crypto blog

Multichain under fire from users as hacking losses grow to $3M

Hackers have continued to exploit a critical vulnerability in the cross-chain router protocol (CRP) Multichain that first appeared on Jan 17. Earlier this week, Multichain urged users to revoke approvals for six tokens to protect their assets from being exploited by malicious individuals. However Multichain’s announcement on Jan. 17 encouraged more hackers to try the exploit. One stole $1.43 million, another offered to return 80% while keeping the rest as a tip. According to Tal Be’ery, the co-founder of the ZenGo wallet, the stolen amount has now risen to $3 million. The @MultichainOrg hack is far from being over.Over the last hours more than additional $1M stolen, rising the total stolen amount to $3M.One victim lost $960K!https://t.co/fYhYxUojB8 pic.twitter.com/Gvh5hB6t6s — Tal Be...

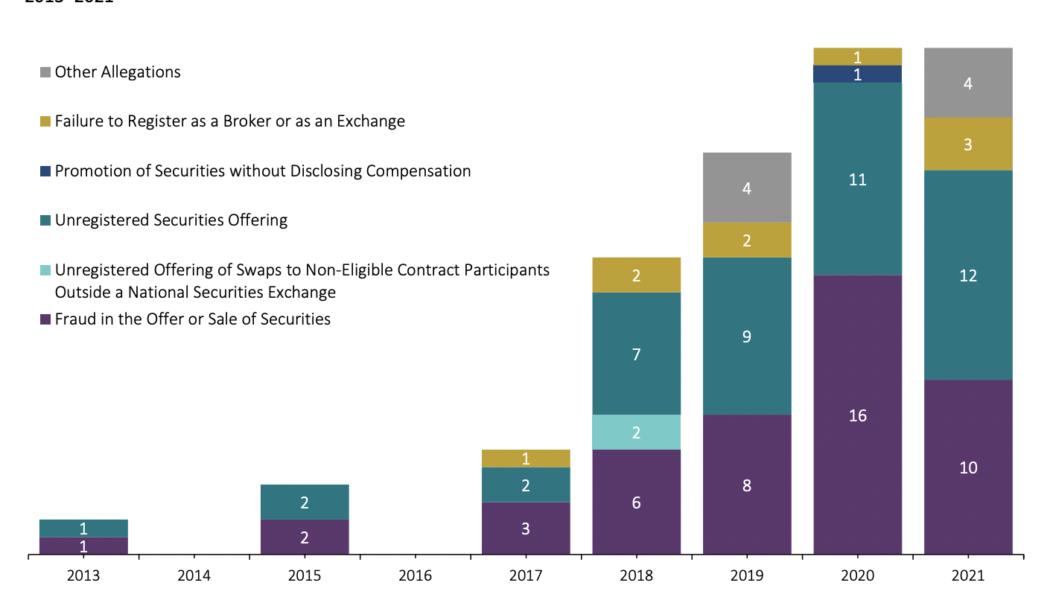

The SEC has issued $2.4B in crypto-related penalties since 2013

The Securities and Exchange Commission (SEC) has issued a total of approximately $2.35 billion in penalties against participants in the digital asset marketplace since 2013 according to a Jan 19 report by Cornerstone Research. The report, SEC Cryptocurrency Enforcement: 2021 Update, found that the SEC brought a total of 97 enforcement actions worth $2.35 billion between 2013 and the end of 2021. Fifty eight of the total of 97 were actions litigations and the remaining 39 were administrative proceedings. Of the total $2.35 billion raised by the litigations, $1.71 billion was charged in litigation and $640 million in administrative proceedings. Allegations in SEC Cryptocurrency Litigations. Source: Cornerstone Research. The majority of those charged were “firm respondents only,” racking up $...

The SEC has issued $2.4B in crypto-related penalties since 2013

The Securities and Exchange Commission (SEC) has issued a total of approximately $2.35 billion in penalties against participants in the digital asset marketplace since 2013 according to a Jan 19 report by Cornerstone Research. The report, SEC Cryptocurrency Enforcement: 2021 Update, found that the SEC brought a total of 97 enforcement actions worth $2.35 billion between 2013 and the end of 2021. Fifty eight of the total of 97 were actions litigations and the remaining 39 were administrative proceedings. Of the total $2.35 billion raised by the litigations, $1.71 billion was charged in litigation and $640 million in administrative proceedings. Allegations in SEC Cryptocurrency Litigations. Source: Cornerstone Research. The majority of those charged were “firm respondents only,” racking up $...

Tom Brady’s NFT platform Autograph raises $170M to scale operations

The nonfungible token (NFT) marketplace Autograph co-founded by Super Bowl champion Tom Brady has announced it closed on a $170 million funding round. In a Wednesday announcement, Autograph said Andreessen Horowitz, or a16z, and VC firm Kleiner Perkin co-led the $170-million Series B round with contributions from crypto investor Katie Haun’s firm, Nicole Quinn of Lightspeed Venture Partners, and San Francisco-based venture firm 01A. The company said it planned to use the funds to scale its NFT technology and hinted at a series of partnerships aimed at expanding its user base. In addition to the funding round, Haun, a16z general partner Arianna Simpson, and Kleiner Perkins partner Ilya Fushman will join Autograph’s board of directors, with a16z general partner Chris Dixon joining the firm’s...

Canadian restaurant chain reports earning 300% gains on BTC investment to weather pandemic

More than a year after a Canada-based Middle Eastern restaurant chain converted its fiat cash reserves into Bitcoin, the owner reported the move helped save the business during the pandemic. According to a Tuesday report from Canadian news outlet Toronto Star, when Tahini’s restaurant owners Aly and Omar Hamam and their cousin Ahmed decided to convert the company’s savings into Bitcoin (BTC) in August 2020 because it offered “a much better alternative to saving cash,” the price of the crypto asset was roughly $12,000. Aly Hamam reported the business had benefited from the initial crypto investment. “We made the move to the corporate balance sheet on a Bitcoin-standard back in August of 2020, and since then, we’re up more than 300 percent on our initial investment,” said Hamam. “It’s really...

MXC’s 200% gain hints that LoRaWAN IOT mining projects could rally in 2022

Cryptocurrency mining has become a hot topic of conversation over the past couple of years due to its lucrative nature and the impact the industry has on the environment. The emergence of Web3 and the increased presence of Internet of Things (IoT) devices has led to a new class of low-cost mining protocols with low-power network technology. These include LPWAN or LoRaWAN which are designed to transmit low bit rate data over long distances. One such protocol that has been gaining traction in recent months is MXC, a Web3 infrastructure protocol designed to provide geolocation-based LPWAN coverage to IoT devices around the world Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.046 on Jan. 1, the price of MXC has seen a 200% rally to a new all-time...

BitMEX acquires a German bank in line with its Europe expansion plans

The agreement of purchase is subject to regulatory approval by Federal Financial Supervisory Authority (BaFin) BMX Operations AG, an affiliate firm created by BitMEX Group execs yesterday, revealed plans to acquire a 268-year-old German bank, Bankhaus von der Heydt. Though financial details were not disclosed, the purchase is to be finalised by the end of Q2 this year. BMX Operations, owned by BitMEX Group CEO Alexander Höptner and CFO Stephan Lutz, said it had signed a purchase agreement with the current owner of the bank, Dietrich von Boetticher. The acquisition of the bank is, however, tentative at present as it hasn’t been given the green light by Germany’s financial regulatory authority BaFin. “Through combining the regulated digital assets expertise of Bankhaus von ...

Metaplex Foundation closes $46 million raise to expand Solana NFT use cases

The firm specifically sought investors in the sports and entertainment industries to stick with the current NFT curve Metaplex Foundation, the creator of Solana’s NFT protocol Metaplex, has today said it completed a funding round in which it raised $46 million. The round was co-led by Jump Crypto and Multicoin Capital, with several other major brands, including Alameda research, Solana Ventures and Animoca Brands involved. Prominent public figures, including American rapper Snoop Dogg and several retired as well as active pro basketballers such as Michael Jordan, Allen Iverson, and Kevin Love took part. DJ production duo The Chainsmokers (via Mantis Venture Capital firm) and New York Knicks Executive Vice President also participated. In total, 90 investors pitched in the fundraising....

Hedera Governing Council to buy hashgraph IP, and open-source projects code

The Hedera Governing Council has officially voted to purchase the intellectual property rights to the hashgraph consensus algorithm from founding architect and inaugural member of the council, Swirlds Inc, for an undisclosed fee. A Wednesday announcement also details plans to transition their code to an open-source model this year under Apache 2.0 license, in addition to transferring core team members such as CEO Mance Harmon and chief scientist Leemon Baird from Hedera to Swirlds Inc. as the CEO and chief technology officer, respectively, and deploying community staking and node opportunities, among other updates. Hedera Hashgraph is an enterprise-grade distributed ledger technology designed to create decentralized applications in the Web3 sphere. It’s governing council is composed ...