crypto blog

Top smart contract platform tokens worth considering on April 25

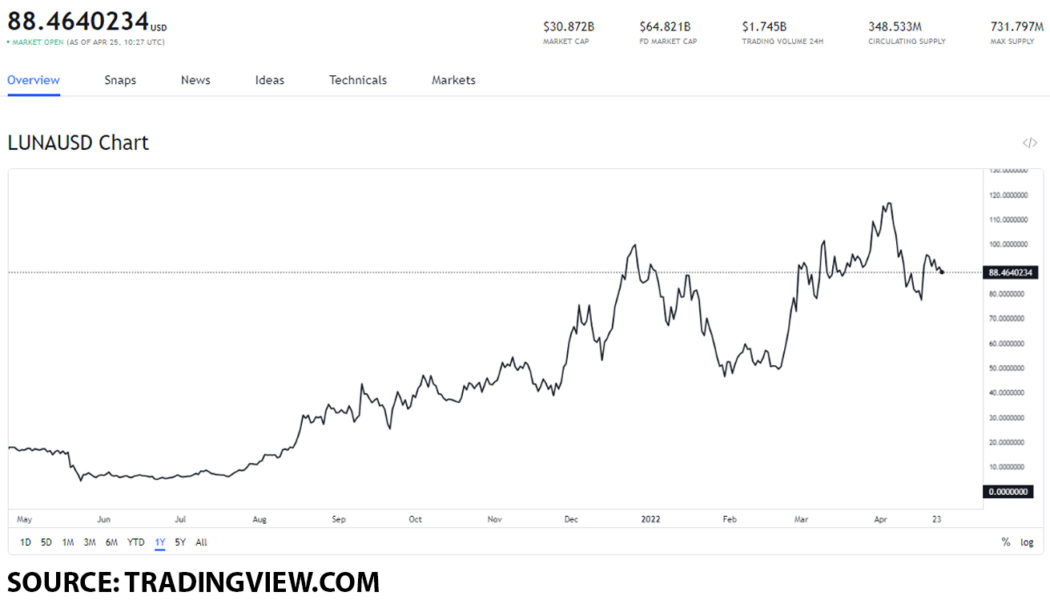

Terra (LUNA), TRON (TRX), Polkadot (DOT), Polygon (MATIC), and Elrond (EGLD) are all smart contract platform tokens. Each token has showcased a significant level of growth throughout the past month. All of these tokens can increase in value going forward and are solid options to buy on April 25. Terra (LUNA), TRON (TRX), Polkadot (DOT), Polygon (MATIC), and Elrond (EGLD) are some of the best smart contract platform tokens that you can get on April 25, 2022. We are going to go over each token individually so you can have a better perspective of what you can expect. Should you buy Terra (LUNA)? On April 25, 2022, Terra (LUNA) had a value of $88.46. The all-time high of Terra (LUNA) was on April 5, 2022, when the token reached a value of $119.18. When we look at March’s performance, Terra (LU...

Kraken awarded crypto trading license in the United Arab Emirates

Californian crypto exchange Kraken becomes the second virtual asset platform after Binance to receive regulatory approval to operate in the Abu Dhabi international financial center and free zone, Abu Dhabi Global Market (ADGM). In a CNBC interview, Kraken’s managing director Curtis Ting explains the importance of diversifying trading pairs to local currencies instead using the traditionally available United States dollar or Great British pounds in global markets. With the new operational license in Abu Dhabi, Kraken aims to better integrate with local banks and payment service providers. According to Ting, this will help the crypto exchange bring global-level liquidity to the United Arab Emirates region. Citing Dubai’s existing massive trading volumes, lik upwards of $25 billion worth of c...

STEPN impersonators stealing users’ seed phrases, warn security experts

Peckshield, a prominent blockchain security firm, exposed the existence of numerous phishing websites for the Web3 lifestyle app STEPN on Monday. Hackers insert a forged MetaMask browser plugin through which they can steal seed phrases from unsuspecting STEPN users, according to Peckshield. When these cybercriminals obtain the seed phrase, they gain complete control over the STEPN user’s dashboard where they may connect their stolen wallets to their own or “claim” a giveaway as per Peckshield. #PeckShieldAlert #phishing PeckShield has detected a bath of @Stepnofficial phishing sites. They insert a false Metamask browser extension leading to stealing your seed phrase or prompt you to connect your wallets or “Claim” giveaway. @Metamask @Coinbase @WalletConnect @phantom pic....

Could XRP price lose another 70% by Q3?

Ripple (XRP) continued its correction trend on April 25, falling by 5.5% to reach $0.64, its lowest level since Feb. 28. More XRP price downside ahead? The plunge increased the possibility of triggering a bearish reversal setup called descending triangle. While these patterns form usually during a downtrend, their occurrences following strong bullish moves usually mark the end of the uptrend. XRP has been in a similar trading channel since April 2022, bounded by two trendlines: a lower horizontal and an upper downward sloping. The pattern now nears its resolve as XRP pulls back toward the support trendline that’s also coinciding with the 50-week exponential moving average (50-week EMA; the blue wave), five weeks after testing the upper trendline as resistance. XRP/USD weekl...

Bitcoin spoofs $39.5K breakout at Wall St open as Elon Musk Twitter takeover nears

Bitcoin (BTC) saw a classic “fakeout” move on April 25 as volatility kept traders firmly on edge. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Traders stay gloomy on BTC outlook Data from Cointelegraph Markets Pro and TradingView showed BTC/USD briefly climbing almost $1,000 as Monday’s Wall Street trading session began. The move was short-lived, the pair coming back down to where it started within an hour after hitting local highs of $39,517 on Bitstamp. Monday had begun with a whimper for Bitcoin bulls, who lost ground on the weekly close and failed to avoid $40,000 flipping to resistance on daily timeframes. For popular trader Crypto Ed, $30,000 was still on the table as a potential short-term target. “To me, it seems any bounce we...

Bitcoin sets up lowest weekly close since early March as 4th red candle looms

Bitcoin (BTC) stayed below $40,000 on April 24 as the weekly close looked set to be a painful one for bulls. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Binance bids slowly thin below spot Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to retake the $40,000 mark after losing it before the weekend. As traders braced for classic volatility into the weekly close, Bitcoin looked decidedly unappetizing. At $39,500 on Bitstamp, the spot price at the time of writing would constitute the lowest weekly close since the week of March 7. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView “Pretty obvious uptrend since mid-to-late January imo. If we have our 4th RED weekly close today could be bad though,” Twitter account CryptoBull comment...

Decentralization ‘absolutely essential’ in building crypto capital markets

If crypto capital markets have a chance of becoming an institutional reality, decentralization will be one of the key aspects according to one industry insider. Capital markets bring suppliers and those in need of capital together to initiate supposedly efficient transactions. Investments or savings are often funneled between suppliers of funds like banks and those who need capital like businesses, governments and individuals. Co-founder of crypto financial service provider VegaX Holdings Sang Lee told Cointelegraph on Monday that incumbent financial institutions have simply been left behind by the rapid pace of developments in the crypto industry. VegaX Holdings is building a suite of crypto-based financial services. Its VegaX decentralized finance (DeFi) platform allows staking, while it...

SkyBridge goes all in on crypto, betting on ‘tremendous growth’ ahead

SkyBridge Capital is working on pivoting the majority of its assets under management (AUM) to digital assets, as the sector represents “tremendous growth” for the firm. The hedge fund was founded by former U.S. politician Anthony Scaramucci in 2005, and first delved into Bitcoin (BTC) in late 2020. The firm also has money deployed in other hedge funds, late-stage private tech companies and real estate, with its total AUM reported being around $7.3 billion. Skybridge now manages a $7 million Bitcoin Fund among others and has been actively working to get a spot BTC exchange-traded fund (ETF) approved by the U.S. Securities and Exchange Commission (SEC). Speaking with Bloomberg in the lead up to the annual SkyBridge Alternatives Conference (SALT) this week, Scaramucci said that the firm is re...

‘Something sure feels like it’s about to break’ — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week in an uncertain place facing uncertain times — is $40,000 now resistance? The largest cryptocurrency has just closed a fourth red weekly candle in a row, something that has not happened since June 2020. As cold feet over the macro market outlook continues to be the norm, there seems little to comfort bulls as the week gets underway — and Bitcoin is not done selling off yet. On the back of $4,000 in losses over the past four days alone, price targets now focus on retests of liquidity levels further towards $30,000. It is not all doom and gloom — long-term hodlers and key participants such as miners are showing a more positive stance when it comes to Bitcoin as an investment. With that in mind, Cointelegraph takes a look at the forces at work when it comes to ...

6 Questions for Lili Zhao of Neo

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Lili Zhao, director of ecosystem growth at Neo — an open-source blockchain development platform. The A to Z of Lili Zhao: Authenticity — easier said than done Blockchain advocate Community — Neo has the best! DAO — fascinating! Economics — interests me much more now than when I was studying it at university Falling — never afraid of it because I always bounce back Game — life is a game, so let’s play Hot — N3 is hot Ideas — too many ideas, not enough focus Job — growing the ecosystem of the Neo blockchain by profession and passion Key — keep your private key safe Love — may everyone be blessed with...

Decentralized credit scores: How can blockchain tech change ratings

The concept of lending and borrowing is as old as time itself. Regarding finances, while some individuals have more than enough for themselves, others barely have enough to get by. As long as there is this imbalance in finance distribution, there will always be a need to borrow and a desire to lend. Lending involves giving out a resource on credit with the condition of it being returned upon an agreed period of time. In this case, such resources would be money or any financial asset. The lender could be an individual, a financial institution, a firm or even a country. Whichever the case may be, the lender, oftentimes, needs a sort of assurance that their resources would be returned to them upon the agreed time. Certain criteria qualify a borrower to take a loan. Among these are the borrowe...

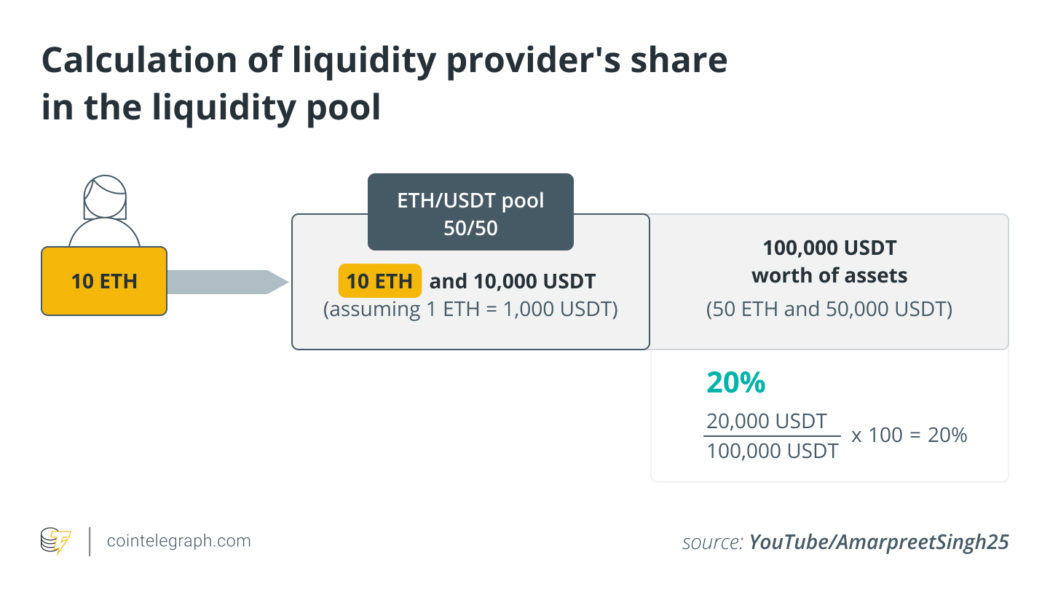

What is impermanent loss and how to avoid it?

The difference between the LP tokens’ value and the underlying tokens’ theoretical value if they hadn’t been paired leads to IL. Let’s look at a hypothetical situation to see how impermanent/temporary loss occurs. Suppose a liquidity provider with 10 ETH wants to offer liquidity to a 50/50 ETH/USDT pool. They’ll need to deposit 10 ETH and 10,000 USDT in this scenario (assuming 1ETH = 1,000 USDT). If the pool they commit to has a total asset value of 100,000 USDT (50 ETH and 50,000 USDT), their share will be equivalent to 20% using this simple equation = (20,000 USDT/ 100,000 USDT)*100 = 20% The percentage of a liquidity provider’s participation in a pool is also substantial because when a liquidity provider commits or deposits their assets to a pool via ...