crypto blog

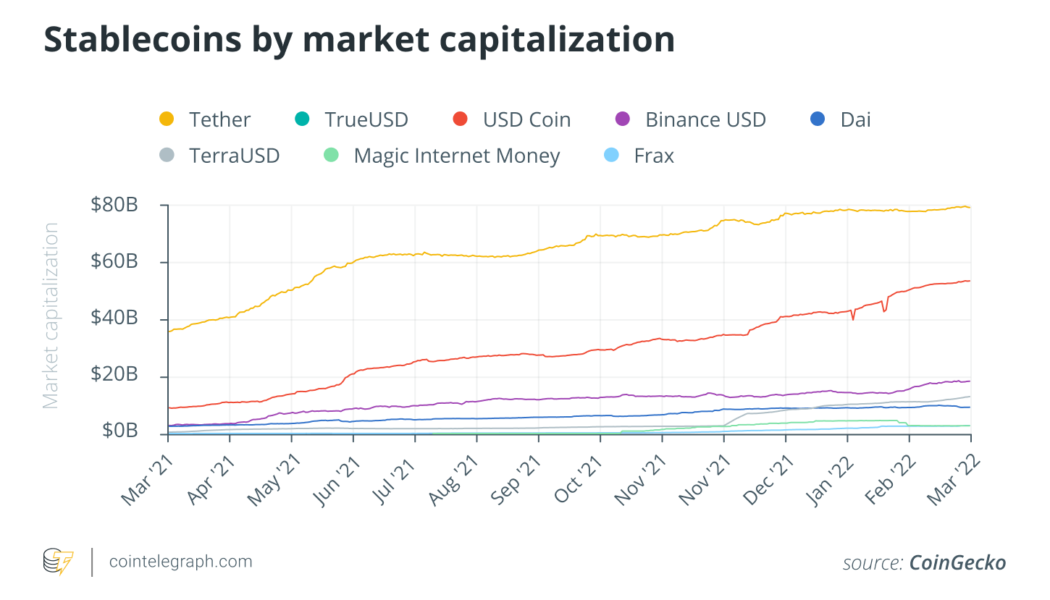

Stablecoins will have to reflect and evolve to live up to their name

In the case of stablecoins, unfortunately, the name is so far a misnomer. The fact that stablecoins are pegged to a “real” asset does not equate to stability. Traditional underlying assets are not exempt from market fluctuations, and with the majority of stablecoins pegged to fiat, they can be just as unstable. What the name could be, however, is aspirational — something that stablecoins might yet live up to if they can tie themselves to a solid foundation. Where did all the stability go? At risk of confusing metaphors, stability is the currency of the day. Markets are volatile, debt levels are high and inflation is spiraling following the COVID-19 pandemic and ongoing supply chain problems. The cryptocurrency markets have benefitted as investors have searched for alternative stores of wea...

Top 5 cryptocurrencies to watch this week: BTC, XRP, NEAR, XMR, WAVES

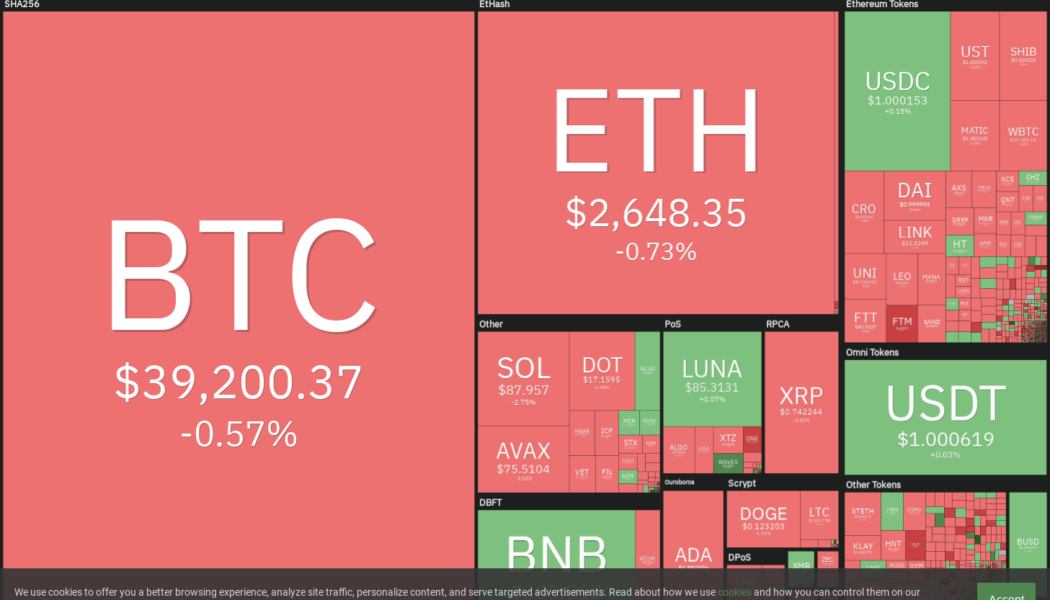

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend. Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021. Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to...

Weekly Report: BitDAO makes bold bet with $633 million allocation

Here are some of the interesting headlines you might have missed in the cryptocurrency sector this week: Rarify gets a $10 million boost in a funding round led by Pantera Capital Rarify, an infrastructure firm that provides businesses and institutions with a platform to natively incorporate non-fungible tokens (NFTs), has completed a $10 million funding round. The raise, which now puts the firm’s valuation at $100 million, was led by asset management company Pantera Capital, with the involvement of other investors including Slow Ventures, Greycroft, Protocol Labs, Hyper, and Eniac Ventures. By providing infrastructure to support enterprise-scale NFT integration, Rarify helps companies jump into the NFT scene with ease. According to the firm’s co-founder Revas Tsivtsivadz, the firm aims to ...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

Bitcoin (BTC) headed lower into the weekly close on March 6 with geopolitical tensions and associated macro weakness firmly in focus. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Could 2022 bring a “Greater Depression”? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting its lowest levels in over a week Sunday after volatility returned overnight. The pair was in the process of testing $38,000 support at the time of writing, with three-day losses approaching 12%. Despite the “out of hours” trading environment, the trend was clearly down for the largest cryptocurrency, as the mood on global equities wobbled among analysts. “Global equities have lost $2.9tn in mkt cap this week as war could trigger major stagflationary sh...

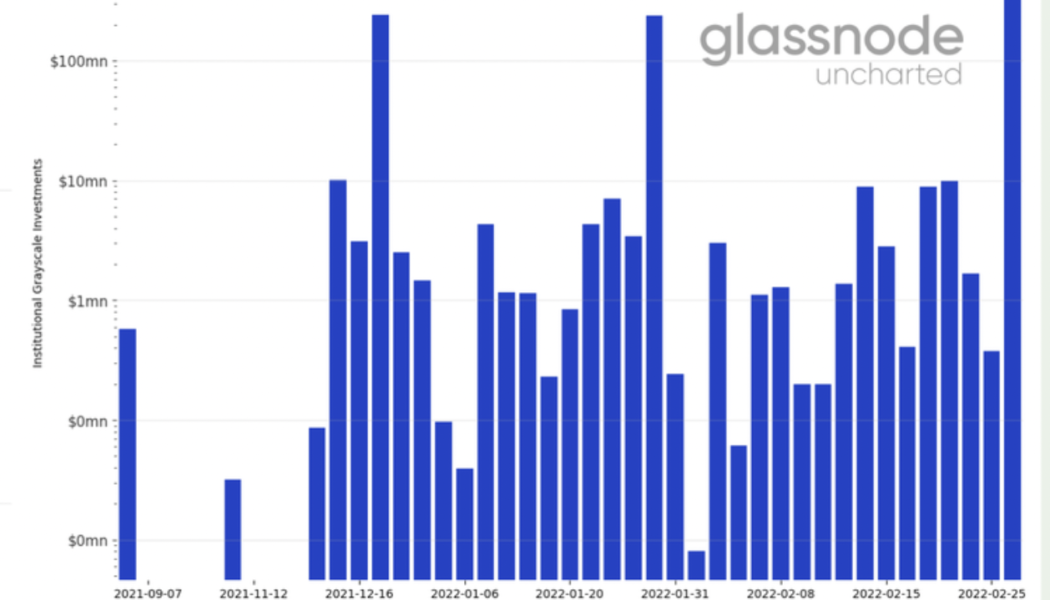

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Institutions increase exposure to Grayscale Bitcoin Trust as GBTC discount nears 30%

Institutional investors are returning to accumulate Grayscale Bitcoin Trust (GBTC) shares as the discount to spot price his risen to nearly 30%, data on Glassnode shows. Since December 2021, some weekly sessions saw investors pouring in between $10 million and $120 million into Grayscale’s flagship fund. Meanwhile, the biggest capital inflow — amounting to nearly $140 million — appeared in the week ending on Feb. 25, as shown in the chart below. Institutional Grayscale Investments since September 2021. Source: Glassnode No selloff yet among high-profile GBTC backers The GBTC trust attracted investments as global markets faced back-to-back shocks in the past few months, including a dramatic selloff in the technology stocks, followed by Russia’s invasion of Ukraine that left many...

Non-crypto natives launch social tokens to engage with community and fans

The COVID-19 pandemic, along with other recent events, have revealed the need for a fully digital economy, giving rise to Metaverse ecosystems, Web3 platforms and the adoption of digital currencies. For example, the Ukrainian government recently reached out to the crypto community on Twitter asking for donations in Bitcoin (BTC), Ether (ETH) and Tether (USDT). Nonfungible tokens, or NFTs, have also gained mainstream adoption as artists and creators across the globe have discovered new forms of monetization with these models. While innovative, these use cases also demonstrate the notion that blockchain-based concepts that emerged early on often take years to resonate with mainstream society. Social tokens in 2022 This also appears to be the case with social tokens o tokens that are is...

Non-crypto natives launch social tokens to engage with community and fans

The COVID-19 pandemic, along with other recent events, have revealed the need for a fully digital economy, giving rise to Metaverse ecosystems, Web3 platforms and the adoption of digital currencies. For example, the Ukrainian government recently reached out to the crypto community on Twitter asking for donations in Bitcoin (BTC), Ether (ETH) and Tether (USDT). Nonfungible tokens, or NFTs, have also gained mainstream adoption as artists and creators across the globe have discovered new forms of monetization with these models. While innovative, these use cases also demonstrate the notion that blockchain-based concepts that emerged early on often take years to resonate with mainstream society. Social tokens in 2022 This also appears to be the case with social tokens o tokens that are is...

6 Questions for Reeve Collins of BLOCKv

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Reeve Collins, co-founder of BLOCKv — a platform for creating, minting and distributing next-generation programmable NFTs. I have always found myself at the forefront of new trends and technology developments. I started in 1997 at the first-ever online advertising agency when the internet was in its infancy. As the “dot-com boom” matured, I created one of the first ad networks in 2000 before shifting into the online branded entertainment space in 2007. By 2013, I was diving headfirst into the world of Bitcoin, and this exploration led me to invent the first-ever stablecoin, Tether, in 2014 and the ...

6 Questions for Reeve Collins of BLOCKv

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Reeve Collins, co-founder of BLOCKv — a platform for creating, minting and distributing next-generation programmable NFTs. I have always found myself at the forefront of new trends and technology developments. I started in 1997 at the first-ever online advertising agency when the internet was in its infancy. As the “dot-com boom” matured, I created one of the first ad networks in 2000 before shifting into the online branded entertainment space in 2007. By 2013, I was diving headfirst into the world of Bitcoin, and this exploration led me to invent the first-ever stablecoin, Tether, in 2014 and the ...