crypto blog

10,000 BTC moves off crypto wallet linked to Mt. Gox hack

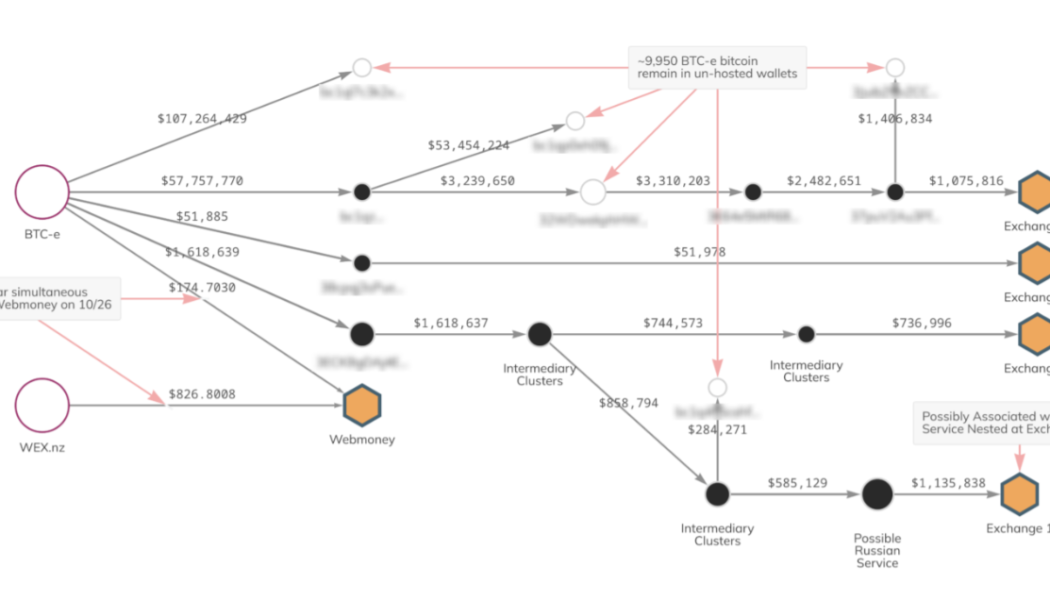

A crypto wallet belonging to the shutdown crypto exchange BTC-e has just moved 10,000 Bitcoin (BTC), currently worth over $165 million, to various exchanges, personal wallets, and other sources on Nov. 23. A Nov. 23 Chainalysis report suggested while this withdrawal is the largest made by BTC-e since April 2018, BTC-e and WEX — an exchange which is thought to be BTC-e’s successor — both sent small amounts of BTC to Russian electronic payments service Webmoney on Oct. 26 before making a test payment on Nov. 11, then transferring out a further 100 BTC on Nov. 21. The movement of BTC belonging to BTC-e and WEX wallets. Image: Chainalysis Of the total amount sent, 9,950 BTC is thought to still be located in personal wallets, while the rest was moved through intermediaries before ending up at f...

Aave proposes governance changes after failed $60M short attack

On Nov. 23, one day after Mango Markets exploiter Avraham Eisenberg attempted to use a series of sophisticated short sales to exploit decentralized finance protocol Aave, project contributors have put forth a series of proposals to deal with the aftermath. As told by protocol engineering developer Llama and financial modeling platform Gauntlet both of whom are deployed on Aave: “Over this past week, the user 0x57e04786e231af3343562c062e0d058f25dace9e [wallet associated with Eisenberg] opened a short position on CRV [Curve] using USDC as collateral. At its peak, the user was shorting ~92M units of CRV (roughly $60M USD at today’s prices). The attempt to short CRV on Aave has been unsuccessful, and the user lost ~$10M USD from the liquidations.” Llama wrote that...

OKX releases Proof of Reserves page, along with instructions on how to self-audit its reserves

Crypto exchange OKX has released a Proof of Reserves page that allows users to audit its reserves to make sure it is solvent. This comes at a time when crypto exchanges are coming under greater scrutiny after the collapse of FTX. OKX announced the new page in a tweet, as well as on its blog. Don’t trust, verify → OKX Proof of Reserves (PoR) is LIVE. To set a new standard of transparency, risk management and user protection, we’re launching our first PoR. You can now verify your assets are backed 1:1 on #OKX ⤵️ Details — OKX (@okx) November 23, 2022 The Proof of Reserves page offers two different options for users to audit the exchange’s reserves. The first allows users to get a brief summary of the exchange’s current reserves and liabilities for its top three cryptocurre...

Casper Association launches $25M grant to support developers on its blockchain

Scalable blockchain network Casper announced the launch of its new Casper Accelerate Grant Program on Nov. 23, created to support developers and innovators who are building apps to support infrastructure, end-user applications, and research innovation on its blockchain. JUST IN from @nextblockexpo: We’re glad to announce the launch of a $25M Casper Accelerate Grant Program. This fund will support learning, development, and innovations in Infrastructure, #dApps, #DeFi, #Gaming & NFTs. Learn more https://t.co/jClYyYxRVW pic.twitter.com/V8KszHEjM3 — Casper (@Casper_Network) November 23, 2022 The Casper Network is a Proof-of-Stake (PoS) enterprise-focused blockchain designed to help businesses to build private or permissioned apps, aimed at accelerating businesses and the adopti...

Block.one and its CEO become largest Silvergate Capital shareholders

Brendan Blumer, CEO of Block.one, which developed the EOSIO blockchain platform and EOS (EOS) coin, has purchased a stake in Silvergate Capital, the holding company for Silvergate Bank, a crypto-fiat gateway network designed for financial institutions, according to an SEC filing. That document, dated Nov. 23, listed Nov. 16 as the date of the transaction. The purchase of nearly 3 million shares represents 9.27% of Silvergate stock. Blumer purchased 571,351 shares personally, and Block.one purchased 2,363,186. According to CNN, this deal will make them Silvergate’s largest shareholder. @BrendanBlumer founder of EOS buys 9.27% of Silvergate Capital $SI + his company https://t.co/tZqWL2yAx6 buys 7.64%https://t.co/Wh64Odn9Nr — yeezus (@yeezuscapital) November 23, 2022 Block.one raised a record...

Bukele’s government introduced a bill to launch the ‘Bitcoin bonds’

Amid the crypto market downturn, El Salvador finally made a decisive step to the realization of its ambitious “Bitcoin bonds” project. The Minister of the Economy, Maria Luisa Hayem Brevé, introduced a bill confirming the government’s plan to raise $1 billion and invest them into the construction of a “Bitcoin city.” A 33-page digital securities bill, dated Nov. 17, urges lawmakers to create a legal framework using the digital assets in public issuances by El Salvador. They should also consider all the requirements for this procedure and the obligations of issuers and asset providers. The “volcano bonds” or “Bitcoin bonds” were introduced by the government of Nayib Bukele back in 2021. The initial plan proposed issuing roughly $1 billion of those bonds and allocating the raised funds to th...

Crypto awakening: Researcher explains ETH exodus from exchanges

Blockchain analytics carried out by a Nansen researcher has highlighted outflows of Ether (ETH) and stablecoins from centralized exchanges in the wake of FTX’s collapse. Nansen research analyst Sandra Leow posted a thread on Twitter unpacking the current state of decentralized finance (DeFi), with a specific focus on the movement of ETH and stablecoins from exchanges. As it stands, the Ethereum 2.0 deposit contract contains over 15 million ETH, while some 4 million Wrapped Ether (wETH) is held in the wETH deposit contract. Web3 infrastructure development and investment firm Jump Trading holds over 2 million ETH tokens and is the third largest holder of ETH in the ecosystem. The current state of DeFi in @nansen_ai charts — sandra lmeow (@sandraaleow) November 22, 2022 Binance, Kraken, Bitfi...

Bank of Japan to trial digital yen with three megabanks

Despite Japan’s uncertainty on whether to issue a central bank digital currency (CBDC), the Bank of Japan (BoJ) continues experimenting with a potential digital yen. The Japanese central bank has started a collaboration with three megabanks and regional banks to conduct a CBDC issuance pilot, the local news agency Nikkei reported on Nov. 23. The pilot aims to provide demo experiments for the issuance of Japan’s national digital currency, the digital yen, starting in spring 2023. As part of the trial, the BoJ is expected to cooperate with major private banks and other organizations to detect and solve any issues related to customer deposits and withdrawals on bank accounts. According to the report, the pilot will involve testing the offline functionality of Japan’s possible CBDC, targeting ...

DeFi protocol raises $10M from Bitfinex, Ava Labs despite turbulent market

The ongoing crypto bear market has proven itself to be a builders market as investments continue to find projects with promise. Onomy, a Cosmos blockchain-based ecosystem, just secured millions from investors for the development of its new protocol. The project merges decentralized finance (DeFi) and the foreign exchange market to bring the latter on-chain. According to the developers, the latest funding round garnered $10 million from big industry players such as Bitfinex, Ava Labs, the Maker Foundation and CMS Holdings among others. Lalo Bazzi, co-founder of Onomy, said the underlying goal of building a decentralized autonomous organization with a public infrastructure should serve the “core tenant of crypto — self-custody — without sacrificing on the user experience.” Both DeFi and self...

Utility Token Metacade (MCADE) is a Solid Long-Term Buy, Investors Say

The cryptocurrency market has gone through a painful bear market but investors are looking for the best projects to lead the next bull run. A new project called Metacade taps into the meme token power of play to earn (P2E) gaming and the metaverse and the project’s MCADE utility token could be a great opportunity for crypto investors. What is Metacade? Metacade is set to be a brand new Web3 community where gamers and crypto fans can meet, to communicate and collaborate on the best metaverse games. The project is seeking to build a fun, dynamic meeting place where gaming enthusiasts can become absorbed in the latest GameFi trends and earn rewards. One of Metacade’s key goals is to create the world’s first community-driven, play-to-earn arcade and that positions it well to be a potent r...

Institutional investors are buying through crypto winter: Survey

A survey of institutional investors suggests that their cryptocurrency allocations have increased over the last year despite the industry going through a prolonged crypto winter. A Coinbase-sponsored survey released on Nov. 22 conducted between Sep. 21 and Oct. 27, found 62% of institutional investors invested in crypto had increased their allocations over the past 12 months. In comparison, only 12% had decreased their crypto exposure, indicating most institutional investors may be bullish on digital assets in the long term despite prices falling, according to the survey. More than half of the investors surveyed said they were currently, or planning, to use a buy-and-hold approach for cryptocurrencies, with the belief that crypto prices will stay flat and range bound over the next 12...