crypto blog

Ukraine Bitcoin exchange volume spikes 200% as Russia war sparks currency concerns

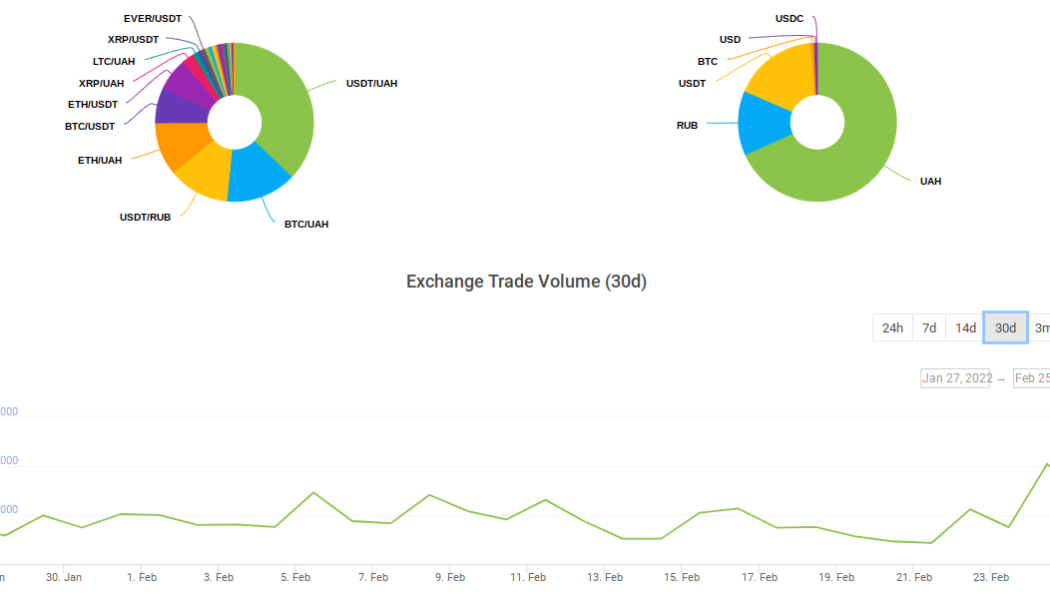

Bitcoin (BTC) and altcoin trading volumes have surged at a major Ukraine cryptocurrency exchange in the aftermath of Russia’s invasion, data shows. According to monitoring resource CoinGecko, on Feb. 24, volume at Kuna almost trippled to over $4 million. Crypto on the radar of Ukrainians As the armed conflict with Russia began, the impact on the fiat currencies of both countries was immediately apparent. While the Russian ruble suffered noticeably more, the Ukrainian hryvnia also fell, targeting 30 per dollar in what would be a new all-time low. Ukraine, which just this month finally ratified a law legalizing cryptocurrency after much to-and-fro between lawmakers, unsurprisingly saw interest in alternatives snap higher. The effect was obvious at seven-year-old Kuna, volumes at which ...

Bitcoin price spike to $39K leads traders to say ‘the panic is over for a few days’

Global financial markets and crypto markets were pummeled over the past 24-hours as the invasion of Ukraine by Russian forces sent investors scrambling and sell-offs took place across most asset classes. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) hit a low of $34,333 in the early trading hours on Feb. 24, shortly after the Ukraine incursion began, and has since climbed its way back to $38,500 after an unexpected short-squeeze may have rapped bearish investors on the knuckles. BTC/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about BTC price and how the ongoing conflict could impact crypto markets in the short-term. BTC in a “great buy area” Bitcoin’s collapse on the night of Feb. 23 was not unexp...

Crypto could bypass President Biden’s ‘devastating’ sanctions on Russian banks and elites: Report

The sanctions announced by United States President Joe Biden in response to Russia’s attack on Ukraine did not include cutting the country off from payments on the SWIFT system or cryptocurrency transfers. In a Thursday announcement from the White House, Biden said the U.S. and its allies and partners would be enforcing sanctions aimed at imposing “devastating costs” on Russia due to “Putin’s war of choice against Ukraine.” The U.S. president announced that the country would sever its financial system from Russia’s largest bank, Sberbank, as well as impose “full blocking sanctions” on VTB Bank, Bank Otkritie, Sovcombank OJSC, Novikombank, and their subsidiaries. Biden also named several elite nationals who have “enriched themselves at the expense of the Russian state” as part of the ...

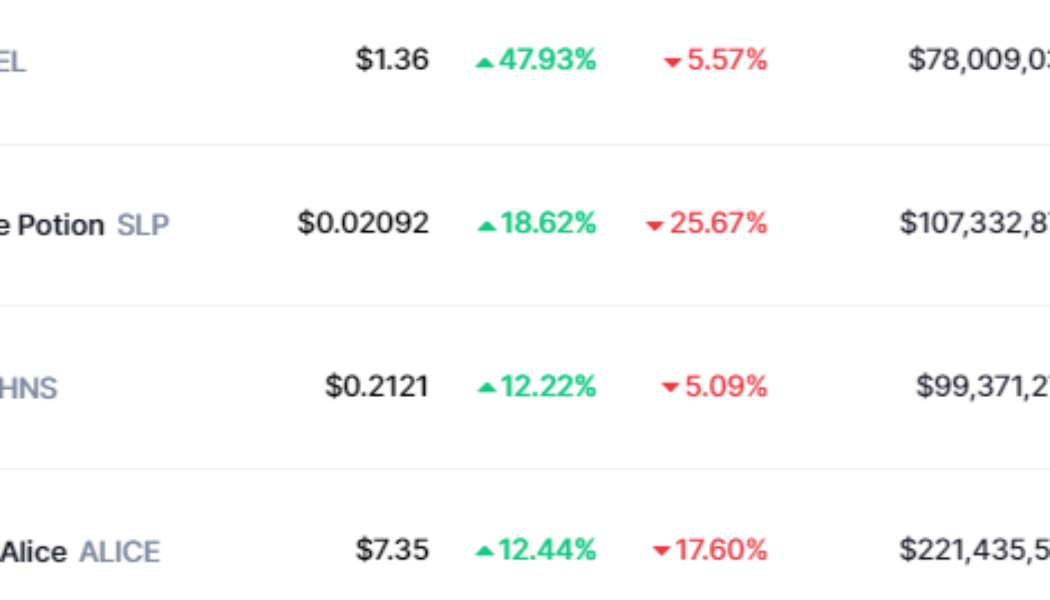

VOXEL, SLP and ALICE rally after protocol updates and a major exchange listing

Crypto markets are taking a beating but there are still a few standout performers even during this week’s volatility. One sector that has managed to rise above the noise are NFT-related altcoins and GameFi tokens. Top gainers in the collectible and NFT sector. Source: CoinMarketCap Data from Cointelegraph Markets Pro and CoinMarket Cap shows that three notable gainers over the past 48-hours were Voxies (VOXEL), Smooth Love Potion (SLP) and MyNeighborAlice (ALICE). Voxie Tactics launches its marketplace VOXEL is the native utility currency of Voxie Tactics, a free-to-play, 3-dimensional, role-playing game that combines the classic look of the popular tactical games of the 1990s and 2000s with modern game mechanics. Data from TradingView shows that after hitting a low of $0.90 on Feb. ...

US Bitcoin miners expanding operations despite price volatility

Crypto mining operations based in the United States are committed to increasing their hash power with more hardware despite Bitcoin’s (BTC) three-month downturn. The Marathon Digital Holdings and GEM Mining companies in the U.S. told Cointelegraph this week that they each expect the size of their respective operations to grow through 2022 by at least doubling the number of machines at their facilities. Marathon Digital’s VP of corporate communications Charlie Schumacher told Cointelegraph in an interview that it is moving forward with plans to deploy 199,000 new machines by 2023 to secure what is “arguably the future of the global monetary system.” GEM Mining CEO John Warren said via email that it “plans to have 32,000 miners online by the end of 2022.” For Marathon, that would b...

BNY Mellon announces Chainalysis partnership to track customer crypto transactions

Bank of New York Mellon has partnered with Chainalysis to enhance its crypto risk management Chainalysis software provides a plethora of services, including flagging high-risk transactions Having added support for Bitcoin back in February last year, America’s oldest bank is now making further moves to enhance its custodial suite of services for crypto. BNY Mellon announced yesterday that it has partnered with blockchain software company Chainalysis to track its customer’s crypto transactions. BNY Mellon, the largest custodian bank globally with $46.7 trillion in assets, sought the services of Chainalysis to track and analyse crypto products easily. The bank believes this will help it manage the legal risks that come with dealing in them. Tracking customers’ crypto A...

The best tokens over $100 you can buy on February 24, 2022: AAVE, KSM and ILV

Aave, Kusama, and Illuvium are all tokens above the $100 price point that you can buy on February 24, 2022. Each token has seen a tremendous level of growth at its ATH point of value, which makes them solid choices. All of these tokens have seen an increase in their trading volume throughout the past 24 hours. There are many tokens available over the $100 price range; however, today, we’ll be discussing why Aave (AAVE), Kusama (KSM), and Illuvium (ILV) are all solid buys. Should you buy Aave (AAVE)? On February 24, 2022, Aave (AAVE) had a value of $114.65. The all-time high value of Aave (AAVE) was on May 18, 2021, when it reached a value of $661.69. This means that at its ATH, the token was $547.04 higher in value or by 477%. When we go over the performance of the token throughout t...

FTX CEO speaks on market crisis amid the Russian invasion of Ukraine

Sam Bankman-Fried said Eastern European countries could consider Bitcoin an alternative to their destabilised currencies He also explored the contrasting positions between fundamental and algorithmic investors Early Thursday, reports of invasion into Ukraine by Russia’s military led Bitcoin and other crypto markets tumbling. Stock markets also fell along with cryptocurrencies as Russia started what President Putin called a demilitarisation operation in Ukraine. In a recent Twitter thread, FTX CEO Sam Bankman-Fried has shared his view on the massive correction that crypto markets saw. According to data provided by CoinMarketCap, Bitcoin fell as low as $34,459. Markets have recovered to some extent and the ticker is currently trading at $35,482. Conflicting sentiments on Bitcoin&#...

Bitcoin rises above $36K as 24-hour crypto liquidations pass $500M

Bitcoin (BTC) edged higher after Wall Street opened on Feb. 24 with Russia’s Ukraine invasion and its aftermath still top on markets’ agenda. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Risk sentiment set to be “dominant driver” in crypto Data from Cointelegraph Markets Pro and TradingView showed BTC/USD nearing $36,400 on Bitstamp two hours after the opening bell, up to $2,000 from its recent lows. Skittish markets faced the music from Russia’s overnight incursion into Ukraine, a move that continued and ricocheted across global trading. Russia’s stock market unsurprisingly faced a different level of trauma, with MOEX losing 50% and at one point halting trading altogether. Bitcoin, suffering earlier in the day, nonetheless staged a ...

Many ETHDenver attendees report positive COVID-19 tests and few masks

The transmissibility of the Omicron variant of COVID-19 seems to have affected many attendees at the ETHDenver developer conference, who reported symptoms and positive test results following the event. Many social media posts from ETHDenver attendees after the conclusion of the Feb. 11–20 conference claim they tested positive for the virus. A local news outlet reported that more than 12,000 people from 100 countries attended the event, which resulted in many infections among both the vaccinated and unvaccinated. Finally got my first COVID infection courtesy of #ETHDenver pic.twitter.com/TDR3OEteI5 — T h i r k (@theThirk) February 22, 2022 According to ETHDenver’s COVID policies, attendees and staff were required to “take a rapid [antigen] test, on-site, prior to picking up their badge” and...

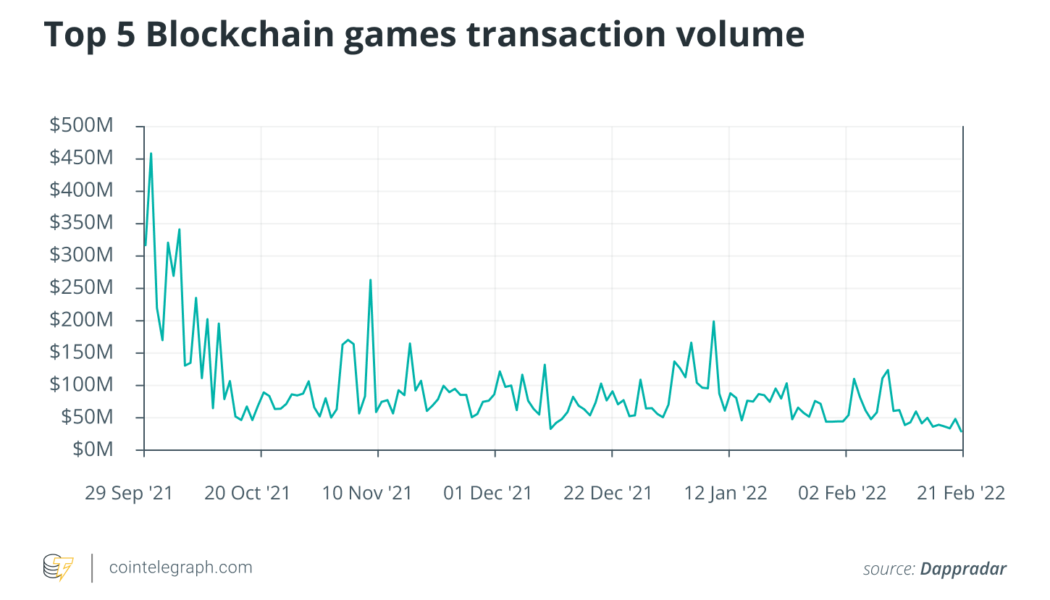

Cointelegraph Consulting: Exploring the DeFi components in GameFi

In 2018, the two main ways video game players can earn a living were through e-sports and live streaming — or perhaps a successful YouTube channel. But, thanks to the rise of blockchain technology, the financial aspect has never been more interwoven with the gaming industry. While most users are acquainted with one or two facets of financialization in gaming such as earning and cashing out rewards from completing game quests a la Axie Infinity, there are several other methods exist that have yet to be explored by most users in the cryptocurrency market’s flourishing new vertical called GameFi. CryptoKitties in 2017 is the first known game to use blockchain technology, introduce nonfungible tokens (NFTs) and enable players to have a verifiable claim on their virtual assets. Then, in 2019, t...