crypto blog

Blockchain forensics is the trusted informant in crypto crime scene investigation

The seizure by the U.S. Department of Justice of $3.6 billion worth of Bitcoin (BTC) lost during the 2016 hack of Bitfinex’s cryptocurrency exchange has all the ingredients of a Hollywood film — eye-popping sums, colorful protagonists and crypto cloak-and-dagger — so much so that Netflix has already commissioned a docuseries. But, who are the unsung heroes in this action-packed thriller? Federal investigators from multiple agencies including the new National Cryptocurrency Enforcement Team have painstakingly followed the money trail to assemble the case. The Feds also seized the Colonial Pipeline ransoms paid in crypto, making headlines last year. The Internal Revenue Service (IRS) seized $3.5 billion worth of crypto in 2021 in non-tax investigations, according to the recently releas...

3 reasons why Lido DAO Token could be on the verge of breaking its downtrend

Ethereum (ETH) and decentralized finance (DeFi) are undergoing a seismic shift as the transition to Eth2 and a proof-of-stake consensus mechanism is helping to increase the value proposition for the network which has historically has been plagued with scaling issues and high transaction costs. Alongside this transition has been the introduction of liquid staking, which is helping to add utility to DeFi and giving investors the option to do more with their assets than just lock them up indefinitely. Liquid staking could also help investors build more capital efficient portfolios. One protocol that has benefited from the shift toward liquid staking is Lido (LDO), a platform that allows investors to earn staking rewards on their tokens while also enabling them to put the resulting...

Are crypto and blockchain safe for kids, or should greater measures be put in place?

Crypto is going mainstream, and the world’s younger generation, in particular, is taking note. Cryptocurrency exchange Crypto.com recently predicted that crypto users worldwide could reach 1 billion by the end of 2022. Further findings show that Millennials — those between the ages of 26 and 41 — are turning to digital asset investment to build wealth. For example, a study conducted in 2021 by personal loan company Stilt found that, according to its user data, more than 94% of people who own crypto were between 18 and 40. Keeping children safe While the increased interest in cryptocurrency is notable, some are raising concerns regarding the ways those under the age of 18 are interacting with digital assets. These challenges were highlighted in UNICEF’s recent “Prospects for children in 202...

Bitcoin traders say $34K was the bottom, but data says it’s too early to tell

Bitcoin (BTC) price traded down 23% in the eight days following its failure to break the $45,000 resistance on Feb. 16. The $34,300 bottom on Feb. 24 happened right after the Russian-Ukraine conflict escalated, triggering a sharp sell-off in risk assets. While Bitcoin reached its lowest level in 30 days, Asian stocks were also adjusting to the worsening conditions, a fact evidenced by Hong Kong’s Hang Seng index dropping 3.5% and the Nikkei also reached a 15-month low. Bitcoin/USD at FTX. Source: TradingView The first question one needs to answer is whether cryptocurrencies are overreacting compared to other risk assets. Sure enough, Bitcoin’s volatility is much higher than traditional markets, running at 62% per year. As a comparison, the United States small and mid-cap stock ...

European Parliament postpones crypto bill vote over proof-of-work

The parliament of the European Union is delaying a vote on a framework aimed at regulating cryptocurrencies amid concerns over proof-of-work mining. In a Friday Twitter thread, European Parliament economics committee member Stefan Berger said the government body had canceled a vote on the Markets in Crypto Assets, or MiCA, framework scheduled to take place on Monday. Berger said parliament needed to clarify “the question of proof-of-work” in discussions with stakeholders to ensure a proper legal framework, adding that some might misinterpret the proposal as a ban on crypto. “The discussion about MiCA indicates that individual passages of the draft report can be misinterpreted and understood as a [proof-of-work] ban,” said Berger. “It would be fatal if the EU Parliament sent the wrong signa...

Bitcoin consolidates after $40K surge as analyst eyes weekly higher low for BTC price

Bitcoin (BTC) began a nervous weekend at around $39,000 on Feb. 26 after an overnight spike briefly saw $40,000 return. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Stocks gains but crypto “fear” pervades Data from Cointelegraph Markets Pro and TradingView revealed calmer conditions for BTC/USD Saturday after overnight volatility saw highs of $40,330 on Bitstamp. With traditional markets closed, the probability of “fakeout” moves up or down was elevated thanks to thinner weekend volumes on crypto markets. The geopolitical turmoil focused on Ukraine and occupier Russia formed the backdrop for continued cautious sentiment, amid concerns that Monday, in particular, could bring fresh instability. The Crypto Fear & Greed Index, while inching up to...

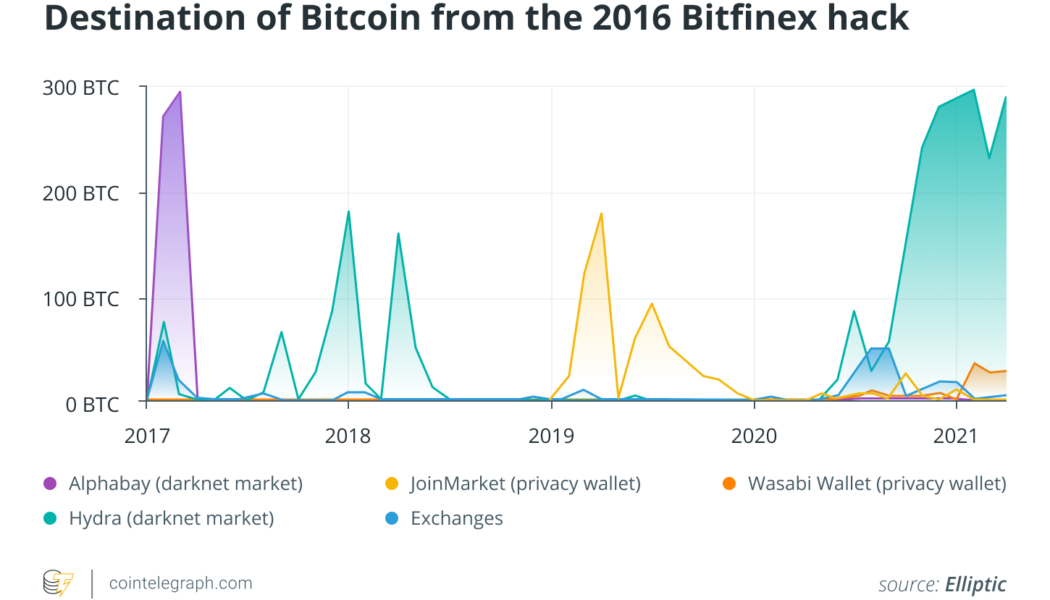

Seizure of Bitfinex funds is a reminder that crypto is no good for money launderers

As public understanding of how digital assets work becomes more nuanced along with the mainstreaming of crypto, the language of Bitcoin’s (BTC) “anonymity” gradually becomes a thing of the past. High-profile law enforcement operations such as the one that recently led to the U.S. government seizing some $3.6 billion worth of crypto are particularly instrumental in driving home the idea that assets whose transaction history is recorded on an open, distributed ledger are better described as “pseudonymous,” and that such a design is not particularly favorable for those wishing to get away with stolen funds. No matter how hard criminals try to obscure the movement of ill-gotten digital money, at some point in the transaction chain they are likely to invoke addresses to which personal details h...

Weekly Report: Crypto market maintains recovery run into the weekend

Key takeaways: The crypto sector has bounced back and seen some calm after Thursday’s crash that was set off by Russia’s invasion of Ukraine Animoca Brands’ Yat Siu believes BitsCrunch will play a significant role in the metaverse future NGO founded to support Ukraine military sees more than $5.3 million in crypto donations US court fines BitMEX founders who pleaded guilty to money laundering Coinbase forecasts that Ethereum staking rewards will rise significantly post-merge Terra’s native token LUNA leads altcoins in the market rebound Thursday morning’s news of Russia invading Ukraine sent the market hurtling, with many of the top cryptocurrencies nosediving. The crypto sector has since made a comeback and conserved the uptrend. Bitcoin (BTC) is up 1.08% in ...

Crypto Biz: Stablecoins are serious business, Feb. 17–24

Stablecoins used to be a sort of taboo subject in the crypto community after it became common practice to criticize Tether’s reserve backing. Are you really a seasoned crypto investor if you haven’t gone down the Tether (USDT) rabbit hole? Some of those concerns were finally quelled in May 2021 when Tether passed an assurance test by disclosing its reserves for the first time. For some onlookers, the reserve breakdown created more questions than answers due to the stablecoin issuer’s oversized exposure to commercial paper. The stablecoin market has grown leaps and bounds over the past four years. While Tether remains firmly in the lead, Circle Internet Financial has surged through the rankings with the success of USDC Coin (USDC). TerraUSD (UST) is also a top player, having just received s...

Front-running, flash bots and keeping things fair in the crypto market

Decentralized finance (DeFi) has the opportunity to democratize access to financial markets that have typically only been open to the rich and powerful. But, DeFi will only survive and continue to grow if we take steps to ensure things are safe, private and fair for both retail and institutional investors. When faced with predatory market behaviors such as miner extractable value (MEV) and front-running attacks it opens up old wounds to a “Flash Boys” era of traditional finance. DeFi can and should do better by not allowing the failures of the past to come creeping back into the future. Fortunately, by implementing cryptographic mechanisms that integrate transactional privacy into public blockchains, information can be proven with things such as an order book without being revealed. ...

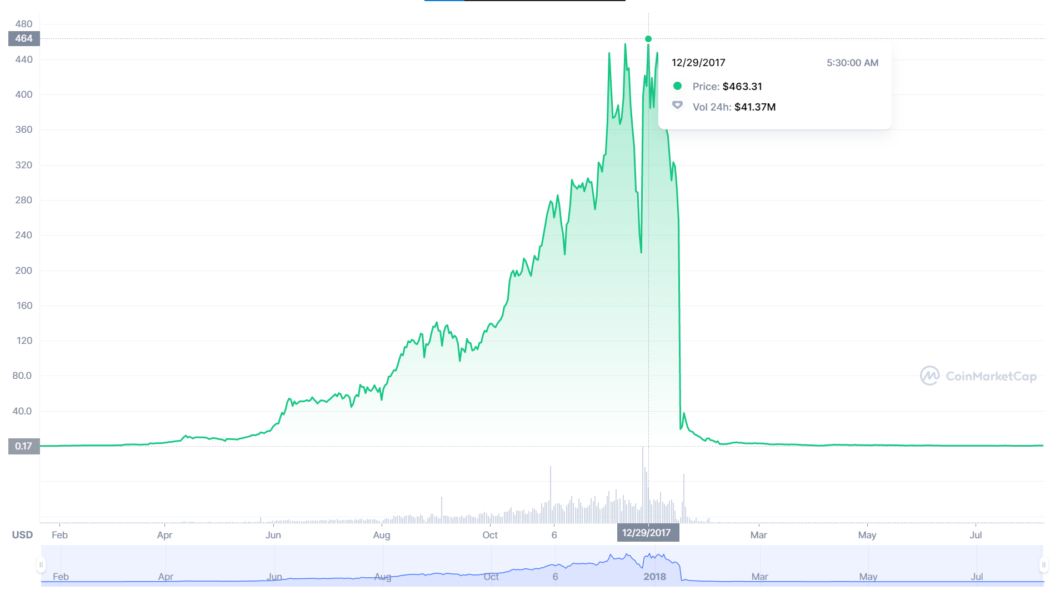

DOJ indicts BitConnect’s Indian founder for $2.4B crypto Ponzi scheme

The founder of the infamous crypto exchange BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s “Lending Program”: “BitConnect operated as a Ponzi scheme by paying earlier BitConnect investors with money from later investors. In total, Kumbhani and his co-conspirators obtained approximately $2.4 billion from investors.” BitConnect (BCC) price history. Source: CoinMarketCap Back in 2017 amid the hype, BitConnect (BCC) recorded an all-time high of $463.31 in trading price, which according to the DOJ reached a peak market capitalizati...