crypto blog

Bitcoin Mayer Multiple returns to July 2021 levels in fresh sign $37K BTC is a long-term buy

Bitcoin (BTC) has dipped enough for one of its best-known indicators to signal a rare long-term investment opportunity is here. As of Feb. 22, the Mayer Multiple is sitting at its lowest level since Bitcoin bounced at $29,000 in July last year. Mayer Multiple down 50% in 3 months The latest in a series of metrics to echo the pit of the 2021 retracement on BTC/USD, the Mayer Multiple currently measures 0.76, having halved since November’s $69,000 all-time high. The Multiple measures Bitcoin’s current price against its 200-day moving average. Its creator, Trace Mayer, believes that any reading below 2.4 offers an increasingly profitable trade for potential investors, and the lower the score, the more likely a long-term buy-in will turn out to be effective. For context, the Multip...

1Password integrates security API into Phantom Wallet

Digital security service 1Password has announced a collaborative partnership with Phantom Wallet to enable asset holders to amalgamate their vast accumulations of public key addresses, seed phrases and other corresponding security details into a single ‘Save in 1Password’ system. Operating primarily in the traditional financial sector at this time, 1Password has over 100,000 corporate clients from a panoply of industries, including well-recognized brands like IBM, Slack, Shopify and Under Armour. The application programming interface (API) of 1Password aims to simplify the user experience, enable asset sovereignty and assign portfolio responsibility to help investors sufficiently manage their cryptocurrencies and nonfungible tokens (NFTs) held on the Solana blockchain. A centralized entity...

Year 1602 revisited: Are DAOs the new corporate paradigm?

In 1602, the Dutch East India Company was formed in what many consider the world’s first initial public offering — allowing perfect strangers to share in stock ownership. Four centuries later, the joint-stock model — especially its incarnation as the modern business “corporation” — sets the pace for much of the economic world. But, decentralized autonomous organizations, or DAOs, could soon disrupt the joint-stock capitalized business model, much as the Dutch East India supplanted the limited partnerships of its day — or so some may say. “DAOs are the new limited liability companies (LLCs),” says DAO investor Cooper Turley of these leaderless internet-native entities where key decisions are typically made by consensus. “In five years, companies won’t have equity anymore. They’ll have token...

Amber Group completes $200M Series B+ funding round featuring Temasek Holdings

Amber Group extended its Series B funding as a special effort to bring Temasek around the investors’ table The raised funds will support global expansion and grow its OpenVerse and WhaleFin products According to a press release shared on Monday, leading digital asset platform, Amber Group confirmed that it had completed a $200 million Series B+ funding round led by Singapore-based investment firm Temasek Holdings. The raise also saw participation from other investors, including Tiger Global Management, Sequoia China, Coinbase Ventures, and Pantera Capital. The round’s completion at a $3 billion valuation represents three times as large as the valuation the firm reached in June 2021, the last time when capital was raised. It also brings the sum raised by Amber Group since its in...

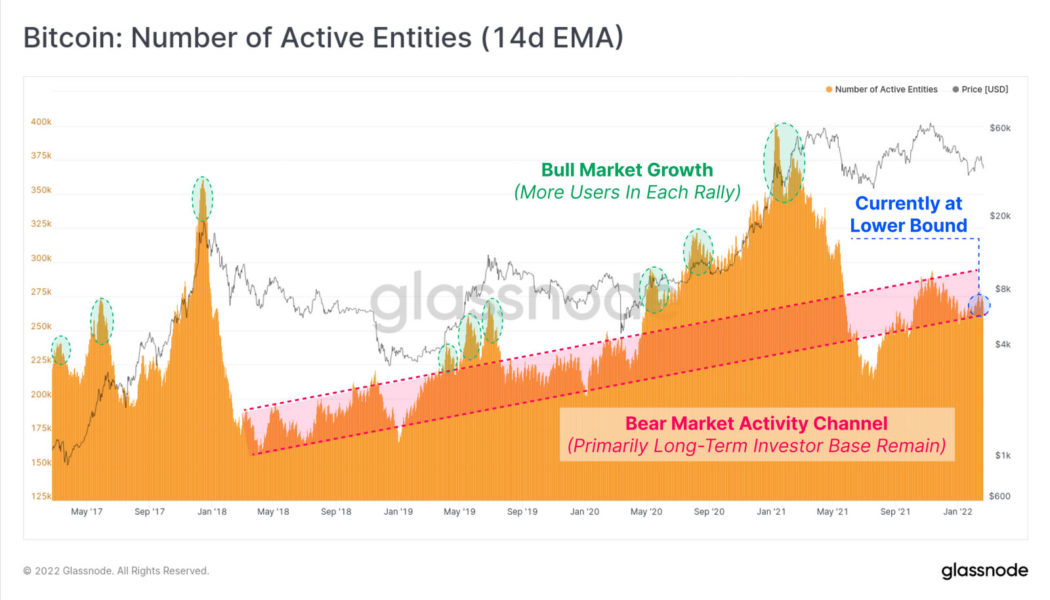

Glassnode theorises an extended BTC bear market, points to on-chain metrics

Analytics firm Glassnode says sizeable investor losses and recency bias are likely to sustain a prolonged bear market Despite the currently unimposing number of daily active users, Glassnode notes that long term hodlers are increasing linearly in the long term In its February 21 newsletter, blockchain data and intelligence provider Glassnode has suggested that Bitcoin investors are seeing a significantly growing number of motivations to sell their holdings. As volatility pushed Bitcoin to either side of the $40k psychological support last week, it peaked close to $45k but eventually closed nearer $38k. The blockchain analytics firm observed that external factors, including anticipation of the Fed’s March meeting and geopolitical issues globally, are cause for the dwindling price leve...

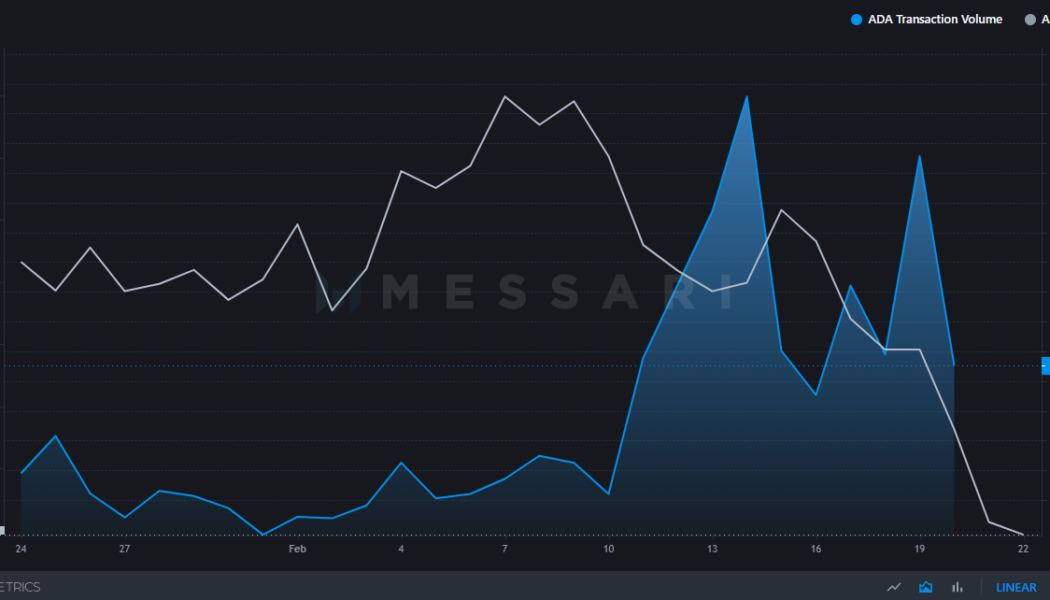

Cardano daily transaction volume surges but ADA prices slump

The Cardano blockchain has experienced an explosion in on-chain activity and now trails only Bitcoin in current 24-hour transaction volume, surpassing Ethereum in the process according to Messari. Cardano (ADA) currently has $17.04 billion in 24-hour transaction volume, according to data from on-chain analytics firm Messari. With Bitcoin (BTC) at $18.85 billion and Ethereum (ETH) at $5.25 billion according to Messari, Cardano is in second place in that category and is closing in on the top position for this metric. #Cardano just surpassed $LTC and $ETH in transaction volume. Are you bullish on $ADA? — The Moon (@TheMoonCarl) February 21, 2022 Overall, this month has seen tremendous activity on Cardano. On Feb. 14, 24-hour transaction volume topped $35 billion and on Feb. 19 it reached $31 ...

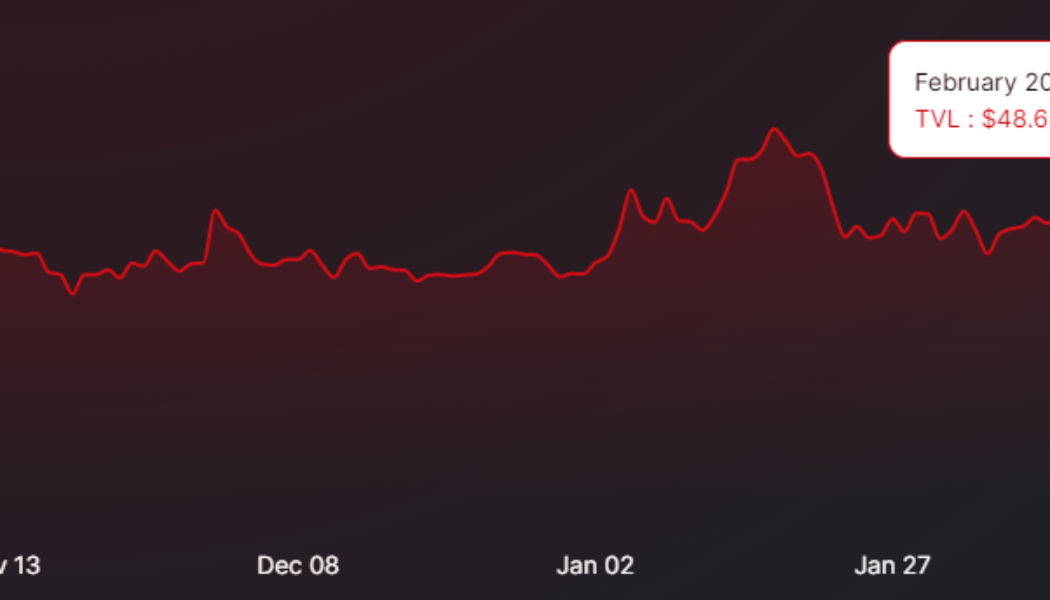

On-chain metrics hint at a bearish outlook for Bitcoin

Blockchain analytics provider Glassnode has depicted a bearish scenario for Bitcoin as on-chain metrics suggest increased selling pressure is imminent. In its weekly analytics report on Feb. 21, on-chain metrics firm Glassnode said that Bitcoin bulls “face a number of headwinds,” referring to increasingly bearish network data. The researchers pointed at the general weakness in mainstream markets alongside wider geopolitical issues as the reason for the current risk-off sentiment for crypto assets. “Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.” It added that as the downtrend deepens, “the probability of a ...

Crypto trading firm Amber valued at $3B after big Singaporean investment

Crypto finance service provider Amber has landed a valuation of $3 billion following a funding round led by Singaporean state-owned investment firm Temasek Holdings. Amber Group was able to raise $200 million in its Series B+ funding round as revealed in a Feb. 21 announcement. Other participants included Sequoia China, Pantera Capital, Tiger Global Management, Tru Arrow Partners, and Coinbase Ventures. We are excited to announce our Series B+, which comes at a time of rapidly increasing crypto adoption globally. The investment reinforces Amber Group’s strategic alignment with its investors, as well as a shared vision of digital assets’ future in a new, digital economy. #wagmi pic.twitter.com/6EOHd1H8Gx — Amber Group (@ambergroup_io) February 22, 2022 Amber has now increased its valu...

Bitcoin investors are not giving up their holdings despite a shaky market

Investors are unwilling to let go of their Bitcoin to avoid making a sale they might regret later, according to Three Arrow Capital CEO Bitcoin’s daily active entities have hit mid-2019 numbers, but the activity remains on a rise Three Arrow Capital CEO Zhu Su has indicated that Bitcoin investors now have more patience and are not panic selling as they did for the Bitcoin copped between 2017-2018. On-chain data has revealed that the top digital asset holders have been hodling for more than an entire year despite the fluctuating prices and endless market corrections. A good number of the large Bitcoin investors have gone as far as adding more coins to their portfolios in that period. Su explained that traders who sold their holdings as the markets slumped between 2018 and 2019 soon en...

BSC whales have been taking up Cardano (ADA) despite the price not looking up

The largest BNB whale recently acquired in excess of 5.1 million worth of ADA BSC whales have also been dabbling in Dogecoin and ALPHA tokens On-chain monitoring tool WhaleStats revealed that the biggest BNB whale added $5.1 million worth of ADA to their portfolio on Sunday. The blockchain service, which tracks the top hodlers on the BSC and the tokens they own, published the information on its BSC-focused Twitter account @WhaleStatsBSC. More specifically, the giant investor copped 5,367,075 ADA tokens for a price of $5,106,208. To note is that the tokens in question are ADA BEP20 tokens, which exist purely on the BNB Chain. They are not actual ADA (Cardano native) tokens but rather tokens tied to ADA’s price on Binance’s chain, meaning such tokens cannot be transferred t...

pSTAKE Finance brings liquid staking and a new airdrop to the Cosmos ecosystem

One of the most significant transitions to occur for the cryptocurrency ecosystem since the launch of Bitcoin (BTC) has been the increasing dominance of proof-of-stake (PoS) protocols over the proof-of-work (PoW) model, primarily due to energy requirements of the PoW model and growing concern over its environmental impact. As more projects launch or transition to the PoS model, a new class of protocols have emerged that are focused on offering liquid staking options that allow token holders to tap into the value held in their staked tokens while still earning a yield for locking their assets on the network. pSTAKE Finance is one of these platforms and here’s a brief look into its long-term goal of adding utility to the proof-of-stake model and how it differs from similar protoc...