crypto blog

SBF prosecutors reportedly dig into donations made to top US Democrats

The prosecutors investigating former FTX CEO Sam Bankman-Fried (SBF) have reportedly reached out to top members of the Democratic Party demanding information about the political donations made by the entrepreneur. Democratic members from the Democratic National Committee (DNC), the Democratic Congressional Campaign Committee (DCCC) and Congressman Hakeem Jeffries were contacted by SBF prosecutors for information to aid their ongoing investigations, according to a New York Times report. The United States attorney’s office for the Southern District of New York sent an email to the Democratic Party elections lawyer Marc Elias, asking for details on donations made by SBF. Similar emails were sent over to other members of the Democratic and Republican parties. The Royal Bahamas police arrested ...

Kazakhstan central bank recommends a phased CBDC rollout between 2023-25

Kazakhstan, the world’s third-largest Bitcoin (BTC) mining hub after the United States and China, found feasibility in launching its in-house central bank digital currency (CBDC), a digital tenge. The National Bank of Kazakhstan (NBK) revealed the finding following the completion of the second phase of testing. In late October, Binance CEO Changpeng’ CZ’ Zhao announced that Kazakhstan’s CBDC would be integrated with BNB Chain, a blockchain built by the crypto exchange. The country’s primary motivation for conducting studies on CBDC was to test its potential to improve financial inclusion, promote competition and innovation in the payments industry and increase the nation’s global competitiveness. The pilot research focused on offline payments and pr...

SEC was “asleep at the wheel” about FTX – US Rep. Sessions

The Securities and Exchange Commission (SEC) was “asleep at the wheel” regarding how FTX Group and its subsidiaries met financial and corporate control requirements, Representative Pete Sessions said in the Saturday Report on December 17. “We need to look at what the Securities and Exchange Commission was doing”, stated the Texas Congressman, adding that “the SEC was asleep at the wheel for these billions of dollars that we now find out about a year later.” The SEC filed charges against Sam Bankman-Fried (SBF), the former CEO of FTX, on Dec. 13, claiming that Bankman-Fried violated the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. In the complaint, the SEC requests an injunction to prohibit Bankman-Fried fro...

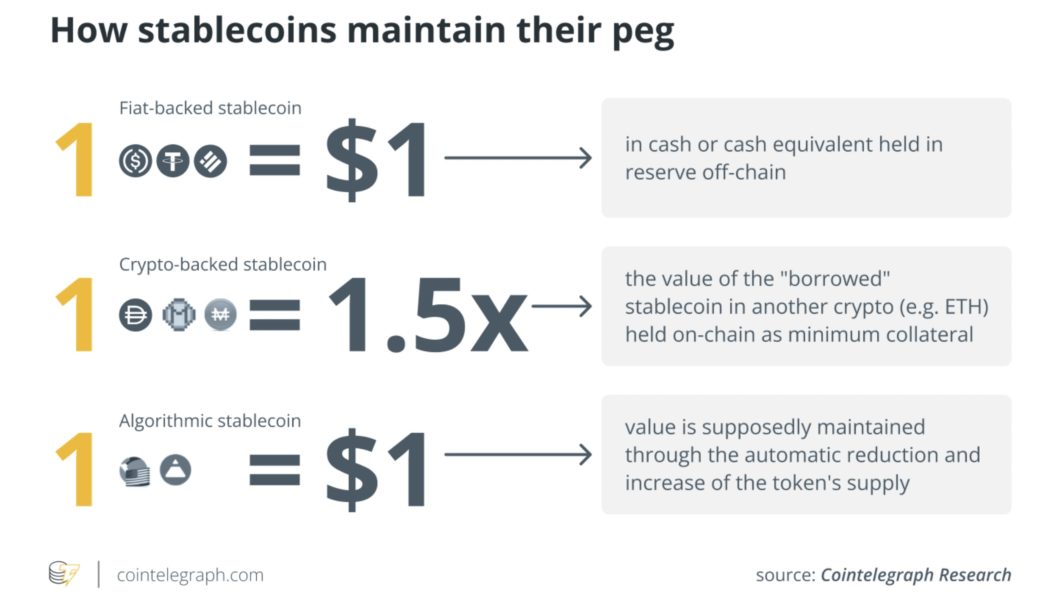

Algorithmic stabilization is the key to effective crypto-finance

After the collapse of Terraform Labs’ cryptocurrency, Terra (LUNA), and its stablecoin, Terra (UST), the notion of “algorithmic stabilization” has fallen to a low point in popularity, both in the cryptocurrency world and among mainstream observers. This emotional response, however, is strongly at odds with reality. In fact, algorithmic stabilization of digital assets is a highly valuable and important class of mechanism whose appropriate deployment will be critical if the crypto sphere is to meet its long-term goal of improving the mainstream financial system. Blockchains, and other similar data structures for secure decentralized computing networks, are not only about money. Due to the historical roots of blockchain tech in Bitcoin (BTC), however, the theme of blockchain-based digita...

SBF risks 115 years in jail, Binance’s FUD, and auditors quit crypto: Hodler’s Digest Dec. 11-17

Top Stories This Week FTX founder Sam Bankman-Fried arrested, set to be extradited to US Sam Bankman-Fried was taken into custody by the Royal Bahamas Police Force and is likely to stay there until February, after his application for bail was denied in Bahamian court. A second application for bail has been reportedly filed by SBF in the Supreme Court of the Bahamas. His arrest came after the United States government officially filed criminal charges against him — including eight counts of fraud. If convicted, Bankman-Fried could face 115 years in jail, but legal commentators have told Cointelegraph there is a “lot to play out” in the case. The domino effect resulting from FTX’s meltdown has also impacted the professional lives of Bankman-Fried’s parents, resulting in their courses a...

Sam Bankman-Fried seeks to reverse decision on contesting extradition: Report

Sam Bankman-Fried, former FTX CEO, has reportedly reconsidered his earlier decision to contest extradition and is expected to appear in court in the Bahamas on Dec. 19 to seek a reversal, Reuters reported on Dec. 17 citing a person familiar with the matter. By consenting to extradition, Bankman-Fried would be able to appear in a United States court. He faces charges of conspiracy to commit wire fraud on customers and lenders, securities fraud, commodities fraud, money laundering and conspiracy to defraud the United States and violate the campaign finance law. The move follows the Bankman-Fried’s bail denial on Dec. 13 due to the “risk of flight”. The former CEO’s lawyers argued that SBF does not possess a criminal record and was suffering from depression and i...

Bitvavo to prefund locked DCG assets worth $296.7M amid liquidity crisis

The Digital Currency Group and its affiliates (DCG), which manages $296.7 million (280 million euros) in deposits and digital assets of crypto exchange Bitvavo for off-chain staking services, suspended repayments citing liquidity problems amid the bear market. However, Bitvavo announced to prefund the locked assets, preventing DCG-induced service disruption for users. With users proactively exploring self-custody options as a means to safeguard their funds, an acute liquidity crisis is expected to loom over exchanges. DCG cited liquidity problems as it suspended repayments, temporarily halting users from withdrawing their funds. Bitvavo, on the other hand, decided to prefund the locked assets to ensure that none of its users are exposed to DCG liquidity issues. “The current situation at DC...

Bitcoin still lacks this on-chain signal for BTC bull market — David Puell

Bitcoin (BTC) only needs one more key on-chain signal for a classic bull market to begin, analyst David Puell says. In a tweet on Dec. 17, the Puell Multiple creator argued that the stage is almost set for the end of the BTC price bear market. Puell: Bitcoin network activity “underwhelming” Despite many calling for new BTC/USD lows of $12,000 or less this cycle, not everyone is wholly bearish on the outlook for Bitcoin. For Puell, two essential on-chain phenomena necessary for BTC price recovery are already in evidence. Long-term holders (LTHs) are resisting the urge to sell despite Bitcoin being down over 70% from its last all-time high. At the same time, short-term “speculators” are feeling acute pain from recent price action. As Cointelegraph reported, these “tourists”...

Central Banks to set standards on banks’ crypto exposure – BIS

A global standard for banks’ exposure to crypto assets has been endorsed by the Group of Central Bank Governors and Heads of Supervision (GHOS) of the Bank for International Settlements (BIS). The standard, which sets a limit of 2% on crypto reserves among banks, must be implemented on January 1, 2025, according to an official announcement on Dec. 16. The report, dubbed “Prudential treatment of cryptoasset exposures”, introduces the final standard structure for banks regarding exposure to digital assets, including tonenized traditional assets, stablecoins and unbacked cryptocurrencies, as well as feedback from stakeholders collected in a consultation launched in June. The Basel Committee on Banking Supervision noted the report will soon be incorporated as a new chap...

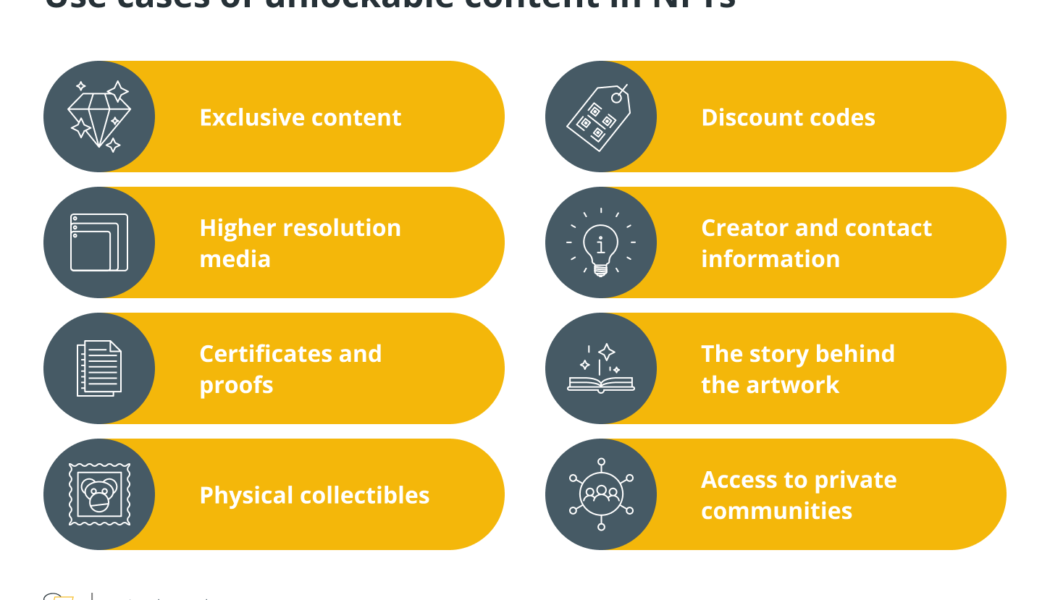

How to add unlockable content to your NFT collection

After a spectacular run in 2021, almost everyone at least superficially knows what nonfungible tokens (NFTs) are. Although not many people are aware that NFTs constantly get new entrancing functionality and use cases. This article will highlight the role of an exciting feature: unlockable content in NFTs. We will break down for you its advantages and use cases and show how to add unlockables to your NFT collection. What is an NFT? Traditionally, NFTs are described as unique cryptographic digital assets on a blockchain that can be bought and sold online. They could be nearly anything, including digital pictures, songs, videos, in-game items, real estate or even personal genomes. Most notably, NFTs provide advantages for artists, such as decentralization, verification and management of owner...

Corporate America has finally taken notice of Web3 — US trademark lawyer

This year saw an influx of trademark applications filed by various companies looking to get in on the Web3 action. By November, a total of 4,999 trademark applications had been filed in the United States for cryptocurrencies and digital-related goods and services — according to United States Patent and Trademark Office-licensed trademark attorney Mike Kondoudis. Kondoudis believes the future of the Web3 ecosystem looks “bright” and “mainstream adoption is inevitable.” To learn more about the impact of Web3 trademark applications filed on the future of the Web3 ecosystem, Cointelegraph interviewed Kondoudis. Cointelegraph has covered a wide range of trademark application stories in 2022, ranging from luxury brands such as Hermès to car brands like Ford, all making a bid for ...

Kadena CEO Stuart Popejoy on blockchain design: proof of work is a feature, not a flaw

When taking its blockchain public, “there was an adjustment period where we had to learn to love crypto,” Kadena founder and CEO Stuart Popejoy said. The admission sounded more like a technical adjustment than a surge of emotion on his lips, but he added, “The people who participate in your ecosystem really are your network and that is obviously not a very enterprise-y thing, that’s very grassroots.” The merits of private blockchains remain a matter of debate, but Kadena transitioned from a private JPMorgan blockchain in 2016 to a public spinoff in 2020, taking Popejoy, formerly a JPMorgan executive, with it. “There was some innovation in private blockchain for a second, and that kind of represents us.” However, “there was this idea that we needed something […] that could serve busin...