crypto blog

ETH to hit $20 trillion market cap by 2030: Ark Invest

A new report from Cathy Woods’ ARK Invest forecasts Ethereum (ETH) will meet or even exceed a $20 trillion market cap within the next 10 years, which would equate to a price around $170,000 to $180,000 per ETH. The report also predicted big things for Bitcoin (BTC), saying it is “likely to scale as nation-states adopt (it) as legal tender… the price of one bitcoin could exceed $1 million by 2030.” ARK Invest is a tech focused American asset management firm based in the United States with $12.43 billion AUM. #BigIdeas2022 Report is here! To enlighten investors on the impact of breakthrough technologies we began publishing Big Ideas in 2017. This annual research report seeks to highlight our most provocative research conclusions for the year. Download! https://t.co/QvUbuqVpIL — ARK Invest (@...

Diem project to sell assets amid looming end, reports suggest

Diem, previously Libra, was proposed by Facebook before its rebrand to Meta The stablecoin project has not seen many good days since its launch It now seems the Diem Association has finally given up on it The Diem stablecoin project pioneered by Meta in October 2019 was mooted as a stablecoin to eventually be used across Meta’s applications. These expectations have seemingly gone to the pack. Bloomberg reports that the project executives have been speaking to investment bankers to initiate a sale of its assets and return the money to the initial investors. However, the talks are still in an early stage, and finding a buyer is not guaranteed. The group is also seeking new employment opportunities for its engineers following the imminent close of business. Worth noting, the project is ...

Bitcoin is still an early adoption technology with a future of volatility, Anthony Scaramucci says

Scaramucci asked Bitcoin investors not to lose focus of the bigger picture He also compared Bitcoin’s volatility during growth to Amazon’s stock in the late 90s SkyBridge Capital founder Anthony Scaramucci has asked investors to hold onto their crypto assets as he believes the current market dip will come to an end soon. “Take a chill pill, stay long bitcoin, other cryptocurrencies like Algorand and Ethereum, and I think you’re going to be very well-served long-term in those investments,” he said. Bitcoin is not yet a mature store of value Speaking during a CNBC interview, he explained that the Dollar will always be the Dollar hence Bitcoin’s change relative to it should not elicit much concern from investors. He asked them to focus ahead and make long-term investments, noting that Bitcoin...

SEC pushes decision on ARK 21Shares Bitcoin ETF to April 3

The U.S. Securities and Exchange Commission has extended its window to approve the ARK 21Shares Bitcoin exchange-traded fund (ETF) originally proposed in July 2021. According to a Tuesday filing from the SEC, the regulatory body will push the deadline for approving or disapproving the ARK 21Shares Bitcoin ETF from Feb. 2 for an additional 60 days, to April 3. SEC Assistant Secretary J. Matthew DeLesDernier noted in the filing that it was “appropriate to designate a longer period” for the regulatory body to consider the proposed rule change, allowing the ETF to be listed on the Cboe BZX Exchange. The exchange originally filed the paperwork to apply for the ARK 21Shares Bitcoin ETF in July 2021, with the SEC able to delay its decision and open the offering to public comment for up to 180 day...

Polygon (MATIC) sees a strong oversold bounce after $250B crypto market rebound

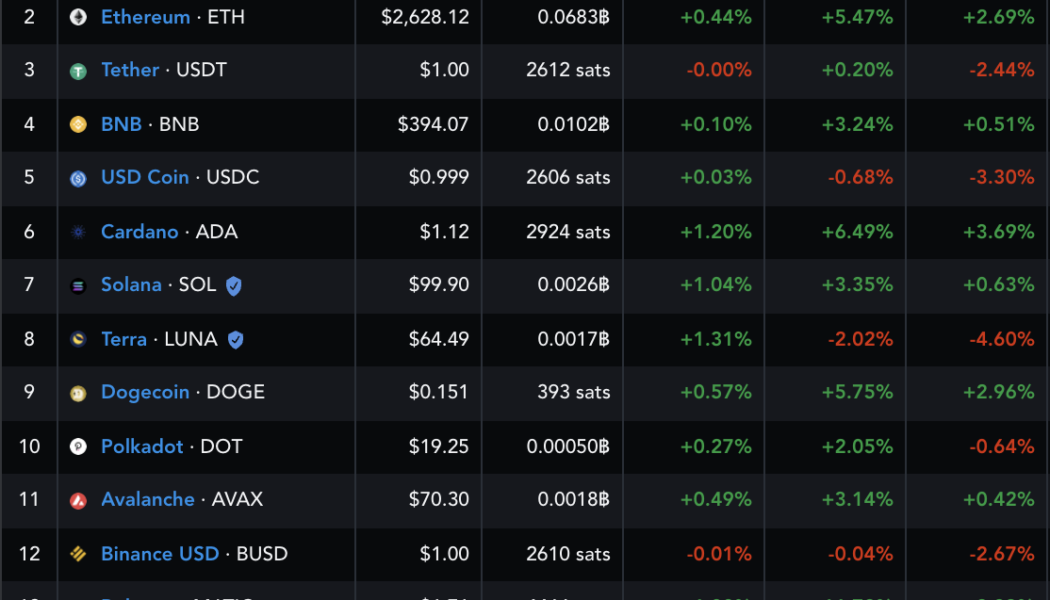

Polygon (MATIC) emerged as one of the best performers among high-ranking cryptocurrencies on Jan. 26 as the price rose nearly 17% to reach an intraday high at $1.825. The gains surfaced amid a synchronous rebound across the crypto market that started on Jan. 24. In detail, investors and traders poured in over $250 billion across digital assets, benefiting Bitcoin (BTC), Ether (ETH) and many others in the process. Performance of the top-fifteen cryptocurrencies in the last 15 days. Source: TradingView Polygon, a secondary scaling solution for the Ethereum blockchain, also cashed in on the crypto market rebound. The valuation of its native token, MATIC, rose from as low as $9.77 billion on Jan.24 to as high as $13.58 billion two days later. Meanwhile, its price jumped from $1....

Ethereum bulls aim to flip $2.8K to support before calling a trend reversal

The dire predictions calling for the onset of an extended bear market may have been premature as prices appear to be in recovery mode on Jan. 26 following a signal from the U.S. Federal Reserve that interest rates will remain near 0% for the time being. After the Fed announcement from, prices across the cryptocurrency market began to rise with Bitcoin (BTC) up 4.11% and making a strong push for $39,000. This sparked a wave of momentum that helped to lift a majority of tokens in the market, but at the time of writing BTC price has pulled back to the $37,000 zone. Data from Cointelegraph Markets Pro and TradingView shows that the top smart contract platform Ethereum (ETH) also responded positively to the rise in bullish sentiment as its price climbed 8.11% on the 24-hour chart to hit a...

FTX US hits $8BN valuation after securing $400M in Series A funding round

The exchange intends to use the funds to expand its workforce by hiring more experts FTX US, the US affiliate arm of global exchange FTX, has concluded its first funding round, netting $400 million. The fundraising drew support from several huge names, including SoftBank Group, blockchain-focused venture capital firm Paradigm and Singapore-based investment company Temasek. Other participants that featured include Ontario Teachers’ Pension Plan Board, Multicoin Capital, Greenoaks Capital, Lightspeed Venture Partners, Tribe Capital, and Steadview Capital. The exchange is now valued at $8 billion, making it one of the biggest players in the US cryptocurrency sector. This new valuation is at par with the target set by FTX chief executive Sam Bankman-Friend last December. FTX previously c...

Valkyrie aims for ETF linked to Bitcoin mining firms on Nasdaq

Crypto asset manager Valkyrie has filed an application with the United States Securities and Exchange Commission to trade an exchange-traded fund (ETF) with exposure to Bitcoin mining firms on the Nasdaq Stock Market. In a Wednesday SEC filing, Valkyrie said its Bitcoin Miners ETF will not invest directly in Bitcoin (BTC) but at least 80% of its net assets would offer exposure to the crypto asset through the securities of companies that “derive at least 50% of their revenue or profits” from BTC mining or providing hardware or software related to mining. The filing added Valkyrie would invest up to 20% of the ETF’s net assets in companies holding “a significant portion of their net assets” in Bitcoin. Valkyrie launched a Bitcoin Strategy ETF in October 2021, which offered indirect exposure ...