crypto blog

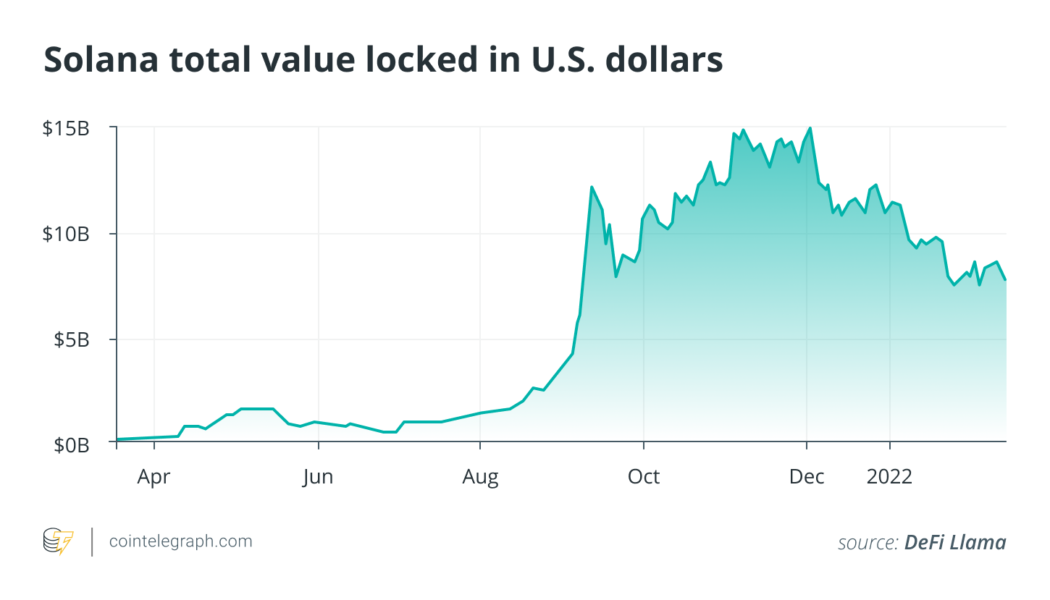

Wormhole hack illustrates danger of DeFi cross-chain bridges

Solana has become one of the fastest-growing smart contract blockchain networks since it was first officially launched in March 2020. The total value locked (TVL) on decentralized finance (DeFi) protocols on the network grew from nearly $152 million in March 2021 to $8.08 billion at the time of writing, as per data from DefiLlama. Simultaneously, the network has also been subject to several network issues and outages. Most recently, the Wormhole token bridge was hit by a security exploit on Feb. 3 that culminated in the loss of 120,000 wrapped Ether (wETH) tokens, worth over $375 million at the current price of Ether (ETH). This exploit was the biggest so far in 2022 and the second largest DeFi hack ever, following the Poly Network hack where over $600 million was stolen from t...

Terra’s Mirror Protocol shows first signs of bottoming after price gains 30% in 48 hours

Mirror Protocol, a decentralized finance (DeFi) protocol built atop the Terra blockchain, was among the biggest gainers in the last 48 hours, primarily as its native token MIR rallied by over 30% to $1.48, its highest level since Jan. 22. MIR/USD four-hour price chart. Source: TradingView Has Mirror Protocol bottomed out? MIR price rose despite an absence of concrete fundamentals, a sight pretty common across crypto assets. As a result, its rally may have been purely technically-driven, especially because it originated after MIR had dropped by more than 90% in value from its May 2021 high near $13, making the token extremely oversold. IncomeSharks, an independent market analyst, called MIR’s rebound move a “no brainer,” noting that its multi-month drop had left ...

Chainlink Verifiable Random Function v2 goes live on mainnet

On Wednesday, blockchain oracle solution Chainlink (LINK) announced the release of Chainlink Verifiable Random Function, or VRF, v2. As told by its developers, the new, improved version of the random number generator can reduce transaction fees by 60% compared to v1. Randomness is a core component of making nonfungible tokens, or NFTs, and gaming applications fair and secure. On their own, blockchains and smart contracts cannot guarantee randomness, but rather require an oracle network to deliver such solutions on-chain. Since its launch, Chainlink VRF (v1) has become the most widely adopted random number generator solution in the blockchain industry, fulfilling more than 3 million request transactions and currently providing verifiable randomness to more than 2,200 unique smart contracts ...

Fidelity International launches Bitcoin ETP on Deutsche Boerse

Major financial services firm Fidelity International will be listing a Bitcoin exchange-traded product on the SIX Swiss Exchange and Germany’s Xetra digital stock exchange. According to a Tuesday announcement from Deutsche Boerse, a physical Bitcoin exchange-traded product, or ETP, from Fidelity International is now available for trading on the Deutsche Boerse Xetra and Frankfurt Stock Exchange under the ticker FBTC. In addition, the company reportedly said it planned to have the crypto investment vehicle listed on the SIX Swiss Exchange in the coming weeks. Fidelity Digital Assets will act as the custodian for the physically-backed Bitcoin (BTC) ETP, which will be centrally cleared with global exchange Eurex Clearing. The ETP has a total expense ratio of 0.75%. At the time of publication,...

Maverick Protocol closes $8M strategic fundraising led by Pantera Capital

The investment round featured several VC firms that will have a significant role in the network’s planned mainnet launch The funds obtained will be used to advance the proprietary Automated Liquidity Placement algorithm and strengthen Maverick’s position in the DeFi derivatives space Decentralised derivatives protocol Maverick on Tuesday announced it had successfully completed an external funding round netting $8 million. The fundraising was led by California-based crypto-focused fund Pantera with participation from other names, including Circle Ventures, Coral Ventures, Altonomy, Tron Foundation, Gemini Frontier Fund, Jump Crypto, LedgerPrime and Spartan Group. Maverick intends to use the funds to release its Automated Liquidity Placement model and open asset-listing function ...

Bitcoin price circles $44K as analyst asks, ‘Who remains to sell here?’

Bitcoin (BTC) broadly held levels at $44,000 and above on Feb. 16 amid fresh optimism that another macro low would be avoided. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView OBV sparks 2021 recovery comparisons Data from Cointelegraph Markets Pro and TradingView showed BTC/USD rebounding after an overnight dip to $43,725 on Bitstamp. In a tightening range, the pair looked increasingly primed for a breakout up or down Wednesday, as support and resistance levels stayed within a short distance of spot. While fears that a stocks correction could cause fresh pain for bears remained, one analyst, in particular, argued that there was now hardly any impetus to sell BTC after three months of downside. “When I consider everything BTC HODLers withstood in 2021- When I observe ...

Fed never did it: US Senate Banking head lashes out at Super Bowl crypto ads

The Super Bowl advertisements by crypto companies, including Coinbase, FTX and several others, ruled social media and news headlines for their out-of-the-box approach. However, United States Senate Banking Committee Chief Sherrod Brown was not impressed and blasted the ad-makers for not including appropriate warnings and risks involved. Brown, during the Tuesday Senate hearing on stablecoins, brought in the topic of popular crypto advertisements that aired during the Super Bowl. He said most of these ads failed to tell people about the downsides of investing in cryptocurrencies. The companies failed to mention the wild price swings and prevalent scams that occur in the market or the fact that the crypto market is not as well regulated as the traditional ones. Super Bowl advertisement ...

Here’s how much digital yuan used at Olympics, according to PBoC

The 2022 Winter Olympics participants, visitors and organizers could be spending more than $300,000 in China’s digital yuan every day, according to new reports citing officials from the People’s Bank of China. The e-CNY, China’s central bank digital currency (CBDC), is being used to make 2 million yuan ($316,000) or more worth of payments each day, PBoC’s Digital Currency Research Institute director-general Mu Changchun said. The official provided the data during a webinar hosted by the Atlantic Council, Reuters reported Tuesday. “I have a rough idea that there are several, or a couple of million digital yuan of payments every day, but I don’t have exact numbers yet,” Mu said, adding that there was no breakdown yet of the number of transactions made by Chinese nationals and foreign a...

Red Bull Racing scores $150M sponsorship with Bybit

Following Red Bull Racing’s most recent wins at Formula One (F1), the racing team scores a three-year partnership with Singapore-based crypto trading platform Bybit for $50 million per year. According to the announcement, the fee will be paid in a combination of fiat and BitDAO (BIT) tokens. The company announced that the partnership aims to broaden the F1 team’s fan engagement through its capabilities as a crypto exchange. Bybit will act as an issuer of fan tokens and as a tech incubator for Red Bull Racing as part of the deal. This means that the exchange will help the team distribute its digital asset collections and support its other initiatives, such as developing talent through the Red Bull Technology Campus in Milton Keynes. A new chapter begins. Announcing our partnersh...

Binance Chain, Binance Smart Chain morph into BNB Chain

Binance has renamed its blockchain ecosystem to reflect changes the chain has undergone since its launch The exchange also introduced ‘MetaFi’, an amalgamation of cutting-edge DeFi infrastructure and projects, including the metaverse. The world’s largest crypto exchange Binance has rebranded its Binance Chain and Binance Smart Chain blockchains into a single unified name; BNB Chain, or Build and Build Chain. The new name is expected to take a more prominent role in the blockchain’s branding. According to an announcement made on Tuesday, Binance said the BNB Chain shows the evolution of the Binance Smart Chain. The ‘new’ name would represent the crypto exchange’s governance and staking platform BNB Beacon Chain (previously Binance Chain) and its Eth...

Russia officials fail to reach a compromise over crypto regulation

Discussions held on Tuesday between the Russian Finance Ministry and Central Bank officials on crypto regulation bore no fruit President Putin has urged deliberations between the central bank and the government to reach a common ground Russia President Vladimir Putin recently chipped on the cryptocurrency conversation – a matter that has brought forth divided opinion in the country. While one facet has strongly pushed for a blanket ban on these digital assets, the other has appeared to lean towards regulating them. Putin urged both sides of the aisle to have a sit-down to reach a resolution. Bloomberg reported that senior government personnel held a meeting regarding the matter on Tuesday, citing individuals who requested not to be identified as the meeting had not been disclosed to the pu...

US SEC is investigating two of Binance.US trading affiliates

The regulator wants to establish the relationship between Binance.US and two affiliate firms associated with Changpeng Zhao Several US authorities have in the past, on more than one occasion, probed Binance over other compliance matters The US Securities and Exchange Commission (SEC) is looking into two trading firms associated with crypto exchange Binance’s US arm. The financial markets regulator is said to be investigating the relationship between Binance.US and these firms which hold ties with Binance CEO and founder Changpeng Zhao. According to a report published by The Wall Street Journal on Tuesday, Merit Peak Ltd and Sigma Chain AG are the entities in question. The two firms trade on Binance.US as market makers. The WSJ detailed that the unnamed sources said that the regulator is se...