crypto blog

Animoca Brands doubles valuation to $5B, OpenSea tops $3.5B in January volume, Microsoft eyes Metaverse gaming: Hodler’s Digest, Jan. 16-22

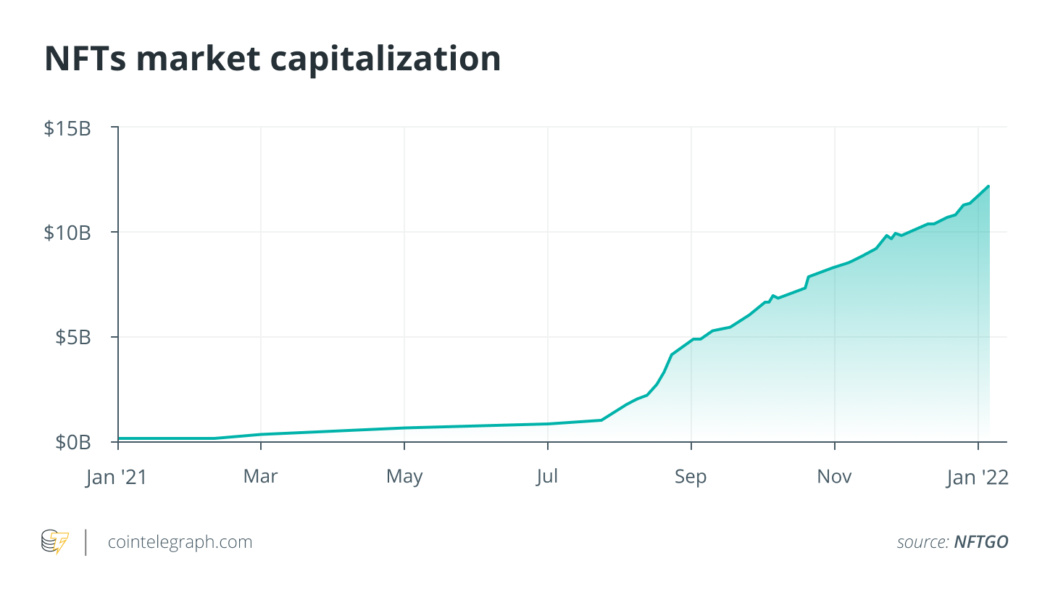

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week NFT-focused Animoca Brands valued at $5B following $358M raise NFT and virtual property-focused firm Animoca Brands secured $358 million worth of funding earlier this week at a valuation of $5 billion. The company said the fresh funds will go towards financing strategic acquisitions and investments, product development, and IP accumulation. The firm has gone from strength to strength over the past 12 months, raising more than $216 million in 2021, while its valuation has more than doubled since its previ...

What are flash loans in DeFi?

Similar to traditional loans, flash loans are expected to be paid back in full eventually. However, there are also marked differences. In typical lending processes, a borrower loans money from a lender. The amount is expected to be paid back in full eventually, with interest, depending on the terms discussed between the lender and the borrower. Flash loans operate on a similar framework but have some unique terms and premises: Use of smart contracts A smart contract is a tool used in most blockchains to ensure that funds do not change hands until a specific set of rules are met. When it comes to flash loans, the borrower is required to repay the full amount of the loan before the completion of the transaction. If this rule is not followed, the transa...

Bearish chart pattern hints at $70 Solana (SOL) price before a possible oversold bounce

Solana (SOL) price may fall to $70 a token in the coming weeks as a head and shoulders setup emerged on the daily timeframe and possibly points toward a 45%+ decline. The chart below shows that SOL price rallied to nearly $217 in September 2021, dropped to a support level near $134 and then moved to establish a new record high of $260 in November 2021. Earlier this week, the price fell back to test the same $134-support level before breaking to a 2022 low at $87.73. SOL/USD weekly price chart featuring head and shoulders setup. Source: TradingView This phase of price action appears to have formed a head and shoulders setup, a bearish reversal pattern containing three consecutive peaks, with the middle one around $257 (called the “head”) coming out to be higher than the oth...

Weekly Report: MicroStrategy chief says firm will hold onto Bitcoin stash amid crypto market tumble

The cryptocurrency market has continued bleeding on the second straight day. Bitcoin has sunk further, hitting a six-month low. It is currently trading at around $35,500, 6.28% down on the day. Ether and other altcoins have also haemorrhaged, erasing a chunk of gains from recent rallies. The crash has been attributed to the global stock sell-off and a looming crypto ban in Russia. Here are other top cryptocurrency headlines that you might have missed this week: Singapore’s top financial regulator goes after cryptocurrency ATM operators Cryptocurrency ATM operators in Singapore were on Monday ordered to halt their operations in accordance with recently published guidelines. The issued ‘request’ outlawed crypto businesses from lending services at physical crypto ATMs. Singa...

The best Ethereum ecosystem tokens worth your attention on January 22, 2022: BNT and BAT

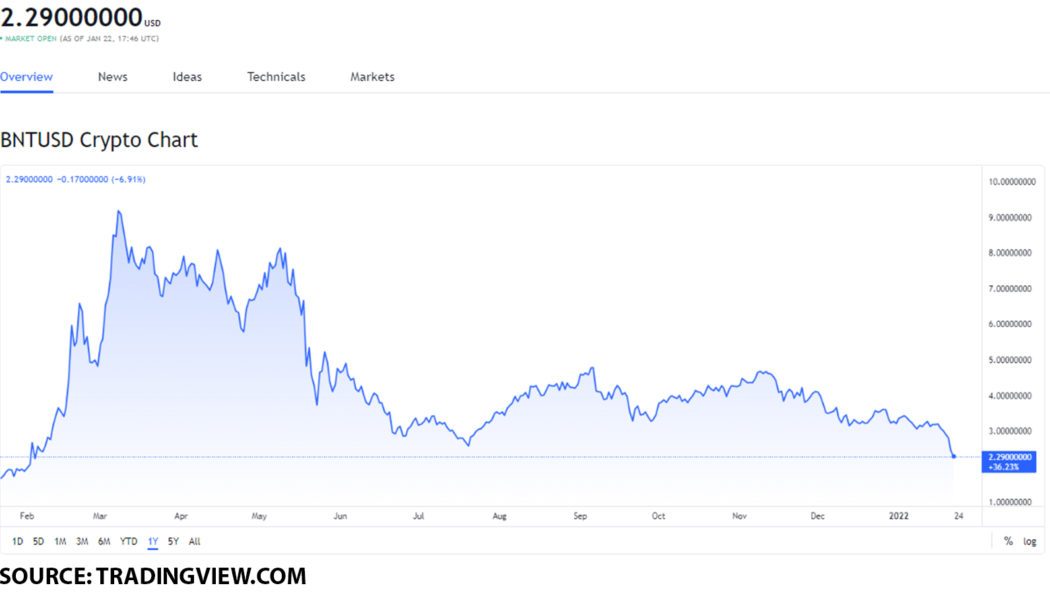

Bancor Network Token (BNT)’s trading volume increased by 41% in the last 24 hours. Basic Attention Token (BAT)’s trading volume saw an increase of 50% in the last 24 hours. Both tokens have the potential to increase in value by the end of February 2022. Bancor is a blockchain protocol that lets users convert different virtual cryptocurrency tokens directly and instantly, powered by the BNT cryptocurrency token. Basic Attention Token is a blockchain-based system that tracks the media consumption time of users, as well as their attention on websites while using the Brave browser, powered by the BAT cryptocurrency token. Should you buy Bancor Network Token (BNT)? On January 22, 2022, Bancor Network Token (BNT) had a value of $2.29. In order for us to see what this value point means for the BN...

BTC price falls to $34K as Bitcoin RSI reaches most ‘oversold’ since March 2020 crash

Bitcoin (BTC) refused to stem recent losses during Jan. 22 as predictions of a flight to $33,000 and lower looked increasingly likely to become a reality. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView. Open interest “still not flushed” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it fell through $35,000 during the first half of Saturday. With few silver linings available for the bulls, lower weekend volume was poised to deliver some classic erratic moves after Bitcoin lost $40,000 support on Friday. While some, including El Salvador, made the most of the new lower levels, others voiced concern that despite the drop, pressure still remained on bulls. “Crazy part is open interest still hasn’t flushed,” trad...

NFTs: Forget apes and penguins — Let’s talk diapers, hardware and museums

Though the likes of Bored Apes and Pudgy Penguins take the headlines, and the potential for decentralized finance (DeFi) and play-to-earn gaming is undeniably grand and exciting, the marketing potential for nonfungible tokens (NFTs) deserves equal attention. It boils down to this: With NFTs, virtually anything can be gamified to promote desired marketing outcomes. Gamification — defined by Gabe Zichermann, author of The Gamification Revolution, as a “process of using game thinking and game dynamics to engage audiences and solve problems” — is not new to sales and marketing. What is new are the mechanisms by which you can engage and motivate prospects and customers. And, gosh, they are exciting. To illustrate the point, here are five example use-cases of NFTs for marketers. Co-marketing to ...

Buyback-and-burn: What does it mean in crypto?

Miners can burn virtual currency tokens using the proof-of-burn (PoB) consensus mechanism. Proof-of-burn is one of several consensus mechanisms blockchain networks use to verify that all participating nodes agree on the blockchain network’s genuine and legitimate state. A consensus mechanism is a collection of protocols that use several validators to agree on the validity of a transaction. PoB is a proof-of-work mechanism that does not waste energy. Instead, it works on the idea of allowing miners to burn tokens of virtual currency. The right to write blocks (mine) is then awarded in proportion to the coins burned. Miners transmit the coins to a burner address to destroy them. This procedure uses few resources (aside from the energy necessary to mine the coins before burning them) an...

Finance Redefined: Secret’s $400M fund, and 1inch expanding, Jan. 14–21

Welcome to the latest edition of Cointelegraph’s decentralized finance newsletter. Following a bearish decline for many of the leading decentralized finance (DeFi) tokens, it is within the fundamental news where the optimism for growth and prosperity lies. Read on to hear about the most impactful DeFi stories of the last seven days. What you’re reading is the shorter, snappier version of the newsletter. For the full roundup of DeFi developments across the week delivered directly to your inbox, subscribe below. Secret Network offers $400M community fund scheme Secret Network, a privacy-oriented layer-one blockchain, announced the launch of a $400 million funding pot this week in a bid to expand their application and network infrastructure, and tooling mechanisms in addition to accelerating ...

MetisDAO TVL surges by 99,800% as the layer-2 race heats up

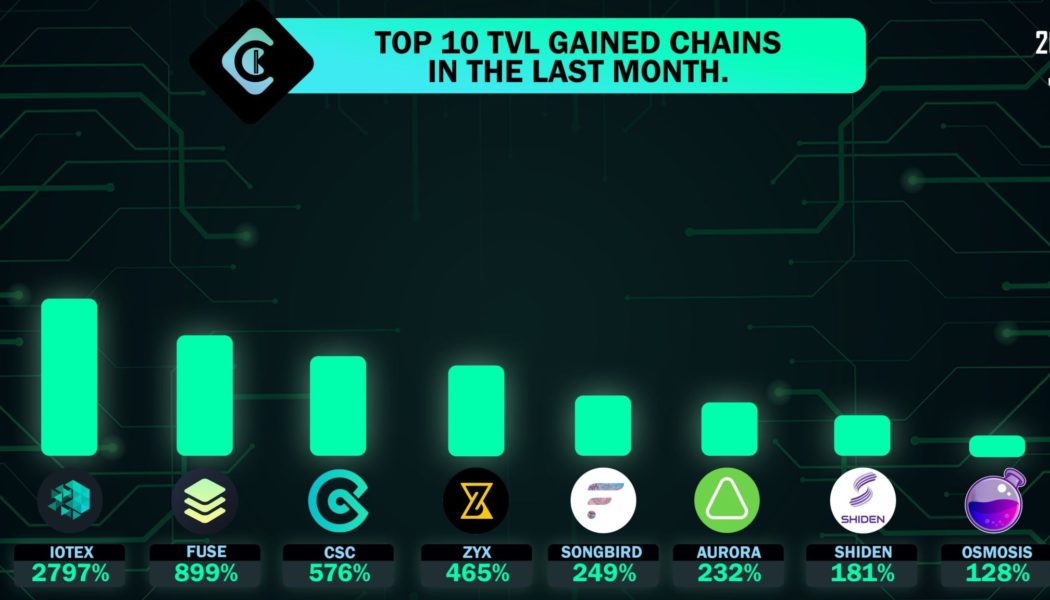

Attracting liquidity has become a de facto arms race in the growing decentralized finance (DeFi) landscape. Projects constantly battle to attract investors’ funds by offering enticing yields for crypto holders willing to take a risk and lock up their assets, and protocols use these funds to build out their products and attract attention from larger investors. One protocol that has been gaining traction in the total value locked (TVL) race is MetisDAO, a layer-two rollup platform designed to fully support the application and business migration from Web2 to Web3. Top 10 TVL gainers over the past month. Source: CCK Ventures Alongside the growth in the TVL on its protocol, the METIS token has also received a boost of momentum, with data from Cointelegraph Markets Pro and CoinGecko showin...

Redditors share their thoughts on buying Bitcoin at all-time highs

Many crypto enthusiasts turned to social media on Friday to voice their frustrations with the state of the crypto market. One Reddit user named imyourkingg allegedly invested 30% of his net worth into Bitcoin (BTC) a few months ago, saying: “I don’t need this money for the next 5 to 10 years, but I have to admit sometimes I get so afraid of Bitcoin’s future; I mean it crashes or never reach $100k, $200k as the predictions for 2025+ says or at least $55k again lol, and I lose that money, especially when all of my friends, my mom and family call me crazy for investing on it.” Crypto’s decentralized nature means there are no circuit breakers equivalent to the ones that exist on traditional stock exchanges. The resulting bull/bear cycles can be extreme, and d...

NFTs and DeFi overturn a banker’s generational curse of poverty in 2 years

Brenda Gentry, a former USAA mortgage underwriter from Texas, believes that the cryptocurrency ecosystem offers a fighting chance to overcome the generational curse of poverty. Gentry, a.k.a. MsCryptoMom, left her decade-long job as a banker to pursue a full-time crypto career as her initial investments from early 2020 confirmed the “unprecedented opportunities offered by crypto.” She currently runs Gentry Media Productions, a firm that advises decentralized finance (DeFi) and nonfungible token (NFT) projects — generating up to 20 ether (ETH) each month, nearly $50,000 at the time of writing. Speaking to Cointelegraph, Gentry recollected the moment she first bought crypto: “It was early 2020 during the lockdown. I bought Bitcoin, Ethereum and Link on Coinbase. When I started, I almos...