crypto blog

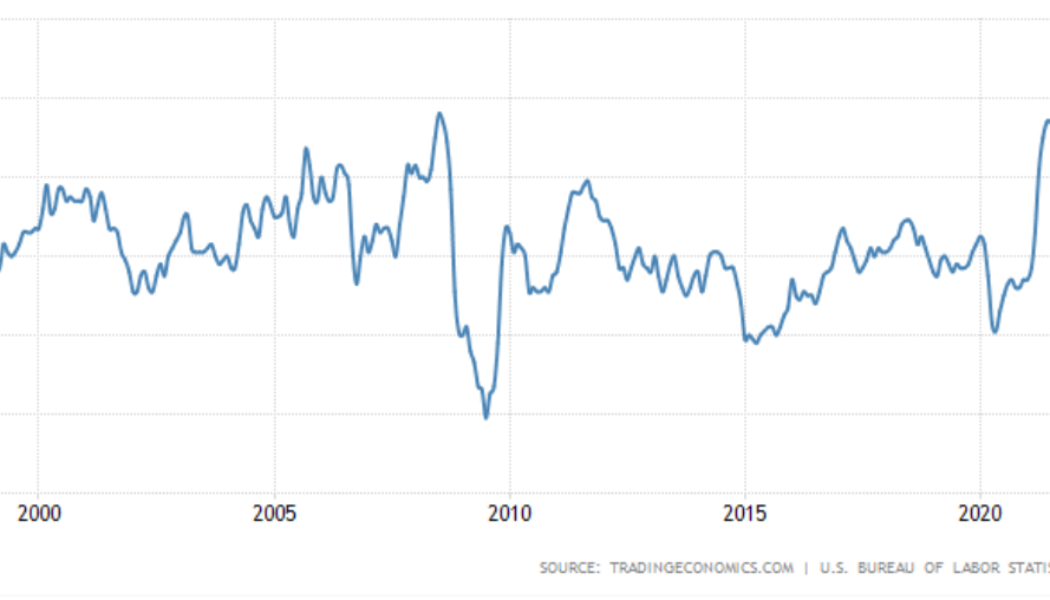

New year, same ‘extreme fear’ — 5 things to watch in Bitcoin this week

Bitcoin (BTC) begins its first full week of 2022 in familiar territory below $50,000. After ending December at $47,200 — far below the majority of bullish expectations — the largest cryptocurrency has a lot to live up to as signs of a halving cycle peak remain nowhere to be found. With Wall Street set to return after stocks conversely ended the year on a high, inflation rampant and interest rate hikes looming, 2022 could soon turn out to be an interesting market environment, analysts say. So far, however, all is calm — BTC/USD has produced no major surprises for weeks on end. Cointelegraph takes a look at what could change — or continue — the status quo in the coming days. Stocks could see 6 months of “up only” Look no further than the S&P 500 for an example of the state of...

Bitcoin holdings of public companies have surged in 2021

The quantity of Bitcoin held by private corporations has increased significantly during 2021, building on increases from the previous year. In a Jan. 3 tweet, on-chain analyst Willy Woo claimed that public companies holding “significant BTC have gained market share from spot ETFs as a way to access BTC exposure on public equity markets”. This has been more noticeable since MicroStrategy’s “Bitcoin for Corporations” conference on Feb. 3 and 4, 2021. The online seminar aimed to explain the legal considerations for firms seeking to integrate Bitcoin into their businesses and reserves. Michael Saylor’s MicroStrategy is a leading business intelligence firm and is known for being particularly bullish on BTC, owning almost $6 billion in crypto assets. On Dec 30, Saylor’s firm pu...

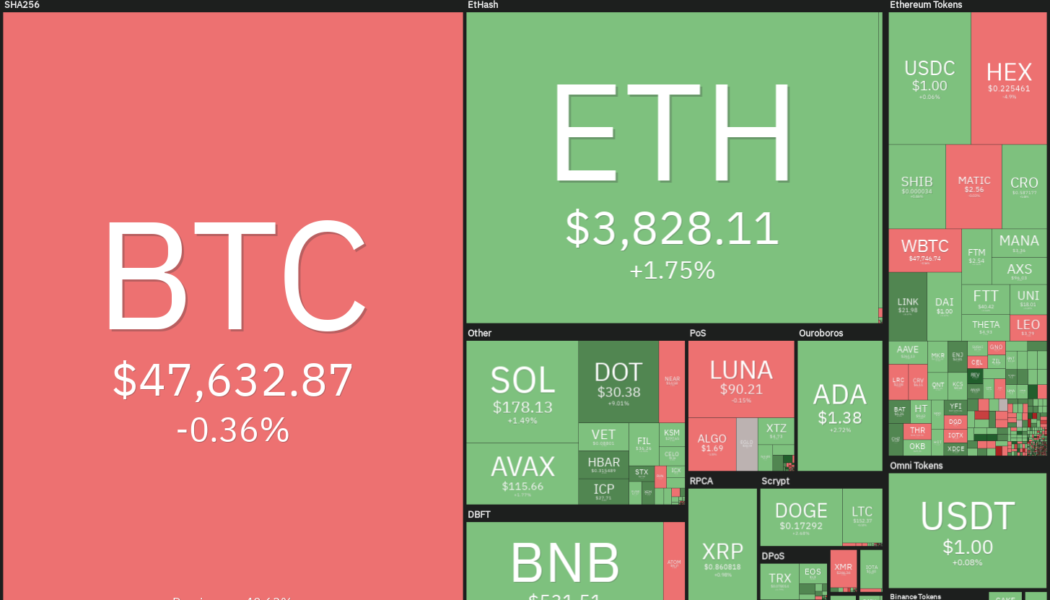

Top 5 cryptocurrencies to watch this week: BTC, LUNA, FTM, ATOM, ONE

Bitcoin (BTC) continues to languish below the psychological level at $50,000 in the first few days of the New Year, indicating a lack of aggressive buying by traders. Former BTCC CEO Bobby Lee said the exodus of the Chinese traders who had until Dec. 31 to exit Chinese exchanges may have kept prices lower into the year-end. However, President Nayib Bukele of El Salvador, the first country to adopt Bitcoin as legal tender, believes that Bitcoin could rally to $100,000 this year. President Bukele also said that two more countries will accept Bitcoin as legal tender in 2022. Crypto market data daily view. Source: Coin360 The increased crypto adoption by institutional investors in 2021 is another long-term positive. According to CoinShares, net inflows into crypto funds in 2021 were more than ...

Unlocking utility is key for fashion brands launching NFTs in 2022

Nonfungible tokens, or NFTs, have become one of the most discussed markets in the crypto space this year. A recent report from Cointelegraph Research found that NFT sales are aiming for a $17.7 billion record by the end of 2021. This may very well be the case, as a number of mainstream brands have begun launching NFTs. According to recent research from Bain & Company and the online luxury fashion platform Farfetch, digital interactions with consumers are becoming increasingly important for brands. The report specifically states that “digital interaction with peers is on the rise when choosing to purchase a product.” As such, nonfungible tokens tied directly to brands and their consumers are now more important than ever before. Understanding what utility means for fashion NFTs Whi...

President Bukele predicts Bitcoin $100k rally, further legal adoption and more

On Jan 2, El Salvador President Nayib Bukele shared five bullish predictions on Bitcoin’s (BTC) performance for the year 2022. Last year, El Salvador became the first country to adopt Bitcoin as legal tender under Bukele’s presidency as a countermeasure to the growing inflation in the country. Since legalization, the president acquired 1,370 BTC for the country’s reserve and reinvested its unrealized gains into new infrastructure projects including a hospital and a school. President Bukele predicted that two more countries will join El Salvador to adopt Bitcoin as a legal tender in 2022. In the same year, he expects a bull run that will take BTC price to a new all-time high of $100,000. 2022 predictions on #Bitcoin: •Will reach $100k•2 more countries will adopt it as legal tender•Wil...

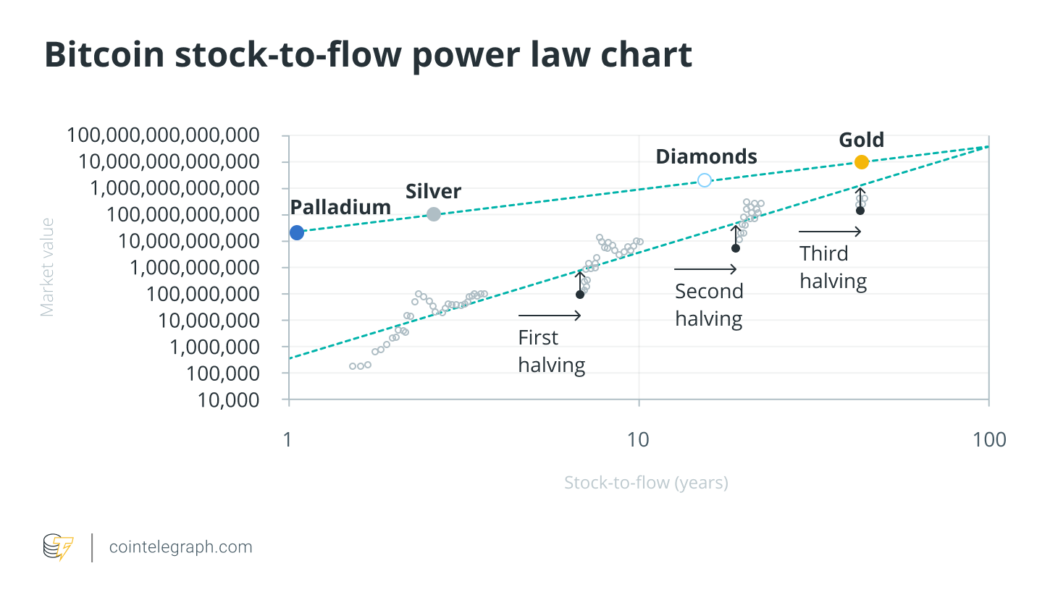

Three reasons why PlanB’s stock-to-flow model is not reliable

In the last couple of years, the stock-to-flow model proposed by PlanB has become very famous. A quantitative study published on the site planbtc.com shows the model and the prediction that Bitcoin (BTC) could reach the capitalization of $100 trillion. Obviously, the crypto industry, including myself, was fascinated by the logic of the model and even more so by the idea that it could reach and exceed $100,000 as early as 2021. In fact, the stock-to-flow model assumes that there is a relationship between the amount of a precious metal that is mined each year (flow) and the amount already mined previously (stock). For example, the gold that is mined each year is just under 2% of the gold in circulation (held by central banks and individuals). It takes over 50 years — at today’s rate of extra...

Fractal: 110K join Discord of Twitch founder’s new NFT gaming marketplace

Twitch co-founder Justin Kan launched a new blockchain gaming-focused nonfungible token (NFT) marketplace on Thursday dubbed Fractal. Fractal’s Discord group has since amassed more than 111,000 members despite only being announced two weeks ago. At the time of writing, it appears that the most significant sale on the platform so far was for a “Baby Scoot” NFT that went for 4 Solana (SOL) worth roughly $680. The Solana-based marketplace enables users to buy, trade and hold NFTs used in blockchain games. In an announcement made on Thursday, the firm unveiled its first partnered blockchain games, including The Sandbox, Nyan Heroes, Caveworld and Genopets, to name a few. first of all: we are live https://t.co/y2yO4R7Ty2 — fractal ❄️ (@fractalwagmi) December 30, 2021 As part of th...

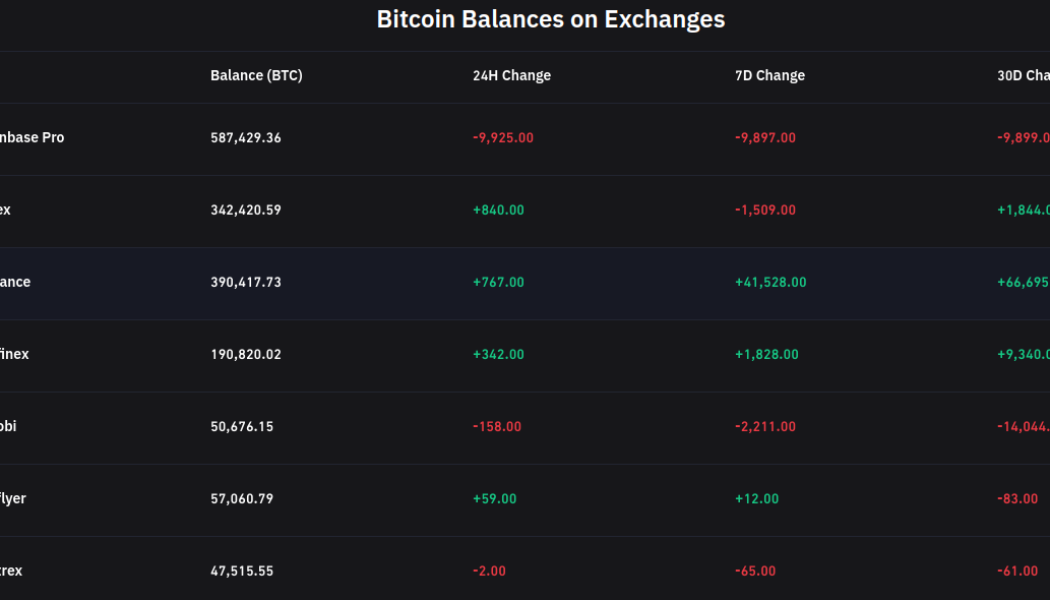

Bitcoin sees ‘non-stop’ end-of-year buying as 10K BTC leaves Coinbase in a single day

Almost 10,000 Bitcoin (BTC) left major United States-based exchange Coinbase on Dec. 30 in a sign that investor appetite is returning to the sphere. Data from on-chain monitoring resource Coinglass shows Coinbase’s professional trading arm, Coinbase Pro, shedding 9,925 BTC in the 24 hours to New Year’s Eve. Binance adds 66,000 BTC in December The buy-in, which runs in contrast to rising or flat balances on other major exchanges, marks a conspicuous short-term trend shift. The latter half of December has been characterized by platforms such as Binance and OKEx seeing increased inflows of BTC — something commentators feared could be a forewarning of a sell-off. While such a mass sale of BTC has not yet occurred, not everyone believes that it will stay that way. At the same time, the ex...

Will US regulators shake stablecoins into high-tech banks?

Regulators around the world have been thinking seriously about the risks associated with stablecoins since 2019 but recently, concerns have intensified, particularly in the United States. In November, the United States’ President’s Working Group on Financial Markets, or PWG, issued a key report, raising questions about possible “stablecoin runs” as well as “payment system risk.” The U.S Senate followed up in December with hearings on stablecoin risks. It raises questions: Is stablecoin regulation coming to the U.S. in 2022? If so, will it be “broad stroke” federal legislation or more piecemeal Treasury Department regulation? What impact might it have on non-bank stablecoin issuers and the crypto industry in general? Could it spur a sort of convergence where stablecoin issuers become ...

Ethereum white paper predicted DeFi but missed NFTs: Vitalik Buterin

Rounding up the last decade, Ethereum co-founder Vitalik Buterin revisited his predictions made over the years, showcasing a knack for being right about abstract ideas than on-production software development issues. Buterin started the Twitter thread by addressing his article dated Jul. 23, 2013 in which he highlighted Bitcoin’s (BTC) key benefits — internationality and censorship resistance. Buterin foresaw Bitcoin’s potential in protecting the citizens’ buying power in countries such as Iran, Argentina, China and Africa. However, Buterin also noticed a rise in stablecoin adoption as he saw Argentinian businesses operating in Tether (USDT). He backed up his decade-old ideas around the negative impacts of Bitcoin regulation. My views today: sure, Bitcoin’s decentralizatio...