crypto blog

Finance Redefined: Axelar becomes a unicorn, new ETH addresses hit 1.5M per month, Feb. 11–18

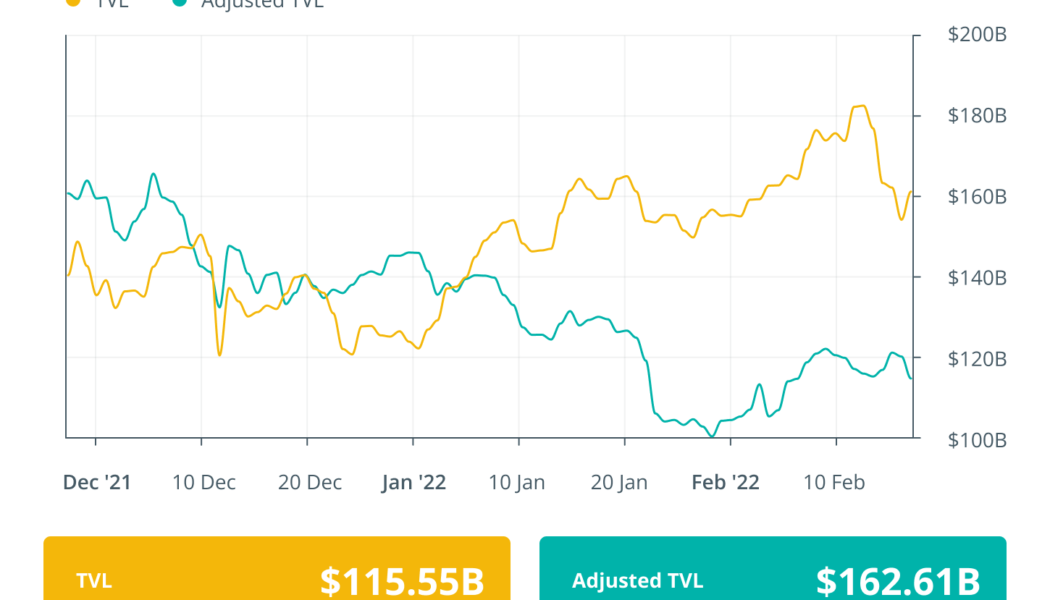

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. This week has been full of funding raises, innovations, service deployments and a bit of volatile technical price action — for a change. Axelar Network attains $1B valuation following secondary raise The Axelar Network announced the completion of a $35-million Series B funding round this week, elevating its total market valuation to over $1 billion and establishing its status as a unicorn corporation. Major participants of the round include Dragonfly Capital, Polychain Capital and North Island Ventures, among others. The network has implemented partnership integrations with a suite of validators, as well as leading blockchain platforms such as Ethereum, Avalanche, Polygon and Polkadot. Cointelegraph spoke ex...

Fed’s Lael Brainard hints at US playing a lead role in development of CBDCs

Lael Brainard, a member of the Federal Reserve’s Board of Governors, encouraged the United States to be a leader in research and policy regarding central bank digital currencies, or CBDCs, due to potential international developments. In remarks prepared for the U.S Monetary Policy Forum in New York on Friday, Brainard said the People’s Bank of China’s pilot program for its digital yuan could have implications on the dollar’s dominance in cross-border payments and payment systems. However, a digital dollar could allow people around the world to continue to rely on its fiat counterpart. “It is prudent to consider how the potential absence or issuance of a U.S. CBDC could affect the use of the dollar in payments globally in future states where one or more major foreign currencies are is...

Solana ecosystem tokens that are worth your consideration on February 18 of 2022: AUDIO, WAVES and GRT

Solana has an ecosystem of hundreds of decentralized applications (dApps). Due to its scalability and throughout, it is the blockchain of choice for many developers. Audius (AUDIO), Waves (WAVES), and The Graph (GRT) are some of the best projects which have the potential for growth. The Solana ecosystem has seen a huge level of growth, both in native decentralized applications (dApps) as well as many other integrations due to its high scalability and throughput. Audius (AUDIO), Waves (WAVES), and The Graph (GRT) are all a part of the Solana ecosystem, and each of them has potential for growth. Should you buy Audius (AUDIO)? On February 18, 2022, Audius (AUDIO) had a value of $1. When we go over the all-time high value of Audius (AUDIO), it occurred on March 27, 2021, when the token reached...

Crypto community condemns Canada for freezing dissidents’ Bitcoin wallets

Global cryptocurrency enthusiasts have expressed concerns over Canadian authorities freezing bank accounts and crypto wallets involved in funding local COVID-19 protests. On Thursday, Ontario Superior Court Justice Calum MacLeod issued an order freezing all the digital assets and bank accounts associated with “Freedom Convoy,” a series of ongoing protests against COVID-19 vaccine mandates and restrictions. According to a report by the Toronto Star, the amount of funds frozen so far in bank accounts and digital wallets with Bitcoin (BTC) and other assets is estimated at more than $1 million. “The names of both individuals and entities as well as crypto wallets have been shared by the RCMP with financial institutions and accounts have been frozen and more accounts will be frozen,” Deputy Pri...

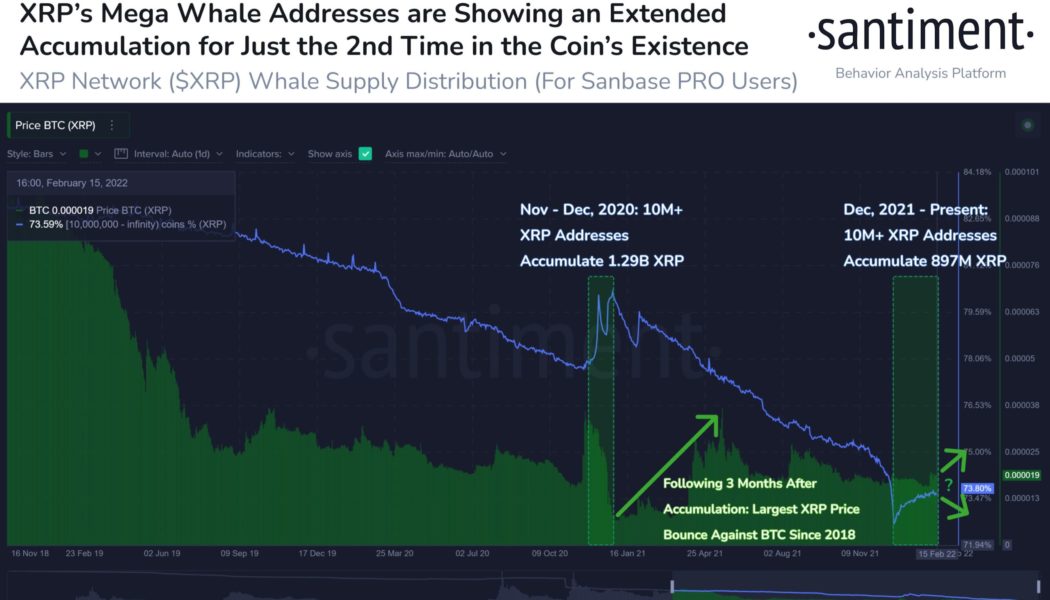

XRP ‘mega whales’ scoop up over $700M in second-biggest accumulation spree in history

XRP addresses that hold at least 10 million native units have returned to accumulating more in the past three months, a similar scenario that preceded a big rally for the XRP/USD and XRP/BTC pairs in late 2020. The return of XRP ‘mega whales’ A 76% spike in XRP “mega whale” addresses since December 2021 has been noted by analytics firm Santiment showing that they added a total of 897 million tokens, worth over $712 million today, to their reserves. The platform further highlighted that the XRP accumulation witnessed in the last three months was the second-largest in the coin’s existence. The first massive accumulation took place in November-December 2020 that saw whales depositing a total of 1.29 billion XRP to their addresses. XRP supply into ...

U.S. inflation breaks 40-year record: Can Bitcoin serve as a hedge asset?

On Feb. 9, the United States Bureau of Labor Statistics reported that the Consumer Price Index, a key measure capturing the change in how much Americans pay for goods and services, has increased by 7.5% compared to the same time last year, marking the greatest year-on-year rise since 1982. In 2019, before the global COVID-19 pandemic broke out, the indicator stood at 1.8%. Such a sharp rise in inflation makes more and more people consider the old question: Could Bitcoin, the world’s largest cryptocurrency, become a hedge asset for high-inflation times? What’s up with the inflation spike? Ironically, the fundamental reason behind the unprecedented inflation spike is the U.S. economy’s strong health. Immediately after the COVID-19 crisis, when 22 million jobs were slashed and national econom...

Here’s why UK and Israel authorities have expressed concerns over Binance

The UK’s FCA says Binance’s partnership with Paysafe is beyond its controlling hand The financial watchdog still holds reservations, with insistence on the ‘significant risk’ warnings it issued against the exchange last year Israel’s Capital Market Authority has suspended Binance operations in the country until the pending licensing issue has been clarified Binance made headlines this week – both for good and bad reasons. The crypto exchange announced the rebrand of some of its assets earlier this week. It was also reported to be under the spotlight of financial authorities in the UK. Not long after, Israel’s market regulator raised the alarm over the exchange regarding the services it offers. Worth noting, the US arm of the exchange, Binance.US, is bein...

Ethereum whales are bullish on meme coin Shiba Inu, on-chain data shows

Shiba Inu ownership among the top 1000 Ethereum whales only lags Ether’s The whales are riding the wave of increased adoption of the meme token Shiba Inu investments by top Ethereum investors have been growing. The token has frequently appeared on previous occasions as the asset with the top holding (besides ETH) among the top 1000 Ethereum whales. On-chain monitoring tool WhaleStats yesterday observed that the whales’ holdings in Shiba Inu had once again crossed $2 billion. Shiba Inu, FTX tokens and USD Coin on the radar of Ethereum whales With the exact Shiba Inu ownership raking up as much as $2,761,646,130 (18,260,127,622,912 tokens) in value, this contributed to 23.01% of their portfolios ranking first among in all crypto holding excluding Ethereum. Though this figure has ...

Nifty News: UFC Strike marketplace, Horrific Crypt TV, and new travel NFTs

NFT developer Dapper Labs launched the UFC Strike nonfungible token (NFT) marketplace on Feb. 18, contributing to a 50% increase in NFT sales on the Flow blockchain over the last 24 hours. Dapper Labs is the company behind NBA Top Shot, CryptoKitties, and the Flow blockchain. UFC Strike, another product from the firm, is a collection of NFTs based on fighters and moments from the Ultimate Fighting Championship (UFC). Now, fans can trade their NFTs in the UFC Strike Marketplace dedicated to the collection. The UFC Strike Marketplace is Now Open Buy and sell iconic Moments from the Octagon, with fight fans across the globe. Start your journey today.https://t.co/R2SyiRsoag pic.twitter.com/yxCLjcrFwM — UFC Strike (@UFCStrikeNFT) February 18, 2022 The new launch has helped Flow climb to third p...

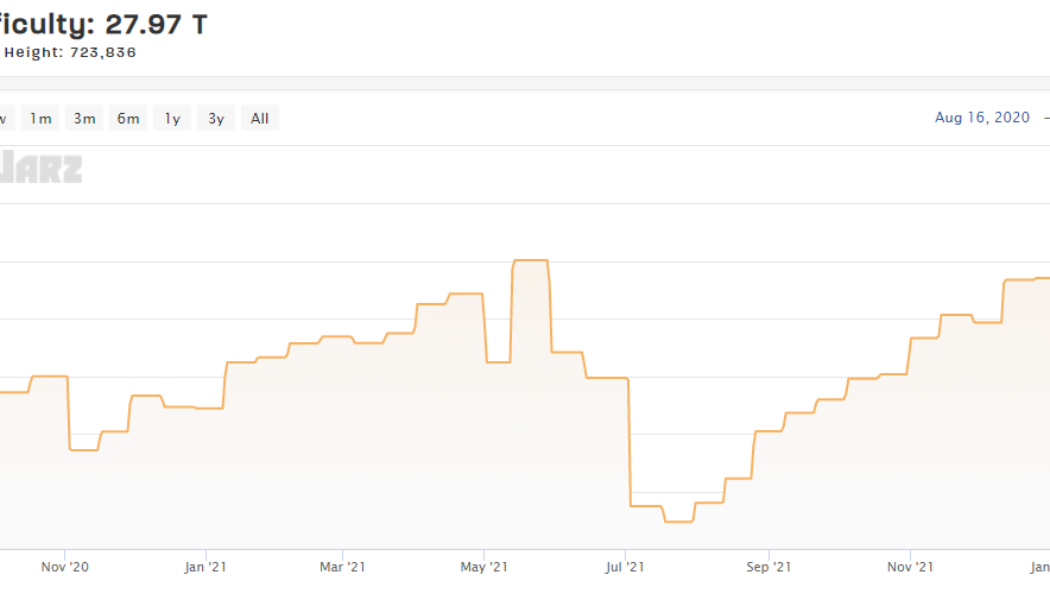

Bitcoin difficulty reaches all-time high, hash rate up 45% in 6 months

The Bitcoin network has hit yet another all-time high in mining difficulty after a steady climb since last July’s lows. On-chain analysis tool CoinWarz indicated on Feb. 18 that mining difficulty reached a new high of 27.97 trillion hashes (T). This is now the second time in three weeks that Bitcoin (BTC) has hit a new ATH in terms of difficulty. On Jan. 23, difficulty reached 26.7 T when hash rates were at 190.71 EH/s (exahashes per second). Higher difficulty means there is more competition among miners to confirm a block and extract a block reward. As a result, miners have recently begun selling off coins or their company’s stock in order to keep their cash reserves intact. Most notably, Marathon Digital Holdings filed on Feb. 12 to sell $750 million in shares of its company. Hash ...

Crypto ‘best place’ to store wealth during Fed rate hike: Pantera CEO

The CEO and founder of leading blockchain venture fund Pantera Capital, Dan Morehead, stated that digital assets will be the “best place” to store capital following the potential fallout of interest rate hikes from the U.S. Federal Reserve. Investors across stock and crypto markets are currently fixated on the direction the Fed might take to combat rising inflation which topped 7.5% as of this month. Bitcoin and crypto markets have often moved in correlation to trends in the stock market, however, Morehead argued in his Feb. 16 newsletter that bonds, stocks, and real estate will cop the brunt of the Fed‘s “massive policy U-turn,” in relation to hiking interest rates. Despite the crypto market suffering a downturn since late 2021, the CEO suggested that digital assets will be the “best plac...