crypto blog

Tennessee lawmaker introduces bill which would allow state to invest in crypto

Jason Powell, a member of the Tennessee House of Representatives, has introduced a bill proposing counties, municipalities, and the state to invest in cryptocurrencies and nonfungible tokens, or NFTs. According to Tennessee House Bill 2644 introduced on Feb. 2, Powell proposed amending the current state code to add crypto, blockchain, and NFTs to the list of authorized investments for the counties, state, and municipalities to make with idle funds. Lawmakers assigned the bill to the House Finance, Ways, and Means Subcommittee on Feb. 8 for further consideration. The legislation was the second related to crypto and blockchain introduced by Powell. The same day, he asked Tennessee lawmakers to consider forming a study committee aimed at making the state “the most forward thinking and p...

ETH addresses with large balances are paring down their holdings, analyst observes

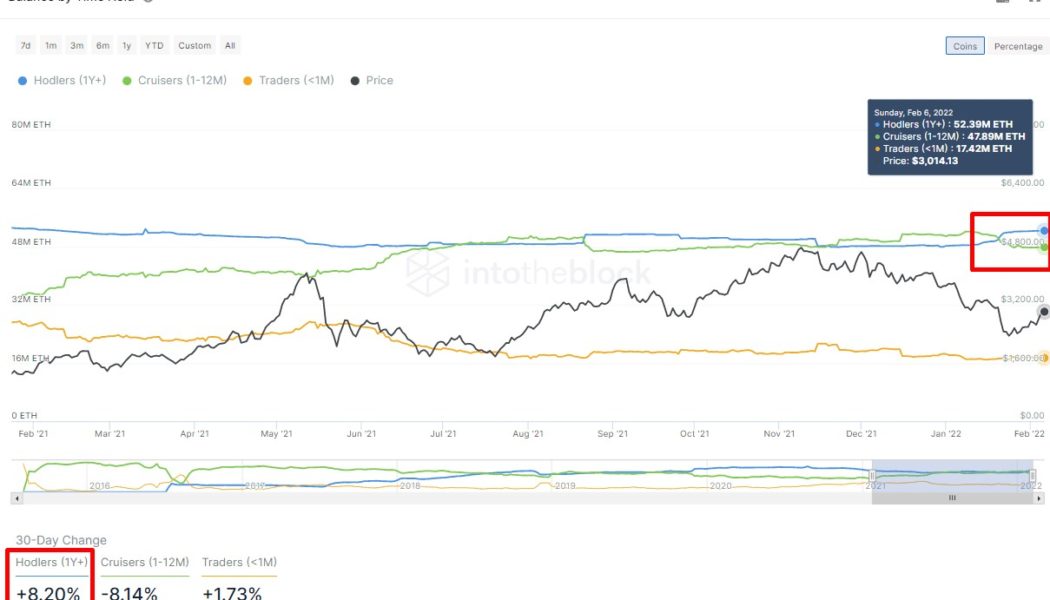

IntoTheBlock analyst Juan Pellicer has reviewed the distribution of Ethereum between long-term and short-term holders in his latest piece for CoinMarketCap, the analyst also assessed the impact of the distribution in the market In an analysis post centred around ‘Who has been buying the last dump,’ research analyst Juan Pellicer noted that the long-term holders have chiefly taken the accretion path even as distribution from fat-cat holders continues. Analysis based on the ‘Balance by Time Held‘ metric As per the data presented by the analyst, Ether hodlers collectively have 52.39 million ETH in their wallets thus far. This group (investors who have held ETH for over 12 months) has the biggest Ethereum balance and accounts for 44.51% of Ethereum holders. It...

CoinDesk CEO reflects on the necessity of decentralised currencies

CoinDesk chief Emily Parker told CNBC yesterday that CBDCs present undue privacy concerns She also noted there is tremendous innovation around privacy in the crypto sector Speaking in an interview with CNBC yesterday, Emily Parker, the chief executive of cryptocurrency news outlet CoinDesk, faulted the possible negatives of a CBDC and rooted for a world where users have an option to hold decentralised currency. Parker inferred to Bitcoin’s fundamental philosophy – decentralisation away from control by centralised entities such as the government, such that no one can manipulate or shut down the network. User privacy concerns The CEO also told Power Lunch that the very definition of centralised currencies illustrates why a decentralised coin is so much needed. Centralised currencies ar...

The crypto industry is still nascent and poised for hyper-adoption, says Wells Fargo

Wells Fargo has advised investors that it is not too late to put their money into crypto The bank is likening crypto’s adoption rate to the internet in the mid-to-late 90s The bank, however, disapproves investment via crypto exchanges, mutual funds, and ETFs at the moment American financial services company Wells Fargo earlier this week said on a note to investors that it’s early but not too early to get into cryptocurrencies. Over the past dozen months, crypto assets have seen it all – from the highest peaks to extreme volatility. Several coins bloomed during the crypto summer, and the sector’s market cap grew from just under $1 trillion to $3 trillion. This rapid industry growth has primarily been attributed to the increasing number of users joining the sector. Still, F...

Russia set to recognise crypto as a form of currency, but with a catch

Authorities in the country have agreed to recognise crypto assets as currency though their use and trading will be regulated The decision comes less than a month after Russian authorities proposed outlawing cryptocurrencies in the country In what can best be described as a U-turn move, Russian authorities have formally agreed to treat cryptocurrencies as currency. News reports emerging from the local outlets in the country detail that the government will collaborate with the Bank of Russia to draw up draft legislation defining these assets’ use. Several parties were reportedly involved in the discussion that birthed the decision. Some of them are the Ministry of Finance, the Federal Tax Service, the Federal Security Service, and the Ministry of Internal Affairs. Russia’s centra...

Bitcoin hasn’t bottomed yet, Bloomberg’s McGlone says

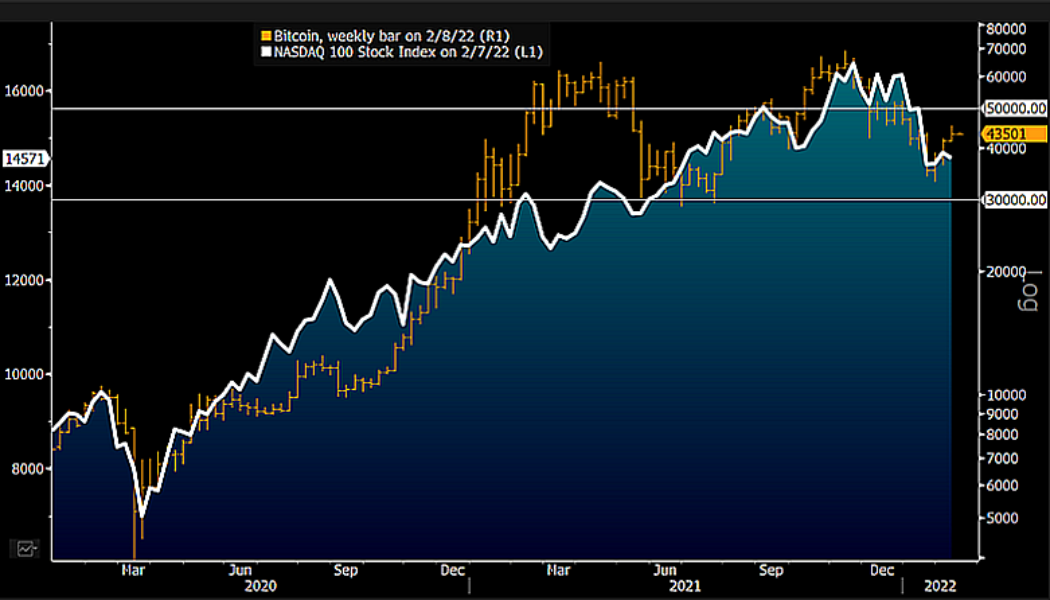

Commodity strategist Mike McGlone has said that Bitcoin will survive the current market forces He, however, noted that it is very likely the flagship cryptocurrency hasn’t hit its lowest thus far Bloomberg Intelligence’s senior commodity strategy has delivered another bullish projection on the leading cryptocurrency. In a tweet sent out today, the commodity expert noted that Bitcoin is showing divergent strength against stocks but warned that the asset hasn’t reached the bottom. He reckons that the crypto asset will sink to its bottom when the stock market pulls a similar move. McGlone, who has previously predicted Bitcoin to touch $100,000 by the end of the year, also observed that many traditional assets are currently enduring deflationary forces resulting from the stat...

Bitcoin dated futures with physical settlement go live on Eqonex

The Nasdaq-listed digital assets financial services company Eqonex has launched a new type of Bitcoin (BTC) investment product, a BTC dated futures contract with a physical settlement. Announcing the news on Wednesday, Eqonex explained that its BTC dated futures are denominated in the USD Coin (USDC) stablecoin and increase in parallel with the BTC price increase against USDC. In contrast to perpetual futures, which have no maturity limit, dated futures expire at a pre-set date and time frame like each month or each quarter, Eqonex noted. “Any position in a perpetual future stays open until the trader decides to close the trade by executing an offsetting trade, or until the trade gets liquidated by Eqonex,” the firm added. According to the announcement, the Eqonex BTC dated futures contrac...

The virus killer: How blockchain contributes to the fight against COVID-19

On Jan. 30, the South China Morning Post reported that one of the largest Asian pharmaceutical companies, Zuellig, had launched a blockchain-based system to track the quality of COVID-19 vaccines. Called “eZTracker,” it allows any user to “instantly verify the provenance and authenticity” of vaccines by scanning the QR code on the package. Somewhat surprisingly, throughout the pandemic, there have not been many reports of blockchain-based products adopted by big pharma or global healthcare organizations to bolster the anti-COVID effort. Here is a rundown of the major cases of such adoption, along with possible reasons for the limited interest in blockchain among healthcare officials. South Korea: Blockchain vaccine passports In April 2021, the South Korean government became the first...

Allbridge to become the first token bridge for the Stacks token

Multi-chain token bridge Allbridge will become the first to offer Stacks (STX) transfers as part of a partnership with Bitcoin software developer Daemon Technologies. STX is the native token for the Stacks Layer-1 blockchain which settles transactions on the Bitcoin (BTC) network. It currently has a market cap of $1.7 billion. Allbridge currently serves 12 blockchains including Ethereum, various Ethereum-compatible sidechains, Solana, Terra, and others. A token bridge allows crypto from one blockchain to be transferred to another one. The new bridge will allow transfers between Stacks and all chains served by Allbridge. The Stacks Bridge will go live in Q2 2022. It will initially only support transfers of STX, but is planned to support transfers of other Stacks protocol SIP010 tokens such ...

Bitcoin centers on $44K as BTC price MACD delivers long-awaited bull signal

Bitcoin (BTC) hovered around $44,000 on Feb. 9 as a modest uptick towards the Wall Street open provided relief for support levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Melt-up or breakdown? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting in the range defined in recent days without significant downside pressure. Circling $44,000, traders were mostly preoccupied with a potential retracement, this having the potential to wipe out practically all recent progress. “Now that we are at monthly resistance we may see a pullback. Even if we do, a higher low to 38K–40K would be “healthy” followed by continuation to 50K+ and a reclamation of our monthly resistance after which point, I’ll have my sights set on a new ATH...

Shiba Inu announces ‘Shiba Lands’ – a virtual real estate in its Metaverse

The lands will be available for auction or purchase according to the announcement post The bidding for land will follow a queue system, with LEASH token holders getting priority The popular meme coin ecosystem Shiba Inu has announced another massive step in the Metaverse direction. The team behind the cryptocurrency has revealed it is working on a virtual real estate project that will allow users to claim ‘lands’ in the Shiba Inu metaverse. The project is part of the developments being carried out in the Shiba Inu Metaverse launched at the end of last month. “We are happy to announce and proudly introduce Shiba Lands! These “lands” found inside our Metaverse will be available for purchase/auction really soon, and it will be our first step towards allowing the ...

Here’s why FSInsight foresees BTC and ETH racing past 200k and 12k, respectively

A report by FSInsight predicts Bitcoin should end the year in the $138k to 222k range The report also indicated that Ethereum could reach $12k as it’s remarkably undervalued Market data outlook firm FSInsight has predicted that Bitcoin could reach $222,000 and Ethereum grow as much as $12,000 in the second half of the year. In a recent report, Digital Assets in A Post-Cycle World, the firm said that a number of factors could work in favour of the coins pushing them to reach the projected price. Several Bitcoin metrics are bullish FSInsight explained that Bitcoin is showing better market efficiency and has not exhibited rapid and unsustainable price appreciation as in previous cycles, which could be attributed to its shift from a payment method to a store of value. Further, the report...