crypto blog

Crypto markets recover from Monday’s brief dip with BTC eyeing $39k

Market activity has been largely positive in the last few hours THETA price has shot up following the pullback while Ether has cut above $2,550 The cryptocurrency sector is still reeling from late Monday’s short-lived slump that saw tokens fall to their weekly lows. Bitcoin, which appeared to have cleared $39k earlier during the day, slid from $39,060 to a 7-day low of $37,387.92 in four hours, CoinGecko data shows. The king cryptocurrency has since bounced back and is changing hands at $38,860 – up 1.40% in the last 24 hours. Ether, whose ETH/USD hourly trading chart shows positive movement, has clawed its way back above $2,575. Yesterday, the token fell to an intraday low slightly below $2,460 – a price level last touched on February 24. The pair has moved up by 1.4% today and is t...

Report: President Biden set to sign a crypto executive order this week

The executive order will put focus on possible legal and economic impacts of digital assets The White House’s approach has come under keen scrutiny in recent days, with concerns that Russia could use crypto to evade economic sanctions US President Joe Biden will reportedly sign an executive order on crypto this week, potentially leading towards a framework for the regulation of digital assets. Talks of market-wide crypto regulation have been around since last October, as the government resolved to fight the then surging threat of cybercrime and ransomware. Now, according to a report published yesterday, Bloomberg says the order could be signed as soon as tomorrow. Citing an individual familiar with the matter who preferred to remain unidentified, the news outlet explained that t...

FinCEN includes crypto in alert on Russia potentially evading sanctions

The United States Financial Crimes Enforcement Network, or FinCEN, a bureau of the Treasury Department, has warned financial institutions to consider crypto as a possible means Russia may attempt to use to evade sanctions related to the country’s military action in Ukraine. In a Monday alert, FinCEN reminded U.S.-based financial institutions “with visibility into cryptocurrency” and convertible virtual currency, or CVC, to report any activity that could be considered a potential way for Russia to evade sanctions imposed by the U.S. and its allies. While the U.S. watchdog said that the Russian government using CVCs to evade large scale sanctions was “not necessarily practicable,” financial institutions were obligated to report such activities from Russian and Belarusian individuals named in...

Bitcoin price rejection at $39K and mounting regulatory concerns tank the market again

Volatility and choppy price action continued to dominate the cryptocurrency market on March 7 and news that United States President Joe Biden plans to sign an executive order later this week that will outline the government’s strategy for cryptocurrencies was added to the list of factors weighing down crypto prices. Data from Cointelegraph Markets Pro and TradingView shows that Bitcoin (BTC) bulls were thwarted in an attempt to regain support at $40,000 on Monday as revelations about the upcoming executive order and the ongoing conflict in Ukraine tanked the market and dropped BTC to a low of $37,155. BTC/USDT 1-day chart. Source: TradingView Here’s what several analysts in the market are saying about the outlook for BTC and whether or not crypto traders should prepare for an e...

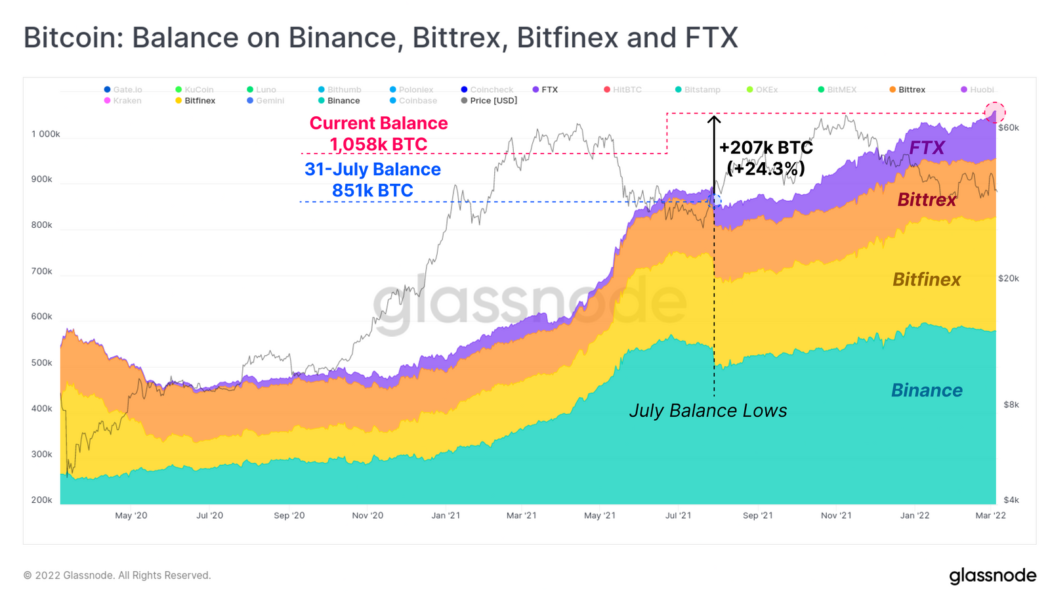

Total exchange BTC inflows have been net negative since July ’21

Bitcoin inflows across all exchanges have been net negative since last July, but four major exchanges have been running contrary to this trend with nearly an equal amount of net positive inflows. There have been total net outflows of 46,000 BTC (worth around $1.8 billion at current prices) from all crypto exchanges since last July. Only Binance, Bittrex, Bitfinex, and FTX have seen net positive inflows of 207,000 Bitcoin (BTC), according to data from blockchain analytics firm Glassnode’s March 7 newsletter. Over the same time period, net outflows have totaled 253,000 BTC from all other exchanges tracked. FTX, Binance, Bittrex, and Bitfinex have seen net positive inflows of BTC since July, 2021 – Glassnode FTX and Huobi have experienced the most dramatic shift in their BTC holdings si...

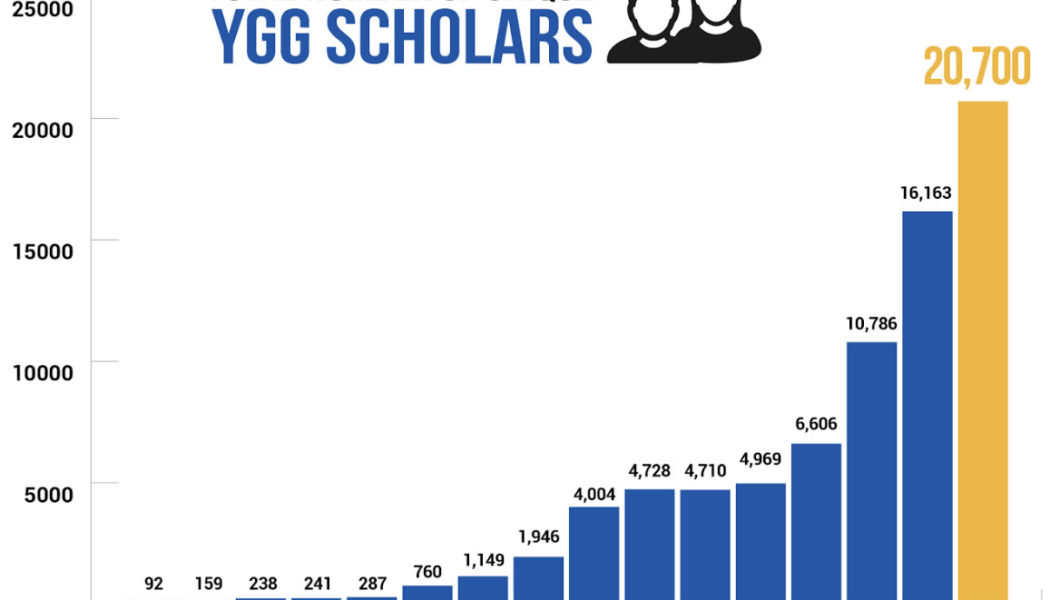

Yield Guild Games Hits 20K Axie Infinity P2E Scholarship Milestone

The popular gaming guild YGG has reached a milestone in terms of new scholars for the Axie Infinity platform and various other play-to-earn games. Yield Guild Games reported 20,700 unique Axie Infinity scholars in February, an increase of 8,500% since the same month last year when there were just 241. The milestone marks a “new record in the play-to-earn space” said YGG in an announcement shared with Cointelegraph. The play-to-earn scholarships allow new players to borrow a team of Axie NFTs from the Guild. Their in-game earnings are then split between the player, the community manager, and the YGG DAO. YGG reported that in February, scholars farmed more than 26.4 million SLP, the native token for Axie Infinity. This figure represents a 57% increase from January’s farming figures. It added...

DeFi ‘Godfather’ Andre Cronje calls it quits as associated projects tank

Andre Cronje has officially left DeFi and crypto, with plans to move back into traditional finance Following the news, projects associated with the iconic DeFi builder plunged Founder of Yearn Finance Andre Cronje and technical advisor at the Fantom Foundation alongside his partner Anton Nell, a senior solutions architect at the Foundation, are leaving the crypto and DeFi scene. It had become apparent last week that Cronje, who quickly became an icon in DeFi with his yield optimisation protocol, was planning to leave since he cleared all of his Twitter activity, deactivated his profile, and updated his LinkedIn status to indicate he had left both Yearn Finance and Fantom Foundation. The exit of the two developers leaves a huge dent In a series of tweets, Nell explained that following their...

Binance unveils Bifinity and reintroduces EUR & GBP bank transfers

Through Bifinity’s intuitive APIs, businesses will gain crypto-readiness. Binance has also fully brought back Euro and Pound bank transfers via SEPA and FTP. Binance, the world’s largest cryptocurrency exchange, is increasingly smoothing the path towards crypto adoption by new users. The crypto exchange today announced the launch of its native fiat-to-crypto payments provider. Dubbed Bifinity, Binance said in a press release published today that the new tech pay firm would enable “mainstream and crypto merchants to scale their businesses” to become crypto ready. Bifinity would provide them with intuitive Application Programming Interfaces (APIs) to enable them to accept payments in crypto easily. Binance added that Bifinity would provide support for crypto buy-sell ...

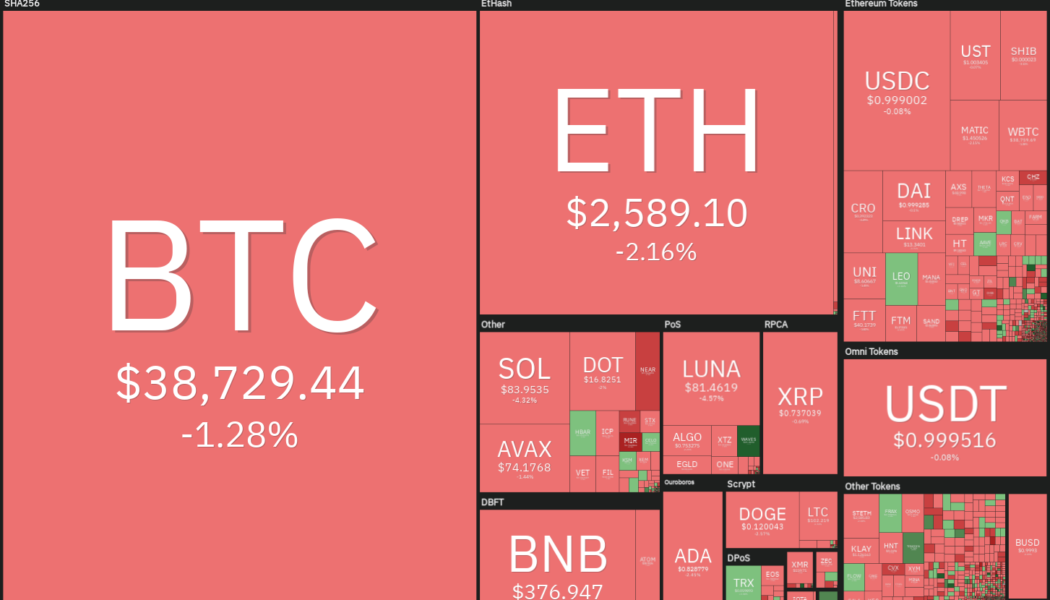

Price analysis 3/7: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The geopolitical tension between Russia and Ukraine has resulted in investors seeking safe-haven assets. Contrary to expectations by crypto investors, Bitcoin (BTC) has failed to rise along with gold and it remains closely correlated with the U.S. stock markets. Lloyd Blankfein, the former CEO of Goldman Sachs, said that the actions of governments freezing accounts, blocking payments and inflating the U.S. dollar should all be positive for crypto but the price action suggests a lack of large inflows. Daily cryptocurrency market performance. Source: Coin360 On-chain data suggests that investors may be accumulating Bitcoin for the long term. Data from Santiment shows that 21 out of the past 26 weeks have seen Bitcoin move off the exchanges. Could Bitcoin climb back above $40,000 and pull alt...

Cryptopedia: Learn the basics of DAOs and how they work

In the latest Cryptopedia episode, viewers can get a succinct and informative overview of decentralized autonomous organizations, or DAOs. Cointelegraph’s Jackson DuMont believes DAOs have the power to “completely transform how work and social collaboration are organized.” [embedded content] What makes this type of organization both decentralized and autonomous? The answer is smart contracts on the blockchain. Fundamentally, a DAO runs on the lines of computer code written on smart contracts that anyone can interacted with in the same way. DuMont described the three major steps necessary to launch a DAO. The first step is creating that smart contract. The second step is to determine how to receive funding and enact governance, usually done by creating a token. Lastly, the...

European Parliament will hold vote on crypto bill without PoW provision

The parliament of the European Union has scheduled a vote on a framework aimed at regulating cryptocurrencies after addressing concerns over proof-of-work mining. In a Monday Twitter thread, European Parliament Committee on Economics and Monetary Affairs member Stefan Berger said the committee will vote on the Markets in Crypto Assets, or MiCA, framework on March 14 following the submission of a final draft of the bill. As the rapporteur — the person appointed to report on proceedings related to the bill — Berger said the legislation will no longer include text that some had interpreted as a possible ban on proof-of-work crypto mining. “With MiCA, the EU can set global standards,” said Berger. “Therefore, all those involved are now asked to support the submitted draft & to vote for MiC...

Crypto funds register largest weekly inflows since December

Inflows into cryptocurrency investment funds rose sharply last week, offering cautious optimism that investors are broadening their exposure to digital assets despite geopolitical uncertainty and monetary tightening from central banks. Digital asset investment products registered $127 million worth of cumulative inflows for the week ending March 6, according to CoinShares data. A CoinShares representative told Cointelegraph that this was the highest weekly inflows since Dec. 12, 2021. The increase was also significantly higher than the $36 million of inflows registered the previous week. Like in previous weeks, Bitcoin (BTC) products recorded the largest weekly inflows at $95 million. Bitcoin fund flows have increased for seven consecutive weeks. Ether (ETH) funds saw inflows totaling $25 ...