crypto blog

Mysterious Bitcoin miner shows off oldest signature dated Jan. 2009

Online forums are integral to the Bitcoin origin story, where Satoshi Nakamoto and early contributors collaborated to discuss and create a disruptive financial system from scratch. One of the oldest Bitcoin forums — bitcointalk.org — still preserves historical discussions around creating the Bitcoin (BTC) logo and the payment system. A curious member of the bitcointalk.org forum recently sought to identify Bitcoin miners from the early days. To their surprise, an anonymous member shared a signature dating back to January 2009, just a week after Bitcoin came into existence. The oldest known Bitcoin signature shared by OneSignature. Source: bitcointalk.org “Maybe OP is inviting Satoshi?” questioned another member after confirming the legitimacy of “the oldest signature” found to date. A...

Elon Musk alleges SBF donated over $1B to Democrats: “Where did it go?”

The attempts of mainstream media to water down the frauds committed by FTX CEO Sam Bankman-Fried (SBF) did not fare well in convincing the crypto community and entrepreneurs. Instead, the misinformation campaign collided with Tesla CEO Elon Musk’s drive to position Twitter as “the most accurate source of information.” The world is yet to overcome the shock after witnessing the legal leniency awarded to SBF for misappropriating users’ funds and shady investment practices via trading firms Alameda Research and FTX. Will Manidis, the CEO of ScienceIO, a healthcare data platform, pointed out that SBF made the “highest ROI trade of all time” by donating $40 million to the right people for getting away with stealing over $10 billion. That’s just the publicly disclosed number. His act...

Bybit announces second round of layoffs in 2022 to survive bear market

Yes, the bear market weeds out the bad actor, but it also forces the existing players to rethink their business strategies to offset resultant losses. In this effort, crypto exchange Bybit announced mass layoffs for the second time in 2022. Ben Zhou, the co-founder and CEO of Bybit, announced a reorganization plan amid a prolonged bear market, which involves a steep reduction in the workforce. The “planned downsizing” will affects employees across the board: “We are all saddened by the fact this reorganization will impact many of our dear Bybuddies and some of our oldest friends.” Independent reporter Colin Wu highlighted that the layoff ratio is 30%. On June 20, Bybit silently laid off employees, citing unsustainable growth, which was confirmed via leaked internal documents. Bybit’s emplo...

Crypto community weighs in on SBF’s ‘apology tour’

The former CEO of FTX, Sam “SBF” Bankman-Fried, has seemingly begun to embark on an apology tour to redeem his image a month after the sudden implosion of FTX, which revealed that the exchange had been improperly using customer and investor funds. OnNov. 30, Bankman-Fried made his first live public appearance since the collapse of FTX — answering a number of questions during the DealBook Summit in New York. During the interview, Bankman-Fried claimed to have “unknowingly commingled funds” between Alameda and customer funds at FTX. He shared: “I unknowingly commingled funds. […] I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part and failure to appoint someone to be chiefly in charge of that.” In another interv...

Alameda Research invested $1.15B in crypto miner Genesis Digital: Report

Crypto mining company Genesis Digital Assets was the biggest venture investment made by Alameda Research, FTX’s sister company and in the center of the exchange’s bankruptcy. Documents disclosed by Bloomberg on Dec. 3 show that Genesis Digital raised $1.15 billion from Alameda in less than nine months. The capital infusion was made before the crypto prices downturn, between August 2021 and April of this year. Genesis Digital is the major United States-based Bitcoin mining company, and it’s not related to Genesis Capital, the trading company with $175 million worth of funds locked away in an FTX trading account. Former FTX CEO Sam Bankman-Fried recently recognized participating in Alameda’s venture decisions, including the investment in Genesis Digital, despite...

The FTX collapse continues to unfold, BlockFi announces bankruptcy filing and Kraken settles a sanctions breach: Hodler’s Digest, Nov. 27 – Dec. 3

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week BlockFi files for bankruptcy, cites FTX collapse for its troubles Digital asset lending company BlockFi announced on Nov. 28 that it has filed for Chapter 11 bankruptcy in New Jersey. The bankruptcy filing revealed, among other details, that BlockFi aims to restructure and keep specific employees on board. BlockFi has eight daughter companies that are also included in the bankruptcy motion. Later news revealed bankruptcy proceeding details, including BlockFi’s attorney reporting that $355 million of the organi...

3AC bankruptcy process faces challenges amid unknown whereabouts of founders

Liquidators for Three Arrows Capital (3AC) will have to present further documents in order to be granted permission to subpoena the now-bankrupt crypto hedge fund’s founders through Twitter, according to a decision from Judge Martin Glenn during a virtual hearing for the Southern District of New York Bankruptcy Court on Dec. 2. Lawyers representing the liquidators claimed that Zhu Su and Kyle Davies, co-founders of the hedge fund, have repeatedly failed to engage with liquidators over the recent months. “A communication protocol was agreed between the liquidators and founders but has not yielded satisfactory cooperation,” according to a hearing presentation. The liquidators claimed that the founders of the company are located in Indonesia and the United Arab Emirates, where it is difficult...

The future of smart contract adoption for enterprises

Decentralized finance (DeFi) markets may have cooled down over the past year, but the technology powering these applications continues to advance. In particular, smart contract platforms that enable transactions to take place across DeFi applications are maturing to meet enterprise requirements. While it’s notable that enterprises have previously shown interest in DeFi use cases, smart contract limitations have hampered adoption. A report published by Grayscale Research in March puts this in perspective, noting that “Despite handling millions of transactions per day, smart contract platforms in their current state would be incapable of handling even 10% of the worlds’ internet traffic.” This notion is particularly troublesome considering the market opportunity behind DeFi. For instan...

Crypto lender Genesis allegedly owes $900M to Gemini’s clients: Report

Crypto lender Genesis and its parent company Digital Currency Group (DCG) allegedly owe $900 million to Gemini’s clients, according to a Financial Times report disclosed on Dec. 3, citing people familiar with the matter. The issue derives from the FTX dramatic collapse in November. Crypto exchange Gemini operates a product called Gemini Earn in partnership with Genesis, offering investors the opportunity to earn 8% in interest by lending out their crypto, including Bitcoin and stablecoins pegged to fiat currencies. On Nov. 16, Genesis announced it had temporarily suspended withdrawals citing “unprecedented market turmoil,” days after disclosing around $175 million worth of funds stuck in an FTX trading account. Genesis is reportedly facing difficulties raising money for its...

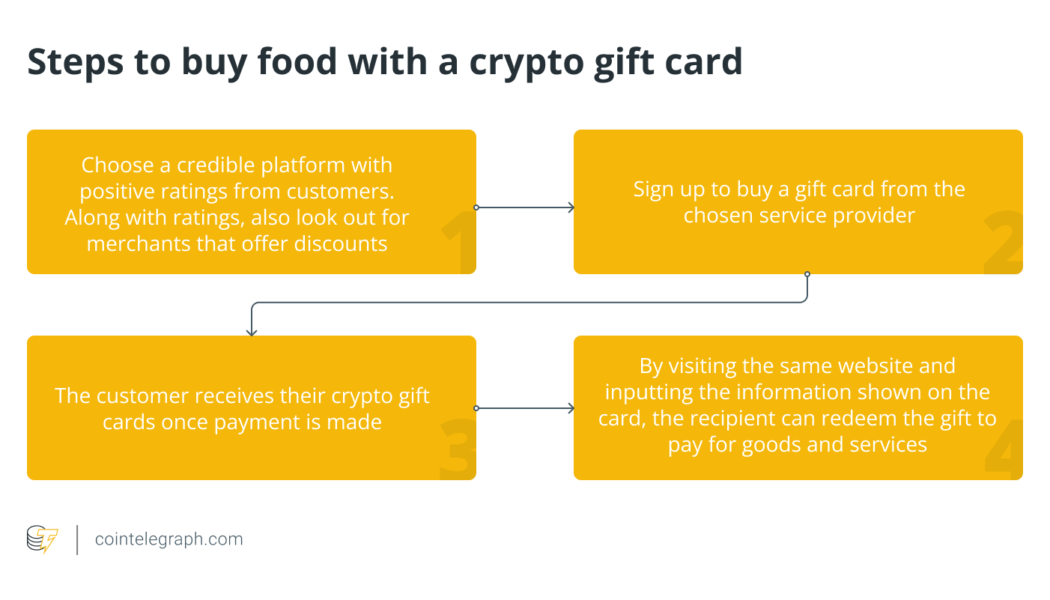

How to buy food with Bitcoin?

Bitcoin (BTC) is a dynamic monetary asset with the potential of being both — a commodity and a currency. For instance, the Securities and Exchange Commission (SEC) classified BTC as a commodity, whereas El Salvador made Bitcoin a legal tender in 2021. So, does this make BTC a store of value or a medium of exchange? It can do both — On one hand, BTC can be added to treasuries as an inflationary hedge. On the other hand, it could also serve the retail purpose of paying for routine expenses. Almost over a decade ago, the first person to utilize Bitcoin for a business transaction was Laszlo Hanyecz, who spent 10,000 BTC on two pizzas, or as the crypto community addresses it, the Bitcoin pizza. However, that is not the amount of BTC anyone needs to actually buy food in the real worl...

WAHED Projects Donates 5 Million WAHED Coins to Fund Autism Research and Therapy

Cranfield, England, 3rd December, 2022, Chainwire Investment and philanthropy platform WAHED has donated 5 million of its utility token WAHED Coin to Fondazione Europea Alessandro Cenci (FEAC) at a private event in Rome. FEAC is an Italian non-profit organization focused on awareness, education and research to improve the care given to children and adolescents on the autism spectrum. In attendance at the Rome event were leadership figures from the WAHED and FEAC organizations. WAHED Chairman Shaikh Abdulla Bin Ahmed Bin Salman AlKhalifa and FEAC President Eros Cenci were joined by prominent members of their teams. Sergio Torromino, former Italian Member of Parliament and current WAHED Board Member Dr. Salvatore Alberto Turiano, staff vascular surgeon at the University Hospital Policlinico-...