crypto blog

Genesis and DCG seek path for the recovery of assets amid liquidity issues

The co-founder of Gemini, Cameron Winklevoss, says that global investment bank Houlihan Lokey has devised a plan on behalf of a committee of creditors to resolve the liquidity issues at Genesis and its parent company, Digital Currency Group (DCG). According to Winklevoss, resolving the liquidity issues would provide a path for Gemini clients to recover assets owed to them by Genesis and DCG following the collapse of FTX. Earn Update: Today, Houlihan Lokey presented a plan on behalf of the Creditor Committee to resolve the liquidity issues at Genesis and DCG and provide a path for the recovery of assets. — Cameron Winklevoss (@cameron) December 20, 2022 According to the brief “Earn Update” shared on Twitter by the Gemini co-founder, the plan presented by Houlihan Lokey on behalf of th...

10 crypto tweets that made a splash in 2022

Another year in the crypto space has nearly passed. As usual, Twitter has been a hotbed of crypto-related conversation during the turbulent year. From Terra’s collapse and the whole situation with FTX to Elon Musk’s takeover of Twitter, 2022 has played out like a television drama, keeping people on the edge of their seats. Tweets can act like time capsules from the past, offering up memories or documenting particular historical points. Here are 10 memorable tweets from 2022. The Terra collapse The crypto space suffered several blows this year, and among them was the collapse of the Terra project. Terra started 2022 as a prevalent project in the crypto industry, with its LUNA asset sitting in the top 10 cryptocurrencies by market capitalization at the start of the year. In May, howeve...

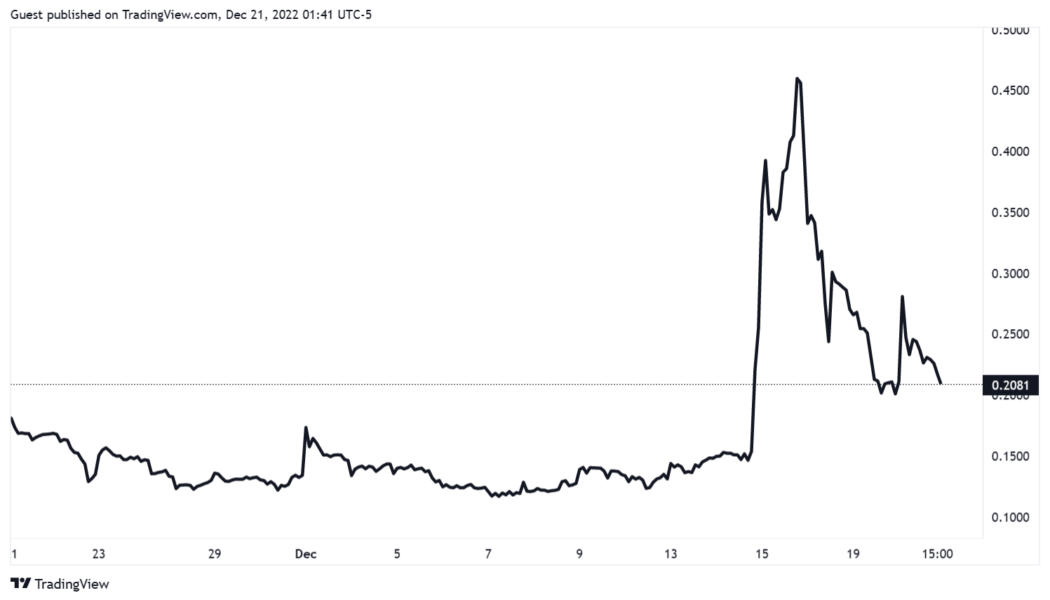

Bitcoin rebound to $18.4K? BTC price derivatives show strength at key support zone

Bitcoin (BTC) price lost 11.3% between Dec. 14 and Dec. 18 after briefly testing the $18,300 resistance. The move followed a seven-day correction of 8% in the S&P 500 futures after United States Federal Reserve Chair Jerome Powell issued hawkish statements after raising the interest rate on Dec. 14. Bitcoin price retreats to channel support Macroeconomic trends have been the main driver of recent movements. For instance, the latest bounce from the five-week-long ascending channel support at $16,400 has been attributed to the Central Bank of Japan’s efforts to contain inflation. Bitcoin 12-hour price index, USD. Source: TradingView The Bank of Japan increased the limit on government bond yields on Dec. 20, which are now trading at levels unseen since 2015. However, not everything has be...

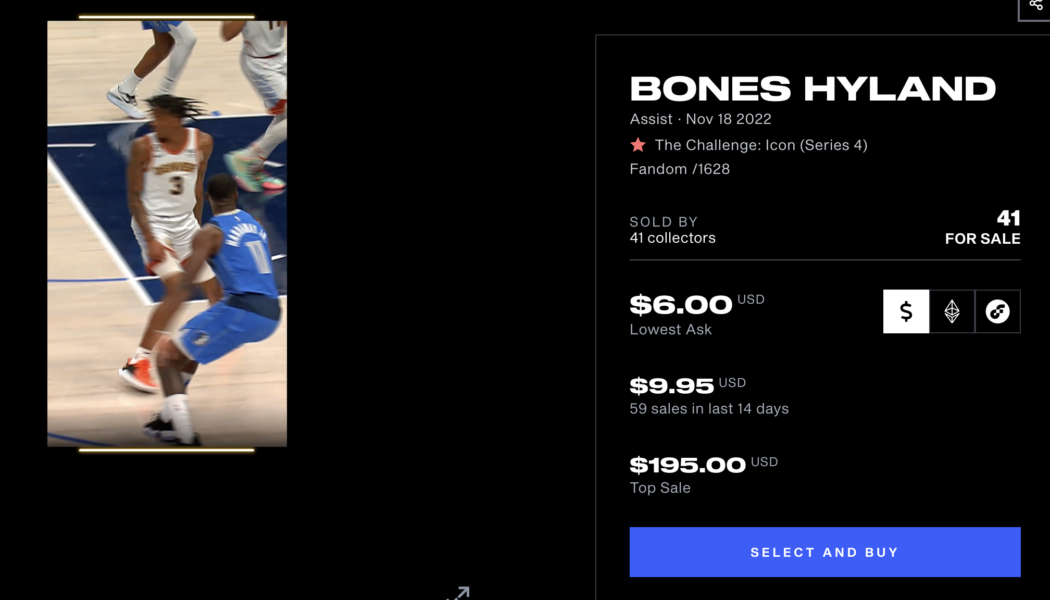

A beginner’s guide to NBA Top Shot NFTs

NBA Top Shot is a nonfungible token (NFT) marketplace that enables basketball fans to buy, sell and trade NBA-themed digital collectibles. These collectibles are “Moments” — NFTs of NBA video clips and digital art — available per their degree of rarity. In other words, users can trade NFTs that feature anything from a winning three-pointe from Luka Dončić to a dunk from Lebron James, depending on their availability. A NBA Top Shot Moment listing example. Source: Official Website The concept is akin to traditional sports collectible where fans attempt to acquire the rarest of items associated with teams, with an aim to either collect or sell it later at a higher price. Except, in the case of NFTs, these collectibles are digital — unique cryptographic tokens that exist on a ...

Sam Bankman-Fried is one step closer to US extradition: Report

Former FTX CEO Sam Bankman-Fried, who has been in the custody of Bahamian authorities, faces extradition to the United States following a hearing. According to reports, Bankman-Fried appeared in a hearing of The Bahamas Magistrate Court on Dec. 21 — the third since his arrest — where he waived his right to a formal extradition process that could have taken weeks. Officials from the U.S. Embassy, Federal Bureau of Investigation, and U.S. Marshals Service were reportedly in attendance to facilitate Bankman-Fried’s handover, to which he had first signed papers on Dec. 20. Reuters reported that SBF’s legal team said the former CEO was “anxious to leave” The Bahamas. Jerome Roberts, on Bankman-Fried’s legal team, reportedly heard SBF say on Dec. 19 his decision...

Price analysis 12/21: BTC, ETH, BNB, XRP, DOGE, ADA, MATIC, DOT, LTC, UNI

As the year comes to an end, investors will be keenly watching for a Santa Claus rally on Wall Street as many believe that if the rally does not happen, the next year may either remain flat or turn negative. Jurrien Timmer, director of global macro at asset management giant Fidelity Investments, tweeted on Dec. 19 that the United States equities markets may remain “sideways” and choppy in 2023. He expects “one or more retests of the 2022 low, but not necessarily much worse than that.” Daily cryptocurrency market performance. Source: Coin360 The cryptocurrency market has been largely correlated with the S&P 500 in 2022. Unless both markets decouple, the sideways or negative action in the equities markets may not bode well for the cryptocurrency market. Analysts remain divided on t...

Shiba Inu vs Metacade: What is the better crypto investment?

Following in the footsteps of meme coins like Doge, Shiba Inu crypto token exploded in 2021 and ended up becoming one of the top-performing assets of the last bull run. But if you’re comparing it to Metacade moving forward, you may not be sure which is the better investment to make. This article should help. It covers everything you need to know about Shiba Inu crypto vs. Metacade to help you figure out which should top your investment list. What is Metacade (MCADE)? Metacade is Web3’s first virtual arcade. It’s a place gamers can go to try out the best GameFi and P2E titles in a single place. With an ever-increasing number of different games to choose from, there’ll be something for everyone to enjoy in the Metacade, whether they’re casual or hardcore gamers. The platform also provides ma...

Bitcoin miner Core Scientific reportedly filing for Chapter 11 bankruptcy

Just days after a creditor offered to help Core Scientific avoid possible bankruptcy, reports have emerged confirming the Bitcoin (BTC) mining company’s fate. Core Scientific is reportedly filing for Chapter 11 bankruptcy protection in Texas owing to falling revenue and low BTC prices. On Dec. 14, financial services platform B. Riley offered to provide Core Scientific with $72 million in non-cash financing — $40 million with zero contingencies and $32 million with conditions — to retain value for stakeholders. The decision was made after Core’s valuation fell from $4.3 billion in July 2021 to $78 million at the time of reporting. As a direct result of an extended bear market, Core Scientific had to sell 9,618 BTC in April to stay operational. A CNBC report quoted a person familiar wit...

Superhero cans merger with Swyftx citing regulatory scrutiny

With more regulators eyeing the crypto space as the FTX debacle continues, the $1.5 billion merger of online investing platform Superhero with the Australian crypto exchange Swyftx was shelved. In an email to its customers, Superhero highlighted that it will not be proceeding with its merger with the crypto exchange. According to the company, this is because of heightened regulatory scrutiny within Australia and globally. They wrote: “As a result of the current environment, we have decided that the best thing for our Superhero customers is to unwind the merger and move forward as a separate, unrelated company.” The firm also assured its users that their funds are safe, as neither their data nor their assets were provided to Swyftx. The companies first announced the merger on June 8 a...

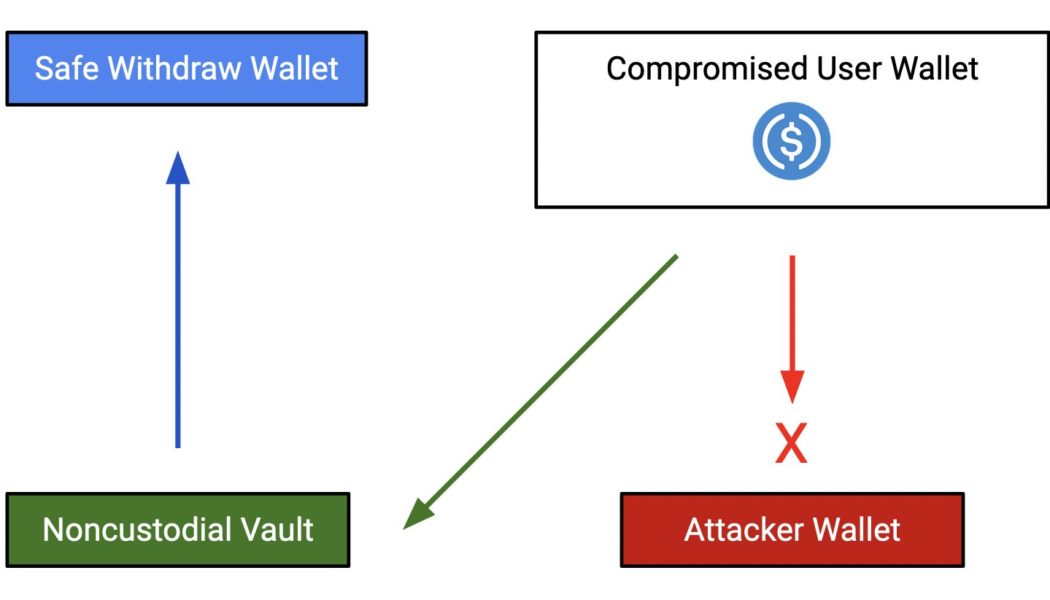

Crypto on-chain crime drama sees the good guys finally win

The stories about people getting their private keys hacked or stolen are nothing new, with a number losing their life savings because of these thefts. However, in quite an anti-climax scene, a crypto user managed to save their crypto holdings despite losing their private keys. Harpie, an on-chain security firm, revealed an instance of on-chain crime drama where the good guys eventually won. One of the users in their Discord group reportedly raised concerns about the suspected theft of their private keys. When the firm looked into said customer’s wallet, someone was indeed trying to transfer funds from the victim’s accounts. How did we do this? About a month ago, this user protected their tokens with Harpie. By approving and protecting their tokens with Harpie, this user gave us permis...

Alaska adds ‘virtual currency’ to its regulatory regime

From Jan. 1, 2023, the term “virtual currency” will take its place in the money transmission regulations of Alaska. It will oblige the companies dealing with digital currencies to obtain a money transmission license in the state. As reported by the law firm Cooley on Dec. 19, the state of Alaska amended its money transmission regulations to include the definition of “virtual currency.” According to the amendment to the local Administrative Code, adopted by the Division of Banking and Securities (DBS), the virtual currency is: “[A] digital representation of value that is used as a medium of exchange, unit of account, or store of value; and is not money, whether or not denominated in money.” The most obvious impact of this change, which will come into force on Jan.1, is the requirement...