crypto blog

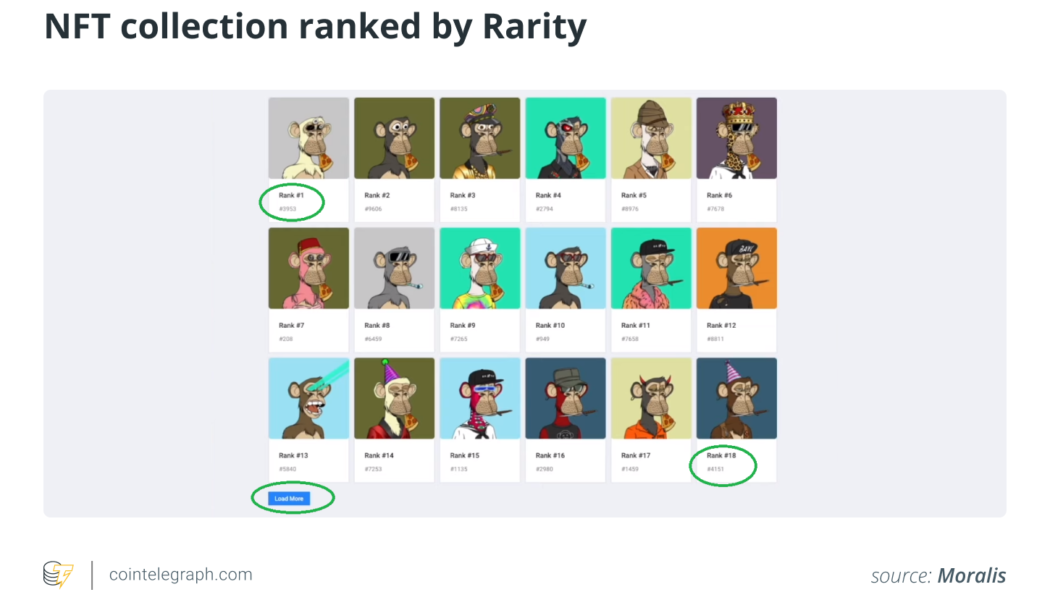

How do you assess the value of an NFT?

Understanding the valuation matrix There is no rule book on how to assess an NFT valuation. The metrics you use for evaluating private companies or conventional investment vehicles such as shares are simply not applicable to NFTs. Usually, the payment rolled out by the last buyer gives some indication of the value. For NFTs, however, it is hard to guess what the next buyer might pay, depending on their estimates. Most buyers lack the skills to ascertain the value of NFTs logically and base their quotes on guesswork. For sellers too, it is hard to determine what they might end up receiving for the tokens they hold. Over time, the value of NFTs is driven by a perception over which both buyers and sellers may lack any control. An example can bring home the point even better. An artwork NFT mi...

Ally or suspect? The war in Ukraine as a stress test for the crypto industry

It has been two weeks since Russia kicked off the first large-scale military action in Europe in the 21st century — a so-called “special operation” in Ukraine. The military conflict immediately triggered devastating sanctions against the Russian economy from the United States, the European Union and their allies and has put the crypto industry in a position that is both highly vulnerable and demanding. As the world watches closely, the crypto space must prove its own standing as a mature and financially and politically responsible community, and it must defy the allegations of being a safe haven for war criminals, authoritarian regimes and sanctioned oligarchs. Up to this point, it has been going relatively well. But despite reassurances from industry opinion leaders, some experts say that...

In defense of crypto: Why digital currencies deserve a better reputation

Ever since its inception and throughout its turbulent journey toward mainstream acceptance, crypto has elicited both enthusiasm and trepidation in equal measure. After the unfair battering it has received over the years, the time has come to defend digital currencies. Unfortunately for crypto, first impressions count. Bitcoin (BTC) initially gained a tawdry reputation in its early years as the currency of choice for illicit activities — favored by dark web users, ransomware hackers, drug traffickers and money launderers worldwide. But, the world has changed since the first Bitcoin was mined in January 2009. There are now more than 18 million of them in circulation, and more than 90,000 people have $1 million or more stashed away in Bitcoin, according to cryptocurrency data-tracking firm Bi...

Crypto Biz: Goldman Sachs tip-toes into ETH, Mar. 4-10

Wall Street’s embrace of digital assets is showing no signs of slowing down. In fact, they don’t even need to tell us about it as the proof is in the fine print. This week, a United States Securities and Exchange Commission (SEC) filing revealed that multinational investment bank Goldman Sachs has been quietly offering clients exposure to Ether (ETH) through Galaxy Digital, a crypto-focused financial services provider headed by billionaire Mike Novogratz. Of course, this isn’t the first time Goldman has worked with Galaxy Digital to offer clients a gateway to digital assets. In June 2021, the investment giant began trading a Bitcoin (BTC) futures project in collaboration with Galaxy Digital. Like other financial services giants, Goldman Sachs sees the writing on the wall and realizes...

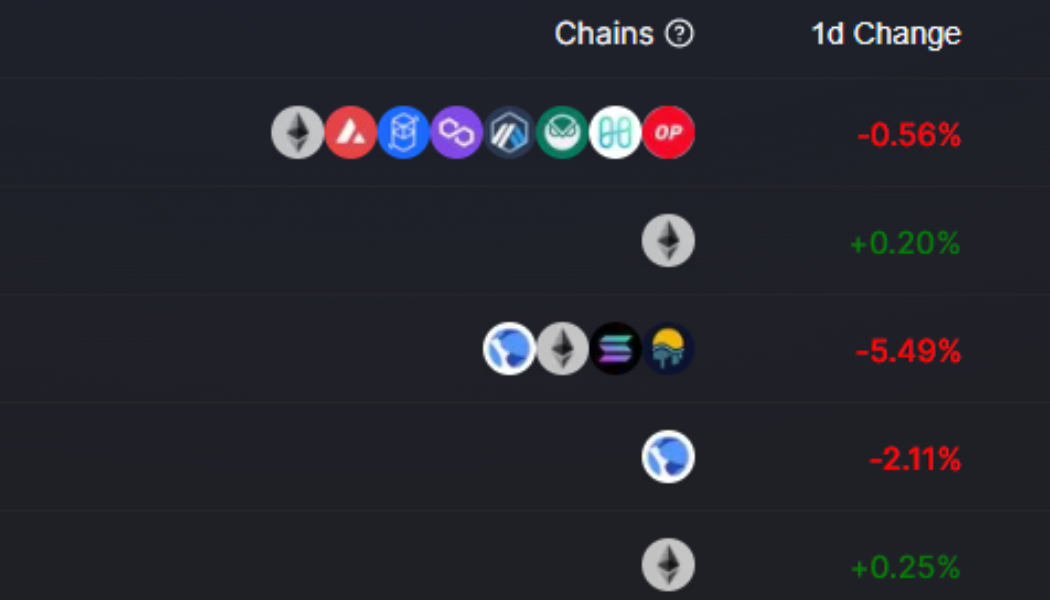

Altcoin Roundup: DeFi token prices are down, but utility is on the rise

The decentralized finance (DeFi) sector has been sitting in the backseat since whipping up a frenzy in the summer of 2020 through the first quarter of 2021. Currently, investors are debating whether the crypto sector is in a bull or bear market, meaning, it’s a good time to check in on the state of DeFi and identify which protocols might be setting new trends. Here’s a look at the top-ranking DeFi protocols and a review of the strategies used by users of these protocols. Stablecoins are the foundation of DeFi Stablecoin-related DeFi protocols are the cornerstone of the DeFi ecosystem and Curve is till the go-to protocol when it comes to staking stalbecoins. Top 5 protocols by total value locked. Source: Defi Llama Data from Defi Llama shows four out of the top five protocols in terms of to...

Terraform Labs donates $1.1B for Luna Foundation Guard‘s reserves

On Friday, Do Kwon, founder and CEO of Terraform Labs, which develops the blockchain ecosystem consisting of Terra Luna (LUNA) and the TerraUSD stablecoin (UST), announced that TFL had donated 12 million LUNA, or $1.1 billion at the time of publication to the Luna Foundation Guard (LFG). LFG launched in January to grow the Terra ecosystem and improve the sustainability of its stablecoins. Kwon noted that the funds, denominated in LUNA, will be burned to mint UST to grow the LFG‘s reserves: “We will keep growing reserves until it becomes mathematically impossible for idiots to claim de-peg risk for UST.” UST is an algorithmic stablecoin with a theoretical exchange rate of 1:1 with the U.S. dollar and is in part maintained by swapping of/for LUNA tokens when its market value deviates from it...

Citi’s digital asset co-heads resign with plans to create crypto startup

Alex Kriete, co-head of digital assets at Citi, announced his resignation from the banking giant after 11 years at the firm on Thursday via LinkedIn. He stated in his post that he intends to devote himself full-time to developing a new cryptocurrency company but provided no additional details at the time. Kriete co-led the digital assets group with Greg Girasole for less than a year since the unit launched in June 2021. Girasole also announced his departure via LinkedIn and together, he and Kriete plan to start their own blockchain-related venture. The two said they would share more details about it in the coming weeks. Kriete‘s excitement for his new undertaking stemmed from the belief that digital assets will “continue to grow in importance to global capital markets and the formatio...

Bitcoin threatens $38K as 3-day chart hints at March 2020 Covid crash repeat

Bitcoin (BTC) further tested $38,000 overnight as the weekend began with uncertainty among traders. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 3-day chart could be “precursor” for weekly Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling $39,000 after several attempts to break $38,000 support. The pair had also seen a brief spurt above $40,000 Friday thanks to geopolitical developments, this nonetheless lasting a matter of minutes before the previous status quo returned. Such “fakeouts” to higher levels — which ended with Bitcoin coming full circle and liquidating both short and long positions — was already familiar behavior for market participants this month. Now, however, lower timeframes were beginning to show signs that a more...

PwC report calls NFTs ‘the future of digital assets in sports’

Nonfungible tokens, or NFTs, and digital assets are one of the ten major trends within the sports industry, according to the consultancy Price Waterhouse Coopers’, or PwC, Sports Outlook 2022 report for North America. From altering sports technology infrastructure to driving fan engagement, the report lists three main use cases for NFTs and their likelihood to shape the future of sports. The first use case is collectible NFTs — assets used to sell collectible, authenticated and limited edition digital content. This refers to traditional memorabilia like trading cards of players or tickets stubs of historic matches that can be digitized, minted and traded on the blockchain. The report added that these collectibles could eventually be displayable and shared across metave...

Immutable X (IMX) gains 50% following the close of a $200M fundraising round

Non-fungible token (NFT) projects have been hard hit by the price decline across the cryptocurrency ecosystem and the current bearish conditions have spared few tokens from a price collapse. One project that is attempting to get back on solid footing is Immutable X (IMX), an NFT-focused layer-2 (L2) scaling solution for the Ethereum (ETH) network designed to offer near-instant transactions and zero gas fees for minting and trading. Data from Cointelegraph Markets Pro and TradingView shows that the price of IMX has climbed 69.6% since hitting a low of $1.09 on March 7 to hit a daily high of $1.86 on March 11. IMX/USDT 4-hour chart. Source: TradingView Three reasons for the reversal in IMX include the completion of a $200 million Series C funding round, the launch of new projects on the plat...

Kadena price soars by 40% after new protocol launches and a major exchange listing

In bull and bear markets, the mantra for cryptocurrency projects that are focused on long-term sustainability is “always be building.” Kadena (KDA) is one project that has earned rewards from its forward-looking approach to development despite the weakness in the wider crypto market and the layer-one proof-of-work blockchain protocol has seen its price reverse direction recently. Data from Cointelegraph Markets Pro and TradingView shows that the price of KDA spiked 40% from a low of $5.94 in the early hours on March 11 to a high of $8.28 as its 24-hour trading volume surged 784% to $325 million. KDA/USD 4-hour chart. Source: TradingView Three reasons for the recent price growth for KDA include a new listing on Binance, the launch of the first decentralized exchange on the Kadena network an...

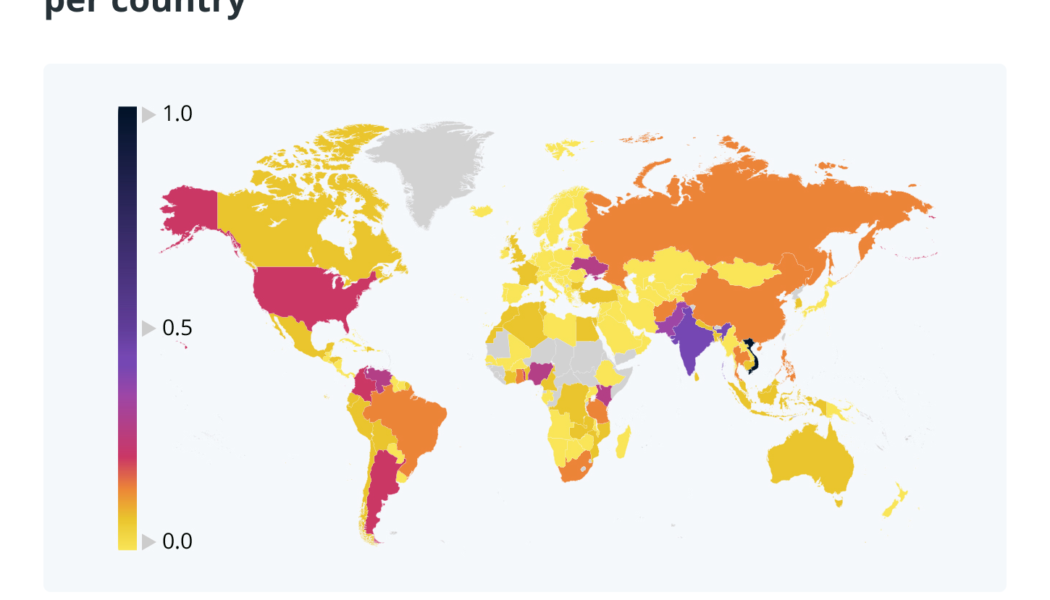

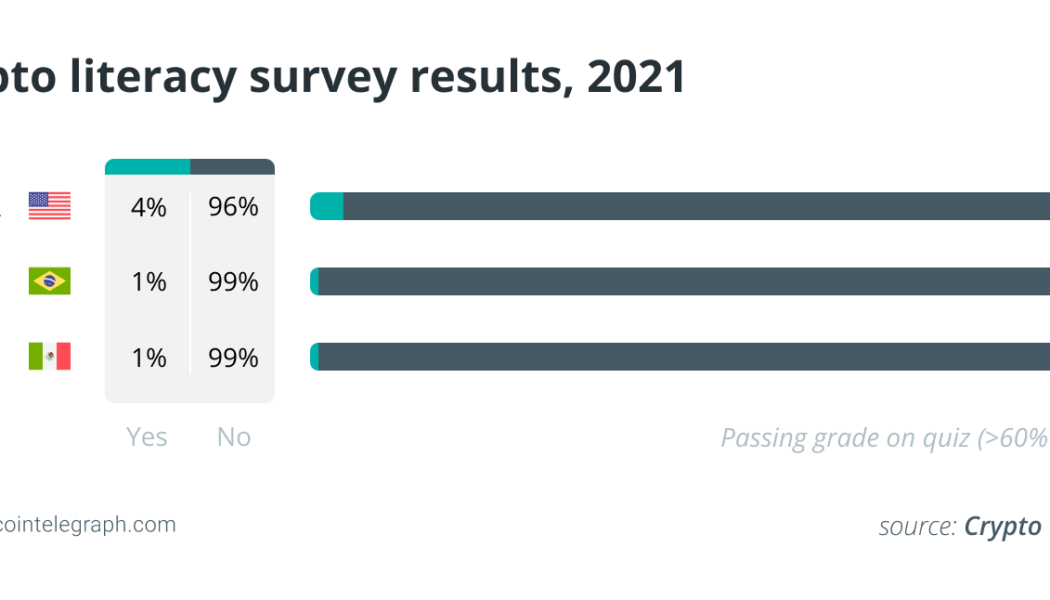

Crypto education can bring financial empowerment to Latin Americans

In October 2021, it was estimated that approximately 15% of the world’s supply of Bitcoin (BTC) was in circulation in Latin America. According to a recent report released by Crypto Literacy, however, 99% of Brazilian and Mexican respondents failed a basic assessment on crypto literacy. Crypto adoption is well underway across the region — on the rise even — but, people still lack a basic understanding of its underlying technology and use cases. When this lack of basic crypto literacy is considered in the context of developing markets across Latin America, where the use cases for blockchain technologies hold real significance, it becomes a serious concern. Latin American populations who lack crypto literacy risk missing out on stablecoins that can offer protection against Latin America...