crypto blog

DAM Finance unvleis out the Moonwalkers v1 testnet

In its quest to introduce a decentralized omnichain stablecoin solution to securely address the liquidity challenges facing the broader decentralized finance (DeFi) ecosystem, DAM Finance has launched the Moonwalker v1 testnet. The Moonwalkers v1 testnet lays the foundation for DAM’s solutions and DAM is expected to introduce its solutions on the mainnet after the testnet phase. This will provide users with a wide range of assets including yield-generating collateral. Using the Moonwalker V1 testnet The Moonwalker v1 testnet has been deployed on both Ethereum’s Goerli Testnet and Moonbeam’s Moonbase Alpha, an EVM-compatible chain built on Polkadot. DAM community members will be able to mint DAM’s decentralized omnichain stablecoin d20 directly using existing stablecoins like USDC on Ethere...

Thai VC fund acquires troubled exchange Zipmex for $100M: Report

After weeks of negotiations on a potential buyout of Zipmex, venture capital fund V Ventures has reportedly reached a deal to acquire the embattled cryptocurrency exchange. V Ventures, a subsidiary of Thoresen Thai Agencies (TTA) public company, is looking to purchase a 90% stake in Zipmex crypto exchange, Bloomberg reported on Dec. 2. The VC fund is about to acquire Zipmex for about $100 million in digital assets and cash, anonymous sources familiar with the matter claimed. Citing a court hearing on Friday in Singapore, the report says that Zipmex was offered $30 million in cash and the rest in crypto. According to the court hearing, Zipmex is planning to use cryptocurrency assets received from the transaction to unlock frozen customer accounts on the exchange by April 2023. The acquisiti...

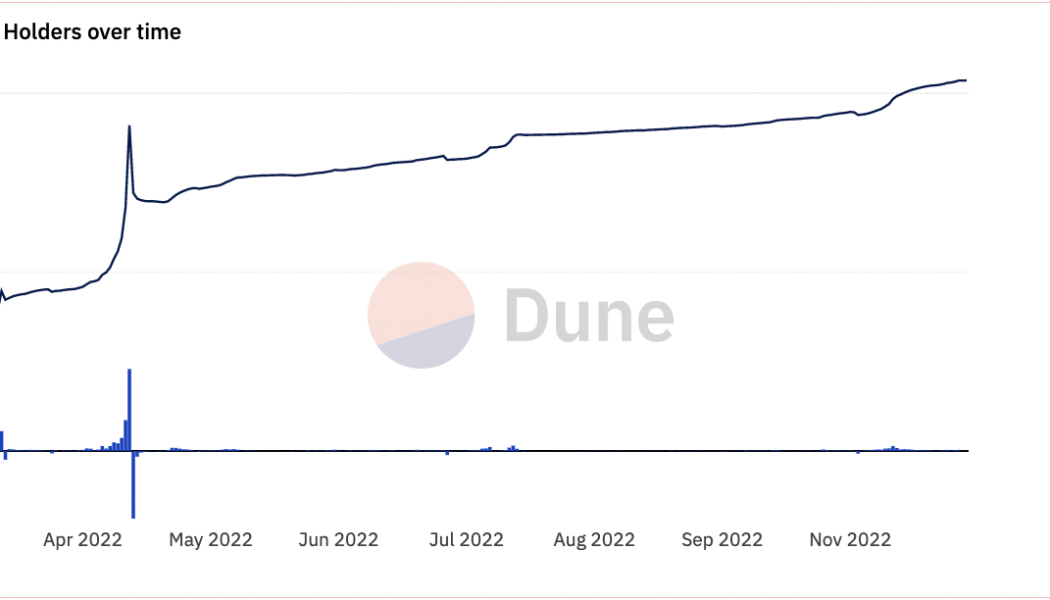

ApeCoin risks 30% crash after APE staking debut in December

The multi-week ApeCoin (APE) market rally is nearing exhaustion owing to a mix of technical and fundamental factors. Fundamental — ApeCoin Staking launch In the past two weeks, APE’s price is up over 50% after bottoming at around $2.60. The APE/USD rebound came in line with similar recovery moves elsewhere in the crypto market. But, it outperformed top assets, including Bitcoin (BTC) and Ether (ETH), as traders pinned their hopes on ApeCoin’s staking debut. The ApeCoin Staking feature will debut on Dec. 5 at apestake.io, according to its developer Horizon Labs. It will allow users to lock their APE holdings into four staking pools — ApeCoin pool, BAYC pool, MAYC pool, and Paired pool — that will allow them to earn yield periodically. The feature announcement has resulted ...

Trader allegedly saw over 5000x gains after Ankr protocol hack

As the BNB Chain-based protocol Ankr was exploited and the hacker dumped Ankr Reward Bearing Staked BNB (aBNBc) tokens, a trader took advantage of the price discrepancies to turn $2,879 into $15.5 million. As previously reported by Cointelegraph, security firm Beosin suggested that the multi-million dollar exploit may have come from vulnerabilities in the smart contract code and compromised private keys due to a technical upgrade. Then, the hacker minted and dumped 20 trillion aBNBc tokens, significantly lowering the price of aBNBc. As this happened, a trader reacted quickly and took advantage of an opportunity. Going through on-chain data, analysis platform Lookonchain recently shared how a trader allegedly managed to gain $15.5 million by making their way through the Helio Protocol...

Mike Novogratz: Bankman-Fried is ‘delusional’ and headed to jail

Former FTX CEO Sam Bankman-Fried (SBF) has been lambasted this week following a series of controversial public appearances, with Galaxy Digital’s Mike Novogratz one of the latest to dish out a lashing to the former kingpin of crypto. On Dec. 1, Galaxy Digital CEO Mike Novogratz unleashed a tirade of criticism towards SBF concerning his interview with Andrew Ross Sorkin at the New York Times annual DealBook Summit on Nov. 30. Speaking to Bloomberg, Novogratz characterized SBF as “delusional” following his declaration in the live interview that he never tried to commit fraud. “It’s kind of surprising that his lawyers are letting him speak,” Novogratz said before adding “having watched two interviews, the word delusional kept coming to mind.” The lambasting didn’t stop there with Novogratz ec...

FTX was the ‘fastest’ corporate failure in US history — Trustee calls for probe

The United States Trustee handling FTX’s bankruptcy proceedings has referred to the now-defunct exchange as the “fastest big corporate failure in American history,” and is calling for an independent probe to look into its downfall. In a Dec. 1 motion, U.S. Trustee Andrew Vara noted that over the course of eight days in November, debtors “suffered a virtually unprecedented decline in value” from a market high of $32 billion earlier in the year to a severe liquidity crisis after a “proverbial ‘run on the bank.'” “The result is what is likely the fastest big corporate failure in American history, resulting in these “free fall” bankruptcy cases.” Vara has called for an independent examination of FTX, stating it was “especia...

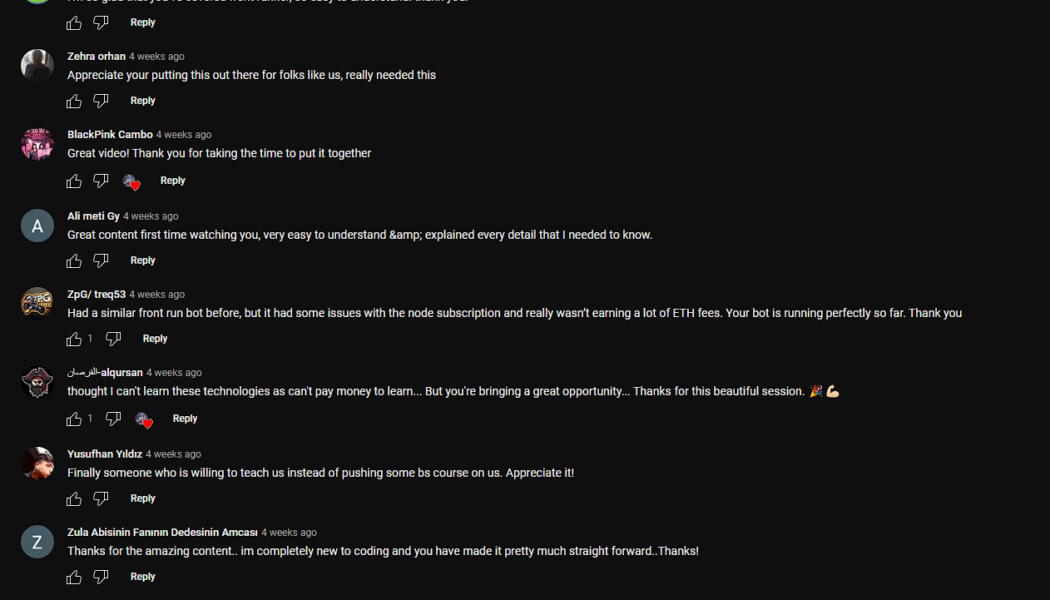

Front-running scams rampant on YouTube with 500% surge in 2022: CertiK

Front-running scam bots are significantly gaining traction on YouTube, with the number of dubious videos increasing six-fold in 2022 according to a new report from blockchain security firm CertiK. In the firm’s Dec. 1 report, CertiK explores how a wave of front-running bot scams are promising free returns as high as 10X a day, but ultimately end up swiping people’s funds. Notably, CertiK’s analysis found 84% of videos on YouTube mentioning “front running bot” were scams, with the number increasing 500% from 28 videos in 2021 to 168 videos in 2022: “There are common themes in all of these videos: free code and huge returns. Successful runners won’t give away free code on a social media site, they will sell it for a large amount on underground forums.” The scam itself genera...

Magic Eden follows OpenSea with NFT royalty enforcement tool

Magic Eden, a Solana-based nonfungible token (NFT) marketplace, has become the latest platform to release a tool allowing creators to enforce royalties on their collections. It follows the announcement of a similar tool from rival NFT marketplace OpenSea in early November. According to a Dec. 1 statement, the open-source royalty enforcement tool is built on top of Solana’s SPL token standard and is called the Open Creator Protocol (OCP). This will allow royalty enforcement for new collections that opt-in to the standard starting Dec. 2. Lu previously floated the idea of NFTs designed to enforce royalties at Solana’s Breakpoint 2022 conference on Nov. 5, citing the need for NFT creators to have a “sustained revenue model.” Creators who use OCP will also be able to ban marketplaces tha...

Clearing company tests out securities transaction settlements on blockchain networks

The Digital Dollar Project (DDP) and the Depository Trust & Clearing Corporation (DTCC) released the results of their Security Settlement Pilot project Nov. 30. The project tested a simulated digital U.S. dollar in transactions with tokenized securities on a blockchain network under real-world conditions. The project was designed “to better understand the implications of a U.S. Central Bank Digital Currency (CBDC) on post-trade settlement,” especially on DvP (delivery versus payment) settlements, sometimes called atomic settlements, that ensure securities transfers only take place simultaneously or nearly simultaneously with payment. No U.S. CBDC has been developed or even authorized yet. DTCC managing director Jennifer Peve wrote in her company’s foreword: “These efforts, which ...

P2P Financial Systems panel: Crypto core values and transparency are critical for DeFi

As one of the main growing sub-sectors in the crypto industry, decentralized finance (DeFi) has faced a challenging year amid market dynamics, cyberattacks and regulatory uncertainty. Its future demands more transparency and clarity in the regulatory landscape, according to a panel discussion at the International Workshop on P2P Financial Systems 2022 on Dec. 1. Moderated by Cointelegraph’s editor-in-chief Kristina Cornèr with Gaspard Pedruzzi, CEO of APWine; Daniel Perez, co-founder of Mero; Hugo Philion, CEO of Flare, and Niall Roche, CTO-in-residence at the University College London School of Management as panelists, the discussion focused on the DeFi future among a disruptive landscape worldwide. Perez emphasized the need for transparency for DeFi’s long-term success, as we...

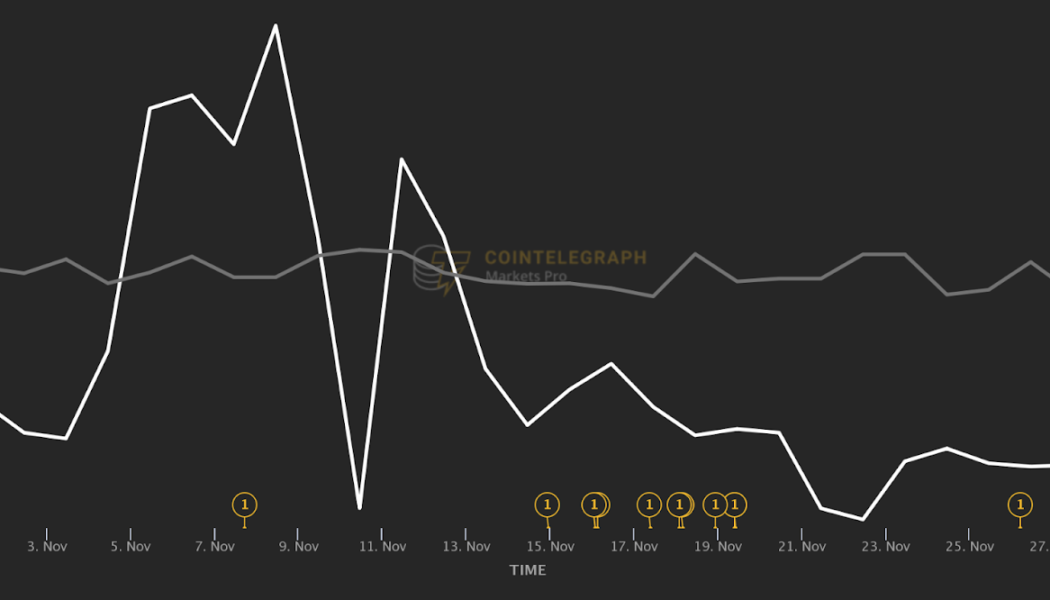

MATIC attack: How smart crypto traders “got out” before a 35% price drop

Disparities in information access and data analytics technology are what give institutional players an edge over regular retail investors in the digital asset space. The core idea behind Markets Pro, Cointelegraph’s crypto-intelligence platform powered by data analytics firm The Tie, is to equalize the information asymmetries present in the cryptocurrency market. Markets Pro bridges the gap of these asymmetries with its world-class functionality: the quant-style VORTECS™ Score. The VORTECS™ Score is an algorithmic comparison of several key market metrics for each coin utilizing years of historical data that assesses whether the outlook for an asset is bullish, bearish or neutral at any given moment based on the historical record of price action. The VORTECS™ Score is d...