crypto blog

Ethereum eyes $3.5K as ETH price reclaims pandemic-era support with 40% rebound

Ethereum’s native token Ether (ETH) looks poised to hit $3,500 in the coming sessions as it reclaimed a historically strong support level on Feb. 5. Ethereum price back above key trendline ETH price rising above its 50-week exponential moving average (50-week EMA; the red wave in the chart below) means the price also inched above $3,000, a psychological support level that may serve as the ground for Ether’s next leg up. ETH/USD weekly price chart. Source: TradingView The 50-week EMA was instrumental in maintaining Ether’s bullish bias across 2020 and 2021. For instance, it served as a strong accumulation zone during the market correction in the second and third quarters last year, pushing ETH price from around $1,700 to as high as $4,951 (data from Binance). As a result, ...

US Treasury targets NFTs for potential high-value art money laundering

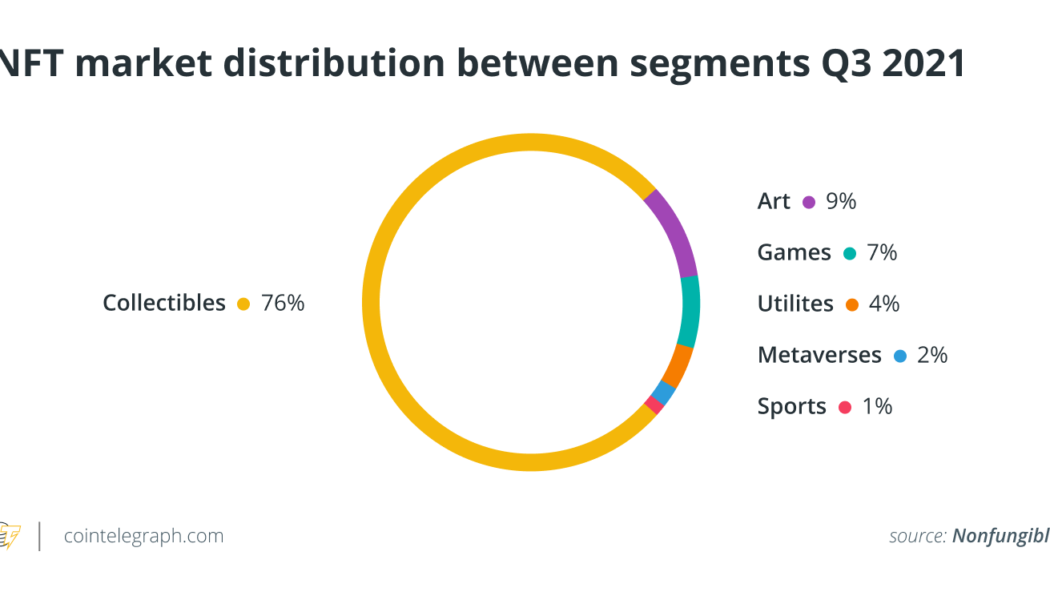

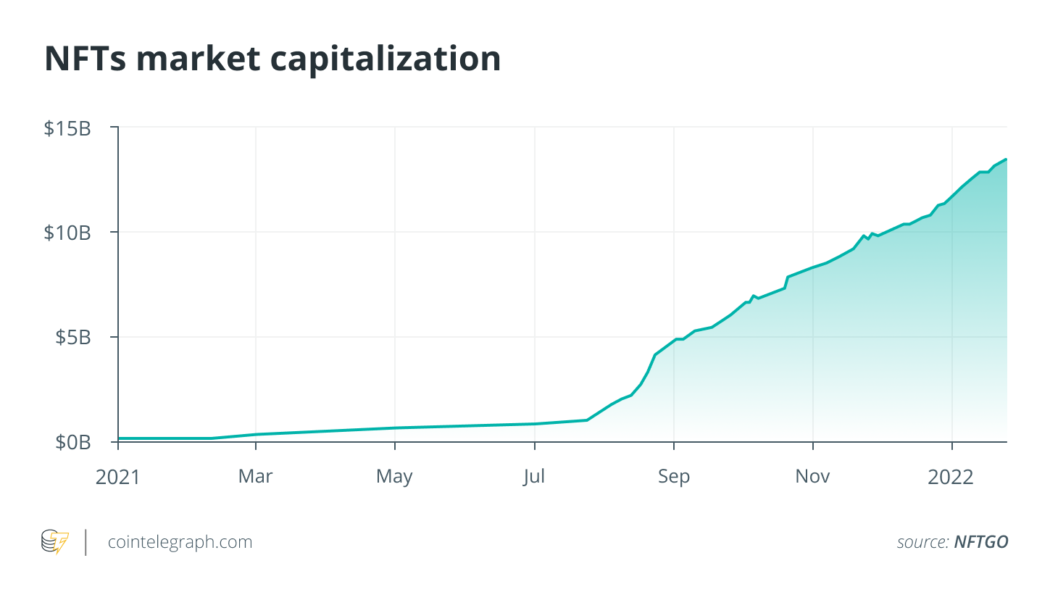

The U.S. Department of the Treasury released a study on the high-value art market, highlighting the potential in the nonfungible tokens (NFT) space to conduct illicit money laundering or terror financing operations. The treasury’s “Study of the facilitation of money laundering and terror finance through the trade in works of art” suggested that the increasing use of art as an investment or financial asset could make the high-value art trades vulnerable to money laundering: “The emerging online art market may present new risks, depending on the structure and incentives of certain activity in this sector of the market (i.e., the purchase of NFTs, digital units on an underlying blockchain that can represent ownership of a digital work of art).” The study underlines the importance of NFTs in r...

Axie Infinity token AXS gains 40% after taking steps to avoid ‘permanent economic collapse’

The price of the Axie Infinity (AXS) token has surged by nearly 40% in three days. AXS rallied to over $65, its best level in more than two weeks, as Axie Infinity revealed a revamped reward structure for its player-vs-player (PVP) competition round. In detail, the play-to-earn startup expanded its number of leaderboard slots to 300,000 and boosted the amount of AXS rewards to 117,676 from the earlier 3,000 for the next season. “This will supercharge the competitive Axie scene and create more demand for quality Axie teams in the ecosystem,” Axie Infinity explained, adding that their move would create a $6 million worth of prize pool for Season 20. AXS/USD daily price chart. Source: TradingView Economic revamp boosts AXS demand AXS serves as a governance token for the Axie ...

Does the IMF have a hidden script for El Salvador’s Bitcoin play?

On Jan. 25, the International Monetary Fund’s (IMF) directors asked El Salvador to “narrow the scope” of its Bitcoin Law by “removing Bitcoin’s legal tender status.” Adopting a cryptocurrency as the Central American country has done “entails large risks for financial and market integrity, financial stability and consumer protection,” the fund wrote. Why did the IMF ask El Salvador to effectively pull the plug on its cryptocurrency experiment? Surely this small country — ranked 104th globally in gross domestic product (GDP) — is no threat to the international bank’s balance sheet. Moreover, 70% of El Salvador’s populace is unbanked, and one-fifth of its GDP is from United States remittances. Arguably, it could profit from Bitcoin’s (BTC) use. Then again, it’s only been half a year since El ...

All eyes on Asia — Crypto’s new chapter post-China

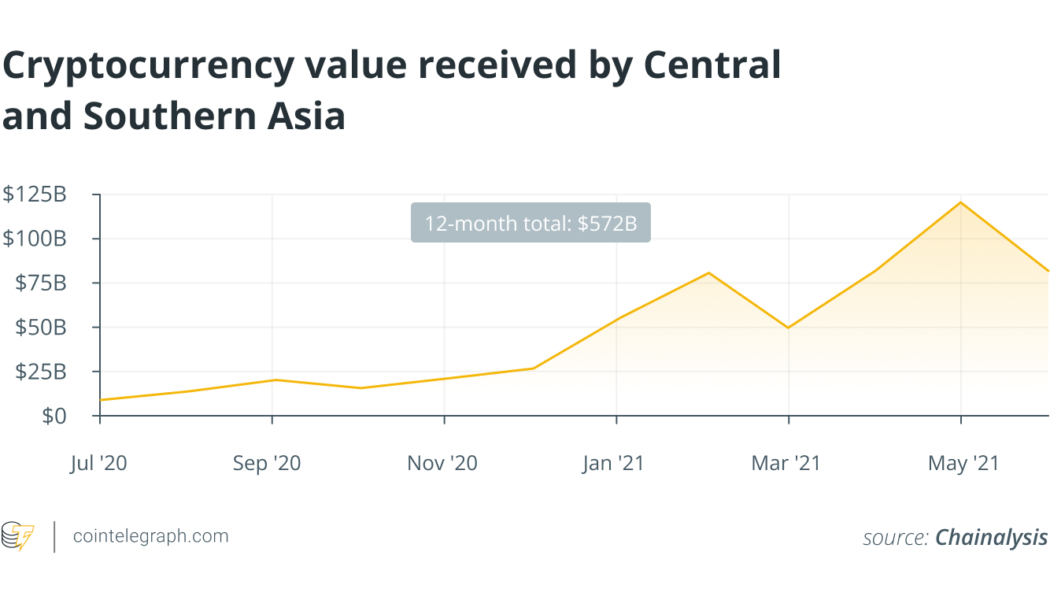

A fundamental trait of crypto is as an asset class that transcends jurisdictions. Yet, one of the key hubs driving adoption and innovation is Asia. Since the heady days of Korea’s Kimchi premium and Bitcoin (BTC) arbitrage opportunities, the region is playing a role in defining crypto’s development pathways and anchoring its future. According to Chainanalysis’ report, in the first half of 2021, Asia was already the destination for 28% of the overall global transaction volume — $1.16 trillion worth of cryptocurrency. Central and Southern Asia alone saw crypto transactions grow 706% year-over-year, making it the world’s third-fastest growing region. Last year, headlines from Asia were dominated by developments in China. However, the rest of the region was also abuzz, boosted by the halo of p...

Are NFTs an animal to be regulated? A European approach to decentralization, Part 1

Nonfungible tokens (NFTs) are constantly in the news. NFT platforms are springing up like mushrooms and champions are emerging, such as OpenSea. It is a real platform economy that is emerging, like those in which YouTube or Booking.com gained a foothold. But it is a very young economy — one that is struggling to understand the legal issues that apply to it. Regulators are starting to take an interest in the subject, and there is risk of a backlash if the industry does not regulate itself quickly. And, as always, the first blows are expected east of the Atlantic. In this first article devoted to the legal framework of NFTs, we will focus on the application of the digital asset regime and financial law to NFTs in France. In a second article, we will come back to the issues of liability and c...

Easy-to-use DeFi protocols will become the new gatekeepers to crypto

It has arguably never been easier to participate in the crypto ecosystem. After centralized exchange powerhouse Coinbase recently began allowing its users to deposit part of their fiat paychecks into the exchange in the form of crypto, more people are beginning to realize the potential of the industry and participate in this ever-growing ecosystem. But, crypto is commonly perceived as fundamentally intricate or lacking the proper interfaces, and whether this is right or wrong, this has been the perception for some time. To some people, the premise of digital currencies will always seem far too complicated. More recently, however, there has been an emergence of easier avenues into the crypto space for those keen to learn more. It’s important to establish just why people should conside...

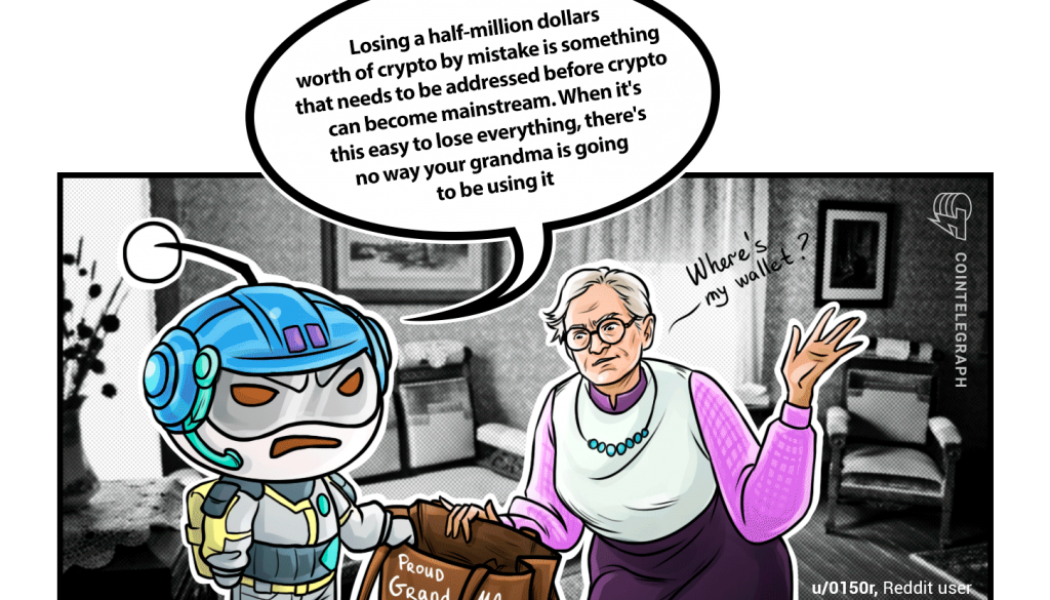

3 things the crypto sector must offer to truly mainstream with TradFi

In the past year, we’ve seen the crypto economy undergo exponential expansion as heaps of money poured into various cryptocurrencies, decentralized finance (DeFi), nonfungible tokens (NFT), crypto indices, insurance products and decentralized options markets. The total value locked (TVL) in the DeFi sector across all chains has grown from $18 billion at the beginning of 2021 to $240 billion in January 2022. With so much liquidity in the ecosystem, the crypto lending space has also grown a significant amount, from $60 million at the beginning of 2021 to over $400 million by January 2022. Despite the exponential growth and the innovation in DeFi products, the crypto lending market is still only limited to token-collateralized loans, i.e. pledge one cryptocurrency as collateral to borro...

Metaverse tokens surge after Meta tanks, Dorsey roasts Diem after it shuts down, a new malware can target 40 browser wallets: Hodler’s Digest, Jan. 28-Feb.5

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Hodlers beware! New malware targets MetaMask and 40 other crypto wallets According to a report from security researcher 3xp0rt, a powerful new malware variant known as the “Mars Stealer,” an upgrade of the information-stealing Oski trojan of 2019, can target more than 40 browser-based crypto wallets, including MetaMask and Coinbase Wallet, along with popular two-factor authentication (2FA) extensions. The nefarious software utilizes a grabber function that steals private keys after it has been downloaded...

Bitcoin stays higher after stocks propel BTC price toward $42K

Bitcoin (BTC) held above $41,000 into the weekend after a late surge Friday took the largest cryptocurrency to two-week highs. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView “The only good bear is a dead bear” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD maintaining newly re-won ground Saturday, with the pair’s correlation to stock makets firmly in focus. Analysts had highlighted the $39,600 area as a key line to cross and flip to new support in order to secure further upside. In the event, this was no issue for bulls, as Bitcoin “gapped up” in seconds as it neared $40,000 to continue higher. Amid the newfound strength, the mood was conspicuously more buoyant than in recent days or even weeks. Popular analyst Credible Cry...