crypto blog

Cointelegraph partners with Nitro Network to bring digital mining and decentralized internet to the masses

Over the past few years, nonfungible tokens (NFTs) have become a multibillion-dollar industry and have solidified themselves among the most tech savvy. They have opened the portal to infinite possibilities and carved out a new direction for the future of the internet. Enter Nitro Network, which is set to revolutionize the NFT space and take it to new heights. With its groundbreaking Non-Fungible Miners (NFMs), Nitro Network will solidify the decentralized web, all while offering generous rewards to its users. That is why Cointelegraph has partnered up with Nitro Network, to pioneer the future of a decentralized internet through the Non-Fungible Miner. NFMs are a unique innovation — an NFT that provides all users the ability to digitally mine Nitro’s native token, NCash, from anywhere in th...

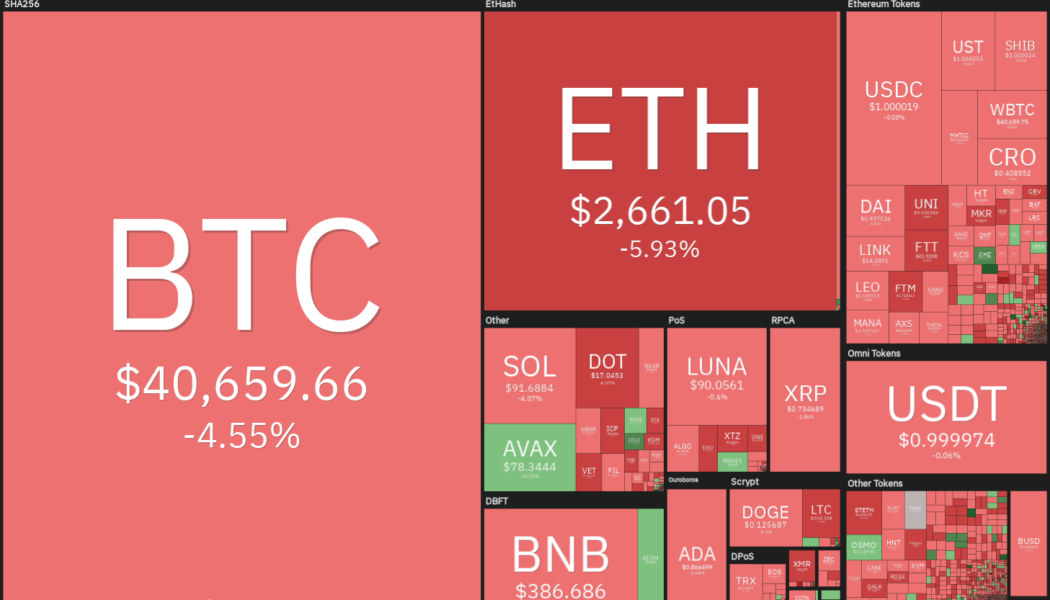

Price analysis 3/4: BTC, ETH, BNB, XRP, LUNA, SOL, ADA, AVAX, DOT, DOGE

The equity markets in Europe and the United States are seeing a sea of red as traders continue to sell risky assets due to the geopolitical situation. Bitcoin (BTC) and several major cryptocurrencies are also witnessing profit-booking after the recent rise. Another reason that could be keeping investors on the edge is the upcoming Federal Open Market Committee (FOMC) meeting on March 16. A statement from Fed hair Jerome Powell on March 2 highlighted that the central bank is likely to hike rates this month. Fitch Ratings chief economist Brian Coulton expects core inflation to remain high in 2022 and the Fed to boost the “Fed fund rate to 3% by the end of 2022.” Daily cryptocurrency market performance. Source: Coin360 ExoAlpha managing partner and chief investment officer David Lifchit...

US Virginia Senate allows state banks to offer crypto custody services

The Senate of Virginia in the United States unanimously approved a bill amendment request that now allows traditional banks operating in the Commonwealth of Virginia to provide virtual currency custody services. Delegate Christopher T. Head introduced the bill (House Bill No. 263) back in January 2022, seeking an amendment to allow eligible banks to offer crypto custody services: “A bank may provide its customers with virtual currency custody services so long as the bank has 26 adequate protocols in place to effectively manage risks and comply with applicable laws.” The bill passed Senate with a sweeping 39-0 vote and is waiting to be signed into law by Governor of Virginia Glenn Youngkin. Banks that intend to offer this service to clients will need to adhere to three specific requir...

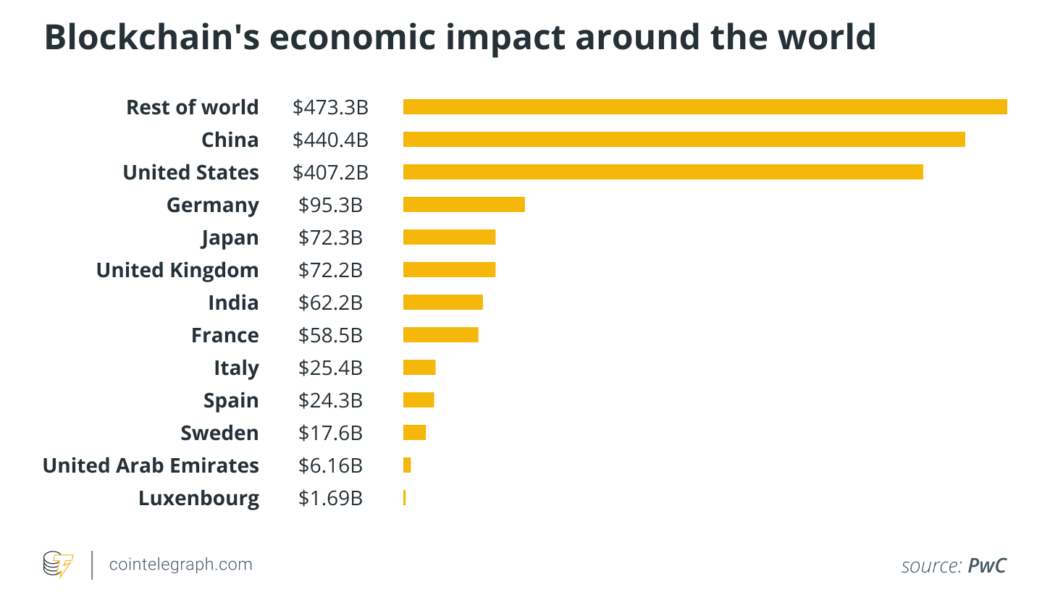

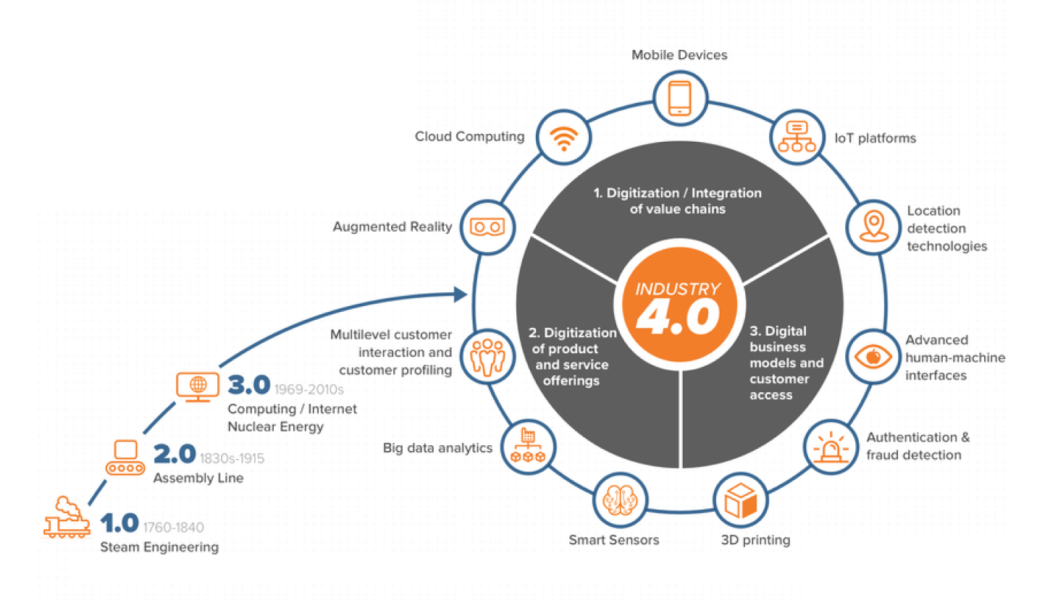

The post-consortia era: How enterprises are embracing Web3 structures

Now that the initial hype surrounding blockchain applications and the prolonged blockchain “winter” that followed are left behind, we now find ourselves in the middle of a “spring” that is helping organizations reimagine how they deliver value. So much so that blockchain is expected to add $1.76 trillion to the global economy by 2030, according to PWC. A significant chunk of this uptick is expected to come from business-to-business (B2B) implementations, which stand to gain the most from the security, immutability and streamlining opportunities afforded by blockchain-based transactions and relationships. With processes that involve multiple partners, dozens (if not hundreds) of products and cumbersome bureaucracy for almost any business process, it’s hard to overstate how much enterp...

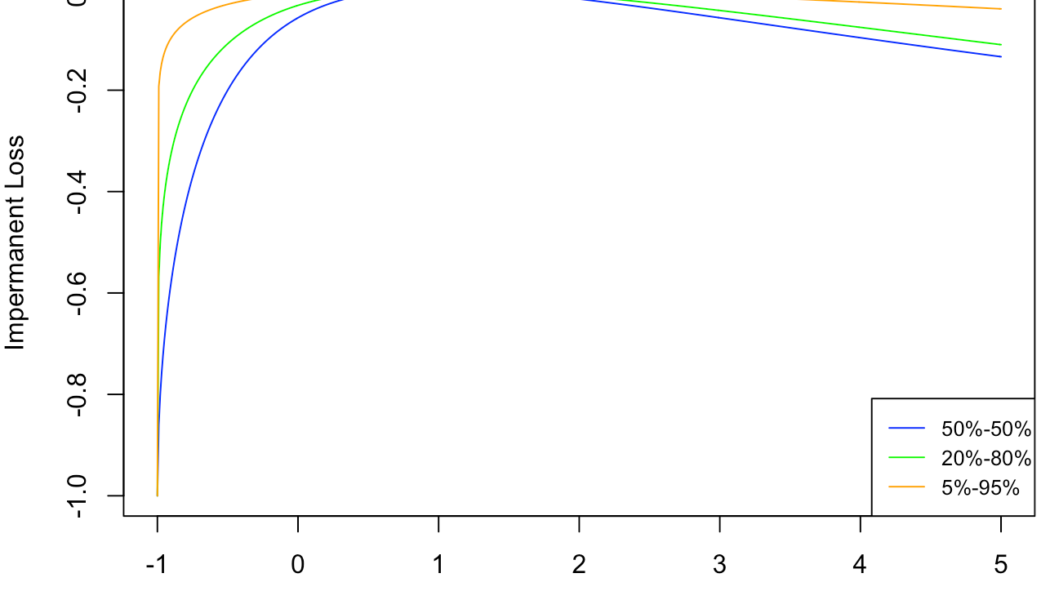

Impermanent loss challenges the claim that DeFi is the ‘future of France’

Impermanent loss is one of the most recognized risks that investors have to contend with when providing liquidity to an automated market maker (AMM) in the decentralized finance (DeFi) sector. Although it is not an actual loss incurred from the liquidity provider’s (LP) position — rather an opportunity cost that occurs when compared with simply buying and holding the same assets — the possibility of getting less value back at withdrawal is enough to keep many investors away from DeFi. Impermanent loss is driven by the volatility between the two assets in the equal-ratio pool — the more one asset moves up or down relative to the other asset, the more impermanent loss is incurred. Providing liquidity to stablecoins, or simply avoiding volatile asset pairs, is an easy way to reduce impermanen...

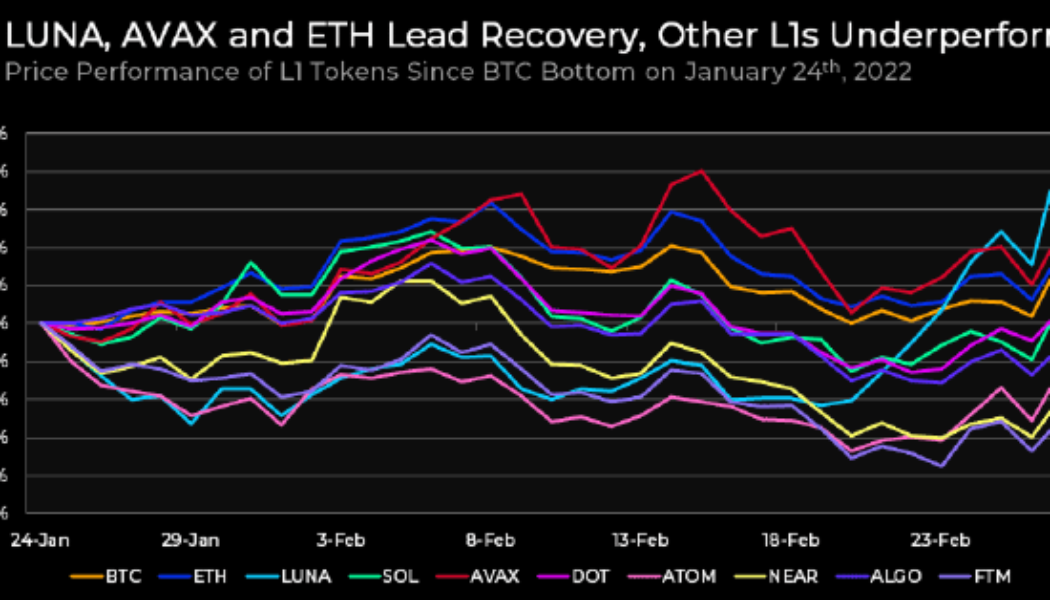

Terra, Avalanche and Osmosis lead the L1 recovery while Bitcoin searches for support

The layer-one (L1) ecosystem has received increased attention in recent months as users search for new investment opportunities in the Cosmos (ATOM), Fantom (FTM) and NEAR. Following January’s market sell-off, where Bitcoin (BTC) price dropped to bottom below $34,000, much of the L1 field has struggled to regain its momentum. Price performance of L1 tokens since Jan. 24. Source: Delphi Digital According to data from Delphi Digital, since the BTC bottom on Jan. 24, the only L1 to experience a notable gain in price include Terra (LUNA), Avalanche (AVAX) and Ethereum (ETH). Terra ecosystem growth The price growth seen in LUNA was in large part due to the announcement from the Luna Foundation Guard that it had raised $1 billion to form a Bitcoin reserve for the ecosystem’s Terra US...

Crypto donations to Ukraine top $37M, eBay eyes crypto payments and South Korea allocates $187M to the metaverse: Hodler’s Digest, Feb. 27-Mar. 5

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Ukraine has received $37M in tracked crypto donations so far Cointelegraph compiled data this week for crypto donations sent to the Ukrainian government, military and charities amid the country’s ongoing conflict with Russia. By Monday, total crypto donations to the Ukrainian government and charities linked to it had reached $37 million. The “Reserve fund of Ukraine” backed by local crypto exchange Kuna appeared to be the largest recipient, garnering roughly $13 million worth of BTC, ETH, USDT and other ...

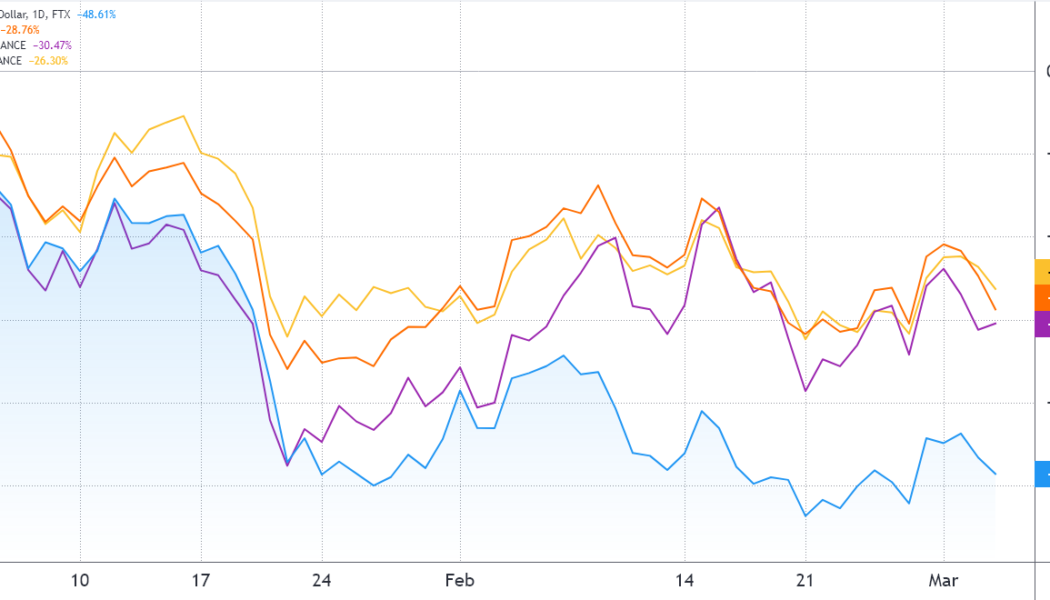

Solana TVL and price drop 50%+ from ATH, but gaming DApps could turn the tables

2022 has not been a good start for cryptocurrencies and to date, the total market capitalization has dropped by 21% to $1.77 trillion. Solana’s (SOL) correction has been even more brutal, presenting a 48.5% correction year-to-date. Solana (blue) vs. Ether (orange), AVAX (purple), BNB (yellow). Source: TradingView Solana leads the staking charts with $35 billion in value locked, which is equivalent to 74% of the SOL tokens in circulation. Multiple reasons can be identified for the underperformance, including four network outages in late 2021 and early 2022. The latest incident on Jan. 7 was attributed to a distributed denial-of-service (DDoS) attack, causing Solana Lab developers to update the code and consequently reject these types of requests. However, investors are more concerned ...

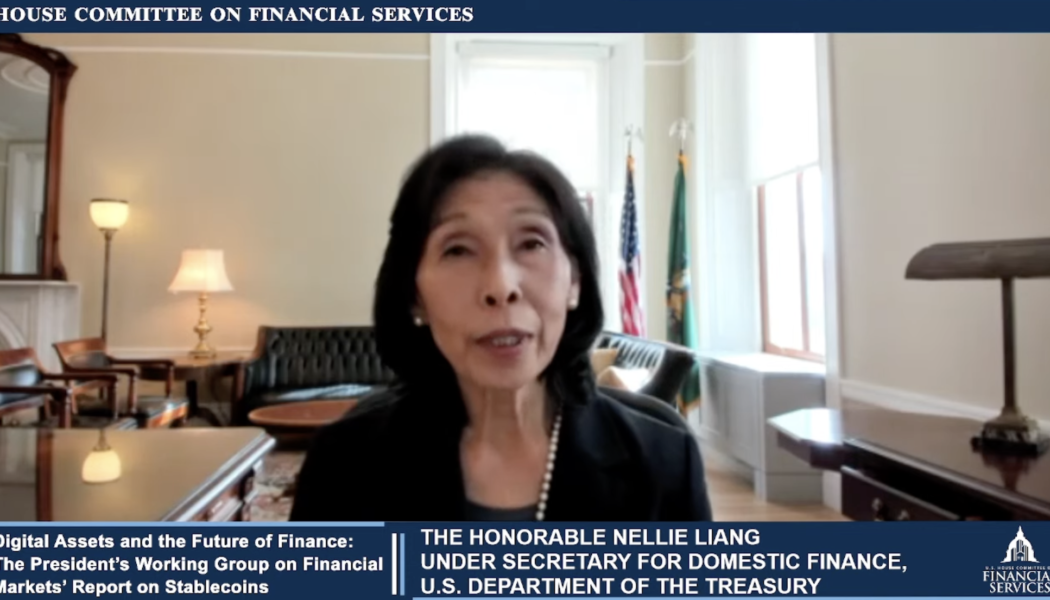

Crypto industry seeks to educate, influence US lawmakers as it faces increasing regulation

Interaction between the cryptocurrency industry and Capitol Hill is becoming ever more intensive as efforts to regulate crypto grow in tandem with its popularity. The surge in crypto industry lobbying last year was given some concrete parameters in February by crypto analytics startup Crypto Head. It released a report showing that the crypto companies that spent the most money on lobbying in 2021 were Robinhood, Ripple Labs, Coinbase and the Blockchain Association. These organizations were the lobbying leaders during the past five years as well, although with different rankings. Here is what the United States crypto-lobbying landscape looks like today. Metrics of influence Robinhood spent $1.35 million on lobbying in 2021 and was the only crypto-related organization to spend more than $1 m...

What is the Algorand blockchain, and how does it work?

What is Algorand? Algorand is a blockchain network created in 2017 by Silvio Micali, an MIT professor who won the Turing Award for his work in cryptography. Algorand is a decentralized permissionless blockchain protocol that anyone can use to develop applications and transfer value. The Algorand protocol is powered by a novel consensus algorithm that enables fast, secure and scalable transactions. Algorand addresses the common issues that most older blockchains have, specifically concerning scalability and consensus. The blockchain uses Pure proof-of-stake (PPoS), a consensus protocol that selects validators at random according to the weight of their stake in ALGO coins. What is Algorand trying to solve? The Algorand protocol is designed to solve three of the biggest problems most blockcha...

Opensea phishing scandal reveals a security need across the NFT landscape

Despite the ongoing volatility plaguing the digital asset sector, one niche that has undoubtedly continued to flourish is the nonfungible token (NFT) market. This is made evident by the fact that a growing number of mainstream mover and shakers including the likes of Coca-Cola, Adidas, the New York Stock Exchange (NYSE) and McDonalds, among many others, have made their way into the burgeoning Metaverse ecosystem in recent months. Also, owing to the fact that over the course of 2021 alone, global NFT sales topped out at $40 billion, many analysts expect this trend to continue into the future. For example, American investment bank Jefferies recently raised its market-cap forecast for the NFT sector to over $35 billion for 2022 and to over $80 billion for 2025 — a projection that was also ech...