crypto blog

CEXs refuse blanket asset freeze of all Russian users, though questions linger

Centralized exchanges (CEX) and CEOs from companies such as Binance, Coinbase and Kraken have all stated they would only freeze the assets of Russian clients specifically targeted by Western sanctions — not that of everyday Russian users. A few days prior, Mykhailo Fedorov, Ukraine’s minister of digital transformation, had called for “all major crypto exchanges to block [wallet] addresses of Russians” and “also to sabotage ordinary users [by freezing their assets].” In explaining why he was not preemptively banning all Russians (though, Coinbase is not available in Russia), Brian Armstrong, CEO of Coinbase, specifically wrote: “We believe everyone deserves access to basic financial services unless the law says otherwise. Some ordinary Russians are using crypto as a lifeline...

Ukraine finds unlikely ally in efforts to bar Russian access to crypto: The Central Bank of Russia

Recently, Ukraine has called for “sabotage” of everyday Russians’ crypto assets due to an ongoing war between the two countries. Among many, its European allies have also voiced mounting concerns that Russia may use crypto to bypass Western sanctions. But ironically, it appears that one of the greatest proponents of barring everyday Russians and financial institutions from accessing cryptocurrencies is actually the Central Bank of Russia, or CBR, itself. As reported by local news outlet tass.ru on Thursday, the CBR continues to adhere to its position of proposing to ban the issuance, mining, and circulation of cryptocurrencies in the Russian Federation. A CBR official stated: “The Central Bank currently supports the position that was previously announced ...

Altcoin Roundup: JunoSwap, Solidly and VVS Finance give DeFi a much-needed refresh

Decentralized finance (DeFi) was the talk of the town in early 2021, but it has since taken a back seat to more appealing sectors like nonfungible tokens (NFTs), memecoins and blockchain gaming. Now that cross-chain bridges and interoperability have allowed for the easier migration of assets to competing chains, a new class of DeFi protocols is arising to challenge those left from 2021. Here’s a look at three DeFi projects that have launched on some of the up-and-coming layer-1 blockchain networks, catching the eye of the crypto community. VVS Finance VVS Finance is the largest DeFi protocol on the Cronos network, a project that emerged out of the Crypto.com ecosystem which has since been fully rebranded to Cronos (CRO). The goal of VVS Finance is to offer instant swaps with low fees...

Bitcoin loses $40K as BTC price support levels give way to 1-week lows

Bitcoin (BTC) stayed below some critical support zones into the weekend after a late sell-off cost bulls the $40,000 mark. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Upper range support levels crumble for BTC Data from Cointelegraph Markets Pro and TradingView painted a lackluster picture for BTC/USD Saturday, the pair lingering near $39,000 after seeing lows of $38,600. Traders had hoped that various price points above $40,000 would be sufficient to steady the market after its latest run to $45,200. In the event, however, bids failed to preserve the trend, sending Bitcoin back to the middle of a range in which it had acted throughout 2022. #Bitcoin is hanging onto the edge of a cliff the past few hours pic.twitter.com/dAD2AveTOi — Matthew Hyland (@MatthewHyland_) Mar...

What is the Crypto Fear and Greed Index?

Various Crypto Fear and Greed Index signals that influence the behavior of traders and investors include Google trends, surveys, market momentum, market dominance, social media and market volatility. To determine how much greed is trending in the market, examine trending search phrases. For instance, a high volume of Bitcoin-related searches means a high degree of greed among investors. This factor accounts for 10% of the index value. Historically, increases in Bitcoin-specific Google searches have been correlated with an extreme volatility in crypto prices. To calculate the number each day, the Bitcoin Fear and Greed Index considers a few other factors, such as surveys, which account for 15% of the index value. Surveys with participants of over 2000 drive the index value higher, indicatin...

REN price gains 65% after Catalog launch brings a cross-chain DEX to its blockchain

Decentralized finance projects like Ren pumped in 2021, only to finish the year right back where they started as high fees on Ethereum (ETH) led to decreased activity for many protocols and DeFi took a backseat to more popular sectors like nonfungible tokens (NFTs). Now, it appears as though that downtrend is in the process of reversing course after recent global events highlighted the benefits of DeFi and holding assets outside the traditional financial system. This week REN price climbed 69% from a low of $0.247 on Feb. 24 to a daily high of $0.418 on March 3. REN/USDT 4-hour chart. Source: TradingView Three reasons for the potential price reversal in REN are the launch of its first layer-one application Catalog, the launch of VarenX on Polygon and several new partnerships and inte...

Bitcoin slides under $39K, leading some traders to forecast a weekend ‘oversold bounce’

March 4 saw another day of seesaw price action for Bitcoin (BTC) and the wider cryptocurrency market as the global economic fallout from the ongoing conflict in Ukraine weighs heavily on a majority of the world’s financial markets. Data from Cointelegraph Markets Pro and TradingView shows that after holding $41,000 in the early trading hours on March 4, a wave of selling in the afternoon dropped the price of BTC below $39,100. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts have to say about the outlook for BTC moving forward as the world faces a period of increased economic uncertainty. A potential retest of $38,000 BTC/USD 1-week chart. Source: Twitter According to Rekt Capital, $43,100 is an important level for BTC because the last time Bitcoin clo...

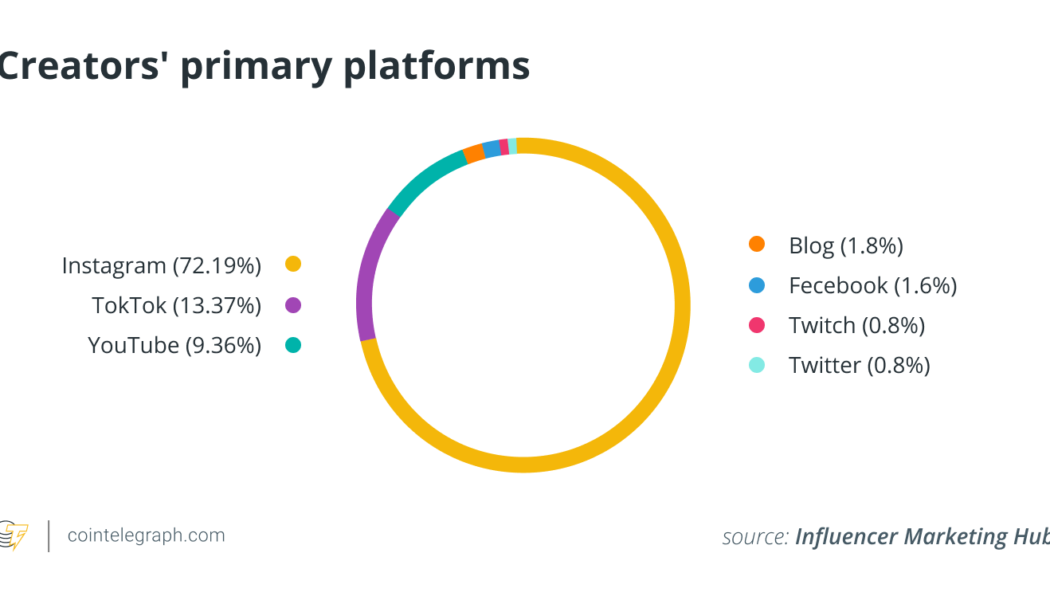

The best is yet to come: What’s next for blockchain and the creator economy

After two years and many COVID-19 restrictions finally subsiding, the world is welcoming the return of in-person theater, movies, comedy, music and sports. This has left some wondering what will happen to the legions of digital creatives who occupied and entertained us while normal life was at a standstill — and to the multibillion-dollar economy they inhabit. Will the world forget the platforms and artists they discovered during the pandemic now the doors of festivals, fashion shows and concerts are open to them again? Is the creator economy, which recent estimates suggest will exceed $100 billion this year, strong enough to withstand a stampede back to real-life experiences? I strongly believe it is. Government-imposed restrictions may have accelerated the pace of change, but the transfo...

Manchester soccer rivalries commence in field of Web3

Leading English soccer club Manchester City has announced an inaugural partnership with cryptocurrency exchange OKX across both its men’s and women’s teams, as well as the club’s emerging esports ventures. According to the club’s press release, the collaboration will focus on “exclusive experiences for OKX’s global customer base, in addition to an in-stadium presence across the Etihad Stadium and Academy Stadium.” OKX, which rebranded from OKEx earlier this year, is the second-largest spot exchange in the industry, reportedly having reportedly over 20 million customers and facilitating over $4.3 billion in normalized trading volume over the past 24 hours. This total places it ahead of Coinbase, which is in third at approximately $3.3 billion, but a ways behind Binance’s dominance...

Bitcoin declines with US stocks as nuclear threat ripples through markets

Bitcoin (BTC) bulls saw no relief at the Wall Street open on March 4 as the $40,000 support appeared on the horizon. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader: Markets “shaky,” but BTC could bounce Data from Cointelegraph Markets Pro and TradingView revealed new March lows of $40,551 for BTC/USD on Bitstamp, taking two-day losses to 10.2%. Fears over the security of Ukraine’s nuclear infrastructure drove not just crypto but traditional markets lower on the day, with the S&P 500 following European indexes to decline by 1.4%. “Bitcoin correcting as tensions around Ukraine are increasing, and fear is increasing too as Gold is rushing upwards,” Cointelegraph contributor Michaël van de Poppe explained in his latest Twitter update. “Might be seeing a b...

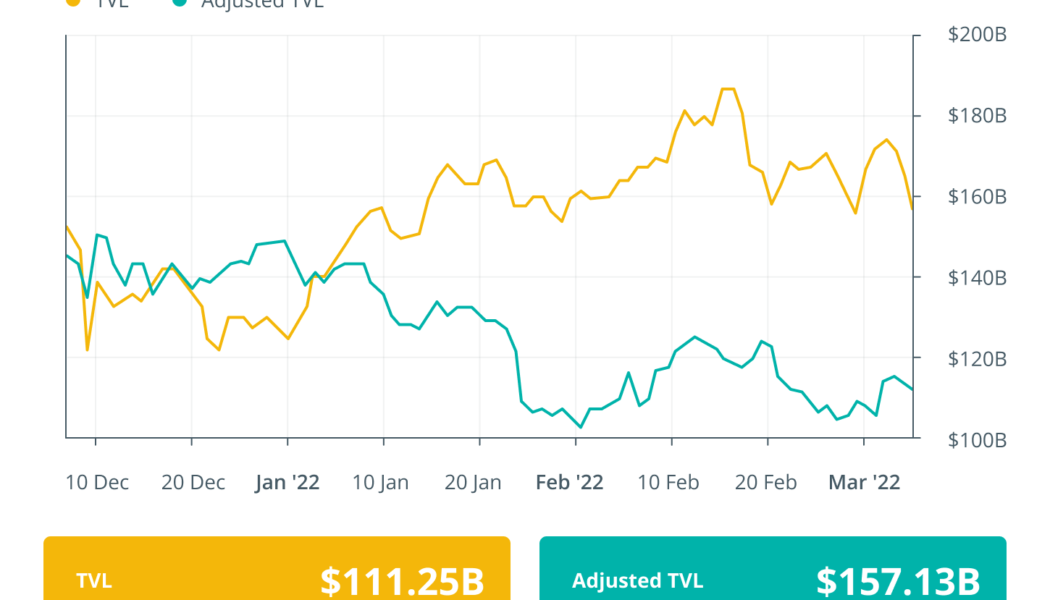

Finance Redefined: Uniswap builds token-swap feature for Ukraine, LUNA surpasses Ether, and more

The crypto community has emerged as one of the leading aid providers for Ukrainians, as crypto donations surged over $50 million. This week, many in the decentralized finance, or DeFi, community have come forward to donate and make it simpler for other people to donate to Ukraine. LUNA continued its price dominance with another double-digit surge over the past week and also flipped Ether to become the most staked altcoin. 1Inch launched a new secure peer-to-peer, or P2P, swap that the firm claimed could open the gates to several new use cases. Uniswap builds an interface to swap altcoins into ETH donations for Ukraine On Tuesday, decentralized exchange, or DEX, Uniswap launched an interface which directly converts ERC-20 tokens into Ether (ETH) and sends them to the official crypto w...

Russian national will use sales of her burning passport NFT to support Ukraine

Olive Allen, a Russian national and artist who has lived in the United States for more than 11 years, has burned her mother country’s passport in the hopes of raising awareness and funds related to the military conflict in Ukraine. Speaking to Cointelegraph on Friday, Allen described herself as “a child of new Russia” and said the country would always be a part of her identity, but she had chosen to cut ties with it based on its recent actions in the Ukraine. Standing in front of the Consulate General of the Russian Federation in New York City, Allen burned her Russian passport — which she said was the only copy she had — and planned to auction the video as a nonfungible token (NFT), with the proceeds going to humanitarian efforts in Ukraine. “I do not consider Putin’s Russia my home...