crypto blog

4 legislative predictions for crypto in 2023

If you saw the returns in my crypto portfolio this year, you would take a pass on my predictions for the direction of the cryptocurrency market. So, I will stick to what I know and share some regulatory predictions for the crypto industry. Few legislative changes A few minor victories will logroll small legislative fixes into “must pass” bills like the defense authorization or omnibus spending bills. The top candidate would be a de minimis exemption for smaller crypto transactions to exempt users from capital gains tax liability every time they purchase a coffee with crypto. The protection for noncustodial crypto providers in Republican Representative Tom Emmer’s bill might make it in as well. On the outside, a bipartisan stablecoin bill may be possible, though Senate Democrats are still a...

Uniswap to allow users to buy cryptocurrency using debit and credit cards

Decentralized exchange Uniswap has partnered with fintech company Moonpay to allow users to buy cryptocurrency on its web app using debit cards, credit cards, and bank transfers. The bank transfer option is being rolled out for users within most U.S. states, Brazil, the United Kingdom and the Single Euro Payments Area, also known as SEPA. In the announcement made on Dec. 20, Uniswap shared that its users will now be able to convert fiat to cryptocurrency on the Ethereum mainnet, Polygon, Optimism, and Artibrum in a matter of minutes. 1/ Go direct to DeFi Starting today, you can now purchase crypto on the Uniswap Web App using a credit/debit card or bank transfer at the best rates in web3 thanks to our partnership with @moonpay! https://t.co/YVyk8e6d2h — Uniswap Labs (@Uniswap) Decemb...

Who has returned donations or contributions from FTX amid the firm’s reputational risks?

Before its downfall, crypto exchange FTX and its then-CEO Sam Bankman-Fried had been some of the most prolific spenders in the space, bailing out crypto firms and donating to political campaigns and media outlets. With more than 1 million FTX creditors looking to be made whole, what’s happening with these funds? Bankman-Fried said in May he had been willing to donate between $100 million and $1 billion to lawmakers as part of elections in 2024. Bloomberg reported on Dec. 12 — hours before SBF’s arrest in the Bahamas — that his total donations could be at least $73 million, given directly to candidates or through political action committees (PACs). Though many of Bankman-Fried’s and FTX’s donations to Democrats were noted with the Federal Election Commission as part of the public reco...

SBF signs extradition papers, set to return to face charges in the US

Sam Bankman-Fried, the jailed founder of the FTX cryptocurrency exchange has reportedly signed papers on Dec. 20 that will soon see him handed over to Federal Bureau of Investigation (FBI) agents and flown to the United States to face criminal charges. The move was expected, as Bankman-Fried was reported to have agreed in principle to being extradited to the U.S. earlier this week on Dec. 19, despite earlier reports indicating he wanted to see the indictment against him fir ABC News reported the development that Bankman-Fried signed extradition papers on Dec. 20 citing The Bahamas’ acting commissioner of corrections Doan Cleare. A Dec. 21 report from Bloomberg said the exchange founder signed surrender documents on Dec. 20 citing Cleare, with another set of papers waiving h...

Polygon and Metacade: Two 50x opportunities for 2023

Bearish times in the market are typically when the newest batch of crypto millionaires are made. People have started speculating and trying to figure out which cryptos are next in line to go to the moon. This article is all about uncovering two tokens that have extremely high growth potential. Polygon (MATIC) and Metacade (MCADE) each have the potential to drive the GameFi sector forward. At the moment, both tokens are extremely underpriced and poised for some meteoric growth. In this article, we’ll be discussing the Metacade and Polygon price predictions and show exactly why these projects are so valuable to the GameFi revolution. What is Polygon? Polygon (MATIC), formerly Matic Network, is a decentralised platform that allows for the instant, secure, and trustless deployment of Ethereum-...

My Neighbor Alice Successfully Released Its Game Version 2.0 To Mainstream Audience

Stockholm, Sweden, 20th December, 2022, Chainwire My Neighbor Alice is a blockchain-based social game that has been popular among its users since its initial release and has now launched version 2 to mainstream audiences. My Neighbor Alice successfully released its game version 2.0 to the mainstream audience on December 16, 2022. The online game was released in June 2022 after a successful nine-month pre-alpha stage in September 2021. The game has been growing in popularity ever since its release. My Neighbor Alice is a multiplayer builder game that allows players to build and manage virtual lands, interact with neighbors, and perform exciting daily activities while earning in-game rewards. The fully decentralized social game functions completely on blockchain technology, bringing diverse ...

What it’s actually like to use Bitcoin in El Salvador

I attempted to spend two weeks travelling in El Salvador living on Bitcoin. I tried to pay for every single thing with Bitcoin, or Satoshis, small amounts of Bitcoin. Spoiler alert, I failed. Outfoxed by car hire companies (fortunately my car of choice was not Fiat); stubborn restauranteurs, a parking meter, pupusas, and a fancy dress shop where I was obliged to purchase a multicoloured wig with a $5 bill, I could not survive in “Bitcoin Country” on Bitcoin alone. So where did I go wrong? How did this happen? Isn’t El Salvador supposed to be Bitcoin Country? Is Bitcoin broken? Am I a scammer? First up, there’s no denying: El Salvador is unashamedly a Bitcoin destination. From Bitcoin conferences, big name Bitcoiners, ubiquitous “Bitcoin accepted here” signs, a laser eyed ...

Bitcoin miner Greenidge signs $74M debt restructuring agreement with NYDIG

According to a Dec. 20 filing with the United States Securities and Exchange Commission, Bitcoin (BTC) miner Greenidge has reached an agreement with its creditor, fintech firm NYDIG, to restructure approximately $74 million worth of debt. The deal, in the form of a non-binding term sheet, would result in a major change to Greenidge’s current business strategy, essentially transforming Greenidge from self-mining to hosting NYDIG’s mining rigs. Under the agreement, NYDIG would purchase miners with approximately 2.8 exahashes per second (EH/s) of mining capacity to be hosted by Greenidge, which would facilitate NYDIG’s rights to a mining site within three months following the completion of debt restructuring and hosting agreements. In exchange for consideration amounting to the purchased...

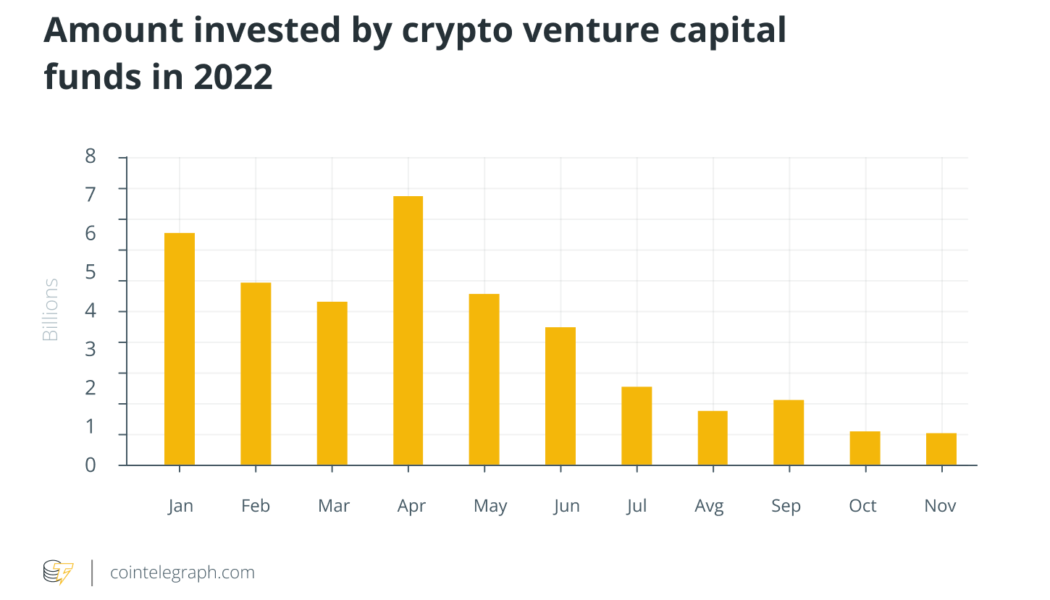

Blockchain VC funding surpasses 2021 total despite declining since May

It’s been a tough year for crypto, and venture capital activity confirms it. The collapse of FTX in November was the latest and most shocking in a series of closures of key market players this year — including Celsius, Voyager and BlockFi — that have shaken investor sentiment and wiped out $1.5 trillion in market capitalization from cryptocurrency space. Blockchain venture capital funding has been on a downward slope since May 2022, and November was no different, with inflows declining even further. However, the total capital inflows for 2022 have surpassed 2021 by almost $6 billion. According to Cointelegraph Research, VC funding declined 4.8% in November, totaling $840.4 million — down from $843 million in October. The Cointelegraph Research Terminal’s Venture Capital Database — which co...

Gate.io closer to launching US services after receiving local licenses

Gate US, the United States arm of the fourth largest cryptocurrency exchange by trading volume, Gate.io says it has received operating licenses in “several” states, bringing it closer to launching services in the country. Founder and president of Gate.io and its U.S. entity, Dr. Lin Han, announced in a Dec. 19 statement that Gate US is now registered as a money services business with the Financial Crimes Enforcement Network (FinCEN) — the country’s money laundering and financial crimes watchdog. He added the exchange “obtained some money transmission licenses or similar to operate, and is currently working to obtain more.” Gate US did not disclose what states it had obtained licenses from but said it is yet to accept users from the country at this stage. Its terms of use however...

BlockFi files motion to return frozen crypto to wallet users

Bankrupt crypto lending platform BlockFi has filed a motion requesting authority from a United States bankruptcy court to allow its users to withdraw digital assets currently locked up in BlockFi wallets. In a motion filed on Dec. 19 with the U.S. Bankruptcy Court in the District of New Jersey, the lender asked the court for authority to honor client withdrawals from wallet accounts that have been frozen on the platform since Nov. 10. The court documents also request permission to update the user interface to properly reflect transactions as of the platform’s pause. In a widely shared email sent to affected users, BlockFi called the motion an “important step toward our goal of returning assets to clients through our chapter 11 cases,” adding “It is our belief that clients unamb...