crypto blog

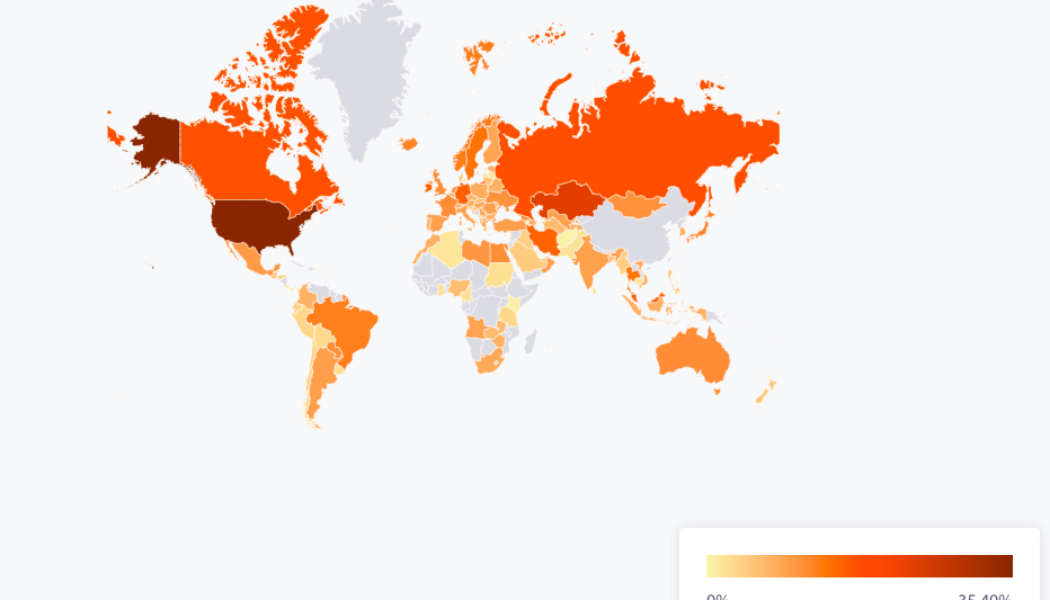

Crypto markets have inadequate liquidity to sustain sanctioned Russia, TRM Labs’ executive says

TRM Lab’s Ari Redbord expects Russia to turn to crypto to skirt the economic pressure of sanctions from the West However, the executive believes that crypto markets are not liquid enough to serve Russia’s financial demands In an interview with CNBC today, Ari Redbord, the Head of Legal and Government Affairs at blockchain transparency firm TRM Labs, has suggested that even though Russia may look towards cryptocurrencies to help navigate the wild effects of sanctions from the west, they just won’t cut it. As the US and its allies attempt to close Russia out of the dollar-denominated financial system, the crypto specialist theorised that he expects Russia to ultimately turn to cryptocurrencies. “Look, crypto provides an alternative to traditional financial systems. If...

Crypto markets clear $300M in liquidations, with a Theta trader losing $11M

More than 70,000 traders have been liquidated in the last 24 hours. A single trader’s loss has contributed to nearly 95% of all liquidations on the Theta network. Last Thursday, as Russia announced its “military operation” into Ukraine, Bitcoin and crypto markets dipped massively, with many traders going into panic. Recovery, however, didn’t take long as markets snowballed into the new week, led by Terra (LUNA). After blowing above its consolidation region of about $38,000, Bitcoin has been roaring upwards. It has gained more than 15% in the last 24 hours as it’s now trading $44,263, a spike of more than $10,000 in less than a week. The recent extreme fluctuations have resulted in massive liquidations across the sector Data from cryptocurrency futures trading ...

Hashstack secures $1M seed funding for its under-collateralized DeFi loans project

A few days after launching its Open Protocol testnet, Hashstack Finance has secured $1 million seed funding in a fundraising round that saw the likes of Moonrock, GHAF Capital, Kane & Rao Group, MarketAcross, Chainridge Capital, and Nimrod Lehavi invest in the project. The funds shall be used to develop the Open Protocol and attract top talent to the growing Hashstack Finance community. Kevin Kurian, a general partner at Kane & Rao Group, said: “Getting the maximum value out of your assets is essential in any market. Hashstack offers a solution that the market has not really seen before. We backed Vinay and his team at Hashstack with our capital to bring forward these new ideas.” Open Protocol The Open Protocol aims at allowing crypto users to access under-collateralized DeFi loans...

Why bandwidth needs a layer-1 blockchain, explained

Users will be able to tokenize their bandwidth and sell it in a decentralized trading marketplace to help provide low-cost access to the internet. PKT is the only layer-1 blockchain that is designed to support bandwidth trading marketplaces and high-speed internet service. PKT uses the world’s first bandwidth-hard proof-of-work (PoW) mining solution to create an economic incentive while building a high-speed data network. Forked from Bitcoin (BTC), PKT replaces the SHA-256 PoW standard with the collaborative PacketCrypt mining protocol. Within the PKT Network, users with unused bandwidth earn PKT Cash (PKT) coins by directing their excess bandwidth and compute resources to mining. The act of connecting bandwidth to the PKT Network is called announcement mining. Announce...

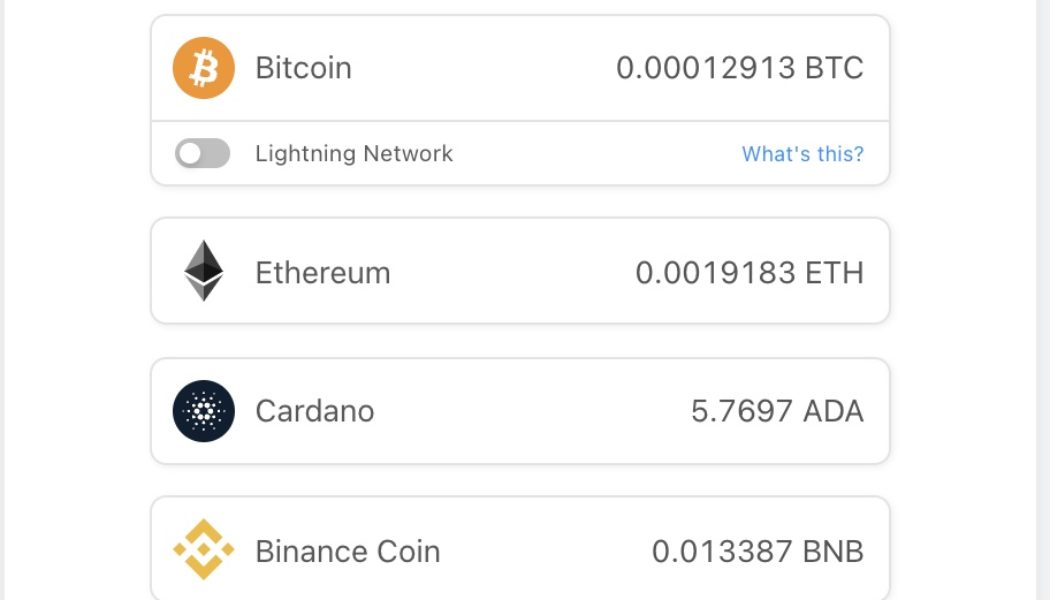

Ukraine accepts DOT, founder Gavin Wood donates $5.8 million

Calls from the crypto community for Ukraine to accept other cryptocurrencies have been answered. The official Ukraine Twitter account shared that it will now accept donations from Polkadot (DOT), while other cryptocurrencies will soon be added. The people of Ukraine are grateful for the support and donations from the global crypto community as we protect our freedom. We are now accepting Polkadot donations too: $DOT: 1x8aa2N2Ar9SQweJv9vsuZn3WYDHu7gMQu1RePjZuBe33Hv.More cryptocurrencies to be accepted soon. — Ukraine / Україна (@Ukraine) March 1, 2022 Gavin Wood, the co-founder of Polkadot had previously shared that if the Ukraine wallets were to add DOT, he would personally contribute $5 million. He made true on his promise, donating 298,367.2269896686 DOT, which is roughly...

Bitcoin analysts eye crucial levels to hold after BTC price almost hits $45K, Ethereum $3K

Bitcoin (BTC) checked its latest gains at the Wall Street open on Mar. 1 as bulls sought to defend $44,000 highs. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC weekly gains hit 17% Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it declined from its local peak of $44,980 on Bitstamp at the opening bell. The second day of trading with armed conflict in Europe as its background, March 1 continued a surprisingly cool phase for U.S. equities, with only oil showing the knock-on effects of the Ukrainian war. Bitcoin, by contrast, held onto the majority of its advances, which had been rekindled in earnest on March 1. Versus the same time a week ago, BTC/USD was up 17% at the time of writing. Bitcoin since weaponized finance began with Russia. C...

Payment services provider Shift4 acquires The Giving Block for $54 million

According to an investor presentation published Tuesday, U.S.-based payment solutions provider Shift4 announced its acquisition of The Giving Block in cash and stock for $54 million, plus a potential earnout of up to $246 million. The Giving Block is an online platform that allows over 1,300 nonprofit organizations and charities to accept crypto donations. As told by its annual report, the organization processed $69.64 million in crypto donations, an increase of 1,558% from 2020. Out of this amount, approximately $12.3 million came from donations by nonfungible token, or NFT, projects. Ether (ETH) became the most-popular crypto donated for the first time, accounting for nearly half of the total volume. Last month, The Giving Block provided Cointelegraph with a sample list of six char...

The current rally in the alt markets could be a bull trap, crypto expert warns

Widely-followed crypto analyst Crypto Capo has suggested that altcoin markets could collapse According to the crypto expert, Cardano (ADA) is obviously bearish Popular crypto strategist Crypto Capo has stated that he is not yet bullish on most altcoins, indicating that 99% of them are showing signs of a slump set to come soon. Addressing his Twitter following yesterday, the crypto trader spoke in retrospect to the recent upsurge in crypto markets crossing into the new month. Market leader Bitcoin cruised upwards of $43k, and as expected, several altcoins tagged along in growth. However, the pseudonymous crypto investor said that while altcoins undergo imminent market growth, the joy could be short-lived since they could well be leading investors into a bull trap. “Some people may think I’m...

The best tokens with the largest ecosystems that you can buy on March 1, 2022: SOL, NEAR, and FTM

Solana’s market cap saw an increase of 10% in the last 24 hours. Near’s market cap increased by 23%, and its trading volume increased by 160% in the last 24 hours. Fantom’s value increased by 16% in the last 24 hours, and its trading volume jumped by 41%. Solana SOL/USD, Near NEAR/USD, and Fantom FTM/USD are all blockchain projects which have some of the largest ecosystems of dApps surrounding them. Each ecosystem has a wide range of projects which have been built on top of the native blockchain network and will likely carry on with its growth. Should you buy Solana (SOL)? On March 1, 2022, Solana (SOL) had a value of $97.19. The all-time high value of Solana (SOL) was on November 6, 2021, when it reached a value of $259.96. When we go over the performance of the token last month, So...

Bitcoin accumulation among whales surges as crypto market rallies

Bitcoin saw a ballistic upswing late yesterday, peaking at $44,000 The number of wallets holding more than 1,000 BTC has risen in the last 24 hours Bitcoin had a fairly decent run in February compared to January, when it fell from $46.73k at the start of the year to $37.45k on the last day of the month. Last month, the flagship cryptocurrency mostly traded above $42k in the first two weeks before paring down in the third week. The correction was followed by a steep crash to a monthly low of $34,459 last Thursday. A renewed rally kicking off late yesterday has put the coin in an uptrend, reclaiming $44k. Along with the price gains, the number of holders in different groups (based on the amount of bitcoin they hold) has increased. Whales are taking up crypto at a faster rate Data from CoinMe...

Cambridge University launches crypto research project with IMF and BIS

The University of Cambridge is collaborating with some of the world’s top banking institutions and private companies to introduce a new project targeting cryptocurrency research. The Cambridge Center for Alternative Finance, or CCAF, has launched a research initiative aiming to bring more insights on the rapidly growing digital asset industry, the CCAF announced to Cointelegraph on Monday. Dubbed the Cambridge Digital Assets Programme, or CDAP, the project is a public-private collaboration with 16 companies including public institutions like the Bank for International Settlements Innovation Hub and the International Monetary Fund. The initiative also includes banks like Goldman Sachs, financial giants like Mastercard and Visa, as well as major exchange-traded fund providers like Invesco. O...