crypto blog

Metacade (MCADE), Cardano (ADA) and Solana (SOL) Price Forecast for Q1 2023

The year 2023 is shaping up to be an exciting time for cryptocurrency investors, with several projects set to make significant moves in the market. This article will dive into the factors likely to influence the first-quarter prices of Metacade, Cardano, and Solana, offering price forecasts and an outlook for each. What is Metacade (MCADE)? Metacade is a new play-to-earn (P2E) community hub that aims to play a pivotal role in the future of gaming. It’s a place for anyone looking to connect with like-minded gamers, explore the fast-growing GameFi space, and discover how to earn more from P2E gaming. On the platform, you’ll find forums, reviews, leaderboards, alpha, and an entire virtual arcade designed specifically for Web3. One of the key aspects of Metacade is its communi...

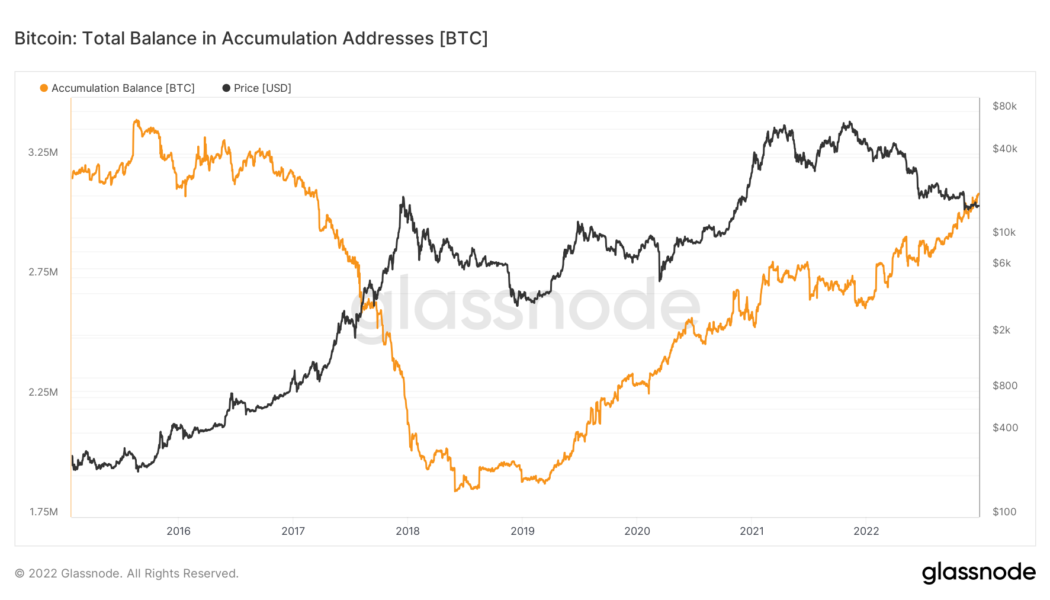

Bitcoin accumulation addresses near record 800K despite whale selling

Bitcoin (BTC) accumulation is nearing a new milestone this Christmas as the redistribution of the BTC supply continues. Data from on-chain analytics firm Glassnode shows that the total BTC balance of so-called “accumulation addresses” is nearing all-time highs. “HODL-only’ BTC addresses climb closer to 1 million mark Behind the scenes in the 2022 Bitcoin bear market, certain entities are in no doubt about their BTC investment strategy. According to Glassnode, Bitcoin accumulation addresses are more numerous than ever before, while the BTC balance they contain is almost at a record high. “Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds,” the firm’s description explains. Glassnode adds that exchange wallets and those...

Bitcoin price volatility due within days, new take says as BTC flatlines at $16.8K

Bitcoin (BTC) hodlers are enjoying another day of zero volatility on Dec. 26 as hopeful forecasts se signs of a trend change. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Opinions diverge further over BTC price bottom Data from Cointelegraph Markets Pro and TradingView confirmed more sideways action near $16,800 for BTC/USD on Boxing Day. The pair took the holiday period in stride, with reduced volumes having no impact on an already deflated market experiencing its lowest volatility on record. With few trading opportunities in the last week of “Do Nothing December,” analysts attempted to ready the ship for potential headwinds to come. “If BTC fails to reclaims ~$17,150 as support before the end of the year… Then $BTC will establish the $13900-$17150 range as its new playgrou...

Andre Cronje says Fantom will focus on DApp ecosystem expansion in 2023

In a new Medium post published on Dec. 26, decentralized finance architect Andre Cronje reaffirmed the goals and priorities for the Fantom ecosystem in 2023. Cronje, who previously created protocols such as Yearn.finance and Keep3rV1, also revealed that he accepted a position as a board member for both Fantom Foundation Ltd and Fantom Operations Ltd, which oversee the namesake directed acrylic graph ecosystem. “Our overarching objective over the next 12 months will be towards creating an environment for dapp developers to build out sustainable businesses, while differentiating ourselves from other layer 1 solutions.” One key point on Cronje’s 2023 Fantom roadmap is gas monetization, which would allow revenue share for decentralized applications, or DApps, as a development incentive. In add...

7 biggest crypto collapses of 2022 the industry would like to forget

2022 has been a bumpy year for the cryptocurrency market, with one of the worst bear markets on record and the downfall of some major platforms within the space. The global economy is beginning to feel the consequences of the pandemic, and clearly, this has had an influence on the crypto industry. Below is a breakdown of some of the biggest disappointments in the crypto space this year. Axie Infinity’s Ronin Bridge hacked In March of this year, Ronin, the blockchain network that runs the popular nonfungible token (NFT) crypto game Axie Infinity, was hacked for $625 million. The hacker took 173,600 Ether (ETH) and 25.5 million USD Coin (USDC) from the Ronin bridge in two transactions. When the Lazarus Group started its attack, five of the nine private keys for the Ronin Network’s cross-chai...

SEC seeks to keep Hinman documents hidden in Ripple case

The United States Securities and Exchange Commission (SEC) has requested to seal the infamous Hinman Speech documents, claiming that they are not relevant to the court’s summary judgment decision. The Motion to Seal Summary Judgment Document was filed by the SEC on Dec. 22, requesting the sealing of various information and documents, most notably the Hinman Speech documents. The Hinman Speech documents refer to the speech given by former SEC Corporation Finance Division Director William Hinman at the Yahoo Finance All Markets Summit in June 2018, where he reportedly stated that Ether (ETH), the native token of the Ethereum blockchain, is not a security. Ripple believes it is a vital piece of evidence to help them with its case against the U.S. regulator. In its latest motion, the SEC said ...

Hackers drain $8M in assets from Bitkeep wallets in latest DeFi exploit

While many are still enjoying the holiday season, hackers are hard at work, draining around $8 million in an ongoing BitKeep wallet exploit. On Dec. 26, some users of the multichain crypto wallet BitKeep reported that their funds were being drained and transferred while they were not using their wallets. In their official Telegram group, the BitKeep team confirmed that some APK package downloads have been hijacked by some attackers and have been installed with code that was implanted by hackers. They wrote: “If your funds are stolen, the application you download or update may be an unknown version (unofficial release version) hijacked.” As the hack continues, the BitKeep team urged its users to transfer their funds to a wallet that came from official sources like Google Play and the ...

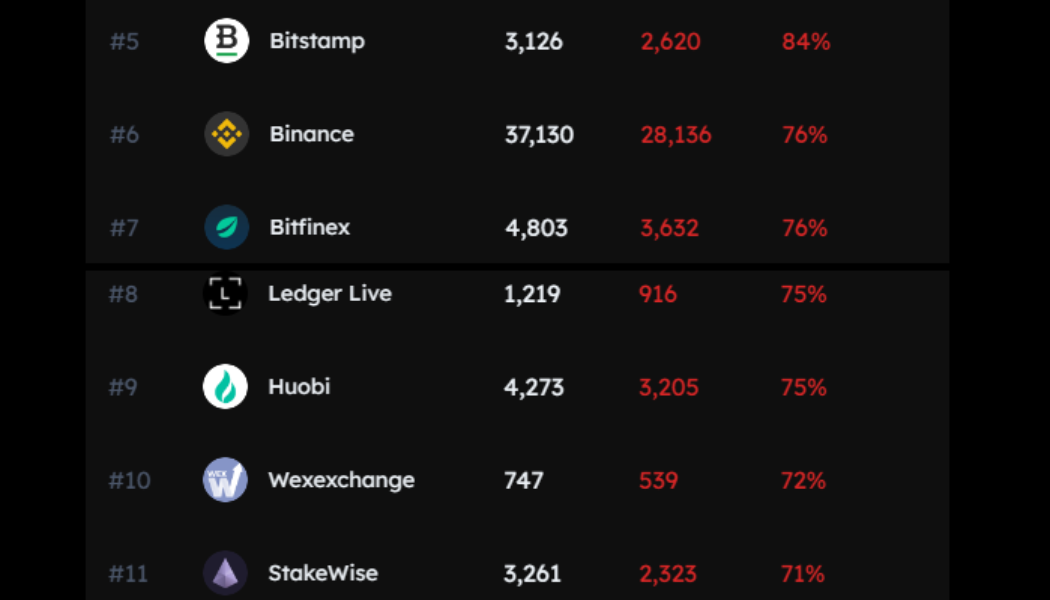

ETH staking on top exchanges contributes to Ethereum censorship: Data

For most crypto ecosystems, being compliant with federal sanctions have a negative impact on its global reach. However, when it comes to Ethereum, investors have significant power to decide the degree of compliance the ecosystem obeys. Nearly 60% of all post-Merge Ethereum blocks comply with the United States sanctions put forth by the Office of Foreign Assets Control (OFAC). While the crypto community stands against this transformation, many fail to realize their own contribution to helping Ethereum attain total OFAC compliance. One of the biggest factors harming Ethereum’s credible neutrality is the use of censoring MEV relays by crypto ecosystems and exchanges. Miner extractable value (MEV) relays work as a mediator between block producers and block builders, which are being used ...

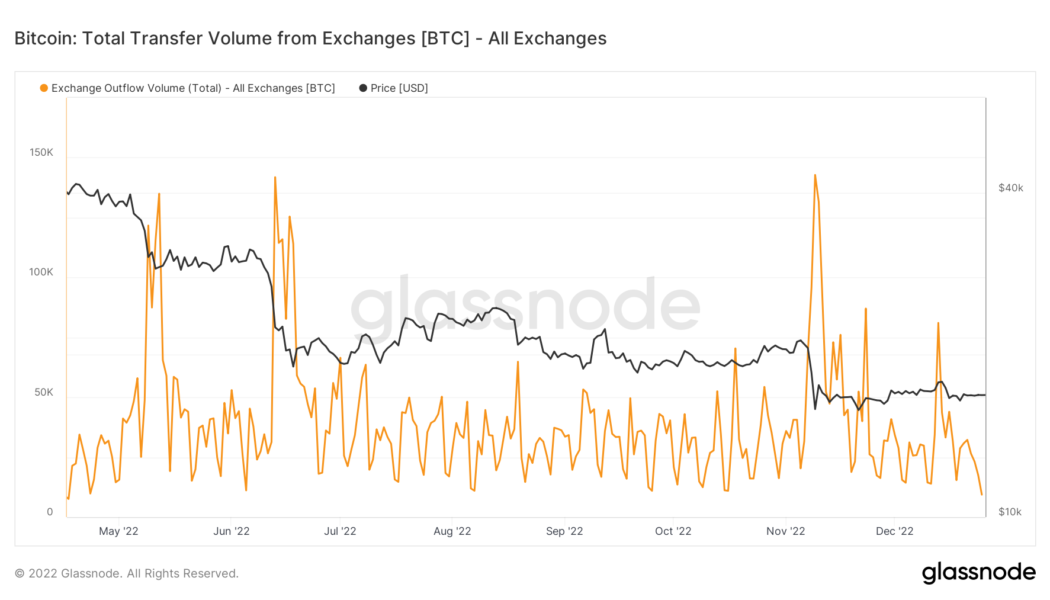

Bitcoin exchange withdrawals sink to 7-month low as users forget FTX

Bitcoin (BTC) exchange users have forgotten all about the FTX scandal this Christmas, data shows. According to on-chain analytics firm Glassnode, exchange outflows have now hit their lowest levels in over six months. Still not your keys, still not your coins? As Bitcoin volatility sets a new record low in what is being called “Do Nothing December,” exchange users’ habits are also rapidly adjusting to the current climate. After seeing an overwhelming surge in light of the FTX meltdown, BTC withdrawals from exchange wallets have entirely reversed the spike which began around six weeks ago. Having hit a peak of 142,788 BTC on Nov. 14, outflows from the trading platforms tracked by Glassnode have declined over ten times. On Dec. 25, the latest date for which numbers are available, total exchan...

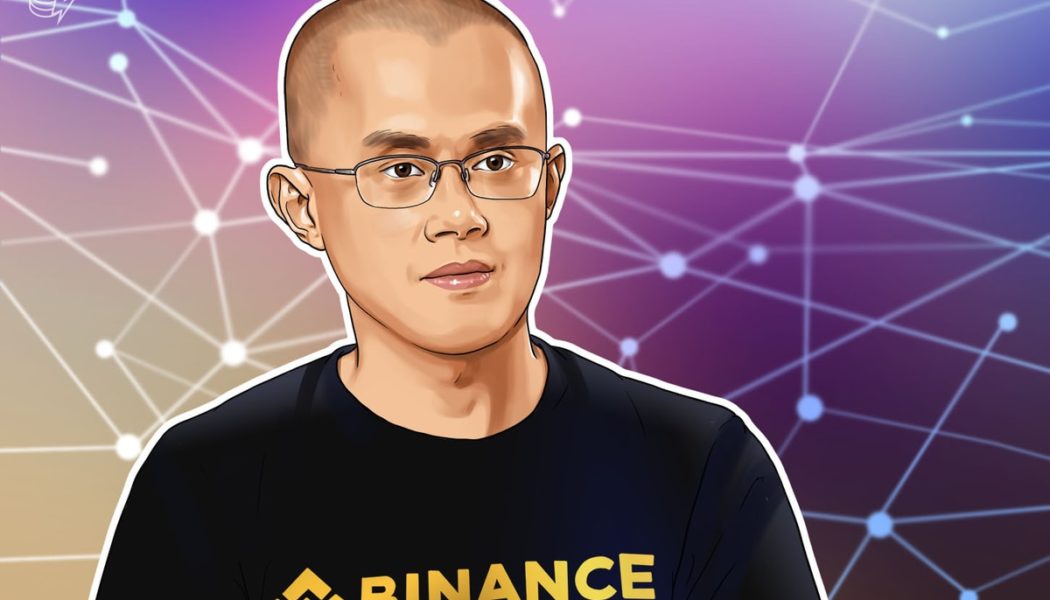

CZ addresses reasons behind Binance’s recent FUD

Binance CEO Changpeng “CZ” Zhao took to Twitter on Dec. 23 to share his perspective on the reasons behind the recent fear, uncertainty, and doubt (FUD) surrounding the crypto exchange. According to CZ in the thread, Binance’s FUD is primarily caused by external factors – not by the exchange itself. One of the reasons mentioned by the CEO was that part of the crypto community hates centralization. “Regardless if a CEX helps with crypto adoption at a faster rate, they just hate CEX,” he noted. CZ also pointed out that Binance has been seen as competition by many industry players, with increasingly lobbying against the exchange and “loaning sums of money to small media that’s worth many times the media outlet’s market value, including buying the...

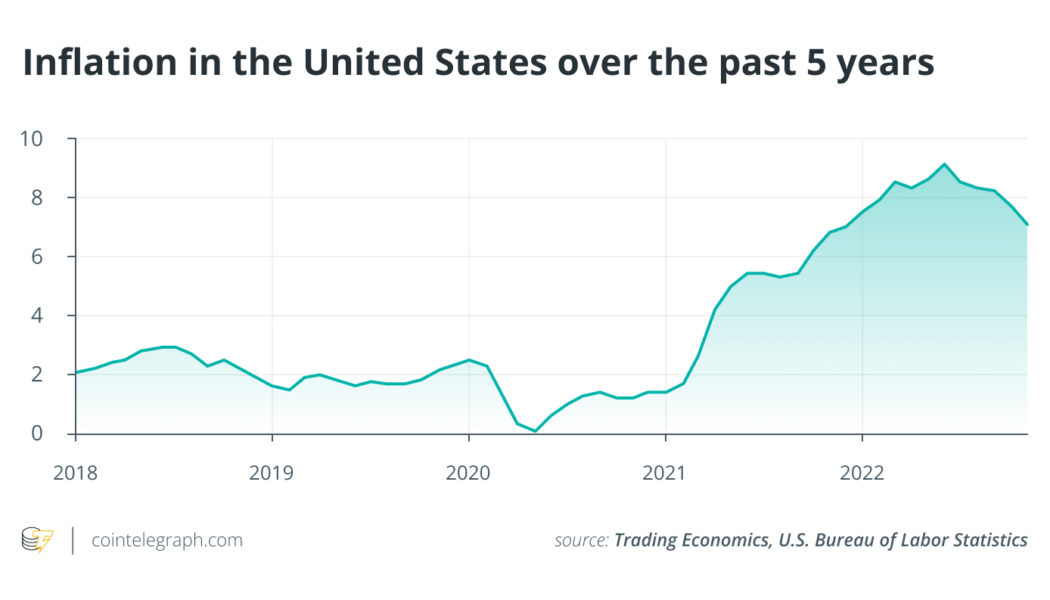

Time in the market: Ways to approach crypto investing in 2023

2022 was brutal for cryptocurrency and nonfungible token (NFT) investors. Bitcoin (BTC) hit its yearly low on Nov. 21, almost exactly a year after it reached its all-time high price of $69,044. After such a tumultuous year, how should crypto investors plan for 2023? Firstly, this space has critical risks worth considering before investing. Macroeconomic risks Investors must recognize the macro and systemic risks impacting the crypto industry as 2023 draws near. The war in Ukraine has led to an energy crisis caused by sanctions on Russian energy. The United States Federal Reserve’s monetary policy response to inflation continues to unsettle markets. The crypto contagion from recent bankruptcies continues injecting volatility into the market, with increasing regulatory pressure and miner cap...