crypto blog

deVere Group CEO Nigel Green notes increasing institutional money in crypto, questions the IMF

The deVere Group CEO said institutional investors are increasing the share of resources they put into crypto. Green also explained that crypto’s use as legal tender in low-income countries would reduce the reliance on ‘first-world’ currencies such as the Dollar. The CEO of financial services and asset management firm deVere Group Limited GmbH Nigel Green has acknowledged Bitcoin as the world’s largest digital asset and earmarked it to play a significant role in the future financial system. Institutions don’t want to be left behind He added that even institutional investors are recognising the status of Bitcoin and other digital assets hence increasingly shifting their portfolios into this nascent space. These entities know that Bitcoin’s attributes are w...

Santiment analysis indicates XRP and Uniswap are entering an opportunity zone

On-chain data shows several altcoins could be set for an upturn as they approach historical opportunity zones Uniswap has recently hit an all-time negative low in MVRV, and XRP is on an eight-month low in this metric Blockchain analytics firm Santiment today reviewed the top altcoins that investors should look to after the sour January they have experienced with the markets. Over the course of the month, the markets have neither spared short-term nor mid-term investors, with the majority seeing trading losses at differing degrees. Advising traders to jump on the opportunity to buy low while others sulk, Santiment reviewed MVRVs of crypto assets and came up with a list of 150 assets that are prime for investment. The analytics firm justified the selection, noting that the tokens show “...

Blockchain enthusiast allegedly losses $500k by sending WETH to contract address

In a now-deleted deleted profile, an anonymous Reddit user allegedly lost close to $500 thousand on Sunday after sending wrapped Ether (WETH) directly into a WETH wrapping smart contract. WETH came into existence as a way for Ether (ETH) to conform to the ERC-20 token standard so that it can be traded directly with altcoins minted on the Ethereum blockchain. To wrap Ether, users first send ETH to the WETH smart contract address and receive an equivalent token in return. However, to unwrap WETH, users must either swap for ETH on a decentralized exchange like Uniswap (UNI) or call the withdrawal function in the WETH smart contract. Instead, the anonymous Reddit user sent the WETH directly back into the WETH smart contract address in the hopes of receiving ETH back. Unfortunately for the user...

What the hell is Web3 anyway?

Web3 — or Web 3.0 as crypto boomers like to call it — is a topical buzzword with only a very vague definition. Everyone agrees it has something to do with a blockchain-based evolution of the internet but, beyond that, what is it really? Yet, the conversation surrounding the meaning and prospects for Web3 has become very fashionable in crypto communities. The term gets thrown about by big corporates trying to muscle in on the space while avoiding the negative connotations of “crypto.” But, without an agreed-on definition, it can’t be properly evaluated. Crypto influencer Cobie is among those deriding Web3‘s lack of specifics: “Despite the deluge of undistinguished think pieces issued by the dominie of the day, nobody really agrees on what Web3 even is. Depending on which tribe you belong to...

Solana ecosystem wallet Phantom raises $109M

Software wallet and browser extension Phantom has raised $109 million in Series B financing to continue expanding its cross-platform capabilities beyond Solana. The funding round was led by Paradigm, an investment firm focused on cryptocurrency and Web3 companies. Other venture firms to have supported Phantom in prior funding deals include Andreessen Horowitz, Jump Capital and Variant Fund. According to Phantom, the funding will help enhance the wallet’s technical capabilities, such as better app discovery, as well as allow the company to hire additional employees. In addition to its funding round, Phantom also announced Monday that its mobile app is now available for iOS devices. Phantom currently boasts of over 2 million monthly active users, having doubled its user count in less t...

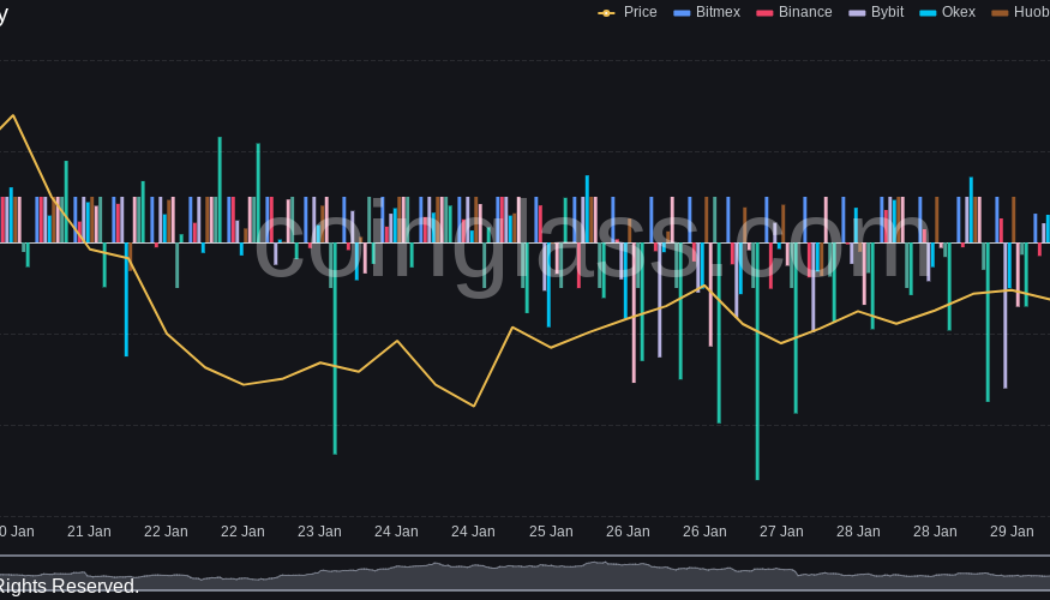

‘No signs Bitcoin has bottomed’ as data warns BTC price downtrend continuing

Bitcoin (BTC) received a welcome boost at the Wall Street open on Jan. 31 as fresh research painted a gloomy picture for near-term price action. BTC/USD 1-month candle chart (Bitstamp). Source: TradingView Trader “not interested” in longs below $38,500 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing toward $38,000 on Monday, reversing a correction which set in immediately after Sunday’s weekly close. With stocks giving some relief to bulls, many analysts remained hands-off on Bitcoin while higher levels nearer $40,000 remained unchallenged. “Bitcoin chopping around and fighting resistance, while the volume remains low overall,” Cointelegraph contributor Michaël van de Poppe summarized after his latest YouTube update. “As ...

New week kicks off with marginal dips in the crypto markets

Top crypto assets are down by between 2% and 5% over the last 24 hours. At the time of press, Bitcoin is holding $37,076, and Ethereum $2,544. Terra continues to lose significantly, declining 25% over the last week. The volatility that has plagued crypto markets in January continued into the last week of the month. Market swings sent the prices rocking with major crypto-asset tokens in the red into the start of the new week. Now having a market cap of $705.98 billion according to CoinMarketCap, Bitcoin has plunged 2.6% in the last 24 hours and is currently trading at $36,975. Though the world’s market-commanding digital asset resided north of $38k in bits over the weekend, it has remained inconsistent, and so has Ethereum’s native coin ETH. ETH is currently down 1.85% on the day, but ...

Monthly Report: SEC’s campaign against Bitcoin Spot ETFs continues

January has been a rough month for the cryptocurrency market. Many crypto coins have bled in the last three weeks erasing gains from the broader market rally at the end of last year. Meanwhile, the larger crypto ecosystem has seen several developments this month. However, no direct crypto ETF has been approved in the US and odds for one being given the green light within Q1 of 2022 are long. Here is a breakdown of this and other important headlines in January, from regulations to crowdfunding. The US SEC is yet to approve a Bitcoin spot ETF The SEC’s preference for ETFs that track Bitcoin futures rather than the digital asset itself has remained unchanged. Citing a failure to reach the standards of a surveillance-sharing agreement, the SEC said on January 20th that it would not accep...

Internet Computer plans to roll out BTC and ETH integrations by year-end

The Internet Computer has released a roadmap for 2022 and beyond, indicating plans to roll out integrations with Bitcoin and Ethereum by the end of the year. The Internet Computer is a public blockchain and protocol that allows developers to install smart contracts and decentralized applications (DApps) directly on the blockchain. It was incubated and launched in May 2021 after years of development by Dfinity — a nonprofit based in Zurich. The #ICP #BTC integration will prompt a new wave of DeFi applications built to leverage the world’s largest cryptocurrency. Full story:https://t.co/kexreQTw20 pic.twitter.com/bQkKdel7r5 — DFINITY Foundation (@dfinity) January 27, 2022 The direct Bitcoin integration will be launched as part of Dfinity’s “Chromium Satoshi Release,” which is planned for Q1 ...

Singapore firm uses blockchain to battle counterfeit COVID-19 jabs

Singaporean healthcare services provider Zuellig Pharma is using a blockchain-based network to track COVID-19 vaccinations to prevent practitioners from administering expired vaccines. Zuellig Pharma says that its new “eZTracker” management system can help prevent improperly stored or counterfeit vaccines from being used by allowing its clients to instantly verify the provenance and authenticity of their vaccines via a mobile app. “Accidents involving expired or improperly stored vaccines can be avoided,” said Daniel Laverick, vice-president and head of digital and data solutions at Zuellig Pharma. eZTracker uses the SAP blockchain to capture, track and trace multiple data points to improve supply chain transparency. The eZTracker website explains how it works: “Simply scan the QR code on ...

US crypto executive order looms — 5 things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week with a bang — but not in the right direction for bulls. A promising weekend nonetheless saw BTC/USD attract warnings over spurious “out of hours” price moves, and these ultimately proved timely as the weekly close sent the pair down over $1,000. At $37,900, even that close was not enough to satisfy analysts’ demands, and the all-too-familiar rangebound behavior Bitcoin has exhibited throughout January thus continues. The question for many, then, is what will change the status quo. Amid a lack of any genuine spot market recovery despite solid on-chain data, it may be an external trigger that ends up responsible for a shake-up. The United States’ executive order on cryptocurrency regulation is due at some point in February, for ex...