crypto blog

Bitcoin miners’ resilience to geopolitics — A healthy sign for the network

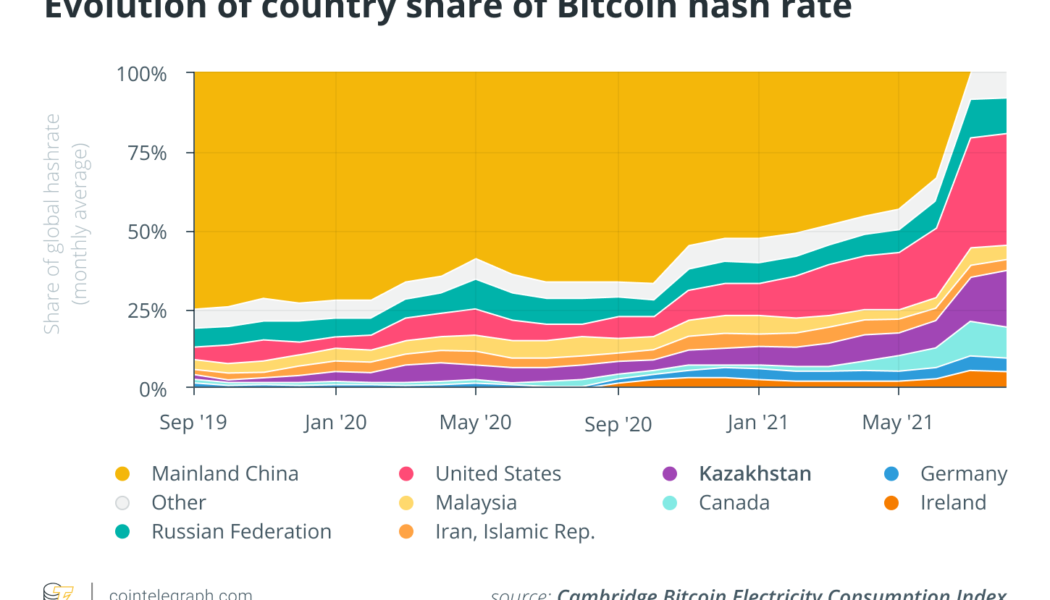

Considering that Bitcoin (BTC) is a blockchain network that uses a proof-of-work (PoW) consensus mechanism, miners are a highly significant part of the market dynamics of the network and the community itself. On Jan. 5, it was revealed that Kazakhstan shut down its internet services due to unprecedented political unrest sparked by rising fuel prices in the country. The protests in Kazakhstan began on Jan. 2 in the town of Zhanaozen to fight against the government doubling the price of liquefied petroleum gas (LPG), which is widely used as car fuel in the country. This change in pricing came as a result of the gradual transition to the use of electronic trading of LPG in order to abolish the existing state subsidies for fuel and allow the market to discover the price of the asset. However, ...

El Salvador’s Bitcoin wallet onboards 4M users with Netki partnership

El Salvador, the first country to make Bitcoin (BTC) a legal tender, has onboarded 4 million users for its government-backed BTC wallet Chivo in partnership with digital identity provider Netki, according to an announcement. Netki has announced that Chivo wallet onboarded over 4 million new users in 45 days using the company’s flagship Know Your Customer (KYC)/Anti-Money Laundering (AML) product, OnboardID. The platform also claimed that it had facilitated the compliant onboarding of 70% of the country’s previously unbanked population. El Salvador passed the Bitcoin bill in June of last year and officially made Bitcoin a legal tender in September. Nayib Bukele, the president of the small Central American nation, made it clear that the goal was to offer digital banking facilities...

Early birds: U.S. legislators invested in crypto and their digital asset politics

According to some estimates, as many as 20% of Americans were invested in cryptocurrencies as of August 2021. While the exact number can vary significantly from one poll to another, it is clear that cryptocurrencies are no longer just a niche passion project for tech enthusiasts or a tool for financial speculation. Rather, digital assets have become a widespread investment vehicle with the prospect of becoming mainstream. Optimistic as that is, this level of mass adoption still does not enjoy a commensurate political representation, with senior United States politicians largely lagging behind the curve of crypto adoption. This makes the very narrow group of congresspeople who are also hodlers particularly interesting. As a lawmaker, does owning crypto, or at least having some crypto ...

Where are the best APYs for stablecoins? | Find out now on The Market Report!

In this week’s episode of “The Market Report,” Cointelegraph’s resident experts showcase where to find some of the best stablecoin yields in decentralized finance, or DeFi. But first, market expert Marcel Pechman carefully examines the Bitcoin (BTC) and Ether (ETH) markets. Are the current market conditions bullish or bearish? What is the outlook for the next few months? Pechman is here to break it down. Next up, join Cointelegraph analysts Benton Yaun, Jordan Finneseth and Sam Bourgi in a debate over the best platforms for stablecoin yields. Will Bourgi’s pick, Convex Finance — with its sizable community, reputation and multiple ways to earn yield — come out on top, or will Yuan’s choice of Beefy.Finance — with its multichain yield optimizer — outshine the rest? Not to be outdone by Bourg...

Binance Auto-Burn program torches nearly $800 million worth of BNB tokens

6296 of the burned tokens were adjusted from the BNB Pioneer Burn Program Binance’s 18th quarterly burn of its native BNB token saw the highest dollar value in tokens cleared off the network. The leading exchange announced yesterday that it had cut from circulation a total of 1,684,387.11 BNB, valued at around $798,079,000 at the time of writing, according to market data. Comparatively, the 17th burn done in October cleared out 1,335,888 BNB valued at $639,462,868 at the time of the burn, and the 15th, which torched in excess of 3 million tokens, did not reach $600 million in dollar value cleared. Of the burnt tokens, 6296.305493 were tokens removed via the BNB Pioneer Burn Program. The program is a Binance initiative to cover customer losses in select cases where tokens are erroneou...

The 5 best yield farming tokens you can buy on January 18, 2022

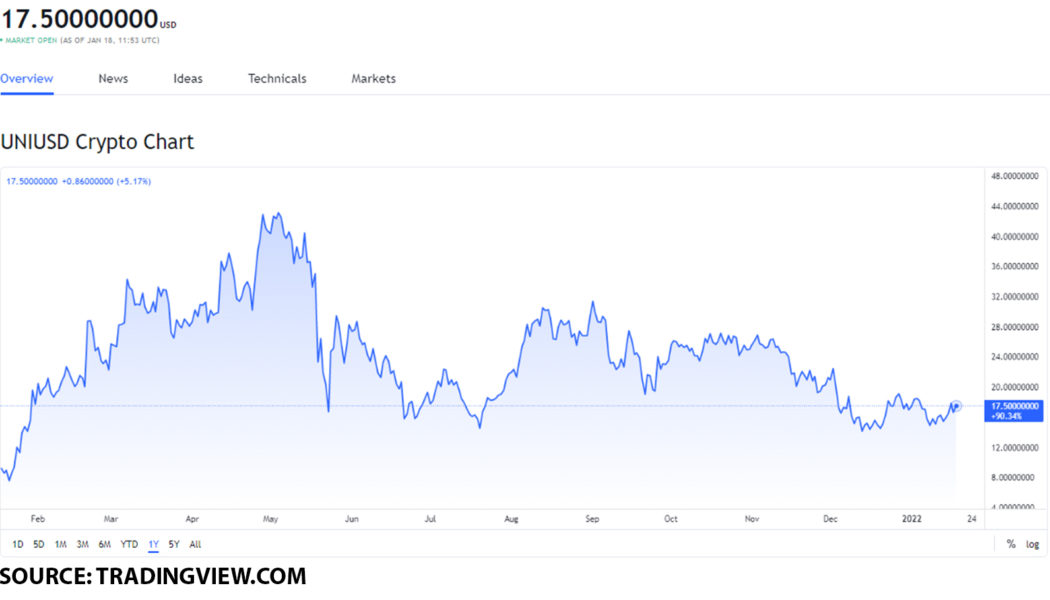

Yield farming tokens have increased in popularity due to their utility. These tokens can be utilized as a means of adding an additional revenue stream to your portfolio. UNI, CAKE, AAVE, COMP, and CRV are the best tokens you can buy. Yield farming is an investment strategy typically utilized within decentralized finance (DeFi). It involves lending or staking cryptocurrency tokens as a means of gaining rewards from the transaction fees or interest which is generated. Should you buy Uniswap (UNI)? On January 18, Uniswap (UNI) had a value of $17.5. Uniswap had its all-time high on May 3, 2021, with a value of $44.92. This means that the token was $27.42 higher in value. On December 2, the token had its highest point of that month at $22.86. The token had its lowest point of value on December ...

Binance partners with Gulf Energy to set up a digital asset exchange in Thailand

Last year, Binance received a criminal complaint from the Thailand SEC over unlicensed operation Thailand-based Gulf Energy Development Public Company has reached an agreement with crypto exchange Binance to explore avenues leading to the development of a digital asset trading platform and related business in the country. A letter sent to The Stock Exchange of Thailand on Monday revealed an MoU reached between the two parties that would see Binance help advance blockchain technology and scale the development of digital assets in the country. Gulf Energy is said to have banked its decision to complete the agreement with Binance in the hopes that the infrastructure around Thailand’s digital economy would proliferate in the coming years. The firm explained that with a combination ...

FTX secures naming rights sponsorship of Australian Blockchain Week

FTX chief executive Sam Bankman-Fried is among the guests expected to present during the flagship blockchain event Bahamian-based crypto derivatives exchange FTX will be the naming rights sponsor of this year’s edition of the Australian Blockchain Week. The festival is scheduled to run from March 21st to 25th and will cover 75 online, in-person, and hybrid events. The major topics that will be covered include taxation, the Metaverse revolution, sovereign digital currencies, venture capital, Web3 & its privacy implications, and regulations. More than 200 speakers are set to attend, including blockchain entrepreneur Sam Bankman-Fried. No specifics on the partnership terms have been revealed as of press time. However, in his LinkedIn post announcing the arrangement, Steve Vallas, th...

Much-anticipated EIP-1559 hardfork goes live on Polygon – What is next?

Onwards, validators will receive a priority fee instead of the total fee in transactions The core development team behind Polygon has, today, announced that it rolled out the EIP-1559 protocol on the Polygon mainnet. The milestone succeeds a fruitful upgrade on the Mumbai testnet. The Ethereum Improvement Protocol – 1559 went live on Polygon at block height 23850000 today at 2.47 am UTC. The upgrade, alternatively known as the London hardfork, will replace Polygon’s “first-price auction” fee approximation system. Following successful implementation, transactions on the Polygon network would be processed differently to find a fair price. A set base fee would be defined – the minimum amount needed to complete a transaction on the chain immediately. The set base fee would, h...

IreneDAO NFTs causing a stir on crypto Twitter

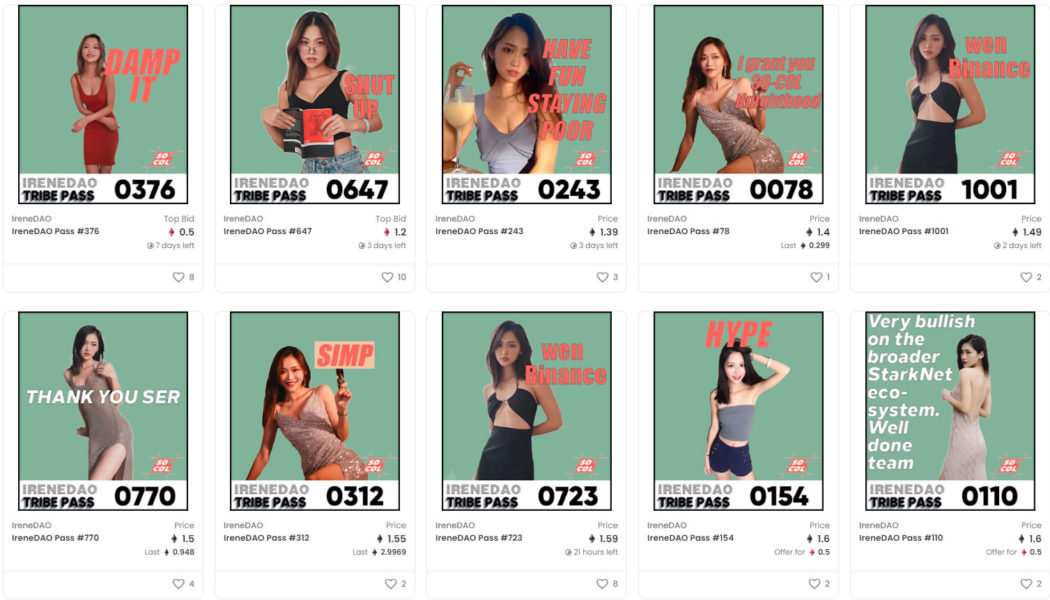

The story of the IreneDAO NFT craze started in October when 28-year-old Chinese crypto influencer and model Yuqing Irene Zhao came up with the idea for “So-Col” with her business partner, Benjamin Tang. So-Col is short for “Social Collectables,” Irene explained to Cointelegraph, and the platform aims to help content creators monetize their content and build communities with their fans. Branded as the “decentralized version of OnlyFans, Discord, Twitch, and Patreon,” the platform allows content creators and influencers to convert their social media content into non-fungible collectible items (NFTs.) It is powered by StarkWare’s layer-two solution StarkEx and leverages the decentralized ID protocol. Fast-forward to Tuesday last week, Tang and Irene launched a sticker pack for Irene’s Telegra...

Chinese police unearth multi-million-dollar DeFi rug pull

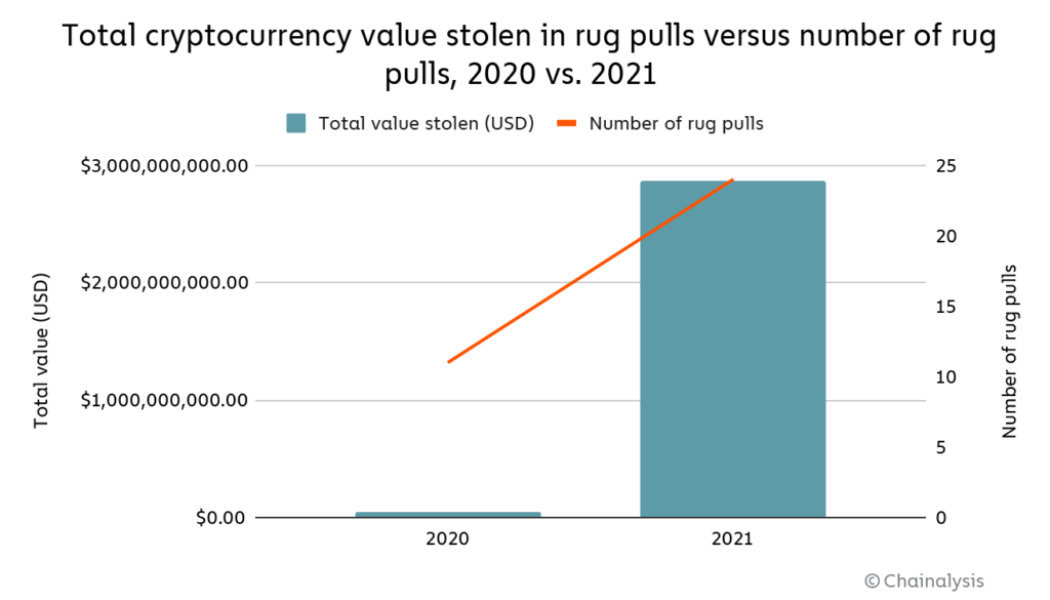

Beijing’s crackdown on crypto continued with the start of the new year, with the Chinese police freezing nearly 6 million yuan ($1 million) worth of crypto and arresting eight people involved with it. As per a report published in Nikkei Asia, the public security bureau of Chizhou unearthed a crypto rug pull scam that could be worth 50 million yuan ($7.8 million). The police began an investigation after an investor lost 590,000 yuan worth of crypto in June last year. The trail of the inquiry led to eight people living in different provinces. The police also seized luxury cars, villas and other expensive items from the accused that were allegedly purchased using the stolen money. The decentralized finance (DeFi) scam lured investors with promises of high returns by swapping liquid...

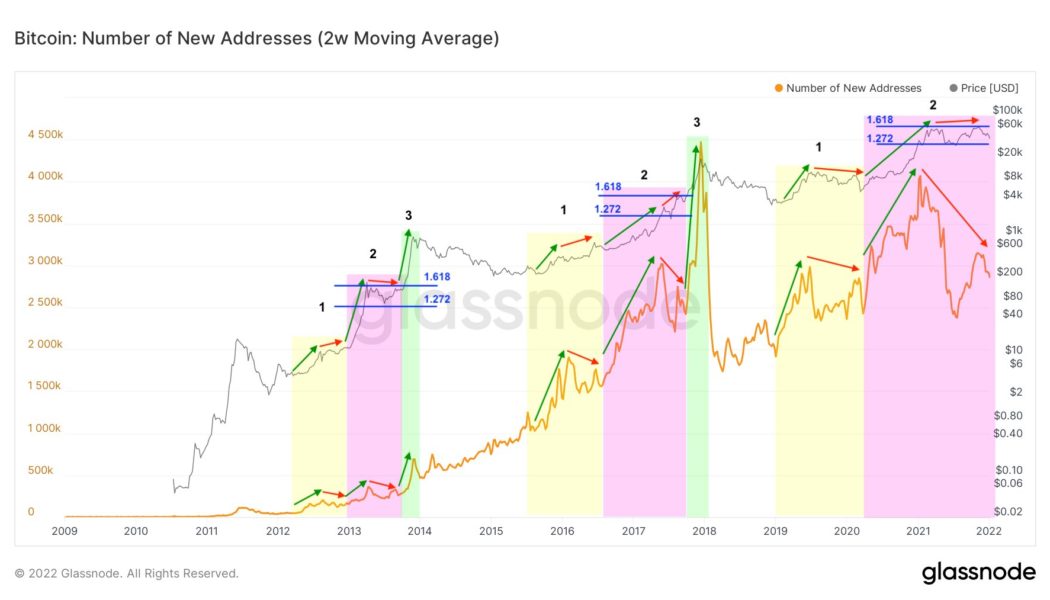

What bear market? Current BTC price dip still matches previous Bitcoin cycles, says analyst

Bitcoin (BTC) has “at least one more upward impulse to come” before reaching this halving cycle’s all-time high, new research maintains. In a series of tweets about the current state of BTC price action, popular analyst TechDev argued that contrary to many opinions, there is nothing unusual about BTC/USD in 2022. Bitcoin in 2021: Nothing to see here With a drawdown of 40% from November’s all-time highs of $69,000 still ongoing, sentiment has likewise taken a hit — “extreme fear” still characterizes both Bitcoin and altcoin markets. For TechDev, known for his optimistic takes on the Bitcoin outlook, there is nonetheless nothing to worry about. Analyzing new wallet addresses relative to price behavior, he showed that last year’s scenario — new address numbers making lower highs while price m...