crypto blog

Altcoins Back in The Green: SOL and LUNA Leading the Comeback

The cryptocurrency market has painted a picture of green into the new week in what is seemingly a trend for February This is the third week that the market has started strongly – last week, the market embarked on an uptrend on Tuesday Bitcoin and Ethereum recover Bitcoin, whose price plunged to a 24-hour low of $38,112 over the weekend, has bounced back and is currently trading at $39,025 against the dollar. Despite seeing a positive 2.01% 24-hour change, the coin is still down over 7.40% in the last seven days. Ethereum’s native coin has similarly bounced from a dip to a weekend low of $2,585.95 posted during yesterday’s trading session. Though Ether is still trading below $2,800 ($2,715) – it has seen approximately 3.33% of gains in the last 24 hours as per CoinMarketCap data. Here’s a l...

Former Cisco employee launches DAO to buy Denver Broncos

A new decentralized autonomous organization (DAO) has been formed to raise money in an effort to purchase the Denver Broncos U.S. National Football League team for around $4 billion. BuyTheBroncos DAO aims to give fans a chance to own a piece of the team no matter their level of wealth. One of the organizers of the DAO, former Cisco employee Sean O’Brien, told CNBC on Feb. 19 that: “The purpose essentially is to establish an infrastructure so that fans from all walks of life can be owners of the Denver Broncos.” If it succeeds, it would join the Green Bay Packers among NFL teams owned by the fans. Fans looking to own a stake of the Broncos through the DAO could contribute as little as they like, as opposed to the $300 per share for the Packers. Members of the DAO who contribute Ether (ETH)...

KB Bank to launch South Korea’s first crypto investment fund

Kookmin Bank is preparing to become the first bank in South Korea to offer crypto investment products to retail investors. KB announced on Feb. 21 that it had formed a Digital Asset Management Preparatory Committee to determine product and strategy capabilities regarding digital assets and artificial intelligence investment funds. The bank expects to launch crypto exchange-traded funds (ETFs) and futures products. The committee will also assess risk and compliance issues for the investment funds. The plans were confirmed by KB’s Head of Index Quant Management Honggun Kim in the official release from the bank. He said, “We will launch a virtual asset-themed equity fund, etc. We plan to publish periodicals as well.” KB Financial Group, the country’s largest by net profit, had abou...

‘Coin days destroyed’ spike hinting at BTC price bottom? 5 things to watch in Bitcoin this week

Bitcoin (BTC) heads into the last week of February lower but showing signs of strength as a key support level holds. After a nervous few days on macro and crypto markets alike, BTC/USD is below $40,000, but signs are already there that a comeback could be what starts the week off in the right direction. The situation is far from easy — concerns over inflation, United States monetary policy and geopolitical tensions are all in play, and with them, the potential for stocks to continue suffering. Further cues from the Federal Reserve will be hot property in the short term, with March expected to be when the first key interest rate hike is announced and delivered. Could it all be a storm in a teacup for Bitcoin, which on a technical basis is stronger than ever? Cointelegraph presents five fact...

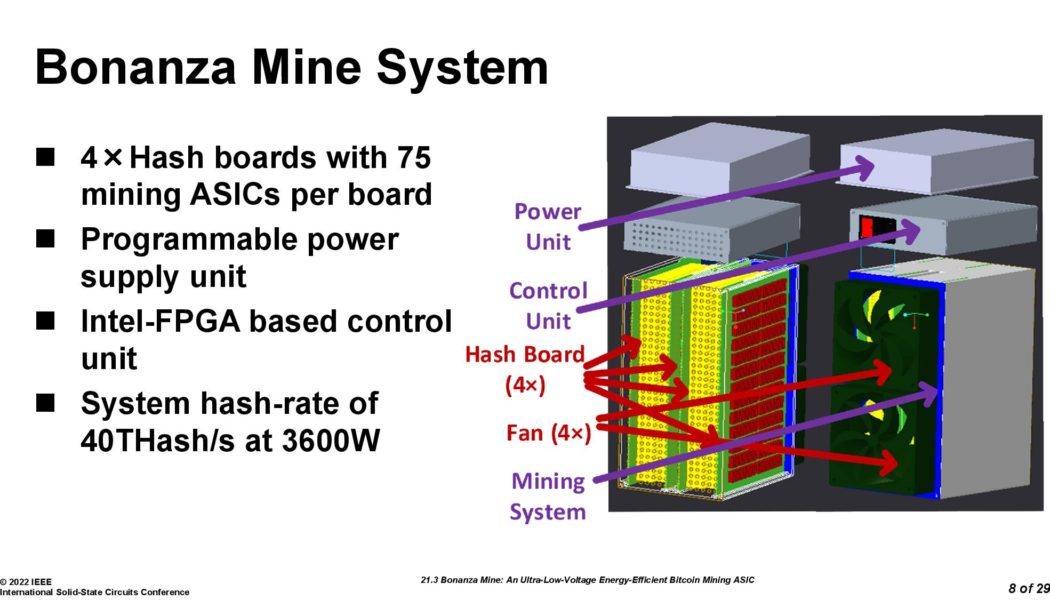

Intel unveils 2nd-gen Bonanza Mine chip for efficient Bitcoin mining

Computer chip manufacturing giant Intel Corporation shared details of a new mining chip that will be coupled with a high-performance 3,600 Watt miner with the ultimate goal of improving Bitcoin (BTC) mining efficiency. Intel revealed its second-generation BTC mining setup during the IEEE International Solid-State Circuits Conference (ISSCC) 2022, a conference dedicated to the electronics and chip manufacturing industry. According to the company, Bonanza mine (BMZ2) is an ultra-low-voltage energy-efficient Bitcoin mining ASIC that can deliver 40 Terahashes per second (40 TH/s) performance. Intel’s Bonanza setup. Source: 2022 IEEE As Cointelegraph previously reported, Intel’s patent related to “high-performance Bitcoin Mining” dates back to November 2018, which had proposed ...

Motorcycle expert turns passion project into sports analytics platform on blockchain

Skill sets gained from working on trading strategies, technology, data science and a personal passion for motorcycle racing made Scott Robinson launch a sports analytics platform. With a bit of blockchain added to the mix, the founder of Apex146 found new ways to proceed in the sports analytics business. Starting as a passion project, Robinson made an internship program offered to a professor at the University of California Santa Barbara. With the help of students, he developed a framework that looks at athlete performance in Grand Prix motorcycle racing. Using techniques he acquired working in capital markets and commodity trading at firms McKinsey & Company and Oliver Wyman, Robinson created sports performance analytics that can be applied to motorcycle racing. Scott Robinson, Founde...

Can Bitcoin break out vs. tech stocks again? Nasdaq decoupling paints $100K target

A potential decoupling scenario between Bitcoin (BTC) and the Nasdaq Composite can push BTC price to reach $100,000 within 24 months, according to Tuur Demeester, founder of Adamant Capital. Bitcoin outperforms tech stocks Demeester depicted Bitcoin’s growing market valuation against the tech-heavy U.S. stock market index, highlighting its ability to break out every time after a period of strong consolidation. “It may do so again within the coming 24 months,” he wrote, citing the attached chart below. BTC/USD vs. Nasdaq Composite weekly price chart. Source: Tuur Demeester, StockCharts.com BTC’s price has grown from a mere $0.06 to as high as $69,000 more than a decade after its introduction to the market, as per data tracked by the BraveNewCoin Liquid Index fo...

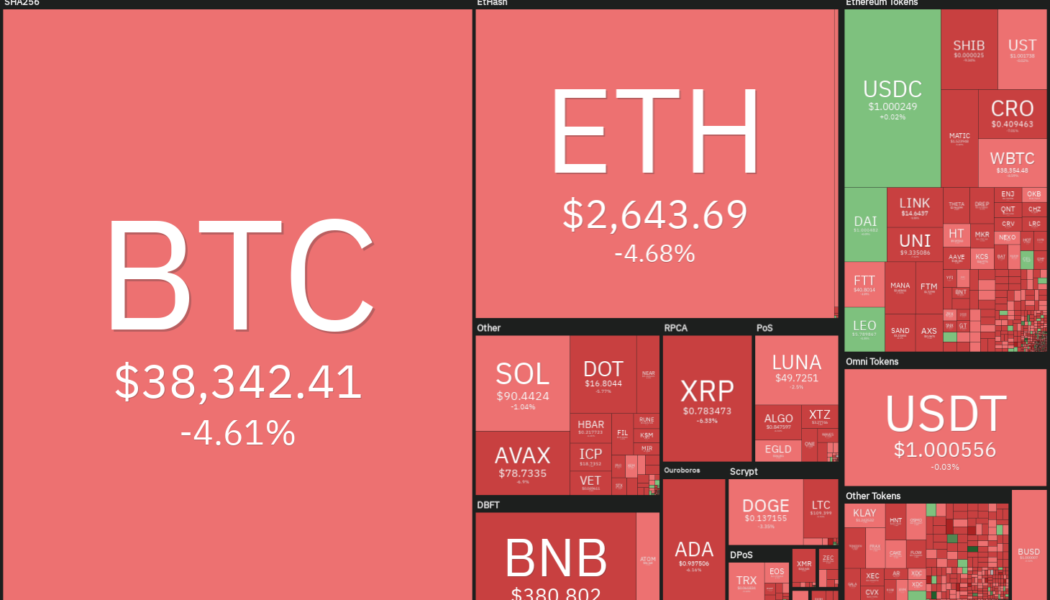

Top 5 cryptocurrencies to watch this week: BTC, LEO, MANA, KLAY, XTZ

Russia’s massive build-up of soldiers, warplanes, equipment and extended military drills near Ukraine’s borders increased fears of a possible invasion within the next few days. That could have renewed selling in Bitcoin (BTC), which plummeted below the strong support at $39,600. Among the gloom and doom, there is a ray of hope for crypto investors because data from Glassnode shows that more than 60% of Bitcoin supply has not been used in any transaction for more than a year. This suggests that long-term hodlers are not dumping their positions in the downtrend. Crypto market data daily view. Source: Coin360 Mike McGlone, chief commodity strategist at Bloomberg Intelligence, warned that Bitcoin could be in for a “rough week ahead” and cautioned that “inflation is unlikely to drop...

Future of finance: US banks partner with crypto custodians

Grayscale Investments’ latestreport “Reimagining the Future of Finance” defines the digital economy as “the intersection of technology and finance that’s increasingly defined by digital spaces, experiences, and transactions.” With this in mind, it shouldn’t come as a surprise that many financial institutions have begun to offer services that allow clients access to Bitcoin (BTC) and other digital assets. Last year, in particular, saw an influx of financial institutions incorporating support for crypto-asset custody. For example, Bank of New York Mellon, or BNY Mellon, announced in February 2021 plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients. Michael Demissie, head of digital assets and advanced solutions at BNY ...

We are all going public: Privacy rules, tax shelters and the future history of art

After a banner year of 2021 for individual object sales through nonfungible tokens (NFTs), 2022 is poised to be the year of MetaFi. A recap of Beeple, Christie’s, Visa and endless aping-in celebrities hardly feels necessary, except to point out that we seem to be standing on (or perhaps have already crossed over) a fundamental precipice. While the rocket-propelled ascent of NFT prices will not continue forever, numerous voices have predicted that a mature tech stack for discovering, vetting, valuing, trading and protecting collections of digital assets will soon emerge, without a crash. But these optimistic takes may even be selling the area short. Namely, the premise of the “NFT-Fi” sector is to create value through liquidity, but it has remained an unstated assumption that this liquidity...

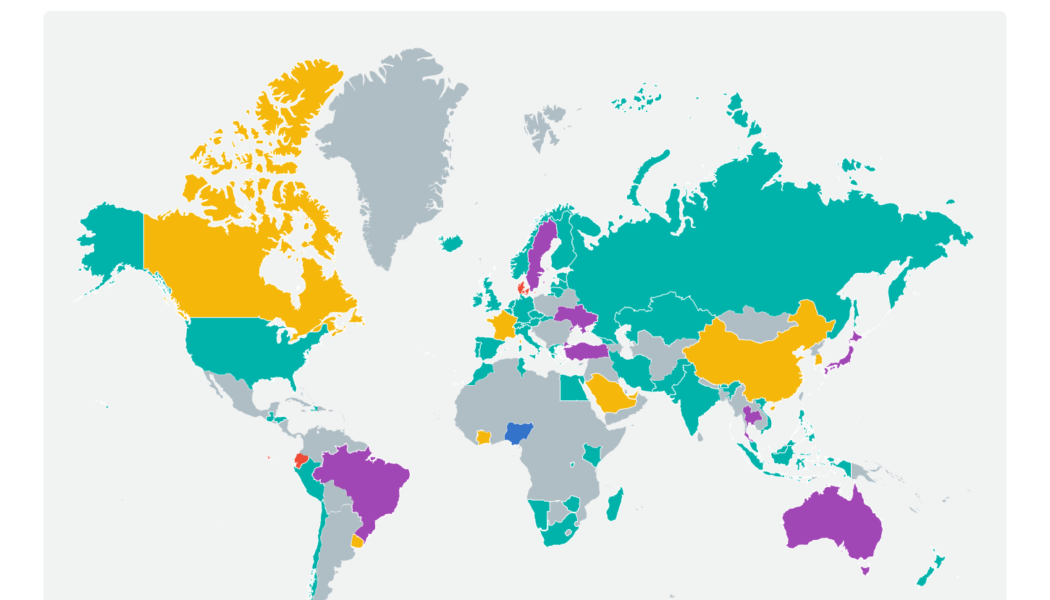

NFTs, payments and conferences: Crypto in Latin America in 2021

In 2021, Latin America saw a soaring rise in crypto adoption among the 20 countries and 14 dependencies that make up the region. A slew of conferences, associations, new regulations and nonfungible token (NFT) projects as well as the global bull market made last year an intriguing one for the region. Let’s take a look at some of the most interesting developments in the blockchain and cryptocurrency ecosystem in Latin America in 2021. Colombian financial firms partner with crypto exchanges Early in 2021, the Financial Superintendence of Colombia authorized several partnerships between banking institutions licensed in the nation’s financial system and cryptocurrency exchanges. The nine partnerships included major names from the cryptocurrency industry such as Binance and Tyler and Cameron Wi...

What is the importance of blockchain in the RegTech ecosystem?

Financial regulators and service providers are looking for the best and most cost-effective solutions to help the banks and other financial institutions comply with the rules and do business in a compliant regulatory environment. As blockchain is already disrupting the conventional ways of doing businesses, thanks to its benefits in terms of enhanced transparency, faster procedures, decentralized and most importantly, cost-effective nature. In essence, blockchain provides the solutions for the existing problems faced by financial institutions in terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. As the transactions in the blockchain system are immutable, they cannot be changed and altered, providing transparency regarding AML and KYC compliance. Customer onboard...