crypto blog

DeFi sparks new investments despite turbulent market: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The prolonged crypto winter aided by the collapse of FTX has kept investors from backing a new protocol that merges DeFi and the foreign exchange market. A new Cosmos blockchain-based DeFi protocol has caught the eyes of investors who have put $10 million behind the project. Cardano-based leading stablecoin ecosystem Ardana abruptly stopped its development after several launch delays. However, the project remains open-source for others to add to it until they restart the development process. Aave community has now proposed a governance change after a failed $60 million short attack. The short attack was later trac...

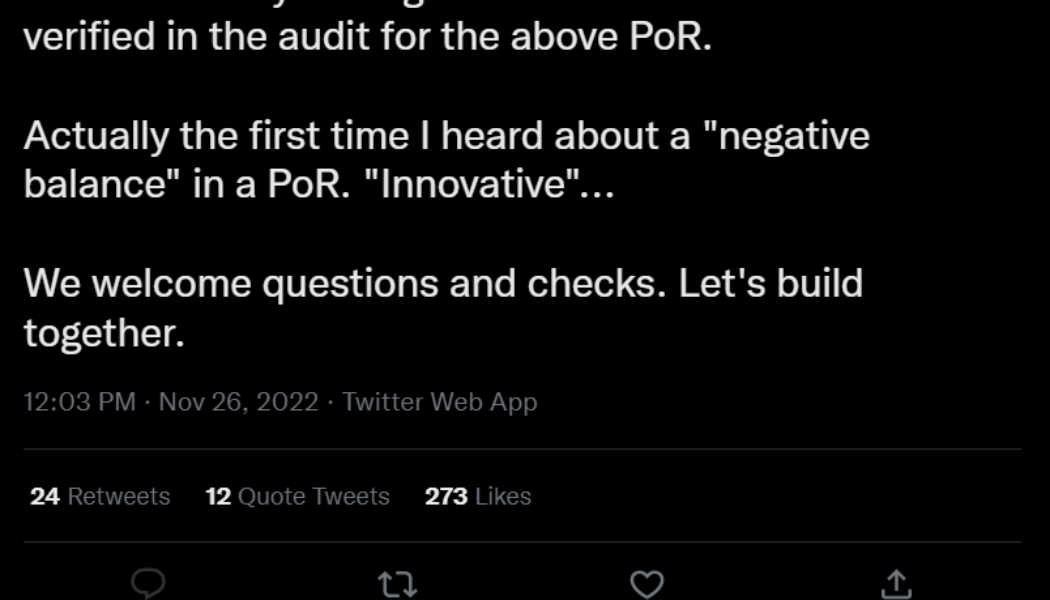

Binance proof-of-reserves is ‘pointless without liabilities’: Kraken CEO

Disclaimer: The article has been updated to reflect Binance CEO CZ’s response to the concerns raised by Kraken CEO Jesse Powell. The collapse of the crypto exchange FTX revealed the importance of proof-of-reserves in avoiding situations involving the misappropriation of users’ funds. While exchanges have proactively started sharing wallet addresses to prove the existence of users’ funds, several entrepreneurs, including Kraken CEO and co-founder Jesse Powell, called the practice “pointless” as exchanges fail to include liabilities. According to Powell, a complete proof-of-reserve audit must include the sum of client liabilities, user-verifiable cryptographic proof that each account was included in the sum and signatures proving the custodian’s control over the wallets. Whil...

SEC chair’s crypto oversight strategy in question as ecosystems collapse

While regulations are often aimed at protecting citizens from bad actors, the effectiveness of crypto regulations in the United States is in question owing to the colossal fall of major exchanges and ecosystems over the past year — FTX, Celsius, Voyager, and Terra (LUNA). Congressman Tom Emmer showed concerns about the oversight strategy implemented by Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC) for the crypto ecosystem. Emmer has been vocal against Gensler’s “indiscriminate and inconsistent approach” toward crypto oversight. On March 16, the Congressman revealed being approached by numerous crypto and blockchain firms that believed Gensler’s reporting requests to be overburdensome and stifling innovation. We are even more concerned now as we’ve...

American regulators to investigate Genesis and other crypto firms

Cryptocurrency lending firm Genesis Global Capital and other crypto firms are under investigation by securities regulators in the United States, according to reports on Nov. 25. Joseph Borg, director of the Alabama Securities Commission, confirmed that its state and several other states are participating in inquiries regarding Genesis’ alleged ties to retail investors, including if Genesis and other crypto firms might have violated securities laws, Barron’s reported. It is still unclear what other companies are being investigated. Borg noted that the investigation focuses on whether Genesis and other crypto companies influenced investors on crypto-related securities without obtaining the proper registration. The investigation is another chapter in the Genesis saga since the company r...

Crypto Biz: Institutions short Bitcoin as SBF is ‘deeply sorry’ for FTX collapse

The monumental collapse of FTX will go down as one of the biggest corporate scandals of all time. But, at least Sam Bankman-Fried, or SBF, is sorry. On Nov. 22, the disgraced founder of FTX penned a letter to his former employees describing his role in the company’s bankruptcy. “I never intended this to happen,” he wrote. “I did not realize the full extent of the margin position, nor did I realize the magnitude of the risk posed by a hyper-correlated crash.” Get this: SBF still thinks the company can be saved because “there are billion of dollars of genuine interest from new investors.” Shouldn’t he be preoccupied with trying to avoid jail right now? Bitcoin (BTC) and the broader crypto market have been reeling in the wake of the scandal. While this has allowed many diamond handed hodlers ...

Trouble in the Bahamas following FTX collapse: Report

Following the collapse of crypto exchange FTX, which was headquartered in the island country of Bahamas, Bahamians are reportedly still trying to find a way to make sense of everything, while remaining optimistic about the future. According to a report by the Wall Street Journal, the island country — which had encouraged cryptocurrency companies to feel at home with their “copacetic regulatory touch” — has been rocked by the implosion of FTX. The Bahamas was hard hit by Hurricane Dorian in 2019 and the pandemic shortly afterward in 2020 and was already struggling to find ways to strengthen its economy, which relies heavily on tourism and offshore banking for a bulk of its gross domestic product. It appeared that the prime minister of the Bahamas, Philip Davis, and his gover...

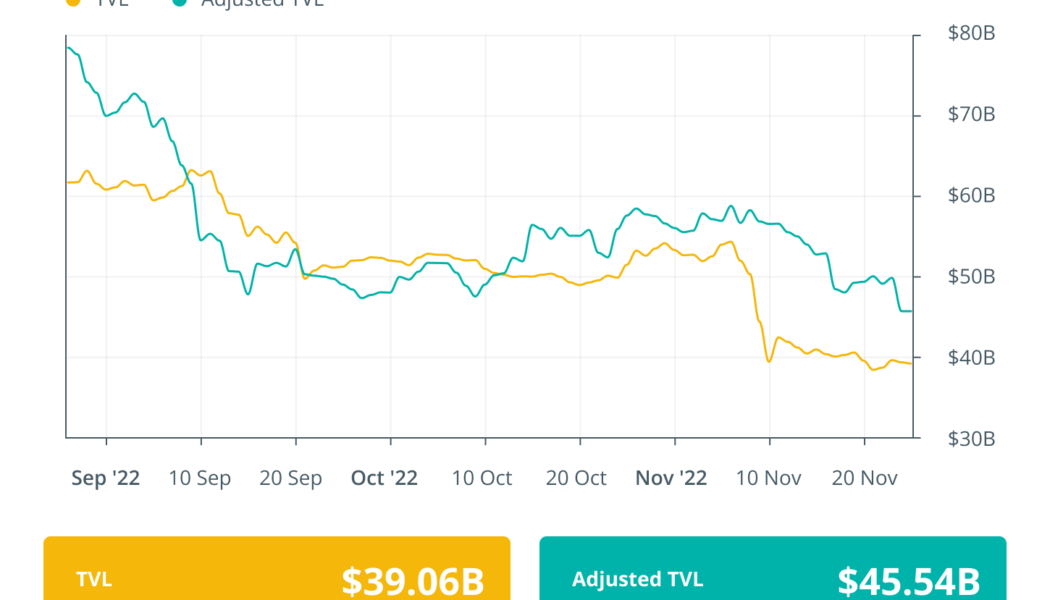

Programming languages prevent mainstream DeFi

Decentralized finance (DeFi) is growing fast. Total value locked, a measure of money managed by DeFi protocols, has grown from $10 billion to a little more than $40 billion over the last two years after peaking at $180 billion. Total value locked in DeFi as of Nov. 2022. Source: DefiLlama The elephant in the room? More than $10 billion was lost to hacks and exploits in 2021 alone. Feeding that elephant: Today’s smart contract programming languages fail to provide adequate features to create and manage assets — also known as “tokens.” For DeFi to become mainstream, programming languages must provide asset-oriented features to make DeFi smart contract development more secure and intuitive. Current DeFi programming languages have no concept of assets Solutions that could help reduce DeFi’s pe...

Disaster looms for Digital Currency Group thanks to regulators and whales

The cryptocurrency tide is flowing out, and it looks more and more like Digital Currency Group (DCG) has been skinny dipping. But let’s be clear: The current crypto contagion isn’t a failure of crypto as a technology or long-term investment. DCG’s problem is one of failure by regulators and gatekeepers. Since its 2013 inception, DCG’s Grayscale Bitcoin Trust (GBTC), the largest Bitcoin (BTC) trust in the world, has offered investors the ability to earn a high rate of interest — above 8% — simply by purchasing cryptocurrency and lending it to or depositing it with DCG. In many ways, the company performed a major service to the crypto industry: making investments into crypto understandable and lucrative for beginners and retail investors. And during the crypto market’s bull run, everything s...

Price analysis 11/25: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, UNI

FTX’s collapse dealt a major blow to the already fragile sentiment among cryptocurrency investors. Although a quick recovery is unlikely, Blockchain analysis firm Chainalysis said that the crypto universe could emerge stronger from this crisis. Chainalysis’ research lead Eric Jardine arrived at the conclusion after comparing FTX’s fall to that of Mt. Gox. Another calming statement came from Bloomberg Intelligence exchange-traded fund analyst James Seyffart, who said that there was a “99.9% chance” that the Grayscale Bitcoin Trust (GBTC) held the Bitcoin (BTC) it claimed. He added that GBTC was “unlikely” to be liquidated. Daily cryptocurrency market performance. Source: Coin360 The negative events of the past few days do not seem to have scared away the small investors who remain on an acc...

Amber Group’s co-founder Tiantian Kullander passes away at 30

Amber Group’s co-founder Tiantian Kullander, also known as TT, unexpectedly passed away in his sleep on Nov. 23, according to the company’s official website. Tiantian was 30 years old and leaves behind a wife and a son. Besides co-founding the Hong Kong-based Amber Group, TT sat on the board of the e-sports company Fnatic and founded KeeperDAO, a DeFi protocol that allows participants to trade, borrow and stake assets with protection from miner value extracted (MEV) bots, before returning it to the community. In an official statement, Amber Group noted that TT had devoted his heart and soul to the company, leading by example with “his intellect, generosity, humility, diligence and creativity.” The company also stated: “TT was a respected thought leader and wid...

How bad is the current state of crypto? On-chain analyst explains

Despite the market downturn and the widespread negative sentiment in the industry in the wake of the FTX collapse, on-chain data still show reasons to be bullish on Bitcoin (BTC). As pointed out by on-chain analyst Will Clemente, it’s enough to look at the positions of long-term holders, which reached an all-time high despite their profitability being at an all-time low. “Long-term holders buy heavily into the bear market. They set the floor, […] and then those long-term holders distribute their holdings to new market participants in the bull market,” he told Cointelegraph in an exclusive interview. Another positive trend worth noticing after the FTX collapse, in Clemente’s opinion, is that the average crypto user is increasingly turning away from exchanges and taking self-cust...