crypto blog

Top 5 cryptocurrencies to watch this week: BTC, LUNA, ATOM, ACH*, FTM

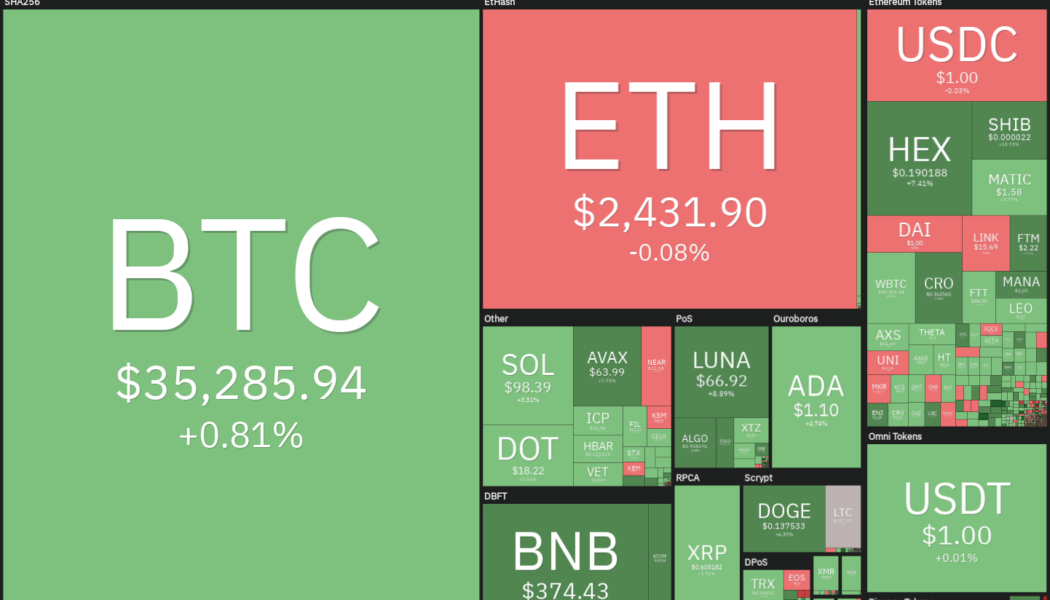

Bitcoin (BTC) fell close to $34,000 on Jan. 21, which reflects a 50% decline from the $69,000 all-time high made on Nov. 10, 2021. Altcoins also could not buck the trend and faced intense selling pressure, which pulled the total crypto market capitalization to $1.6 trillion, a 46% decline from its November 2021 all-time high near $3 trillion. It is not only the crypto markets that are facing selling by investors. The S&P 500 has also plummeted 8% year-to-date. However, gold has outperformed and risen about 1.76% during the period, cementing its billing as a safe haven asset. Crypto market data daily view. Source: Coin360 Several retail traders who purchased Bitcoin near its all-time high are voicing their concerns on social media. However, El Salvador’s President Nayib Bukele does not ...

Vibe killers: Here are the countries that moved to outlaw crypto in the past year

Last week, Pakistan’s Sindh High Court held a hearing on the legal status of digital currencies that might lead an outright ban of cryptocurrency trading combined with penalties against crypto exchanges. Several days later, the Central Bank of Russia called for a ban on both crypto trading and mining operations. Both countries could join the growing ranks of nations that moved to outlaw digital assets, which already include China, Turkey, Iran and several other jurisdictions. According to a report by the Library of Congress (LOC), there are currently nine jurisdictions that have applied an absolute ban on crypto and 42 with an implicit ban. The authors of the report highlight a worrisome trend: the number of countries banning crypto has more than doubled since 2018. Here are the ...

SEC rejects MicroStrategy‘s Bitcoin accounting practices: Report

Business intelligence firm MicroStrategy reportedly acted contrary to the Securities and Exchange Commission’s (SEC‘s) accounting practices for its crypto purchases. According to a Bloomberg report, a comment letter from the SEC released Thursday showed that the regulatory body objected to MicroStrategy reporting information related to its Bitcoin (BTC) purchases based on non-Generally Accepted Accounting Principles (GAAP). The business intelligence firm has been reporting that it used these methods of calculating figures for its BTC buys, excluding the “impact of share-based compensation expense and impairment losses and gains on sale from intangible assets.” Essentially, this negates some of the effects of the volatility of the crypto market. GAAP rules are seemingly not design...

El Salvador buys its cheapest 410 Bitcoin as prices reach $36K

The Central American country of El Salvador has added 410 Bitcoin (BTC) to its central reserve as BTC prices trade below $37,000, a price last seen on July 26, 2021. The fresh addition to El Salvador’s BTC reserve was announced by President Nayib Bukele who confirmed that the purchase of 410 BTC was made against $15 million, placing the price at approximately $36,585 per BTC. Nope, I was wrong, didn’t miss it. El Salvador just bought 410 #bitcoin for only 15 million dollars Some guys are selling really cheap ♂️ https://t.co/vEUEzp5UdU — Nayib Bukele (@nayibbukele) January 21, 2022 El Salvador adopted BTC as a legal tender on September 7, 2021, as a means to overcome catastrophic inflation amid the weakening spending power of the nation. Fast forward to today, th...

Crypto and NFTs meet regulation as Turkey takes on the digital future

In her monthly Expert Take column, Selva Ozelli, an international tax attorney and CPA, covers the intersection between emerging technologies and sustainability, and provides the latest developments around taxes, AML/CFT regulations and legal issues affecting crypto and blockchain. Turkey — the cradle of civilization — is quietly digitizing despite its high-inflation economy, and the lira’s volatility might be correlated with the prices of Bitcoin (BTC) and Ether (ETH). During the fourth quarter of 2021, the TRY/USD exchange rate crashed from 9 to 18.5 liras per dollar in the six weeks leading up to mid-December before strengthening to as high as 10 liras and then falling back to 13.87 liras at the time of writing, rendering the currency a highly volatile asset. The lira’s volatility stemm...

Custodial vs non-custodial NFTs: Key differences

Nonfungible tokens can be minted, sold or bought on NFT trading platforms that are either custodial or non-custodial Today, the crypto space is filled with NFT platforms of all kinds such as mass and niche ones, self-service or invite-only platforms, gaming NFT platforms, sports or music NFT marketplaces and many others. All of them operate slightly differently, provide distinct functionality and offer various types of NFTs. The majority of NFT marketplaces are based on the Ethereum blockchain while others belong to blockchains like Binance Smart Chain (BSC), Polkadot, Solana and Cosmos, to name a few. Some marketplaces are custodial and some are non-custodial. It is worth noting that some types of NFTs may not get accepted on certain platforms, mostly custodial ones as they get to choose ...

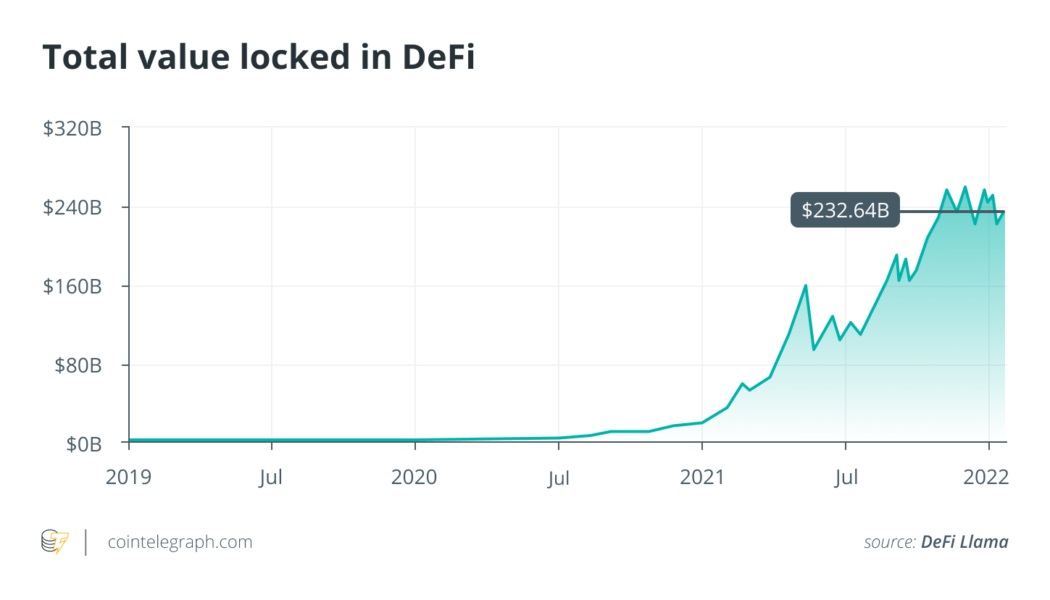

How should DeFi be regulated? A European approach to decentralization

Decentralized finance, known as DeFi, is a new use of blockchain technology that is growing rapidly, with over $237 billion in value locked up in DeFi projects as of January 2022. Regulators are aware of this phenomenon and are beginning to act to regulate it. In this article, we briefly review the fundamentals and risks of DeFi before presenting the regulatory context. The fundamentals of DeFi DeFi is a set of alternative financial systems based on the blockchain that allows for more advanced financial operations than the simple transfer of value, such as currency exchange, lending or borrowing, in a decentralized manner, i.e., directly between peers, without going through a financial intermediary (a centralized exchange, for example). Schematically, a protocol called a DApp (for decentra...

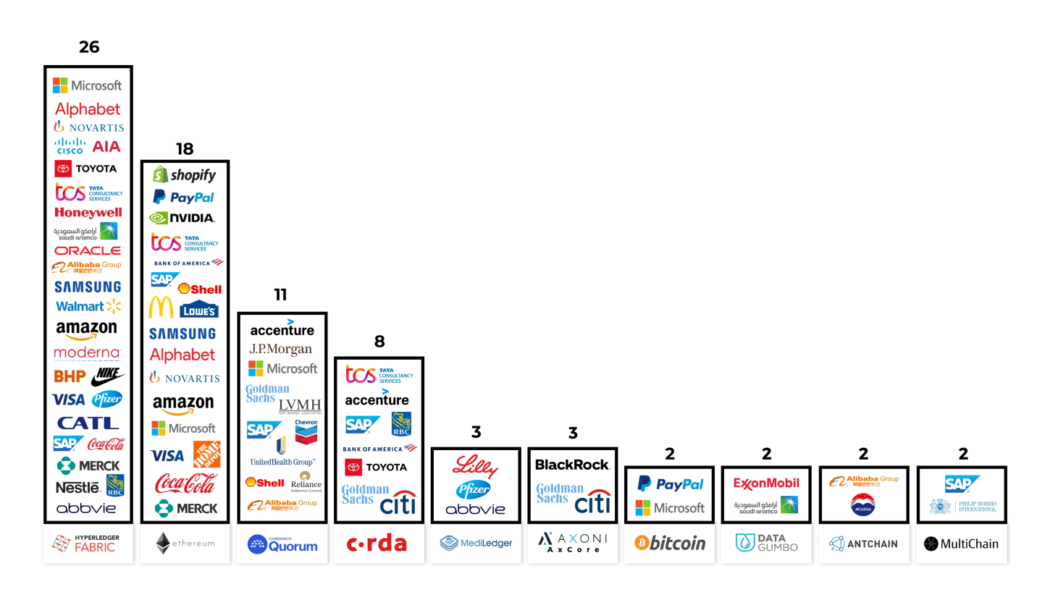

Decentralized and traditional finance tried to destroy each other but failed

The year 2022 is here, and banks and the traditional banking system remain alive despite decades of threatening predictions made by crypto enthusiasts. The only endgame that happened— a new Ethereum 2.0 roadmap that Vitalik Buterin posted at the end of last year. Even though with this roadmap the crypto industry would change for the better, 2021 showed us that crypto didn’t destroy or damage the central banks just like traditional banking didn’t kill crypto. Why? To be fair, the fight between the two was equivalently brutal on both sides. Many crypto enthusiasts were screaming about the coming apocalypse of the world’s financial systems and described a bright crypto future ahead where every item could be bought with Bitcoin (BTC). On the other hand, bankers rushed t...

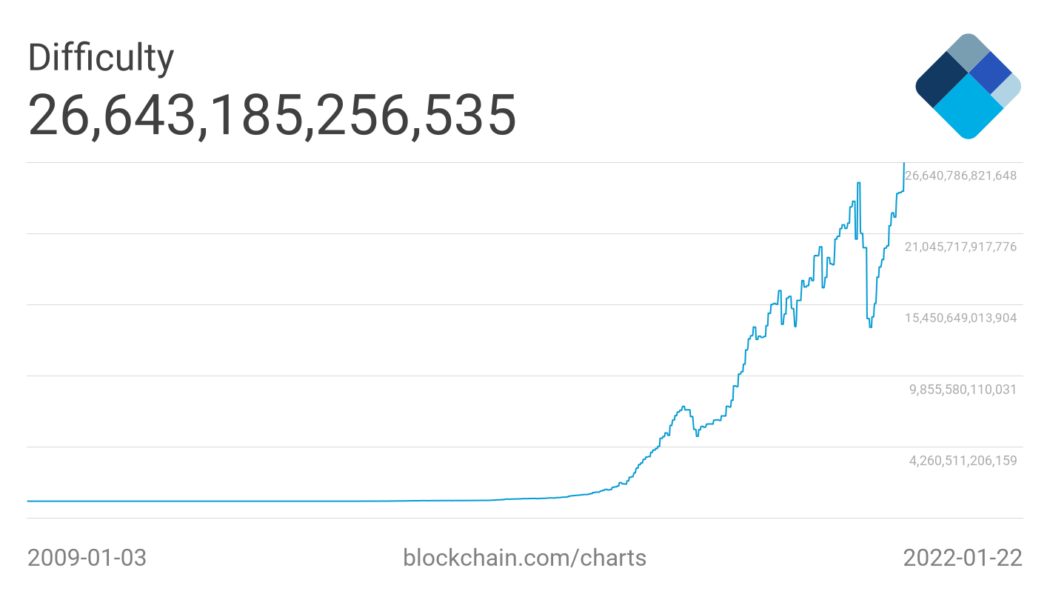

Bitcoin records all-time high network difficulty amid price fluctuations

The Bitcoin (BTC) network has recorded a new all-time high mining difficulty of 26.643 trillion with an average hash rate of 190.71 exahash per second (EH/s) — signaling strong community support despite an ongoing bear market. The Bitcoin network difficulty is determined by the overall computational power, which co-relates to the difficulty in confirming transactions and mining BTC. As evidenced by the blockchain.com data, the network difficulty saw a downfall between May and July 2021 due to various reasons including a blanket ban on crypto mining from China. BTC network difficulty. Source: Blockchain.com. As the displaced miners resumed operations from other countries, however, the network difficulty saw a drastic recovery since August 2021. As a result, on Saturday, the BTC network reco...

Nifty News: FLUF World and Snoop Dogg fundraise, Adidas and Prada NFTs, WAX gifts 10M NFTs

There was so much Nifty News this week that a second round-up was necessary to catch up on the latest nonfungible token (NFT)-related news. FLUF World and Snoop Dog partner for charity FLUF World, Beyond VR studio and Snoop Dogg teamed up to raised over $1 million via a one-day charity NFT auction on behalf of the Kiwi nonprofit organization Auckland City Mission. Seven FLUF World NFTs were paired with seven limited-edition Snoop Dogg-themed Burrows designed by Beyond and sold on OpenSea. The partnership with the rapper included a 500 Snoop Dogg studio drop announced this past week. What. The. Fluf. Over $1 Million NZD raised in just 12 hours in our @SnoopDogg Burrow & Fluf Auction for the @AKcitymission. We’re blown away Thanks to our partner @beyondvrgames, all who ...

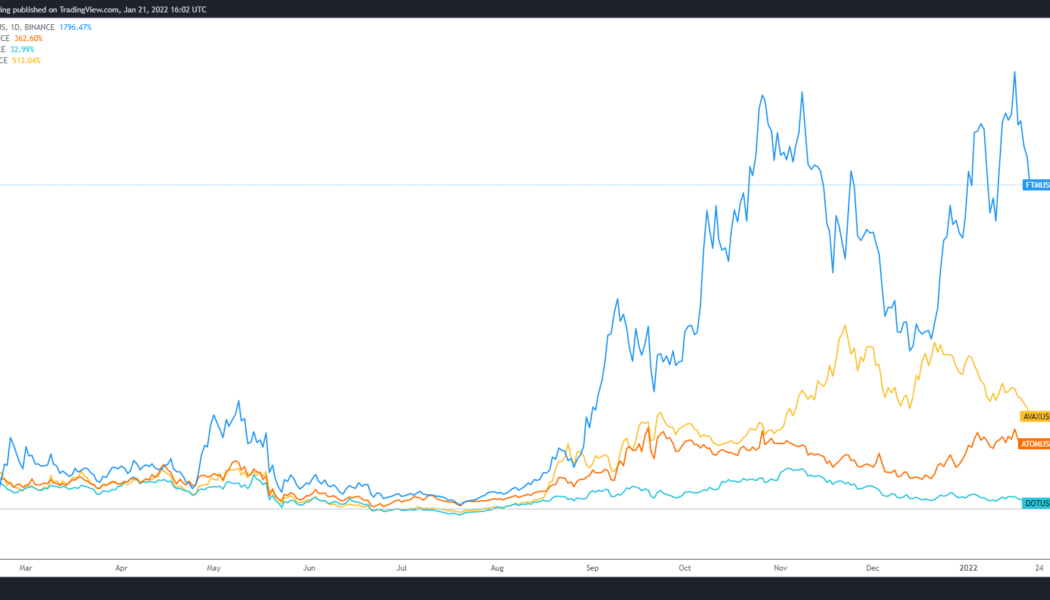

3 possible reasons why Polkadot is playing second fiddle in the L1 race

2021 was a sort of “coming-of-age” for many layer-one (L1) blockchain protocols because the growth of decentralized finance (DeFi) and nonfungible tokens (NFTs) forced users to look for solutions outside of the Ethereum (ETH) network where high fees and network congestion continued to be barriers for many. Protocols like Fantom (FTM), Avalanche (AVAX) and Cosmos (ATOM) saw their token values rise and ecosystems flourished as 2021 came to a close. Meanwhile, popular projects like Polkadot (DOT) underperformed, comparatively speaking, despite the high expectations many had for the sharded multi-chain protocol. FTM/USDT vs. AVAX/USDT vs. ATOM/USDT vs. DOT/USDT daily chart. Source: TradingView Setting aside the specific capability that each protocol offers in terms of transactions ...