcoin disappoints on bull run as AMZN stock sees biggest 1-day drop since 2014

Bitcoin (BTC) fell into the Wall Street open on April 29 as United States markets opened to volatility, including an 11% drop in Amazon stock. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView All change at the Fed Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD dipping to $38,622 on Bitstamp Friday. Despite a let-up in the U.S. dollar’s relentless bull run, Bitcoin showed little signs of strength as it remained firmly under $40,000. Macro factors remained against the largest cryptocurrency along with risk assets more broadly, commentators noted, as the Federal Reserve reduced its balance sheet. The start of #Fed deleveraging? Fed balance sheet has shrunk for the 2nd consecutive week. Total assets now at $8,939bn, equal to 36.6% of US’ GDP vs ECB&...

Robinhood makes significant strides in crypto business in Q1 despite falling revenue

On April 28, discount-brokerage platform Robinhood published its financial results for the first quarter of 2022. Year-over-year, the firm’s net revenue declined by 43% to $299 million. Specifically, revenue from cryptocurrency trading fell by 39% to $54 million during the same period. This was partly due to a decrease in the interest in meme stocks as well as an ongoing cryptocurrency bear market that dominated much of the first three months of the year. However, despite a decrease in sales, the company’s net cumulative funded accounts rose by 27% year-over-year to 22.8 million. At the same time, total assets under custody increased 15% to $93.1 billion. Robinhood took several important steps in enhancing its crypto business. First, the firm rolled out crypto wallets to the ap...

Crypto start-up Argent announces $40 million raise

The London-based firm seeks to make it easier for users to manage its non-custodial wallet offering Part of the funds will be invested in initiatives around DeFi and Web 3 One of the co-founders noted that the firm intends to address the scalability issue of its wallet Argent, the firm behind the eponymous smart wallet, on Thursday disclosed it had completed a Series B funding round that saw it raise $40 million. Two VC firms Fabric Ventures and Metaplanet led the fundraising, which also had participation from Index Ventures, Creandum and Paradigm. Animoca Brands, Jump Crypto, and Starkware (creator of rival Ethereum-scaling solution StarkNet) featured in strategic capacities. Worth noting, StarkNet is the host of Argent’s wallet – Argent X. This explains the strategic colla...

Top metaverse tokens that will take your earnings to the next level

SAND, MANA, and ENJ are all solid metaverse tokens. Each of these tokens powers its own ecosystem and has potential for growth. As the metaverse evolves, so will their value increase. Metaverse tokens have seen numerous developments and updates. On April 25, 2022, The Sandbox announced that they are expanding on Hong Kong culture with the second part of their LAND sale, which is centered around the Mega CIty district. This led to a lot of activity in the network. Decentraland also saw numerous updates; on April 28, they announced that they are excited to attend and sponsor NFTxROADS – The NFT event in Spain. On April 25, 2022, Enjin Coin partnered with Bit2Me Global, the first cryptocurrency platform that is recognized by the Bank of Spain and a company that offers simple, secure, and...

Bipartisan bill to give CFTC authority over exchanges and stablecoins

A bipartisan group of lawmakers in D.C. introduced an updated bill on April 28 to regulate cryptocurrency developers, dealers, exchanges, and stablecoin providers, bringing them under the regulatory control of the United States Commodity Futures Trading Commission (CFTC). The Digital Commodity Exchange Act of 2022 (DCEA) was re-introduced to Congress by Republican Representatives Glenn Thompson and Tom Emmer with support from Democrat co-sponsors Darren Soto and Ro Khanna. The updated version includes a section covering stablecoin providers, who can register as a “fixed-value digital commodity operator.” These operators would be obligated to share how the stablecoin operates, retaining records for the regulator along with providing information on the assets backing the “fixed-value digital...

VeChain can be used as payment in 2M stores — and VET bridged to BNB chain

Supply chain blockchain project VeChain has announced a new partnership with crypto payment services, Alchemy Pay that will allow people to use its VET token as payment in over 2 million stores throughout 70 different countries. The news came alongside its inclusion as a supported token on the recently launched Binance Bridge 2.0. Thanks to partner @AlchemyPay, $VET can now be used to buy goods at 2 million+ stores globally! Using our advanced low-#carbon #blockchain, transactions cost fractions of a cent & are processed in seconds from any #VeChain wallet!$ACH #DeFi $VTHO #Web3https://t.co/ceeHRpcbKT — VeChain Foundation (@vechainofficial) April 27, 2022 VeChain was included in the first group of tokens to be supported on the new Binance Bridge 2.0. The Binance Bridge 2.0 provides a n...

Residents of 3 Chinese cities paying taxes and charges with digital yuan

Residents in three major Chinese cities have begun paying tax, stamp duty and social security premiums using the country’s central bank digital currency — the digital yuan (e-CNY). According to a domestic news report, a number of government agencies in the Zhejiang province — located just south of Shanghai — are currently running real world trials programs that involve citizens using the digital yuan to pay taxes. The Zhejiang Taxation Bureau is working with the country’s central bank — the People’s Bank of China (PBoC) — to explore a variety of taxation payment methods using the digital yuan. The PBoC and affiliated local government agencies are reportedly looking to the next major test for the digital yuan, the Asian Games which will take place in Hangzhou in September. Local autho...

Dogecoin Jesus? Roger Ver resurfaces on Twitter, backs DOGE over BTC

Roger Ver, an early investor and ardent promoter of Bitcoin (BTC) which earned him the moniker “Bitcoin Jesus” has resurfaced on Twitter after a year and backed Dogecoin (DOGE) in an interview, preferring it for payments over the world’s first crypto. In an interview with Bloomberg, the Bitcoin.com founder said how he was a fan of the memecoin due to its fast transaction times and low fees: “Dogecoin is significantly better, it’s cheaper and more reliable [than Bitcoin]. If I had to pick three contenders for the world’s dominant cryptocurrency, they would be Doge, Litecoin and Bitcoin Cash.” Ver also took time in the interview to voice his support for honorary Dogecoin CEO Elon Musk’s Twitter takeover. “It’ll certainly make Twitter more attractive,” said Ver. “I am really, really grateful ...

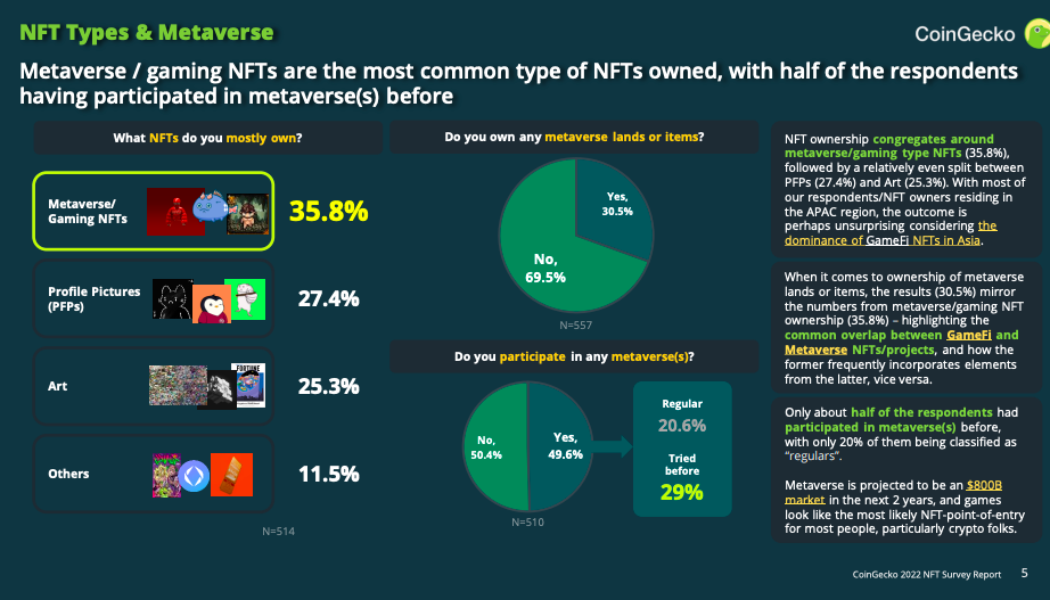

The NFT sector is projected to move around $800 billion over next 2 years: Report

Although NFTs have been a part of the cryptocurrency market since 2014, interest and adoption ha risen rapidly over the last two years. At their height in August 2021, the total trading volume of NFTs rose to over $5 billion, kickstarting what briefly came be to known as “NFT Summer”. According to a report by Coingecko, the NFT market is now expected to move more than $800 billion in the coming two years. The report, which mostly utilized investors from Asia and the Pacific, highlighted that of 871 respondents, around 72% of them already own NFT(s), with more than 50% of them declaring that they had 5 or more. As for investors, the report indicated a balance between the generations, suggesting 43.6% of NFT investors surveyed were between 18-30 years old and 45.2% are between 30-50 yea...

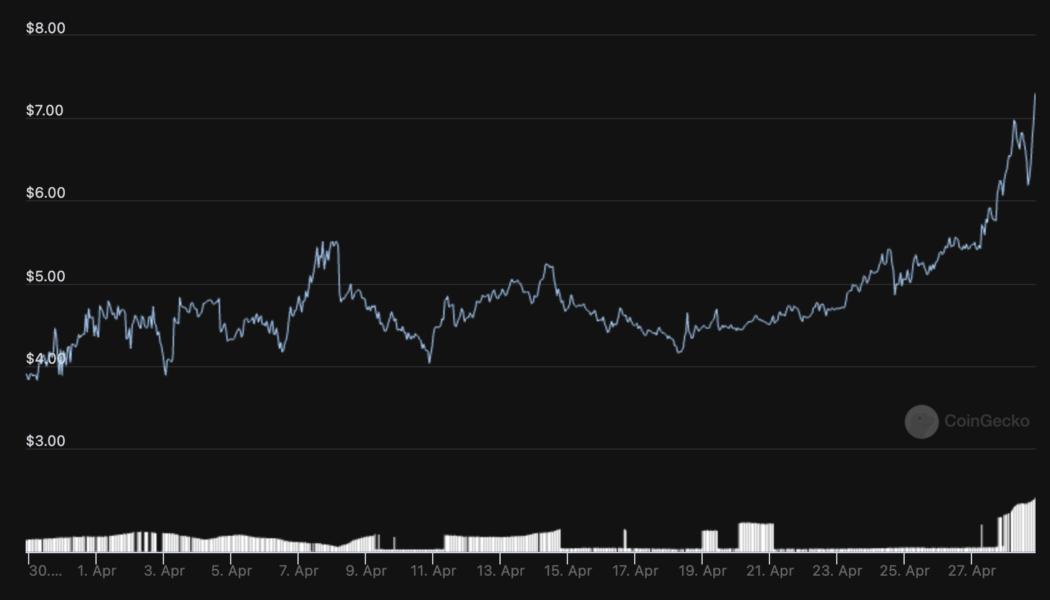

NFT traders STEPN to a new groove — Is move-to-earn the future of fitness or another fad?

Axie Infinity was a pioneer of the play-to-earn movement and the project inspired new Web3 applications that aspire to apply the earning model to their respective ecosystems. The latest project to join the move-to-earn movement is STEPN, a Solana-based Web3 application where owners of the NFT sneakers earn as they walk. STEPN has programmed a few factors that determine just how much a person can make with its sneakers and the Green Satoshi Token (GST) is STEPN’s in-game token that currently trades for $7.30. Over the last 30-days the token has surged over 77%, but is it sustainable? GST monthly price action. Source: CoinGecko What’s interesting about the move-to-earn phenomenon is that it’s essentially a form of P2E since it gamified fitness through a digital asset (the sneaker). Reg...

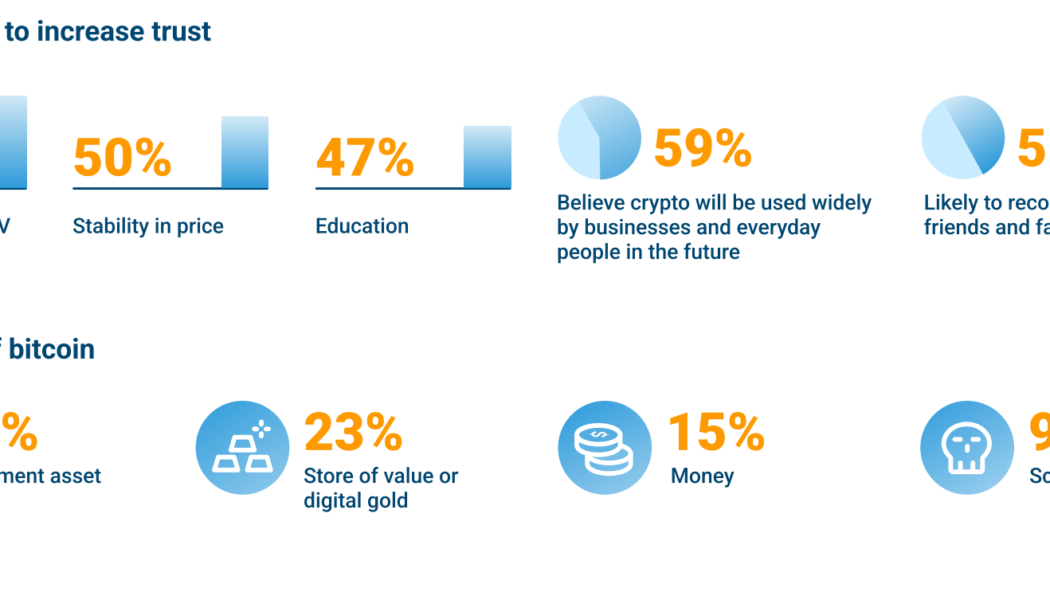

Singaporean investors’ appetite for crypto is key to mainstream adoption — Survey

As Singapore continues to play an active role in boosting crypto adoption across the Asia-Pacific region, the country’s first licensed crypto exchange Independent Reserve conducted a retail-focused survey to better understand the underlying potential of the regulated market. Independent Reserve’s survey — conducted across all age groups and genders of the Singapore population — revealed a strong affinity for various financial opportunities brought forward by decentralized finance (DeFi) and other investment opportunities. As explained by Raks Sondhi, managing director of Independent Reserve Singapore, the country’s rapid crypto adoption is driven by high level of trust and confidence in the future of crypto: “58% [Singaporeans surveyed] perceive Bitcoin as an investment asset or a sto...