crypto blog

Elrond announces strategic support for Web3 data brokerage system Itheum

Elrond has announced its strategic support for Web3 data brokerage platform Itheum, which will debut on Elrond’s strategic launch platform, the Maiar Launchpad, CoinText learned from a press release. Itheum will allow everyone to manage their personal data By taking advantage of Elrond Network’s scalable blockchain technology, Itheum will give everyone everywhere a chance to manage their personal data as assets. Itheum is also working on NFT technology to create NFMe IDs, data avatars for the Metaverse. Beniamin Mincu, CEO of Elrond Network commented: The elements are in place for building a compelling environment where adventure, exploration, and curiosity are elevated to unprecedented levels of immersion and unique relevance. Data will be the building blocks of the Metaverse,...

Disruption in the payments space is threatening major market players, Block co-founder argues

In a recent appearance on CNBC’s TechCheck, Block co-founder Jim McKelvey has suggested that the rate of disruption by crypto-focused firms in the payments sector is increasing. The burst of firms that had come out to capture the mantle of payments, including Block, have seen a reduced pace of growth in recent days due to several matters, including regulation. McKelvey, however, disagrees with the idea that disruption will take longer than expected. The American billionaire investor explained that with increasing innovation in payments, the space is building “an increasingly fast rate of disruption throughout the entire market.“ Bitcoin because of its unique properties In the same interview, the inclination of Block’s other co-founder (Jack Dorsey) towards Bitcoin c...

Treasury Secretary Yellen ‘mistakenly’ publishes response to Biden’s executive order

The Biden administration will support responsible innovation around digital assets The executive order will also look to establish consumer and investor protection measures International partners will be involved in defining standards for digital assets The office of the United States Secretary of the Treasury Janet Yellen yesterday released a statement, dated March 9 (today), that indicated that President Biden’s executive order would support responsible innovation via a coordinated approach to establishing digital asset policy. Strange, and maybe accidental Meant to be a response to the yet-unreleased directive by the White House, the statement by the Treasury secretary has since been deleted but was captured by a web archive. Yellen explained that this approach benefits the nation...

Janet Yellen let slip details of Biden‘s executive order on crypto

A statement from United States Treasury Secretary Janet Yellen on President Joe Biden’s executive order regarding digital assets calls for efforts to support innovation while addressing risk in the industry. Yellen’s statement was released a day early, apparently by error, and quickly deleted but was captured on a web archive. It shares early insights into the details of President Biden’s soon-to-be-released executive order. The order will call for “a coordinated and comprehensive approach to digital asset policy.” Yellen’s statement said that the executive order could “result in substantial benefits for the nation, consumers, and businesses.” “It will also address risks related to illicit finance, protecting consumers and investors, and preventing threats to the financial system and broad...

Treasury to launch financial education initiative around crypto investments

The United States Treasury Department is launching a new initiative to raise awareness of the risks involved in investing in digital assets. The move comes as the asset class transitions from a niche market into mainstream investment, according to a top Treasury official, potentially drawing in less sophisticated investors. The Department’s Financial Literacy Education Commission is developing educational materials designed to inform the public how crypto assets operate and differ from traditional assets. Treasury undersecretary for domestic finance, Nellie Liang, told Reuters that the target demographic is people that have limited access to mainstream financial services. She stated: “We’re hearing more and more about investors and households who are purchasing crypto assets, and we recogn...

Charles Hoskinson under fire for… not dropping out of a Ph.D. program?

A debate has surfaced online following claims that Cardano founder and Ethereum co-founder Charles Hoskinson may have fudged the specifics of his educational background. While the issue is hardly a major scandal, it concerns conflicting reports around whether Hoskinson dropped out of a Number Theory-focused Ph.D. program — as he suggested — or if he embellished the story. Crypto journalist and Unchained Podcast host Laura Shin suggested in her new book and on social media that he never finished an undergraduate degree or enrolled for a Ph.D. The dispute started on Sunday after a Twitter user stated they were reading Shin’s book “The Cryptopians” to get a rundown of the early days of Hoskinson and Cardano as reported in the book. Hoskinson responded to the post by stating: “Great work of fi...

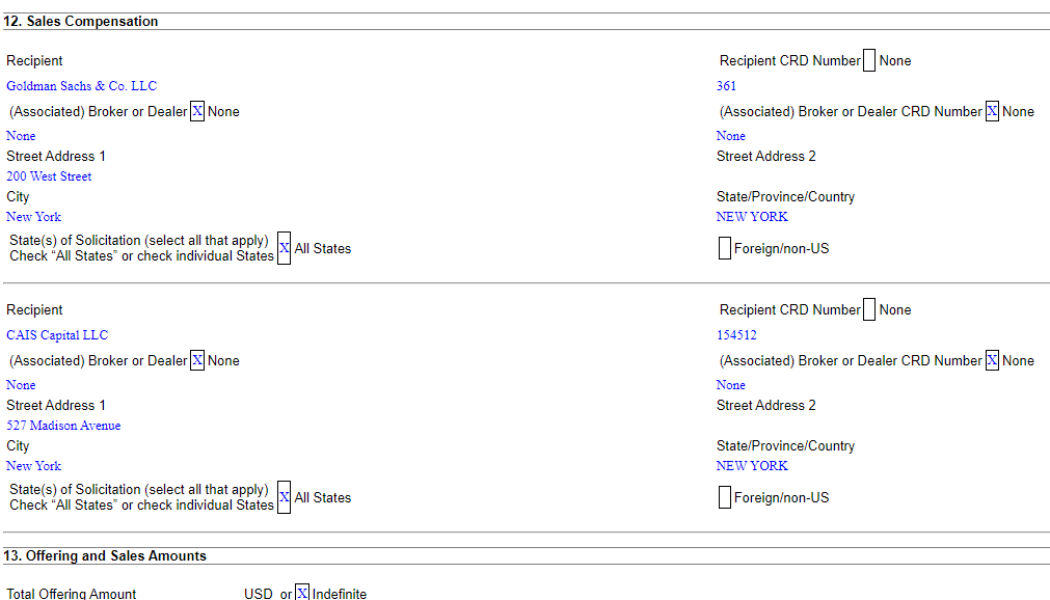

Goldman Sachs is hooking clients up with Galaxy Digital’s ETH fund

Financial services giant Goldman Sachs has been offering clients exposure to Ether (ETH) through Galaxy Digital’s Ethereum Fund, according to a new Securities and Exchange Commission filing. Goldman Sachs clients keen on spot exposure to ETH have been offered space in Galaxy’s ETH Fund. This strategy became apparent in a Tuesday filing from Galaxy which listed Goldman as a recipient of introduction fees for referring clients to the fund. Galaxy Digital is billionaire Mike Novogratz’s crypto-focused financial service provider. It controlled $2.8 billion assets under management (AUM) as of the end of Q4 2021. It is unclear exactly how much Goldman clients have bought, but the minimum investment per investor is $250,000. The filing also states that Galaxy’s ETH Fund has had sales of...

How to navigate cryptocurrency tax implications amidst the CPA shortage

Cryptocurrency is a hot topic worldwide, especially with prices of Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies hitting higher thresholds and resulting in another banner year for investors. While the earnings look good on paper, one factor is often left to consider –– that is, crypto taxes. It is not uncommon for traders to take advantage of the constant fluctuations, buy the dip, sell the uptrend, and repeat it frequently. Unfortunately, each transaction is considered a taxable event, making the conversation about cryptocurrency taxes a daunting one. The impending crackdown on cryptocurrency taxation only spurs on the need to start the conversation. This crackdown is far from recent, with 2021 headlines of an IRS chief stating the country was losing trillions of dollars in unp...

How HAL and Aldrin are helping to keep crypto assets secure during bear markets

Crypto bear markets are known for their downturns and their liquidations for investors who are trading with leverage. On top of that, decentralized finance, or DeFi, projects can become targeted by hacks or suffer rug pulls, leading to enormous losses for investors of their tokens. Now new software seeks to alert investors in real-time about potential risks to their positions. Users and executives from two such services, HAL and Aldrin, explain. HAL is a Web3 data infrastructure tool allowing companies or traders to track, monitor and trigger data. HAL recently launched simple API notifications on Avalanche (AVAX), which seeks to enable users on the blockchain to automate notifications of risky positions. Meanwhile, Aldrin is the first fully-audited decentralized exchange, or DEX, on...

Happy International Women’s Day! Leaders share their experiences in crypto

The International Women’s Day theme this year is #BreakTheBias, so Cointelegraph spoke to 10 leaders in the blockchain industry about their experiences as women in Web3 and gathered their advice. From discussing barriers to entry to nonfungible tokens and role models, the following comments are from women in the U.S., Latin America, Europe and Asia. When asked what the current barriers to entry that women may face when considering careers in crypto, Dr. Cagla Gul Senkardes, Co-founder of the Istanbul Blockchain Women Association and lecturer at Istanbul Bilgi University, flatly answered “bias.” Speaking from a more academic point of view, Senkardes sees gender bias and culturally constructed ideologies in the context of cryptofeminism, the concept of havin...

Here’s why the UK’s FCA is not impressed with EQONEX’s agreement with Bifinity

The FCA says the agreement granted Bifinity certain contractual rights over Eqonex The UK financial markets regulator insists it retains powers to suspend an unfit firm’s crypoasset registration The UK’s Financial Conduct Authority yesterday sent out a note indicating that it is still keeping a close eye on Binance. The message came on the heels of Binance’s subsidiary pay tech firm Bifinity completing a strategic agreement with FCA-regulated EQONEX Limited. Binance launched payment tech company Bifinity yesterday, noting that EQONEX, the first publicly listed digital asset firm in the US, would receive a $36 million convertible loan as part of the agreement. Further, the cooperation would also give Bifinity the right to appoint the CEO, CFO, and Chief Legal Officer of EQ...