crypto blog

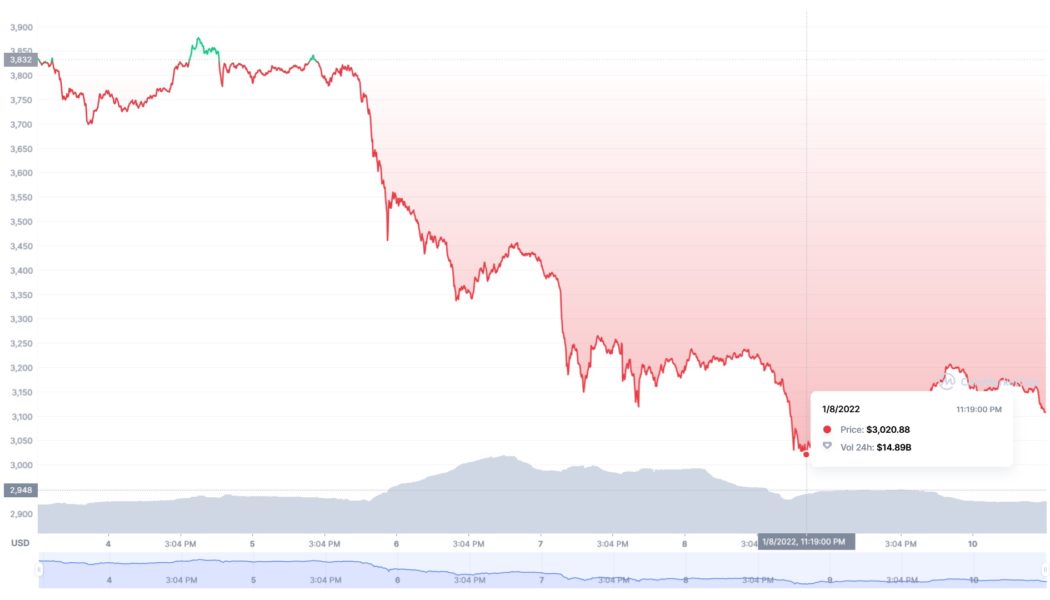

Crypto strategist Justin Bennett sees $3,000 as Ethereum’s turning point

Bennett revealed that he intends to buy ETH at around $3,000 as he expects the market to turn around that point Crypto analyst Justin Bennett has predicted what he expects to see from Ethereum this month, even as crypto markets dwindle and continue on a downward trend. Last Friday, Bennett outlined in a video that Ethereum must recover towards a crucial level over the next few weeks, which he defined as the region around $4,000. The crypto strategist noted that he sees this as a necessity for Ether to have a chance at restoring a major bullish run. “As long as ETH is below $4,000, you have to be a little bit careful. If we do see Ethereum over the coming weeks and months reclaim this area up here at $4,000 on a weekly and monthly closing basis, then yes, I do think we’re going ...

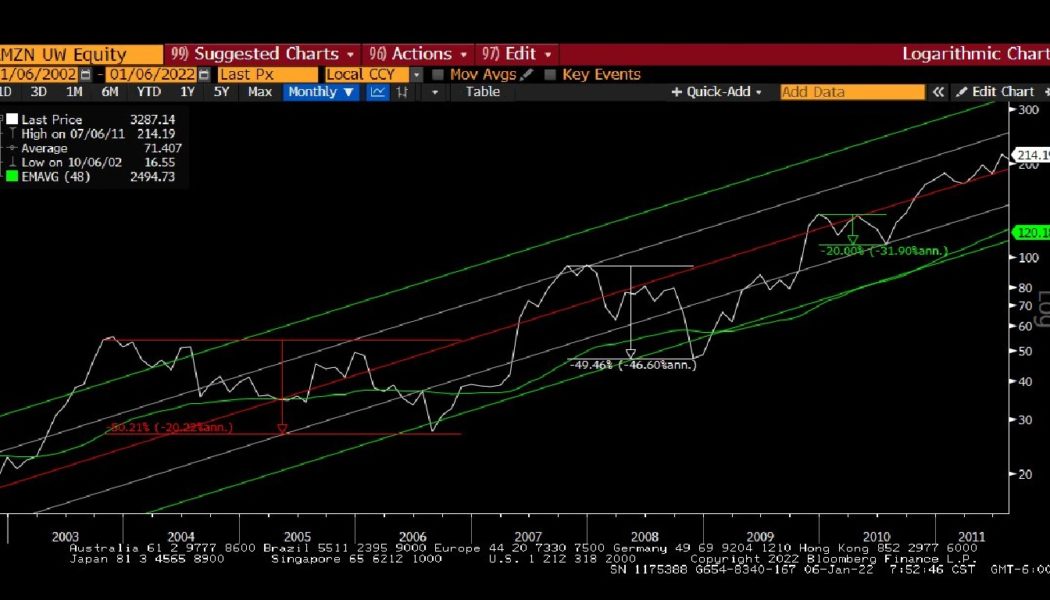

Raoul Pal: Bitcoin is charting a path similar to Amazon’s stock

Raoul Pal also suggested that Bitcoin is grossly undervalued and should ideally be around $100,000 Former hedge fund manager Raoul Pal provided an interesting observation in the relation between the historical price action of Amazon and that of Bitcoin since 2013 on Saturday. The Real Vision co-founder and chief executive cited Metcalfe’s Law which positions that the value of a network increases exponentially as the number of users on the network grows. The investment strategist first reviewed Bitcoin’s current price relative to Metcalfe’s Law. He opined that the world’s leading digital asset is highly undervalued. An extrapolation based on the Global Macro Investor’s Metcalfe Model indicated that the crypto should be tied around the $100,000 price point...

Arbitrum network suffers minor outage due to hardware failure

The Ethereum layer-two network Arbitrum has suffered its second outage in less than five months following a hardware failure. Arbitrum is back online at the time of writing but the team did report some downtime during the late hours of Jan. 9. The timing of the tweets suggests that the network was down for around seven hours. At the time, the Offchain Labs platform reported that it was experiencing some issues with the sequencer which prevented transactions from being processed for the period. We are currently experiencing Sequencer downtime. Thank you for your patience as we work to restore it. All funds in the system are safe, and we will post updates here. — Arbitrum (@arbitrum) January 9, 2022 On Jan. 10, Arbitrum released a post mortem explaining what had occurred to cause the brief o...

‘Most bullish macro backdrop in 75 years’ — 5 things to watch in Bitcoin this week

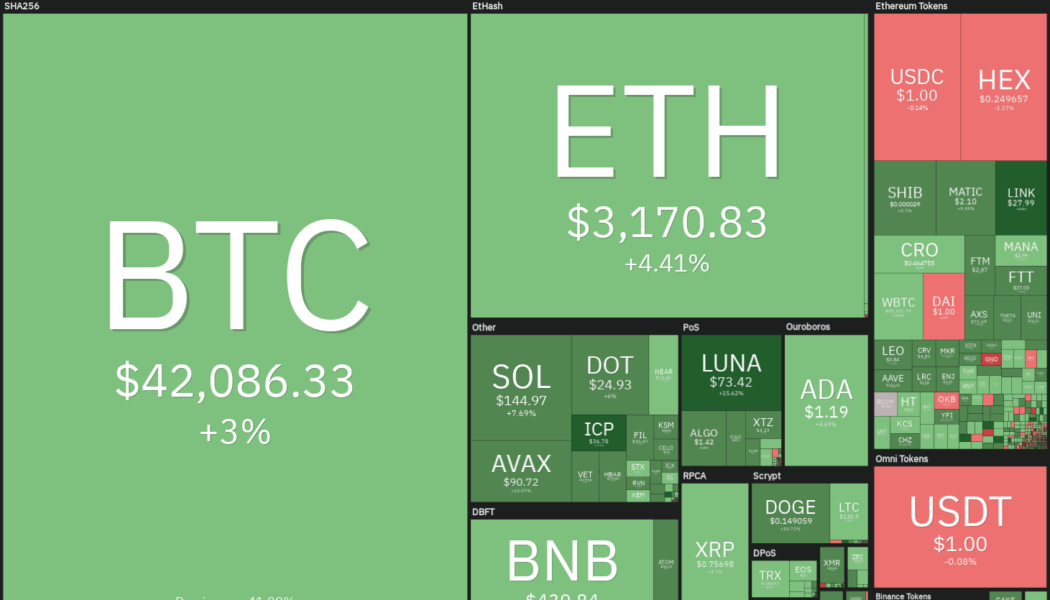

Bitcoin (BTC) starts a new week in a strange place — one which is eerily similar to where it was this time last year. After what various sources have described as an entire twelve months of “consolidation,” BTC/USD is around $42,000 — almost exactly where it was in week two of January 2021. The ups and downs in between have been significant, but essentially, Bitcoin remains in the midst of a now familiar range. The outlook varies depending on the perspective — some believe that new all-time highs are more than possible this year, while others are calling for many more consolidatory months. With crypto sentiment at some of its lowest levels in history, Cointelegraph takes a look at what could change the status quo on shorter timeframes in the coming days. Will $40,700 hold? Bitcoin saw a tr...

Top 5 cryptocurrencies to watch this week: BTC, LINK, ICP, LEO, ONE

Bitcoin (BTC) and most major altcoins remain under pressure as supports give way and bears sell at each rally attempt. This negative sentiment pulled the Crypto Fear & Greed Index to 10/100 on Jan. 8, one of its lowest readings ever. In comparison, 2021 had started on a bullish note with the reading hitting levels of 93/100, indicating “extreme greed.” This weak opening in the new year has not unnerved Bloomberg Intelligence analyst Mike McGlone who remains bullish. He said in a recent analysis that Bitcoin may rally to $100,000 and Ether (ETH) to $5,000 this year. Crypto market data daily view. Source: Coin360 However, some analysts argue that Bitcoin may struggle to maintain its bullish trend in an environment where interest rates are rising. Holger Zschaepitz questioned whether Bitc...

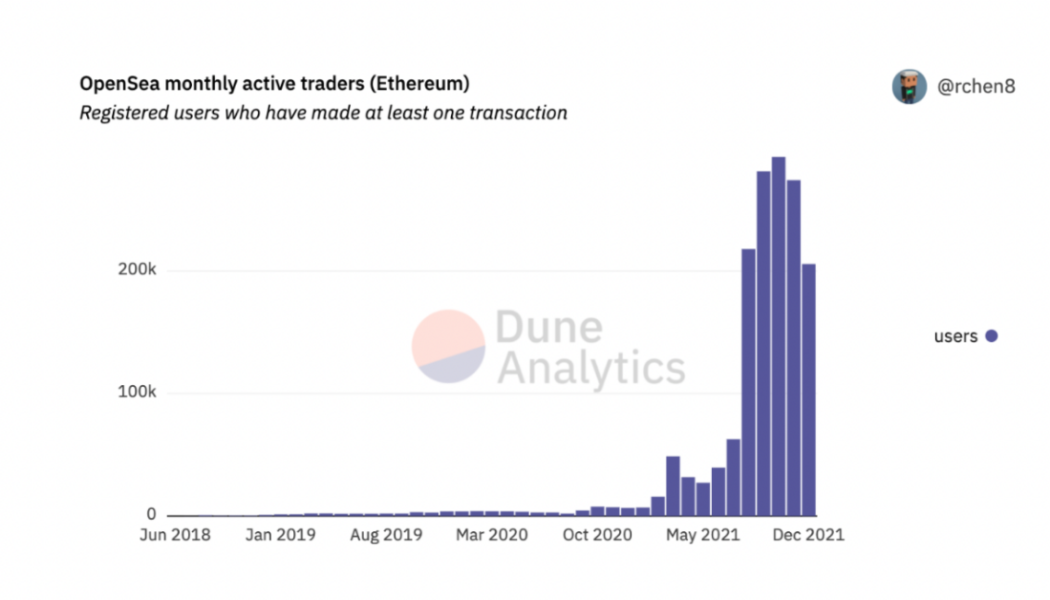

5 NFT marketplaces that could topple OpenSea in 2022

OpenSea has been the dominant decentralized platform for users looking to mint, buy, sell and trade nonfungible tokens (NFTs). Serving more as an NFT aggregator than a gallery, OpenSea locked in $3.25 billion in volume for December 2021 alone, according to data from Dune Analytics and from December 2020 to December 2021, the total volume increased by a whopping 90,968%. No stranger to contention and criticism, OpenSea has had its fair share of perils and pitfalls. Most notably, its former head of product, Nate Chastain, found using insider information to front-run and profit from selling the platform’s front page NFTs. Adding to the overall feeling of distrust, the community felt devalued after newly appointed chief financial officer (CFO) Brian Roberts hinted at going public. However, he ...

Bitcoin performs classic bounce at $40.7K as BTC price comes full circle from January 2021

Bitcoin (BTC) bounced off what is for some a key level on Jan. 9, closely mimicking events from September 2021. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Shorters will get rekt” at $40,700 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing course at around $40,700 to subsequently pass $42,000. The behavior, while uninspiring for some, firmly reminded others of Bitcoin price behavior at the end of September, when $40,700 acted as a springboard which ultimately produced $69,000 all-time highs seven weeks later. History and Context 40.7k $BTC https://t.co/LqlkxxJ0BF pic.twitter.com/neJlH6mnmN — Pentoshi DM’S ARE SCAMS (@Pentosh1) January 8, 2022 “Months have passed since September. And yet, BTC finds itself in the...

What should the crypto industry expect from regulators in 2022? Experts answer, Part 2

Michelle is the CEO of the Association for Digital Asset Markets, which works in partnership with financial firms and regulatory experts to devise a code of conduct for digital asset markets. “2021 was the year Washington woke up to the digital assets industry. The year started with the rushed FinCEN “Unhosted Wallets” proposal, which the industry was able to voice its concerns and delay. At the same time, pro-digital asset Senator Cynthia Lummis joined the Senate. As the Biden Administration got up to speed on digital assets, it seemed like all of Washington was studying the industry in some shape or form. Then came the Infrastructure Bill, which contained a rushed provision defining a broker for tax reporting purposes. This flawed language unleashed digital ...

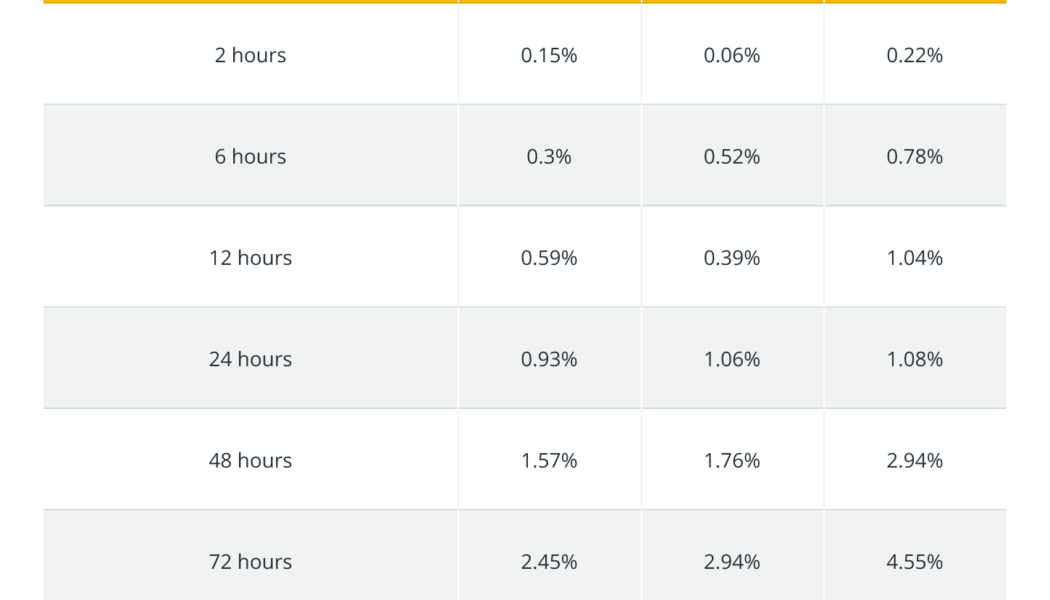

Even after the pullback, this crypto trading algo’s $100 bag is now worth $20,673

Exactly one year ago, on Jan. 9, 2021, Cointelegraph launched its subscription-based data intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at around $40,200, and today’s price of $41,800 marks a year-to-year increase of 4%. An automated testing strategy based on Markets Pro’s key indicator, the VORTECS™ Score, yielded a 20,573% return on investment over the same period. Here is what it means for retail traders like you and me. How can I get my 20,000% a year? The short answer is – you can’t. Nor can any other human. But it doesn’t mean that crypto investors cannot massively enhance their altcoin trading game by using the same principles that underlie this eye-popping ROI. The figure in the headline comes from live testing of various VORTECS™-based tra...

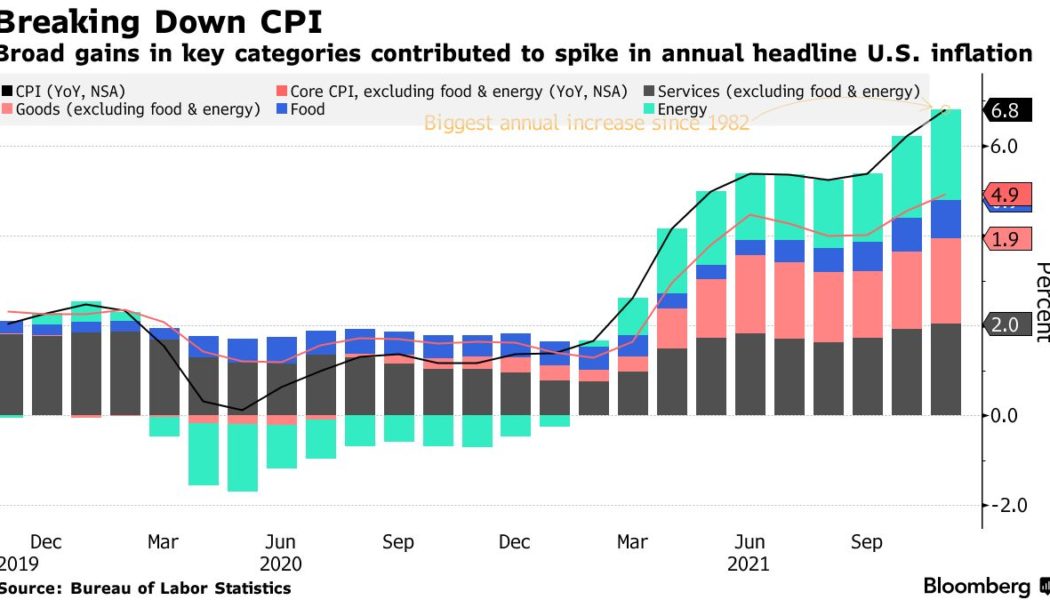

Bitcoin crash ahead? Expert warns higher inflation could whip BTC price to $30K

Bitcoin (BTC) may end up falling to as low as $30,000 if the U.S. inflation data to be released on Wednesday comes any higher than forecasted, warns Alex Krüger, founder of Aike Capital, a New York-based asset management firm. The market expects the widely-followed consumer price index (CPI) to rise 7.1% for the year through December and 0.4% month-over-month. This surge highlights why the U.S. Federal Reserve officials have been rooting for a faster normalization of their monetary policy than anticipated earlier. U.S. headline inflation. Source: Bureau of Labor Statistics, Bloomberg Further supporting their preparation is a normalizing labor market, including a rise in income and falling unemployment claims, according to data released on Jan. 7. “Crypto assets are at the furthest en...