crypto blog

Sequoia China leads $25M equity round for DeFi wallet DeBank

DeBank, a cryptocurrency wallet focused on decentralized finance (DeFi) solutions, has closed new funding led by major venture capital firm Sequoia China. The firm announced Tuesday on Twitter that it raised $25 million, bringing DeBank’s total valuation to $200 million. Apart from Sequoia China, the funding round featured major crypto investment firms like Dragonfly, Hash Global and Youbi. The raise also included strategic funding from Coinbase Ventures, Crypto.com exchange, stablecoin provider Circle and hardware wallet maker Ledger. DeBank is a cryptocurrency wallet designed to track DeFi data, including decentralized applications or exchanges (DEX) and DeFi interest rates. It also lets users navigate and manage various DeFi assets and projects. The platform includes analytics for decen...

What were the biggest crypto outcomes of 2021? Experts Answer, Part 1

Hatu is the co-founder and chief strategy officer of DAO Maker, which creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors. “For a space as dynamic as blockchain, it is tough to pinpoint the reasons behind the industry evolving during the year. However, I feel the adoption of smart contracts has bolstered the growth of the industry and its relevance in the traditional setup. From optimizing supply chains to building a corporate structure around them, smart contracts are assisting everywhere. DAOs have emerged as a new wave of democratization of firms and associations. By transferring ownership to everyone involved and reducing centralized authority, DAOs and community governance are here to stay. In 2021, we could see m...

Bitcoin daily losses near $4K as S&P 500 hits 69th all-time high of 2021

Bitcoin (BTC) dropped nearly $4,000 on Dec. 28 as the market offered a sharp reminder that the bull run would need to wait. BTC analysts eyes $44,000 BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $48,335 on Bitstamp at Dec. 28’s Wall Street open. The pair had passed $52,000 the previous day, this marking a three-week high, before pressure from sellers halted progress. At the time of writing, Bitcoin circled $49,000 as traders took the opportunity to remind audiences of Bitcoin’s ongoing active range. “Humans get bullish at resistance. It’s a thing,” Scott Melker summarized. “Still ranging. Nothing has changed.” The $52,000 trip indeed failed ...

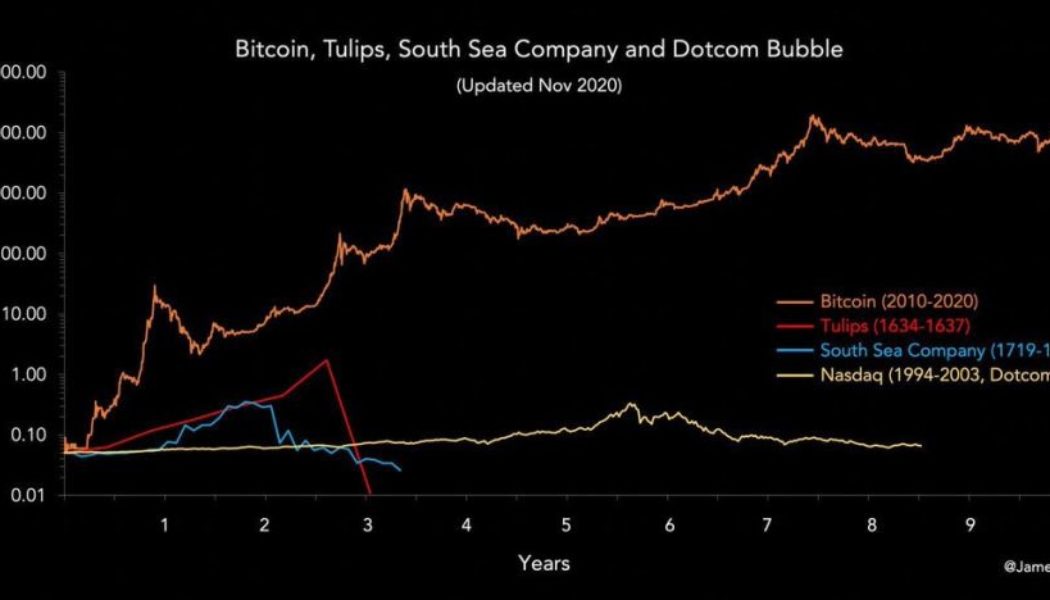

A new intro to Bitcoin: The 9 minute read that could change your life

By now you’ve probably heard of Bitcoin. You may have heard that it’s made some people rich. You may also have heard that it’s a new form of digital money, and that it’s the future of commerce; or that it’s a criminal enterprise, and that it’s bad for the planet. The messaging is confused and confusing — which is partly because no one person controls it. Just like Bitcoin, which belongs to… well, all of us. In this short essay I want to help the Bitcoin-curious understand a few facts about the world’s top cryptocurrency. It’s not technical, and it’s not hard to follow. It’s not comprehensive, either, which is why this article is peppered with links so you can find out more. I’m not advocating for Bitcoin as an investment, although I do think it’s worth owning a little. I’m just trying to s...

Crypto fraudster arrested in Thailand for duping and stealing $15M from victims

The suspect is said to have collaborated with others to steal from unsuspecting victims through a bogus cryptocurrency scheme This weekend, Thailand’s Crime Suppression Division apprehended Mana Jumuang for running a cryptocurrency scheme that saw victims lose their funds between 2018 and 2019. The 50-year old is said to have been the mastermind behind the scam operation. He illegally obtained more than 500 million Baht (the equivalent of almost $15 million) before deserting investors. According to a story in the Bangkok Post, Jumuang had co-conspirators with whom he ran the scheme. He is said to have lured both local and foreign victims by promising them that they would gain huge profits in the range of 400% after an investment period of 200 days. Jumuang presented himself as a crypto gur...

The best Ethereum ecosystem tokens worth buying on December 28: Polygon (MATIC), Chainlink (LINK) and Axie Infinity (AXS)

MATIC, LINK, and AXS are the go-to tokens for December 28. Chainlink’s trading volume increased by 17% in the last 24 hours. AXS saw an increase in trading volume by 36% in the last 24 hours. Polygon is a protocol as well as a framework used for building and connecting blockchain networks that are Ethereum-compatible. Chainlink is a decentralized blockchain oracle network that is built on and runs on top of Ethereum. Axie Infinity is an NFT-based online video game that uses Ethereum-based cryptocurrencies. Should you buy Polygon (MATIC)? On December 28, Polygon (MATIC) had a value of $2.641. To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high-value point as well as its performance last month. The all-time high value of the MAT...

Bitcoin rises above $51K as the dollar flexes muscles against the euro

Bitcoin (BTC) regained its bullish strength after reclaiming $50,000 last week and continued to hold the psychological level as support on Dec. 27. Meanwhile, its rival for the top safe-haven spot, the U.S. dollar, also bounced off a critical price floor, hinting that it would continue rallying through into 2022. Triangle breakout The U.S. dollar index (DXY), which measures the greenback’s strength against a basket of top foreign currencies, has been trending towards the apex of a “symmetrical triangle” pattern on its daily chart. In doing so, the index has been treating the structure’s lower trendline as its solid support level, thus hinting that its next breakout would resolve to the upside. DXY daily price chart featuring symmetrical triangle setup. Source: Tradi...

Crypto Twitter year in review: 10 influential tweets of 2021

Another year has come and gone in the cryptocurrency industry, leaving behind an ocean of developments, drama, price swings and innovation — all moving at a breakneck pace that even Barry Allen would have a hard time keeping up with. Similar to previous years, Twitter has yet again served as a hotbed of crypto industry discussion in 2021. Over the past 12 months, Bitcoin (BTC) rode a price rollercoaster, nonfungible tokens (NFTs) sold for millions of dollars and Dogecoin (DOGE) reached illogical price highs — and that’s just the tip of the iceberg. Twitter, of course, sat right in the middle of the action, with people and companies posting all sorts of industry-related content. Providing a glimpse into some of the action — a time capsule of sorts for the future, or maybe an update fo...

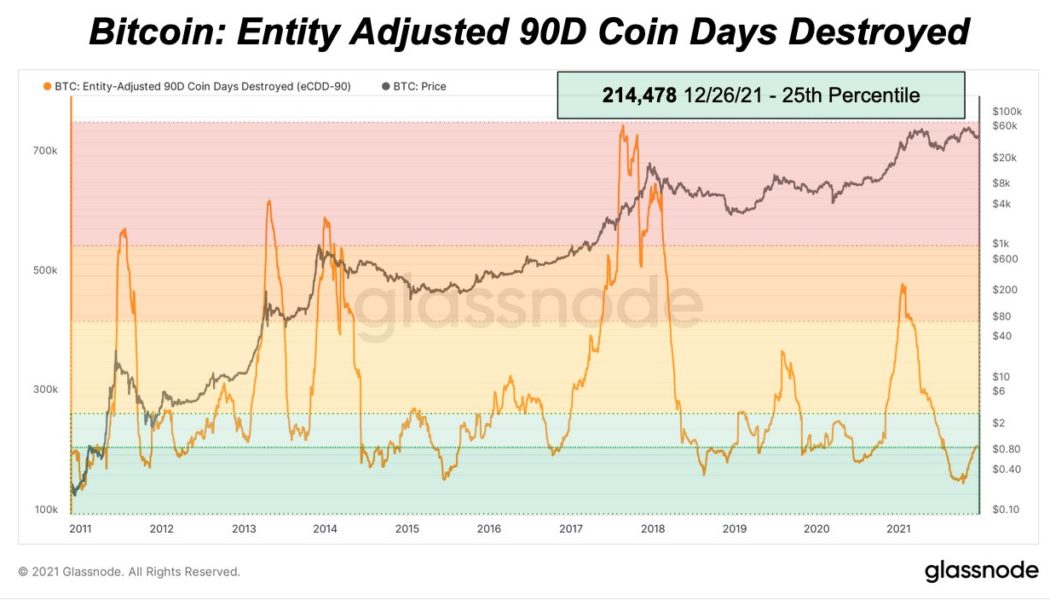

Veteran Bitcoin hodlers are still selling record low amounts of BTC despite 70% gains in 2021

Seasoned Bitcoin (BTC) hodlers have hardly spent any coins despite $69,000 all-time highs this year, data shows. According to the Coin Days Destroyed (CDD) metric from on-chain analytics firm Glassnode, the proportion of coins being spent by old hands remains near record lows. Strong hands knuckle down throughout 2021 In the latest sign of the conviction of those who invest in and hold Bitcoin over multiple years, CDD remains extremely calm. The indicator refers to how long each BTC has been dormant each time it moves. This provides an alternative to simple volume measurements to determine market trends. Older coins are thus more “important” than younger ones with a history of active movement. “Despite a rise over the last few months, the current value is still around historic lows,” Twitt...

Speed, scaling, regulation to play key role for crypto in 2022: FTX CEO

FTX founder and CEO Sam Bankman-Fried, also known as “SBF,” rounded off 2021 on an optimistic note. SBF waxed lyrical about the crypto market’s state in 2021 while revealing the roadmap for FTX in 2022 in a Twitter flood. In his view, there are three keystones to industry progress in 2022: regulation, scaling and transaction speeds. He proposes solutions to each puzzle piece, referencing his exchange’s involvement. On regulation, SBF states stablecoins could be better reported and audited. In line with FTX stablecoin policies, he said more transparency would solve “80% of the problems while allowing stablecoins to thrive onshore.” Meanwhile, better markets oversight and an anti-fraud-based regime for token issuances could address other regulatory gaps. Secondly, while crypto users number s...

Some Salvadorans claim funds are missing from their Chivo wallets

Some of the money from El Salvador’s state-issued Chivo wallets is reportedly missing, according to many Salvadorans posting on social media. In a Dec. 16 Twitter thread started by user “the commissioner,” at least 50 Salvadorans have reported December losses totaling more than $96,000, following the setup of the Bitcoin (BTC) wallets by the government. Some of these transactions were for as little as $61, but others said they were missing thousands or more. 2- $3,921 pic.twitter.com/fvP8aLHQyP — El Comisionado (@_elcomisionado_) December 18, 2021 “There is a security flow on the wallet where money and transactions disappeared,” said Luis Guardado in a direct appeal to President Nayib Bukele. “No tech support and only useless calls, where is my money.” Bukele said in October that 3 million...

Bitcoin can hit $333K ‘parabolically’ if this BTC price fractal plays out

Bitcoin (BTC) could target a massive $333,000 by May 2022 if the U.S. Federal Reserve provides a “perfect storm” of low rates, a new prediction argues. Updating an uncannily accurate price forecast on Dec. 27, filbfilb, co-founder of trading platform Decentrader, drew dizzying conclusions about BTC price action next year. Analyst: “You don’t have enough crypto” for 2022 bull run After acting almost to the letter throughout 2021, BTC/USD stands to make huge gains in the coming six months if conditions remain the same. The Fed is poised to make two interest rate hikes next year, and these are likely priced in, pundits say — but a surprise change of tact could have far-reaching consequences. For Filbfilb, analyzing Fibonacci sequences alongside historical price a...