crypto blog

Bitcoin slumps following Putin’s announcement of a military operation in Ukraine

Russian President Vladimir Putin has announced military action in Ukraine Bitcoin, alongside the majority of the crypto assets, have plunged as the market reacts to the news Tensions have been high across the month, with reports warning that Russia has been consolidating troops in areas bordering Ukraine. Russia has insistently maintained that it had no plans to invade Ukraine. However, the situation has changed dramatically in recent hours. Russia’s President Vladimir Putin announced early Thursday that the country’s military is advancing into Ukraine for what he referred to as a “special military operation” to conclude the “demilitarisation” of Ukraine. With reports of explosions in Ukraine’s Kyiv capital, worry is growing that this could turn in...

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings. Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy. The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday. “If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official st...

FTX CEO weighs in on Bitcoin market outlook amid Ukraine crisis

The world woke up to a “sea of red” that was not necessarily limited to the financial markets, as Russia declared war on Ukraine early Thursday. The traditional financial markets along with the crypto markets have been sliding bearishly for the past week and saw a rapid decline early on Thursday. Apart from crude oil prices, which jumped to an eight-year high above $100, the majority of stocks has lost over 5%. The Russian invasion on Thursday triggered the bears leading to a $500-billion crypto market sell-off, where the majority of the cryptocurrencies lost critical support to trade at a three-month low. The crypto market capitalization saw a 10% decline during early morning Asian trading hours, falling below the $1.5-trillion mark. Bitcoin (BTC) is considered an inflation hedge, and man...

Games will adopt blockchain in 2022 through esports and P2E models: Report

In the past, earning money through games was only possible by uploading gaming videos online, streaming game content and playing competitively through esports. But in 2021, many realized that through blockchain, gamers can earn money simply by playing. This trend may continue in 2022 as play-to-earn (P2E) business models become more developed and blockchain adoption in esports becomes more mainstream. In a report published by gaming insight company Newzoo, the firm predicts that P2E models will become more viable in 2022 as gaming companies try to adopt blockchain. “Publishers might use blockchain technology to facilitate more secure and legitimized player-to-player trading within a centralized game environment.” Additionally, the need to diversify earning streams may lead esports organiza...

Last Bitcoin support levels above $20K come into play as BTC price faces ‘time of uncertainty’

Bitcoin (BTC) may yet reenter the $20,000 zone, but the coming weeks could provide a solid buying opportunity, a new report forecasts. In its latest market update on Feb. 24, trading platform Decentrader laid out the final areas of support between the current Bitcoin spot price and $20,000. Analyst eyes BTC’s 20-week and 200-week MA for cues Military action by Russia in Ukraine has markets in a spin Thursday, with stocks and crypto following a firm downtrend as uncertainty grips Asia, Europe and the United States alike. Bitcoin has already lost 12% in under 24 hours, and expectations are that the worst is not yet over —reactions to the Russian offensive continue to flow in, along with potential financial sanctions. As such, Decentrader, like many other analysts, is notably cautious o...

Ethereum’s rejection off its bull market support band could mean an extended bear market

Benjamin Cowen, a popular crypto analyst, has expressed bearish sentiment on Ethereum The crypto strategist has predicted an extended period of market correction for the native token of the top smart contract platform Speaking in a video published on his YouTube channel on Monday, Cowen reviewed Ethereum’s recent behaviour around the bull market support band. He observed that Ethereum faced rejection at the support band, arguing that its price is becoming a cause for concern. The bull market support band is a moving average indicator that integrates the 20-week simple moving average (SMA) and the 21-week exponential moving average (EMA). Ethereum did not even actually reach the 21-week exponential moving average before it resumed the slump, which the crypto strategist labelled a show...

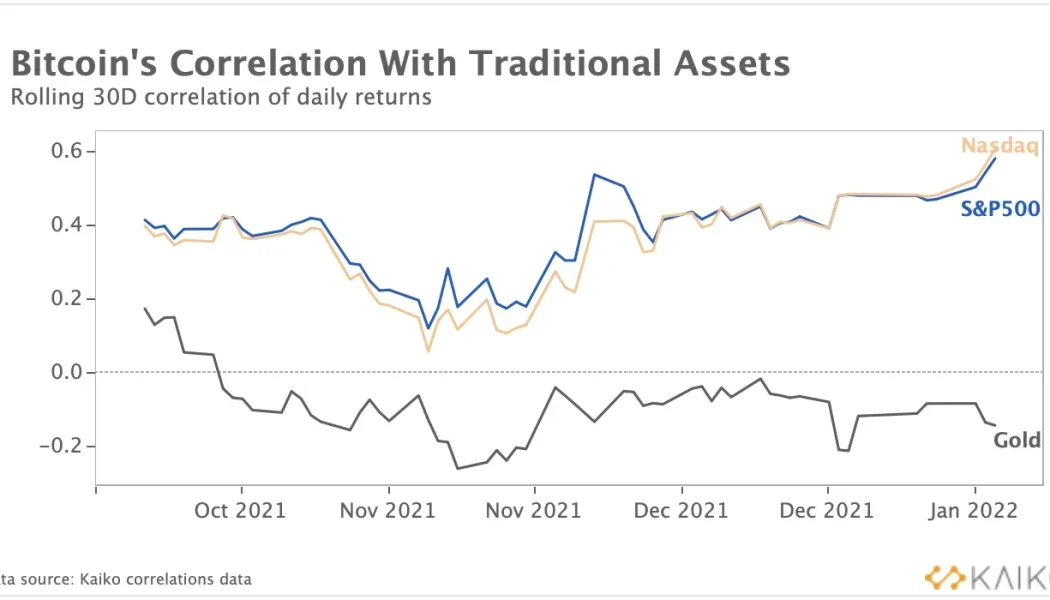

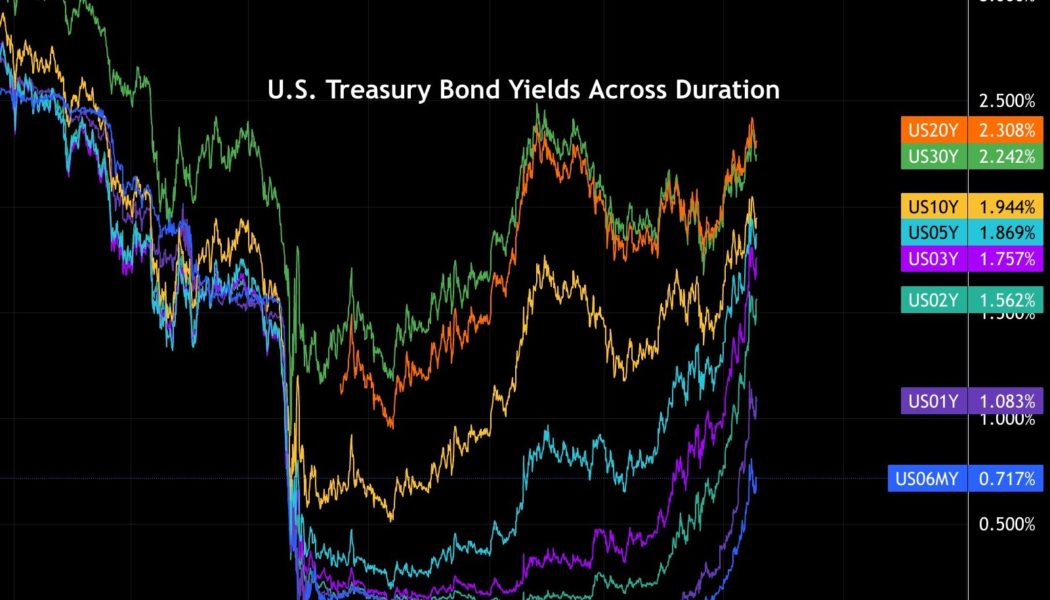

Hedge fund report says Bitcoin price is ‘at a relatively inexpensive place’

There has been a lot of focus on the performance of the stock and cryptocurrency markets over the past year or two as the trillions of dollars that have been printed into existence since the start of the COVID pandemic have driven new all-time highs, but analysts are now increasingly sounding the alarm over warning signs coming from the debt market. Despite holding interest rates at record low levels, the cracks in the system have become more prominent as yields for U.S. Treasury Bonds “have been rising dramatically” according to markets analyst Dylan LeClair, who posted the following chart showing the rise. U.S. Treasury bond yields across duration. Source: Twitter LeClair said, “Since November yields have been rising dramatically — bond investors begun to realize that w/ inflation ...

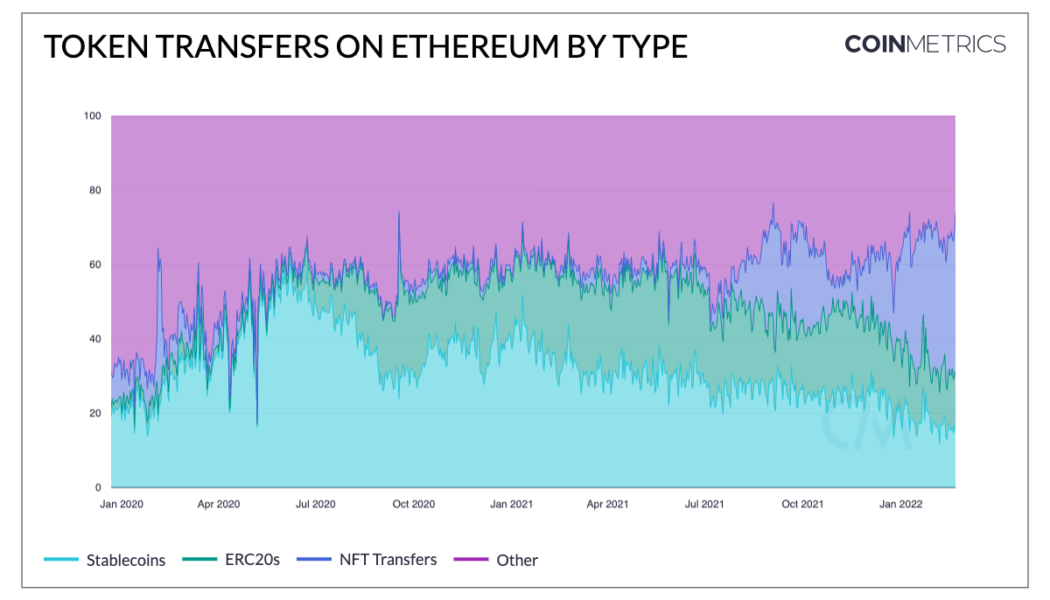

NFTs most popular assets on Ethereum, but Wrapped Bitcoin growth stalls

Transfers of nonfungible tokens (NFT) on Ethereum have surpassed transfers of stablecoins and altcoins while the supply of wrapped Bitcoin (WBTC) has remained relatively stagnant since late last year. Those are two of the key findings in the latest State of the Network update from Coin Metrics. It details how ERC-721 transfers overtook stablecoins and altcoins on Ethereum starting last July and have continued to increase the margin between them ever since. ERC-721 is the token standard for NFTs on the Ethereum network. NFT transfers topped 50,000 per day on average starting late July and have not dipped below that line since. Daily NFT transfers are now averaging an all-time high over 300,000, a 600% increase since July. Conversely, ERC-20 tokens including altcoins and stablecoin transfers...

Few calls to ‘Buy The Dip’… but uber-rich Family Offices are keen on crypto

Short term social media data suggests that traders aren’t calling for buying the Bitcoin (BTC) dip right now… but the long term picture is much brighter, with separate research showing that 77% of family offices in the U.S. are either looking at, or have invested in crypto. The BTFD data was compiled from posts mentioning “buy the dip” on social media platforms such as Twitter, Reddit, Discord and Telegram by K J Lanaul and published on the Insights Santiment blog earlier this week. It tells a positive story too, in a roundabout way. The research indicated that many traders over the past year have called for buying the dip too early on a downward trend, with the price often falling significantly further afterward and failing to recover for months at a time. “Often the crowd una...

BNY Mellon partners with Chainalysis to track users’ crypto transactions

The Bank of New York (BNY) Mellon has announced a partnership with blockchain-data platform Chainalysis to help track and analyze cryptocurrency products. BNY Mellon is the world’s largest custodian bank, currently overseeing $46.7 trillion in assets. Chainalysis is a blockchain-data analysis platform that offers services to traditional financial institutions, allowing large firms to manage the legal risks that come with cryptocurrency more easily. As part of the partnership, BNY will utilize Chainalysis software to track, record and make use of the data surrounding crypto assets. The risk management software offered by Chainalysis includes KYT (Know Your Transaction), Reactor, and Kryptos, with the most important being the KYT flagging system — which automatically detects whether cryptocu...

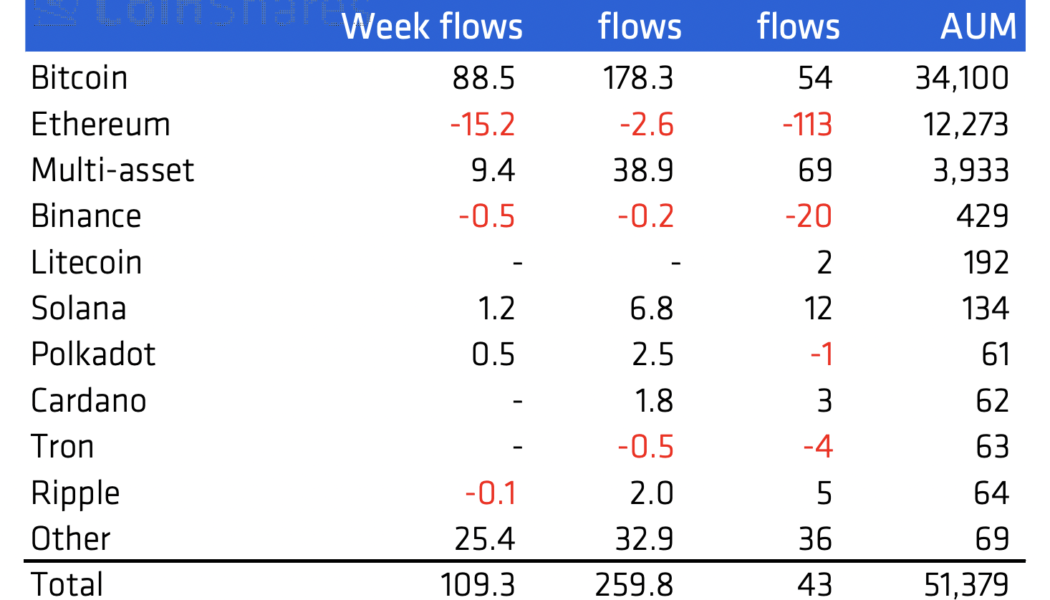

Avalanche price rallies 20% after report reveals $25M inflows into AVAX investment vehicles

Avalanche (AVAX) rallied by around 20% in the last two days as a new report revealed millions of dollars flowing into AVAX-based investment products. Penned by CoinShares, an institutional crypto fund manager, the report highlighted that Avalanche-based investment vehicles attracted about $25 million in the week ending Feb. 21, the second-biggest inflow recorded in the said period after Bitcoin’s (BTC) $89 million. Flow of assets. Source: Bloomberg, CoinShares In contrast, Ether (ETH), Avalanche’s top rival in the smart contracts sector, witnessed an outflow totaling $15 million. On the whole, Avalanche and similar cryptocurrency investment products attracted around $109 million, recording their fifth week of positive inflows in a row. AVAX rebounds against macro headwinds...

Security firms seek to make it more difficult for scammers to get away with DeFi project hacks

The rise of community-oriented blockchain security companies may be making it more difficult for alleged bad actors to get away without a trace. Early Wednesday, CertiK issued a community alert regarding Flurry Finance, where its smart contracts were allegedly breached by hackers, leading to $293,000 worth of funds being stolen. Shortly after the incident, CertiK published the wallet addresses of the alleged perpetrator, the address of the malicious token contract, and a PancakeSwap pair address allegedly involved in the attack, leading to a warning issued on BscScan. While the firm audited the project’s smart contracts, it appears that the exploit was the result of external dependencies. #CommunityAlert @FlurryFi’s Vault contracts were attacked leading to around $293K worth of asset...