crypto blog

Bitcoin’s boring price action allows XMR, TON, TWT and AXS to gather strength

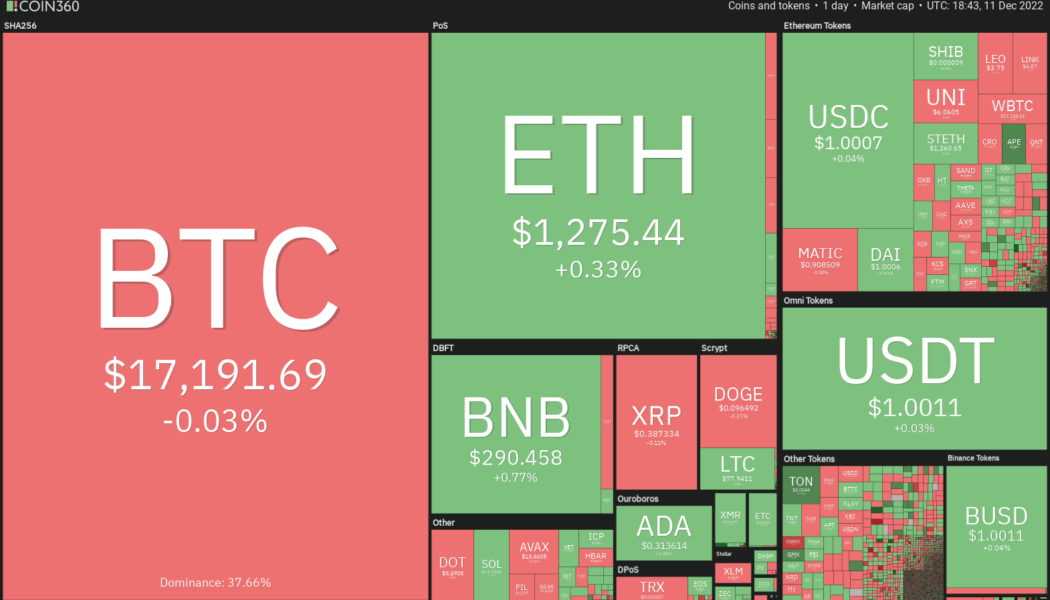

The relief rally in the United States equities markets took a breather this week as all major averages closed in the red. Traders seem to have booked profits before the busy economic calendar next week. The S&P 500 index dropped 3.37%, but a minor positive for the cryptocurrency markets is that Bitcoin (BTC) has not followed the equities markets lower. This suggests that crypto traders are not panicking and dumping their positions with every downtick in equities. Crypto market data daily view. Source: Coin360 The range-bound action in Bitcoin suggests that traders are avoiding large bets before the Federal Reserve’s rate hike decision on Dec. 14. However, that has not stopped the action in select altcoins, which are showing promise in the near term. Let’s look at the charts of Bitcoin ...

Florida best-prepared US state for widespread crypto adoption: Research

It’s not just pro-crypto regulations but also a supporting infrastructure that allows sustainable crypto adoption in any jurisdiction. Weighing in factors such as the number of Bitcoin (BTC) ATMs, blockchain companies and public interest in cryptocurrencies, Florida comes out as the most crypto-ready state in the United States. The U.S. hosts a network of 33,865 Bitcoin ATMs, representing 87.1% of total crypto ATM installations worldwide. In addition, the nation contributes to 37.8% of the global Bitcoin hash rate, which makes the US the most dominant player in crypto. However, a state-wise analysis reveals that not all 50 states are equally prepared for the inevitable mainstream crypto adoption. Research conducted by Invezz regarded Florida as the crypto capital of the US for its active e...

Abnormal token price movements on Binance not hack-related, confirms CZ

Crypto exchange Binance began investigating suspicious behavior on its platform after noticing abnormal price movements for certain trading pairs involving Sun Token (SUN), Ardor (ARDR), Osmosis (OSMO), FUNToken (FUN) and Golem (GLM) tokens. Nearly 40 minutes into the investigation, Binance CEO Changpeng ‘CZ’ Zhao revealed that the price movements “appears to be just market behavior.” On Dec. 11 at 3:10 am ET, Binance issued a notice about abnormal price movements for some trading pairs. The exchange began an investigation to narrow down suspicious accounts responsible for the issue. To investors’ relief, Binance’s investigation did not point to the possibility of compromised accounts or stolen API keys. Based on our investigations so far, this appears to be just market behavior. One guy d...

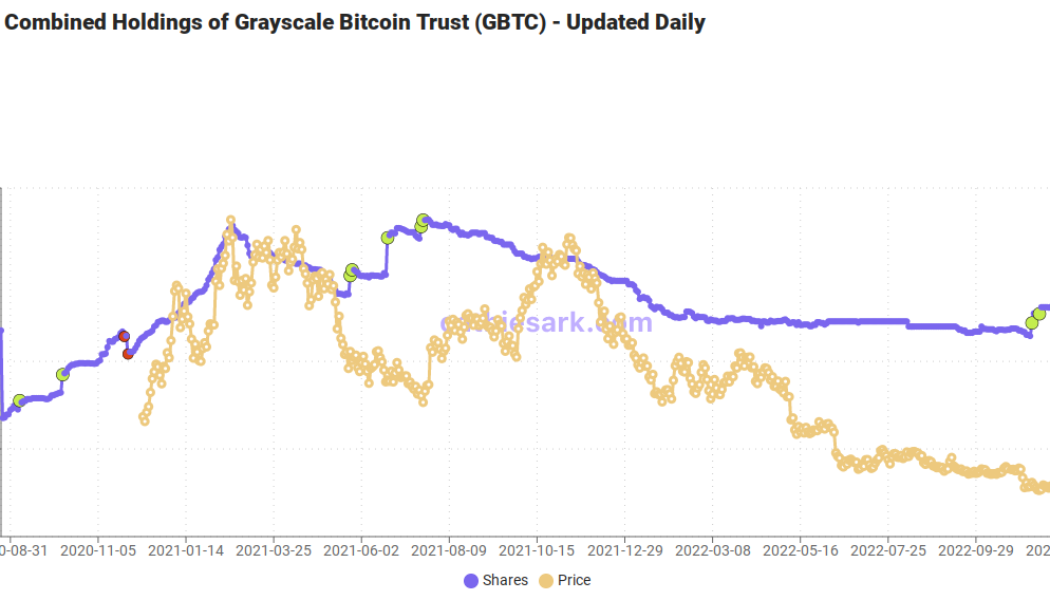

SBF ‘didn’t like’ decentralized Bitcoin — ARK Invest CEO Cathie Wood

Bitcoin (BTC) is too “decentralized and transparent” for former FTX CEO Sam Bankman-Fried, says Cathie Wood. In a tweet on Dec. 10, Wood, who is CEO of investment giant ARK Invest, delivered a fresh damning appraisal of the FTX saga. Wood: SBF “couldn’t control” Bitcoin As the legal ramifications of FTX and Bankman-Fried, also known as SBF, continue, Bitcoin loyalists are giving him little sympathy. ARK’s Wood is now firmly among them, not mincing her words as BTC price action continues to trade around 20% down over the month. “The Bitcoin blockchain didn’t skip a beat during the crisis caused by opaque centralized players,” she wrote. “No wonder Sam Bankman Fried didn’t like Bitcoin: it’s transparent and decentralized. He couldn’t control it.” Wood linked to ARK Invest’s...

Lodestar Finance exploited in flash loan attack

Arbitrum-based lending protocol Lodestar Finance was exploited in a flash loan attack on Dec. 10. According to Lodestar, the attacker manipulated the price of the plvGLP token before borrowing all platform liquidity using the inflated token. In a Twitter thread, Lodestar explained the attack flow. The attacker first manipulated the exchange rate of the plvGLP contract to 1.83 GLP per plvGLP, “an exploit that by itself would be unprofitable”, said the company. Then, the attacker supplied plvGLP collateral to Lodestar and borrowed all available liquidity, cashing out part of the funds “until the collateralization ratio mechanism prevented a full liquidation of the plvGLP.” Following the hack, “several plvGLP holders also took advantage of the opportunity and als...

Binance suspends trader’s account after complaints on Twitter

Crypto exchange Binance closed a trader account on Dec. 9 after a user complained about the exchange’s response for alleged funds theft. Binance CEO Changpeng “CZ” Zhao said the firm does not want to service “unreasonable” clients. A user by the name of CoinMamba on Twitter started complaining about the lost funds on Dec. 8, claiming that a leaked API key tied to crypto trading firm 3Commas was used “to make trades on low cap coins to push up the price to make profit.” The trader claims in a series of tweets that Binance was unable to provide him with appropriate support: Have talked to Binance support and so far they are refusing to do anything to help me with the situation, saying that is my fault. Not sure how the API was leaked, and whose fault is this. — CoinMamba (@coinmamba) Decembe...

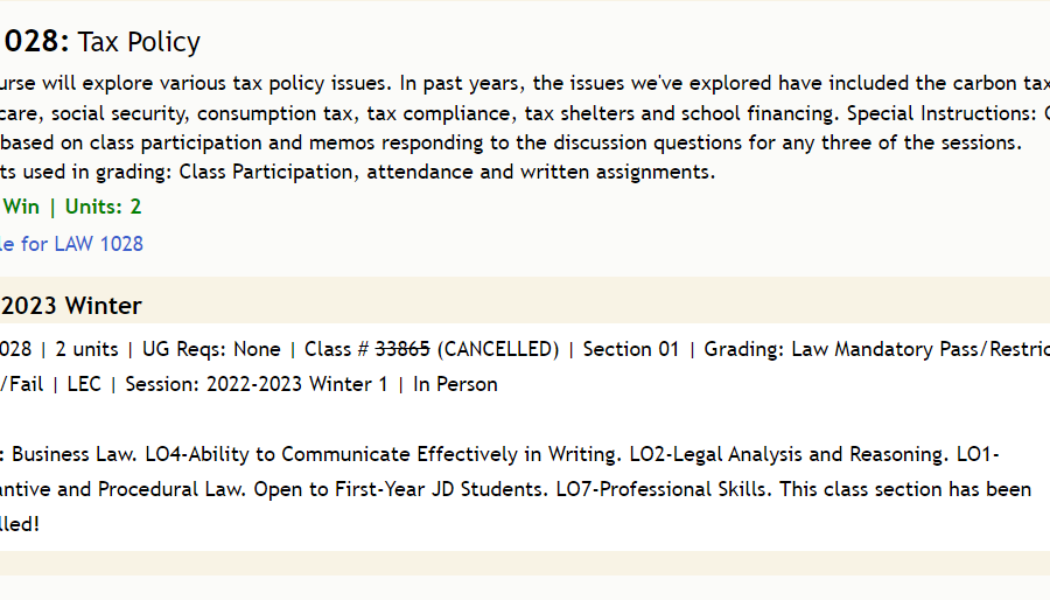

Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

The domino effect of FTX CEO Sam Bankman-Fried’s actions came full circle as his reputation began impacting the professional lives of his parents — Stanford Law professors Joseph Bankman and Barbara Fried. SBF’s father, Bankman, had to cancel his winter session course on tax policy, which according to The Standford Daily, was at a time when the family was accused of acquiring an FTX-owned $16.4 million vacation home before the crypto exchange’s collapse. Stanford Law professor Joseph Bankman’s tax policy course was canceled. Source: explorecourses.stanford.edu On the other hand, SBF’s mother, Fried, was surprisingly not even listed as an instructor for any of the courses. While this event coincides with FTX’s fallout, where Fried became a focal point of discussion owing to her ...

FTT investors’ claims to be investigated for securities laws violations

To help out the recently duped investors of FTX Tokens (FTT), shareholder rights litigation firm — Schall Law Firm — has taken up the task of investigating the investors’ claims against FTX for violations of the securities laws. It is estimated that over one million people have lost their life savings owing to the financial fraud committed by FTX CEO Sam Bankman-Fried. To help the investors legally recoup losses, the law firm plans to investigate FTX for issuing misleading statements or failing to disclose crucial information. In an official statement, Schall Law Firm highlighted how various media publications uncovered the cracks within FTX-Alameda operations, eventually leading to the crash of FTX’s in-house FTT tokens. The law firm advised all FTT investors to participate in the drive b...

5 tips for investing during a global recession

The economy is facing an outlook bleaker than a Welsh weather forecast, and few are rushing to buy risk assets. Here are a few tips for weathering unfavorable market conditions. Option #1: Save cash There’s no shame in sitting on the sidelines and saving cash or stablecoins. When bullish momentum returns, you will have plenty of dry powder to make big allocations. In the meantime, there are still lots of opportunities to earn yield across crypto markets as long as you trust the protocol you’re using. But isn’t this timing the market, which is impossible? Possibly. But this is more about spotting momentum and general market trends as opposed to more focused price targeting or calling reversals. Larger trends are easier to spot. However, if that’s a bit risky, there’s another option. Option ...

SBF tried to destabilize crypto market to save FTX: Report

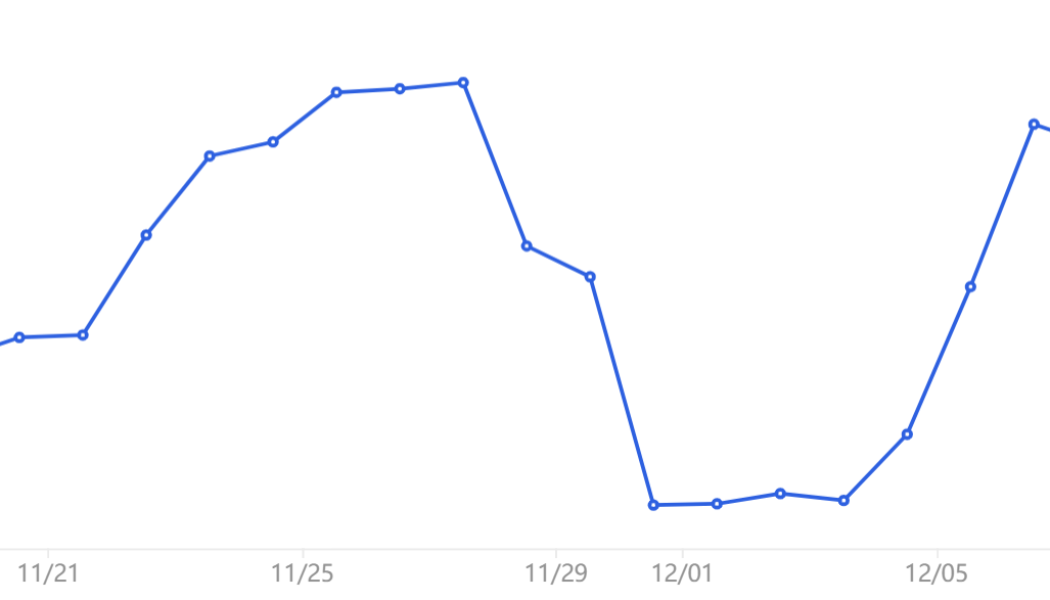

Tether executives and Binance CEO Changpeng “CZ” Zhao worried that Sam Bankman-Fried (SBF), former FTX CEO, was attempting to destabilize the crypto market aiming to save the now-bankrupt exchange, according to reports on Dec. 9. Messages seen by The Wall Street Journal of a Signal group chat named “Exchange coordination” reveals an argument between CZ and SBF on Nov. 10 about Tether’s stablecoin USDT. According to the report, CZ and others in the group worried that trades made by Alameda Research were focusing on depeg the stablecoin, which would have a ripple effect in crypto prices. Binance CEO reportedly confronted SBF: “Stop trying to depeg stablecoins. And stop doing anything. Stop now, don’t cause more damage.” SBF denied the claims in a statement to the WSJ....

Goldman Sachs buying crypto firms, FTX news, 3AC and Celsius updates: Hodler’s Digest Dec. 4-10

Top Stories This Week 7 class action lawsuits have been filed against SBF so far, records show Former FTX CEO Sam Bankman-Fried has been named in seven class action lawsuits filed since the fall of his crypto empire. These lawsuits, however, are separate from the numerous probes and investigations examining the crypto exchange and its founder, including a reported market manipulation probe by federal prosecutors. Another headline shows the United States House of Representatives has called on SBF to speak at a hearing on Dec. 13. Amid investigations by lawmakers and a flurry of civil litigation, SBF hired former federal prosecutor Mark Cohen to act as his defense attorney. A team of financial forensic investigators was also hired by FTX’s new management to track down the billions of dollars...