crypto blog

Price analysis 1/3: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

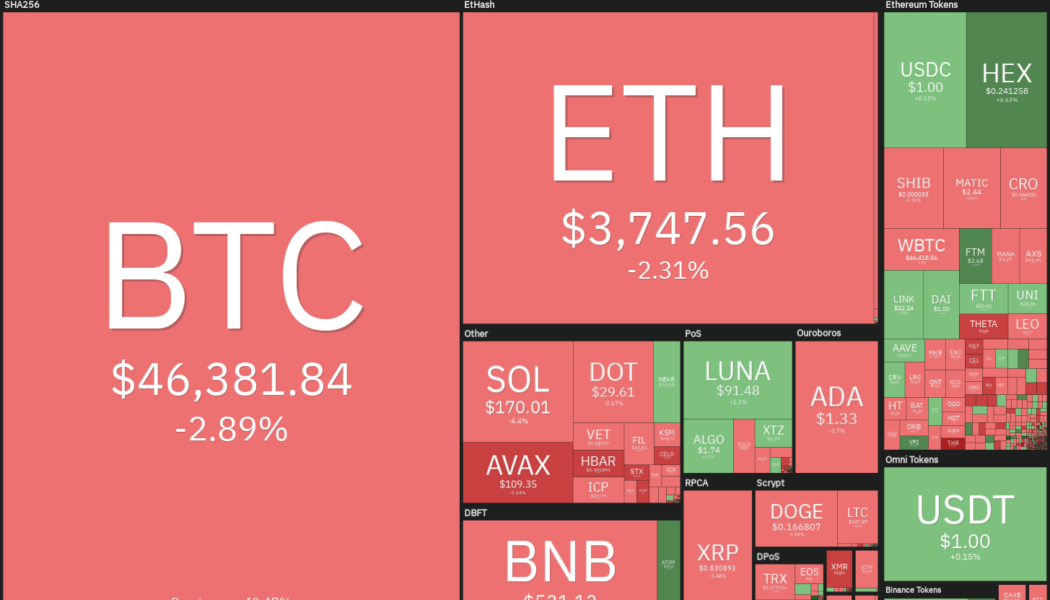

Bitcoin’s (BTC) price action has been uneventful in the first few days of the new year and it continues to languish below the psychological level at $50,000. The Crypto Fear and Greed Index is in the fear zone registering a value of 29/100. On-chain analytics resource Ecoinometrics said stages of extreme fear rarely remain for long, which means “there is a limited downside at 30 days.” Bitcoin continues to garner support from various quarters. Wharton School finance professor Jeremy Siegel said in an interview with CNBC that Bitcoin has replaced gold as an inflation hedge in the minds of Millennials. Daily cryptocurrency market performance. Source: Coin360 Savvy investors have been turning to Bitcoin to protect their portfolios against the possible debasement of fiat currencies. Hung...

Cardano became the most developed crypto project on GitHub in 2021 — Santiment

According to data compiled by CryptoRank and Santiment, Cardano was the most developed crypto project on GitHub in 2021, with over 140,000 events. Rounding out the top three were Kusama and Polkadot at second and third places, respectively, with roughly the same number of events over the year. Cardano beat Ethereum’s development activity by a wide margin, with the latter coming in fourth place. Santiment defines a GitHub event as either creating an issue, creating a pull request, commenting on an issue or pull request, or forking/starring/watching a code repository, among others. The Most Developed Cryptos on @Github in 2021 According to @Santimentfeed, @Cardano, has become the most developed project in the industry, followed by @Kusamanetwork, and @Polkadot. https://t.co/gjKPm...

Bitcoin traders expect $60K by month’s end, marking $45K as ‘accumulation’

The bearish pressures facing the cryptocurrency market at the end of 2021 have continued into the first week of 2022 after the price of Bitcoin (BTC) dropped below $47,000 on Jan. 1 and the asset still faces stiff headwinds on the shorter timeframe charts. Data from Cointelegraph Markets Pro and TradingView shows that, after climbing above $47,500 to start the new year, the price of BTC fell under pressure in the afternoon on Dec. 3. Currently, the price has dropped to $46,500 where bulls now look to mount a defense. BTC/USDT 4-hour chart. Source: TradingView Here’s a look at what several analysts in the market are saying about the path ahead for Bitcoin in 2022 as the global economic system continues to grapple with inflation. BTC needs to reclaim support at $48,670 Analy...

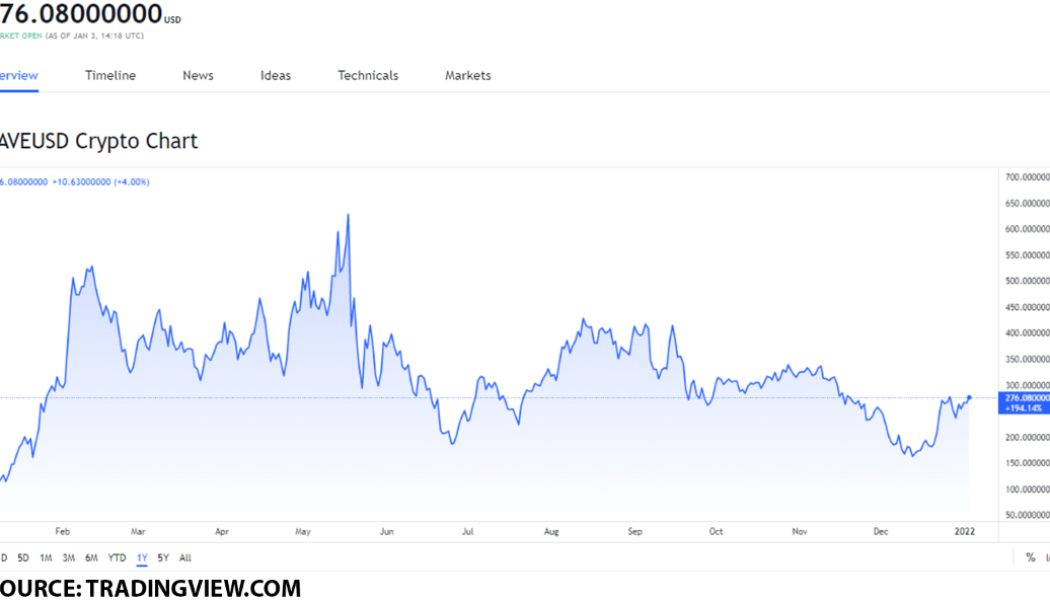

The top 3 Yield Farming tokens worth buying on January 3: AAVE, CAKE and CRV

AAVE’s trading volume increased by 77% in the last 24 hours. CAKE’s trading volume saw an increase of 47% in the last 24 hours. CRV’s value increased by 10%, and its market cap saw an increase of 15% in the last 24 hours. Aave is a decentralized finance protocol that allows users to lend as well as borrow crypto, and its AAVE token allows for yield farming. PancakeSwap is an automated market maker (AMM) as well as a decentralized finance (DeFi) application that lets users exchange tokens, provide liquidity, and engage in yield farming through which they can earn fees in return for doing so through the CAKE token. Curve is a decentralized exchange for stablecoins that leverages an automated market maker (AMM) to manage liquidity. Users of Curve tokens can engage in yield farming. Should you...

Ethereum co-founder Buterin labels Bitcoin Cash a failure

Buterin was also proud to note that he had foreseen the development of decentralised exchanges like UniSwap Hardly a day into the New Year, Ethereum co-founder Vitalik Buterin went on a “mini-tweetstorm” in which he reviewed comments he has made in the past on crypto-related matters, providing his present standing on the said subjects. One particular view that stood out from his series of tweets was his conclusion that Bitcoin Cash is now largely a failure as he sees it. Launched in August 2017, Bitcoin Cash was developed as a Bitcoin fork that offered larger transaction volumes per block and lowered fees owing to the larger blocks. In its initial stages, the token enjoyed success, and by mid-November in that year, it had surpassed Ethereum in market cap. At that point, Buterin...

El Salvador’s Nayib Bukele predicts Bitcoin to hit $100k this year

Bukele, a Bitcoin proponent, also said he expects to see two other countries take up Bitcoin as legal tender this year Nayib Bukele’s Bitcoin campaign soldiers into the New Year, with the El Salvador President giving his predictions on the coin yesterday. Though most of the predictions were seemingly quite bold and ambitious, Bukele has never been irresolute in his belief in Bitcoin. The El Salvador president said he expects Bitcoin to notch a price point of $100,000 this year and that two additional countries would adopt it as legal tender. His country, El Salvador, became the first and sole country in the world, so far, to assume the use of Bitcoin as an accepted official currency at the beginning of September last year. The move was plagued with criticism and technical hitches, bu...

Slim Shady buys Bored Ape ‘EminApe’ NFT for $460K

Marshall Mathers III, better known as Eminem, joined the “Bored Ape Yacht Club” (BAYC) by purchasing one of the nonfungible token (NFT) Bored Apes for $462,000 on OpenSea’s NFT marketplace. Eminem’s Bored Ape depicts a gold chain necklace and khaki army cap that he wears in real life and has been officially added to his portfolio by OpenSea. The NFT nicknamed the “EminApe” was created by GeeGazza in collaboration with Bored Ape. The transaction was completed by digital agency Six, which has previously worked with other celebrities in the NFT sector, including Wu-Tang Clan, Tycho and Galantis. Congrats! This aged well https://t.co/s82B6sZOAf — 0xFastly.eth (@0xFastly) December 31, 2021 This is not the first time that Eminem has invested in NFTs. The Missouri-born rapper currently owns sever...

Yearn.finance risks pullback after YFI price gains 100% in less than 3 weeks

Yearn.finance (YFI) looks poised for a price correction after rising five days in a row to approach $42,000. Notably, an absence of enough buying volume coupled with overbought risks is behind the bearish outlook. The YFI price rally so far YFI’s price surged by a little over 47% in five days to $41,970 as traders rotated capital out of “top-cap” cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) and looked for short-term opportunities in the altcoin market. #DeFi assets are showing some nice signs of growth to kick off 2022. $YFI, $UNI, and $AAVE are all ticking up nicely thus far with the first Monday of the year looking #bullish for several #altcoins. https://t.co/8ujolCvt5z pic.twitter.com/ASpf1dUbtn — Santiment (@santimentfeed) January 3, 2022 Yearn.finance was among the beneficia...

Bitcoin is new gold for millennials, Wharton finance professor says

Bitcoin (BTC), the world’s most-valued cryptocurrency, has replaced gold as an inflation hedge for young investors, according to Wharton’s finance professor. Gold’s performance was “disappointing” in 2021, Wharton School finance professor Jeremy Siegel said in a CNBC Squawk Box interview on Friday. On the other hand, BTC has been increasingly emerging as an inflation hedge among younger investors, Siegel argued: “Let’s face the fact, I think Bitcoin as an inflation hedge in the minds of many of the younger investors has replaced gold. Digital coins are the new gold for the Millennials. I think that the story of gold is a fact that the young generation is regarding Bitcoin as the substitute.” Siegel also reminded that older generations witnessed how gold had soared during the inflation...

More billionaires turning to crypto on fiat inflation fears

Previously anti-crypto investors are increasingly turning to Bitcoin and its brethren as a hedge against fiat currency inflation concerns. One example is Hungarian-born billionaire Thomas Peterffy who, in a Jan. 1 Bloomberg report, said that it would be prudent to have 2-3% of one’s portfolio in crypto assets just in case fiat “goes to hell”. He is reportedly worth $25 billion. Peterffy’s firm, Interactive Brokers Group Inc., announced that it would be offering crypto trading to its clients in mid-2020 following increased demand for the asset class. The company currently offers Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, but will be expanding that selection by another 5-10 coins this month. Peterffy, who holds an undisclosed amount of crypto himself, said that it is possible that digita...