crypto blog

Raoul Pal says ‘reasonable chance’ crypto market cap could 100X by 2030

Former Goldman Sachs hedge fund manager and Real Vision CEO Raoul Pal thinks that the crypto market cap could increase 100X by the end of this decade. At the time of writing, the total market cap of the global crypto sector stands at $2.2 trillion, and Pal told podcast Bankless Brasil “there’s a reasonable chance” this figure could grow to around $250 trillion if the crypto network adoption models continue on their current trajectory. Pal drew comparisons between the current benchmarks of other markets and asset classes such as equities, bonds and real estate, noting that they all have a market cap between “$250-$350 trillion.” “If I look at the total derivatives market, it’s $1 quadrillion. I think there’s a reasonable chance of this being a $250 trillion asset class, which is 100X from h...

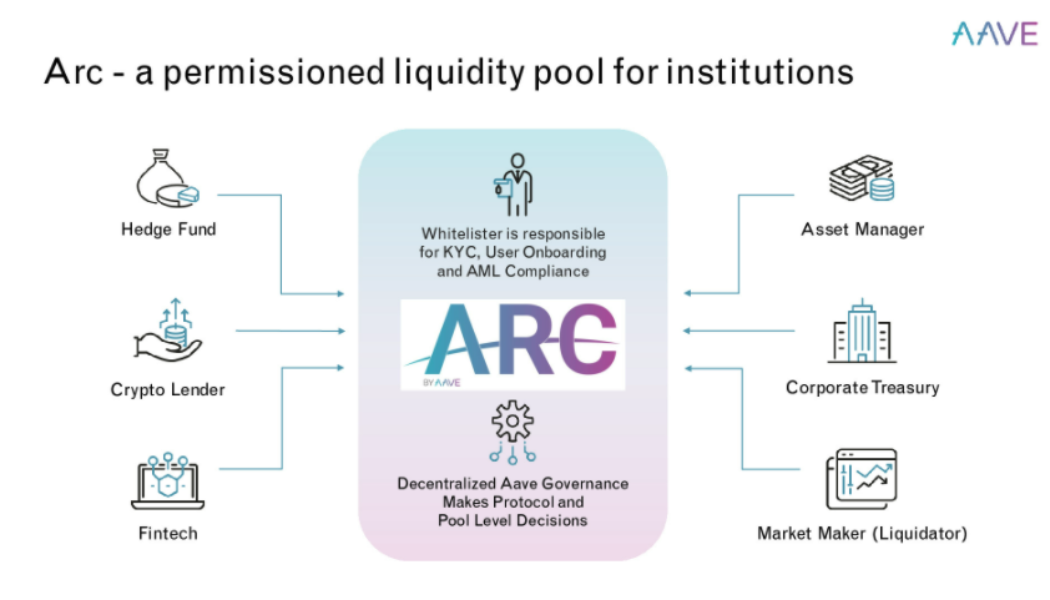

Aave launches its permissioned pool Aave Arc, with 30 institutions set to join

Decentralized lending platform Aave has launched its permissioned lending and liquidity service Aave Arc to help institutions participate in regulation-compliant decentralized finance. As opposed to its permissionless cross-chain counterparts on the platform, Aave Arc is a permissioned liquidity pool specifically designed for institutions to maintain regulatory compliance in the decentralized finance (DeFi) space. The first of 30 entities lined up for the whitelist for Aave Arc was Fireblocks, the institutional digital asset custodian. It explained in a Jan. 5 announcement the pool “enables whitelisted institutions to securely participate in DeFi as liquidity suppliers and borrowers.” Users of Aave Arc must perform due diligence procedures such as know your customer/ anti-money laundering ...

SEC delays decision on NYDIG Bitcoin ETF for another 60 days

The commission previously punted two other Bitcoin ETF products for an additional 45 days The US Securities and Exchange Commission on Tuesday revealed that it had pushed the deadline for reviewing the spot ETF proposal from technology and financial services firm NYDIG for another 60 days. The regulator explained that it saw it appropriate to delay the decision to either approve or reject the application until March 15th. The extended period, according to the commission, would provide enough time to review and make a determination on the ETF. “The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the iss...

Kazakh government resigns, shuts down internet amid protests, causing Bitcoin network hash rate to tumble 13.4%

On Wednesday, Kazakhstan, the second-largest country in the world when it comes to Bitcoin (BTC) mining hash rate, experienced unprecedented political unrest due to a sharp rise in fuel prices. As a result, the country’s presiding cabinet resigned, but not before the state-owned Kazakhtelecom shut down the nation’s internet, causing network activity to plunge to 2% of daily heights. The move dealt a severe blow to Bitcoin mining activity in the country. As per data compiled by YCharts.com, the Bitcoin network’s overall hash rate declined 13.4% in the hours after the shutdown from about 205,000 petahash per second (PH/s) to 177,330 PH/s. The country accounts for 18% of the Bitcoin network’s hash activity. Just days prior, the Kazakh government removed price cap...

Moneygram buys 4% stake in crypto ATM operator Coinme

Money transmission network MoneyGram now has a minority investment in crypto ATM operator Coinme following a Series A funding round. In a Wednesday announcement, MoneyGram said it had purchased a roughly 4% ownership stake in Coinme — likely more than $764,000, given its valuation of $19.1 million in June — as part of a strategic investment in the crypto company. The investment follows a May 2021 partnership between the two firms aimed at expanding access to crypto-fiat exchanges. “We continue to be bullish on the vast opportunities that exist in the ever-growing world of cryptocurrency and our ability to operate as a compliant bridge to connect digital assets to local fiat currency,” said MoneyGram CEO Alex Holmes. “Our investment in Coinme further strengthens our partnership and co...

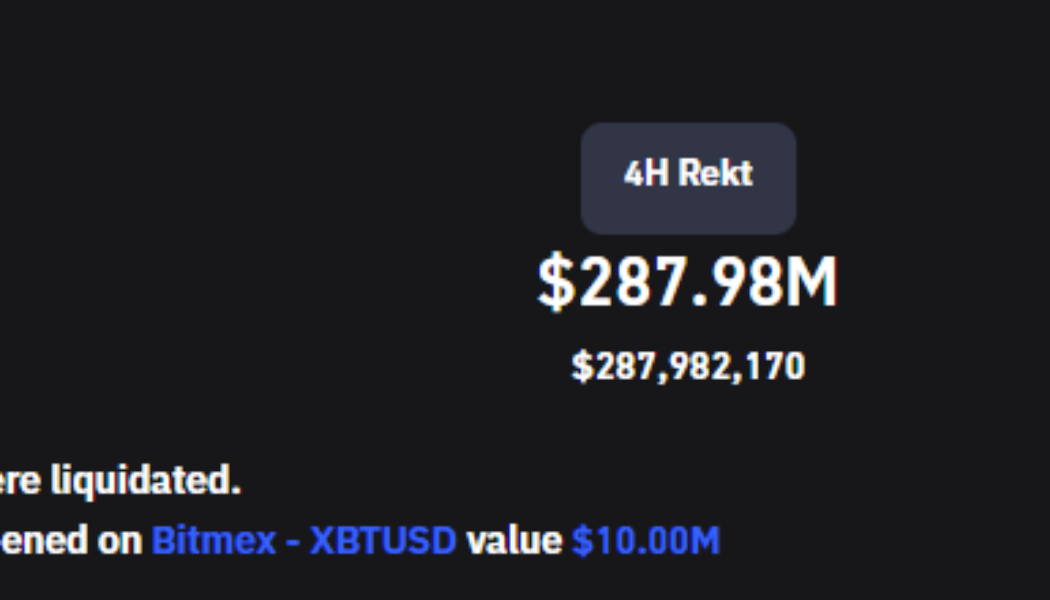

Bitcoin price drops to $43.7K after Fed minutes re-confirm plans to hike rates

Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022. As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour. Total liquidations. Source: Coinglass Data from Cointelegraph Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717. BTC/USDT 4-hour chart. Source: TradingView Based on the current situati...

3 reasons why Cosmos (ATOM) price is near a new all-time high

Blockchain network interoperability is shaping up to be one of the main themes for the cryptocurrency ecosystem in 2022. New users are continuing to onboard into the growing world of crypto while both new and established projects search for the chain that will best serve the needs of their protocol and community. One project that has 2022 off to a bullish start thanks to its focus on facilitating the communication between separate networks is Cosmos (ATOM). This project bills itself as “the internet of blockchains” and seeks to facilitate the development of an interconnected decentralized economy. Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $25.06 on Dec. 30, the price of ATOM has rallied 75% to hit a daily high at $43.98 on Jan. 4 as its 24-...

Bitcoin monthly RSI lowest since September 2020 in fresh ‘oversold’ signal

A key Bitcoin (BTC) metric has just reached its lowest levels since the months after the March 2020 market crash. As noted by popular analysts on Jan. 5, Bitcoin’s relative strength index (RSI) is printing a “hidden bullish divergence” on monthly timeframes — and if it plays out, they say, the result will be very pleasing for hodlers. RSI falls below summer 2021 floor Amid frustration at the lack of direction on BTC/USD, it is no secret that a host of on-chain indicators has long demanded higher price levels. The current $46,000 may slide further, but the classic RSI metric now shows just how comparatively “oversold” Bitcoin is at that price. “Bitcoin monthly RSI is currently lower than the May–July 2021 correction,” popular analyst Matthew Hyland ...

CertiK identifies Arbix Finance as a rug pull, warns users to steer clear

Binance Smart Chain-based yield farming protocol Arbix Finance was identified by blockchain security company CertiK as a rug pull. According to the firm’s incident analysis, there were several reasons why the project was flagged. The security firm states that “The ARBX contract has mint() with onlyOwner function, 10 million ARBX tokens were minted to 8 addresses,” and 4.5 million ARBX was minted to a single address. Following this, CertiK confirmed that “The 4.5M minted tokens were then dumped.” The firm also reported that the $10 million in funds deposited by users was directed to pools that are unverified, and eventually, a hacker drained all the assets from the pools. Using the platform’s Skytrace tool to analyze the risk of fraud, the firm determined...

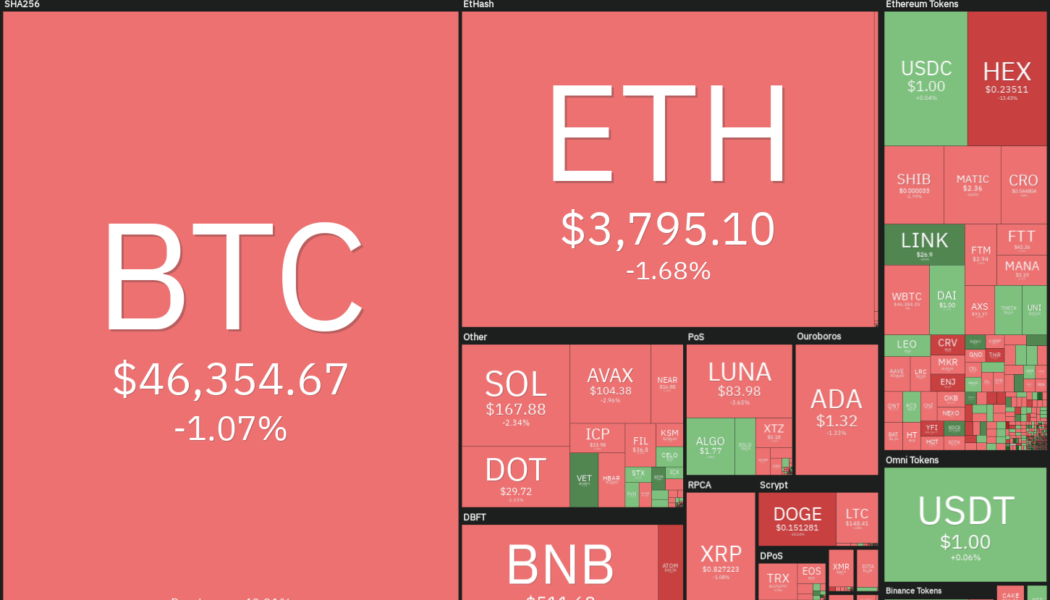

Price analysis 1/5: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

Bitcoin (BTC) and most major altcoins are stuck in a tight range with bulls buying near the support and bears selling at resistance levels. Usually, such tight ranges are followed by an expansion in volatility. Although a few analysts have not ruled out a quick drop to low $40,000s, most traders expect Bitcoin to rebound sharply and move up to $60,000. Goldman Sachs said in a note to investors that if Bitcoin continues to increase its market share over gold as a store of value and crosses the 50% mark, then it could rally to $100,000 over the next five years. Daily cryptocurrency market performance. Source: Coin360 On-chain analytics provider Glassnode said in its report on Monday that Bitcoin’s illiquid supply has increased to more than 76% of the total circulating supply. According to Gl...

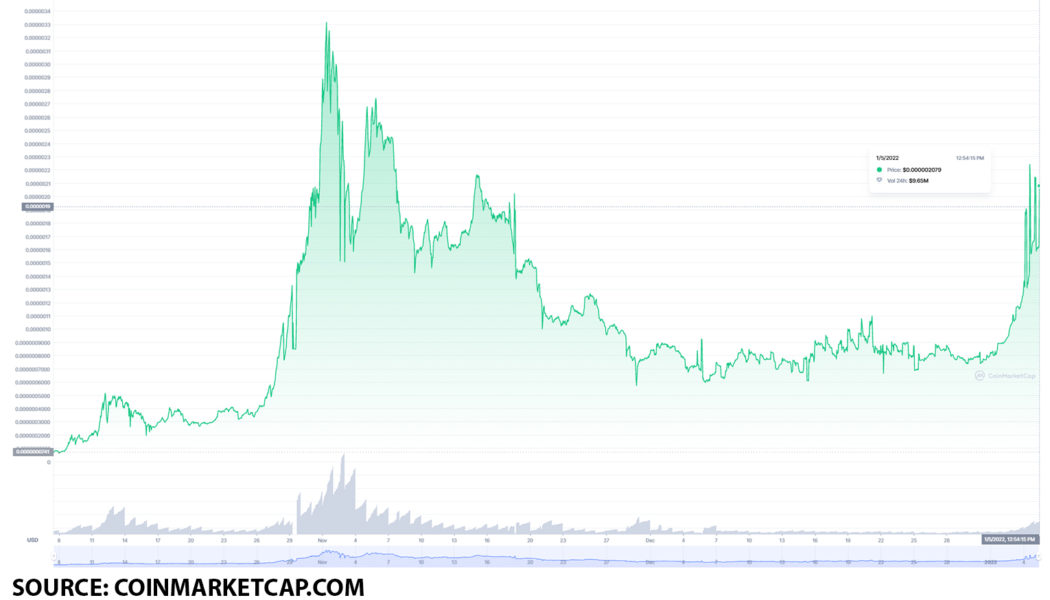

Top 3 tokens to buy on January 5: EverGrow (EGC), Dogecoin (DOGE) and Polkadot (DOT)

EverGrow (EGC), Dogecoin (DOGE), and Polkadot (DOT) are all at solid price points. Each token has potential for growth throughout January. Each token serves a separate role and, as such, can help diversify your portfolio. EverGrow (EGC) is a cryptocurrency that rewards its holders with BUSD. It is a deflationary token designed to become scarce over time, and all of the holders earn an 8% reward from every buy or sell transaction. Dogecoin (DOGE) started off as a meme-token; however, over time grew into one of the largest tokens in terms of market capitalization and is used as a means for transacting online, tipping creators, or simply buying merchandise on supported platforms. Polkadot (DOT) is software that incentivizes a global network of computers to operate a blockchain, where us...