crypto blog

Binance VC arm leads $60M round in cross-chain protocol Multichain

Binance Labs, the venture capital and incubation arm of Binance cryptocurrency exchange, has led a financing round for the cross-chain protocol Multichain, previously known as Anyswap. Shortly after rebranding from Anyswap last week, Multichain has raised $60 million in a seed funding round led by Binance Labs, the firm officially announced on Dec. 21. Other participants in the raise included major VC firms and industry investors like Sequoia China, IDG Capital, Three Arrows Capital, Primitive Ventures, DeFiance Capital, Circle Ventures, Hypersphere Ventures, HashKey and Magic Ventures. Apart from providing capital investment for Multichain, Binance is also building a stronger relationship with the cross-chain protocol. On Dec. 20, Multichain announced that it is now officially recommended...

Crypto exchange FTX US partners with four Washington, DC sports teams

The company behind four major Washington, D.C.-based professional sports teams has announced FTX US will be its official crypto exchange and nonfungible token partner. In a Monday announcement, Monumental Sports and Entertainment, or MSE, said FTX US would be the official crypto partner of the Washington Capitals hockey team, the Washington Wizards men’s basketball team, the Washington Mystics women’s basketball team and the Capital City Go-Go basketball team as part of a multi-year deal. According to MSE, FTX US’ NFT platform will have exclusive rights to future token drops by the four teams and the exchange will be a partner for an in-game highlight series, dubbed “Big Block-Chain.” “The integration of blockchain technology with the sports experience has only just begun, and together we ...

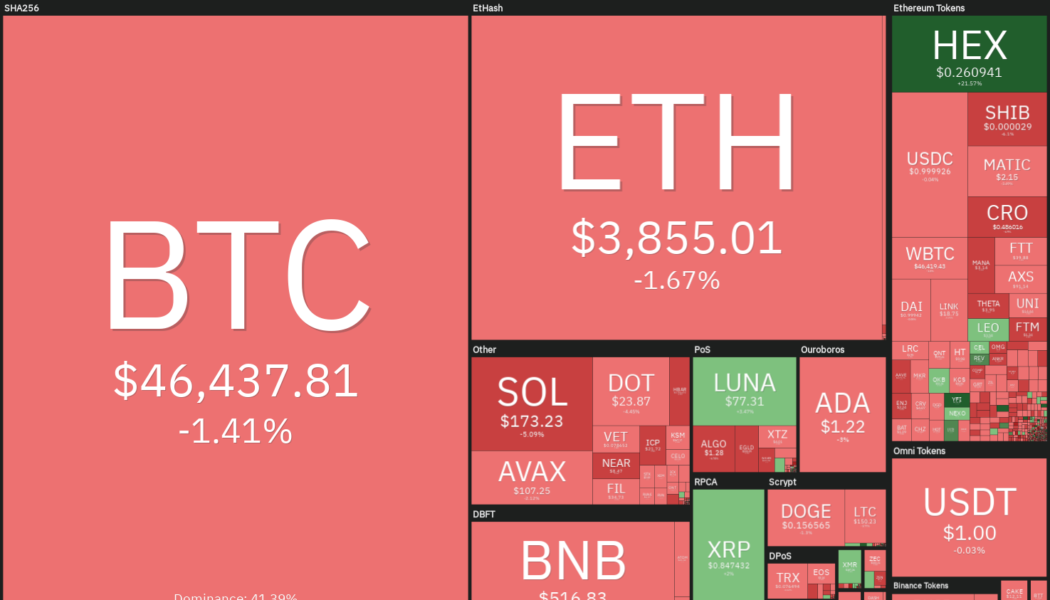

Price analysis 12/20: BTC, ETH, BNB, SOL, ADA, XRP, LUNA, AVAX, DOT, DOGE

Bitcoin (BTC) continues to lose ground in December, a signal that traders may be locking in their gains before the end of the year. The lack of a Santa rally in the U.S. equity markets indicates that the risk-off sentiment prevails due to the uncertainty regarding the spread of the COVID-19 omicron variant in several parts of the world. Even after the sharp drop in Bitcoin’s price, the demand from institutional investors remains tepid, and data shows that the largest institutional Bitcoin product, the Grayscale Bitcoin Trust (GBTC), is trading at a discount of more than 20%. Daily cryptocurrency market performance. Source: Coin360 Veteran trader Peter Brandt said that “high volume panic capitulations” usually signal a bottom in Bitcoin and that has not yet happened during the current decli...

Crypto regulation is coming, but Bitcoin traders are still buying the dip

Looking at the Bitcoin chart from a weekly or daily perspective presents a bearish outlook and it’s clear that (BTC) price has been consistently making lower lows since hitting an all-time high at $69,000. Bitcoin/USD on FTX. Source: TradingView Curiously, the Nov. 10 price peak happened right as the United States announced that inflation has hit a 30-year high, but, the mood quickly reversed after fears related to China-based real estate developer Evergrande defaulting on its loans. This appears to have impacted the broader market structure. Traders are still afraid of stablecoin regulation This initial corrective phase was quickly followed by relentless pressure from regulators and policy makers on stablecoin issuers. First came VanEck’s spot Bitcoin ETF rejection by the U.S....

Former acting comptroller of the currency joins Voyager Digital’s board

Crypto trading platform Voyager Digital announced Bitfury CEO and former Acting Comptroller of the Currency Brian Brooks has joined the firm’s board of directors. In a Monday announcement, Voyager chair Philip Eytan said Brooks had joined the board as an “independent, non-executive director,” citing the former comptroller’s experience at crypto companies and his leadership behind regulatory initiatives in the United States during his time at the OCC. Brooks served as acting Comptroller of the Currency until January, was Coinbase’s chief legal officer from 2018 to 2020 and held the position of CEO at Binance.US for less than four months this year. Welcome Brian Brooks as the newest member of our Board of Directors Brooks, the Former Acting Comptroller of the U.S. Currency, is a globally rec...

Former acting comptroller of the currency joins Voyager Digital’s board

Crypto trading platform Voyager Digital announced Bitfury CEO and former Acting Comptroller of the Currency Brian Brooks has joined the firm’s board of directors. In a Monday announcement, Voyager chair Philip Eytan said Brooks had joined the board as an “independent, non-executive director,” citing the former comptroller’s experience at crypto companies and his leadership behind regulatory initiatives in the United States during his time at the OCC. Brooks served as acting Comptroller of the Currency until January, was Coinbase’s chief legal officer from 2018 to 2020 and held the position of CEO at Binance.US for less than four months this year. Welcome Brian Brooks as the newest member of our Board of Directors Brooks, the Former Acting Comptroller of the U.S. Currency, is a globally rec...

SEC commissioner Elad Roisman will leave by end of January

Elad Roisman, one of five members of the Securities and Exchange Commission’s board, has announced his intention to resign from the government agency. In a Monday announcement, Roisman said he had sent a letter to President Joe Biden informing him of his decision to leave the SEC by the end of January 2022. The SEC commissioner said he would continue working with his colleagues “to further our mission of protecting investors, maintaining fair, orderly and efficient markets, and facilitating capital formation” until his departure. Roisman was sworn into office in September 2018 under the previous administration and served as acting SEC chair from December 2020 to January 2021, when he was replaced by commissioner Allison Herren Lee. His term was originally set to expire in 2023. Gary Gensle...

SEC commissioner Elad Roisman will leave by end of January

Elad Roisman, one of five members of the Securities and Exchange Commission’s board, has announced his intention to resign from the government agency. In a Monday announcement, Roisman said he had sent a letter to President Joe Biden informing him of his decision to leave the SEC by the end of January 2022. The SEC commissioner said he would continue working with his colleagues “to further our mission of protecting investors, maintaining fair, orderly and efficient markets, and facilitating capital formation” until his departure. Roisman was sworn into office in September 2018 under the previous administration and served as acting SEC chair from December 2020 to January 2021, when he was replaced by commissioner Allison Herren Lee. His term was originally set to expire in 2023. Gary Gensle...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

Law Decoded: Making sense of mixed signals, Dec. 13–20

The crypto regulation regime in any jurisdiction is an equilibrium among multiple institutional, group and personal interests of actors who have a sway over financial and monetary policies. These interests never perfectly align, frequently resulting in contradictory signals coming out of various power centers. Speaking about systemic risks facing the world’s largest economy last week, the United States Federal Reserve chair said digital assets were not a financial stability concern. Two days later, the U.S. Financial Stability Oversight Council issued a report that concluded that stablecoins and decentralized finance could pose sizeable financial stability risks. The source of this discrepancy could lie in the fact that the Fed’s mandate is to maintain a robust economy, while the FSOC, whi...

The biggest winners and losers of the crypto industry in 2021

The cryptocurrency and blockchain industry experienced explosive growth in 2021, particularly in its decentralized finance (DeFi) and nonfungible token (NFT) sectors. The year was also marked by continued price volatility, baffling behavior from China, a grand experiment in Central America, escalating institutional interest, and the rise of some faster smart-contract networks — all of which is reflected in this year’s list of industry “winners and losers.” Winners in 2021 Kazakhstan When China effectively banned Bitcoin (BTC) mining operations in May 2021, Kazakhstan rushed in to fill the vacuum, pitching displaced miners and others on its cheap and plentiful coal supply. Many set up operations in the Central Asian country, including a top-five crypto mining pool operated by BIT Mini...