crypto blog

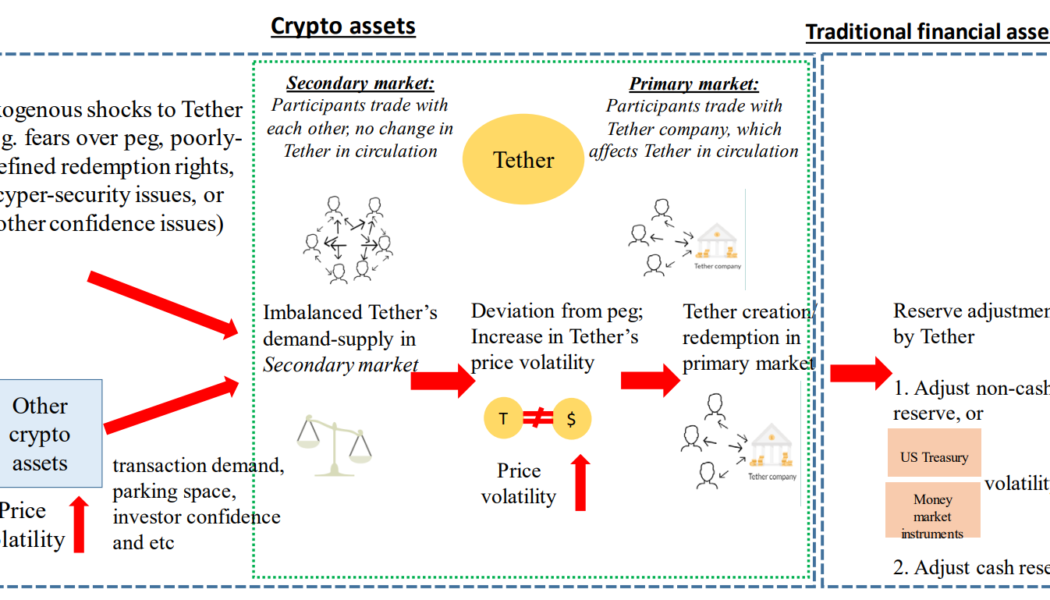

Hong Kong believes stablecoin volatility can spillover to traditional finance

The fall of crypto giants this year reignited questions about the stability of cryptocurrencies and their impact on fiat ecosystems. Hong Kong Monetary Authority (HKMA) assessed the situation and found that the instabilities of crypto assets, including asset-backed stablecoins, can potentially spill over to the traditional financial system. The HKMA assessment on asset-backed stablecoins pointed out the risks of liquidity mismatch, negatively impacting their stability during “fire-sale” events. A fire sale event relates to a momentary price fluctuation when investors can purchase stablecoins cheaper than their market price — a phenomenon noticed during the Terra (LUNA) crash. According to Hong Kong’s central bank, the interconnection of crypto assets has made the crypto ecosystem more vuln...

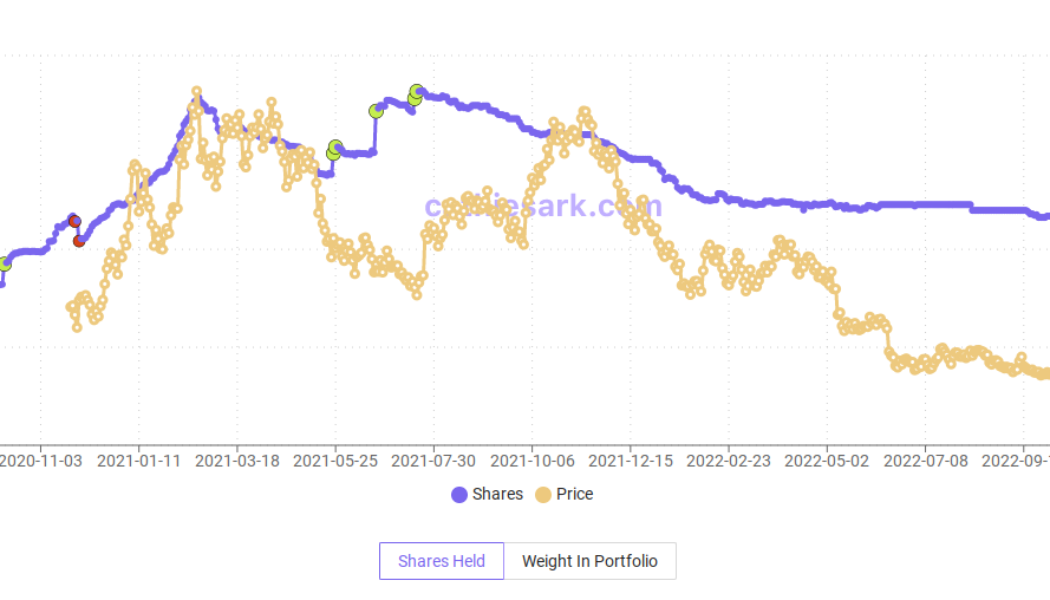

Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

Bitcoin (BTC) firms’ shares are a major “buy” for asset manager ARK Invest in the midst of the FTX meltdown. The latest data confirms that ARK continues to up its holdings of both exchange Coinbase (COIN) and the Grayscale Bitcoin Trust (GBTC). Cathie Wood buys the dip With FTX contagion still rippling through the crypto industry, ARK’s decision to add exposure to two firms caught in the firing line stands out. According to numbers supplied by CEO Cathie Wood’s dedicated tracking resource, Cathie’s Ark, the firm added 176,945 GBTC shares on Nov. 21. These join a larger tranche of 273,327 shares from Nov. 15, that purchase completed just a week after FTX fell apart. ARK Invest GBTC holdings chart (screenshot). Source: Cathie’s Ark Since then, GBTC has come under the spotlight as ...

Senate Banking Committee Democrats warn SoFi about meeting its compliance deadline

Chairman of the United States Senate Banking Committee Sherrod Brown and three other Democratic committee members sent letters Nov. 21 to federal officials and to Anthony Noto, president of SoFi Technology. They expressed concern about the online bank’s efforts to conform to Federal Reserve Board requirements and nonbank digital asset trading activities conducted through SoFi Digital Assets. In the letter to Noto, Sherrod, along with Sens. Jack Reed, Chris Van Hollen and Tina Smith, notes that the Federal Reserve had said that SoFi “is currently engaged in crypto-asset related activities that the Board has not found to be permissible” for a bank holding company (BHC) or financial holding company (FHC). The Federal Reserve granted SoFi the status of financial holding company after its purch...

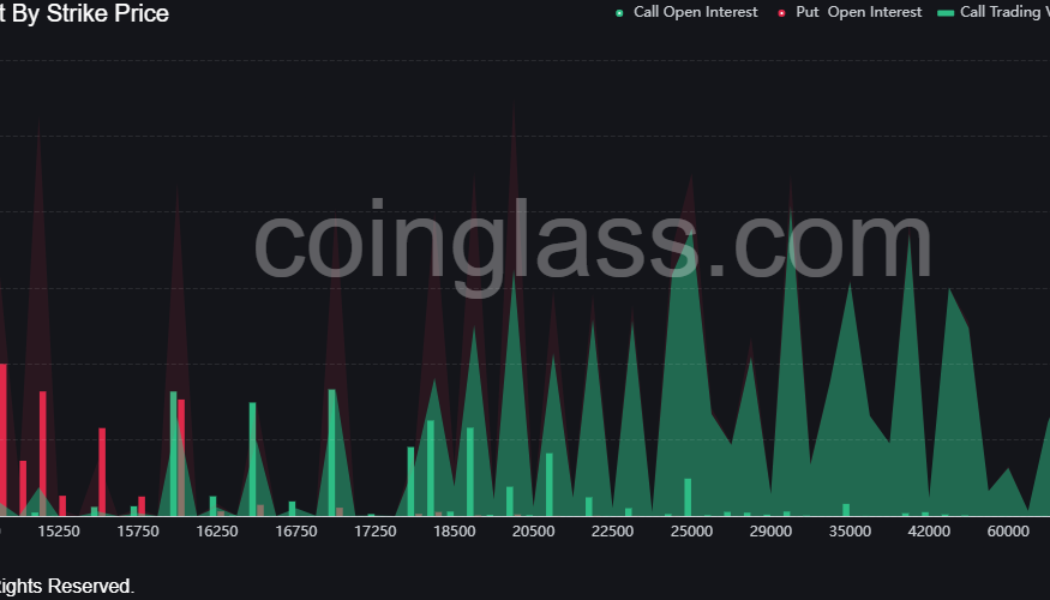

Why is Bitcoin price down today?

Bitcoin (BTC) price accelerated its sell-off on Nov. 21 to hit a new yearly low at $15,654. The move follows a market-wide decline that was catalyzed by investors running for the hills in fear that the FTX-induced contagion would infect every corner of the crypto sector. Stocks also closed the day in the red, with the tech-heavy Nasdaq down 1% and the S&P 500 losing 0.42% on the back of investors’ concerns about rising interest rates. Data from Coinglass shows over $100 million in leverage longs were liquidated on Nov. 20 and Nov. 21 as investors fear an accelerated sell-off if Digital Currency Group (DCG) and BlockFi fail to secure funding and are forced to declare bankruptcy. BTC open interest by strike price. Coinglass Some analysts are betting on Bitcoin price declining below...

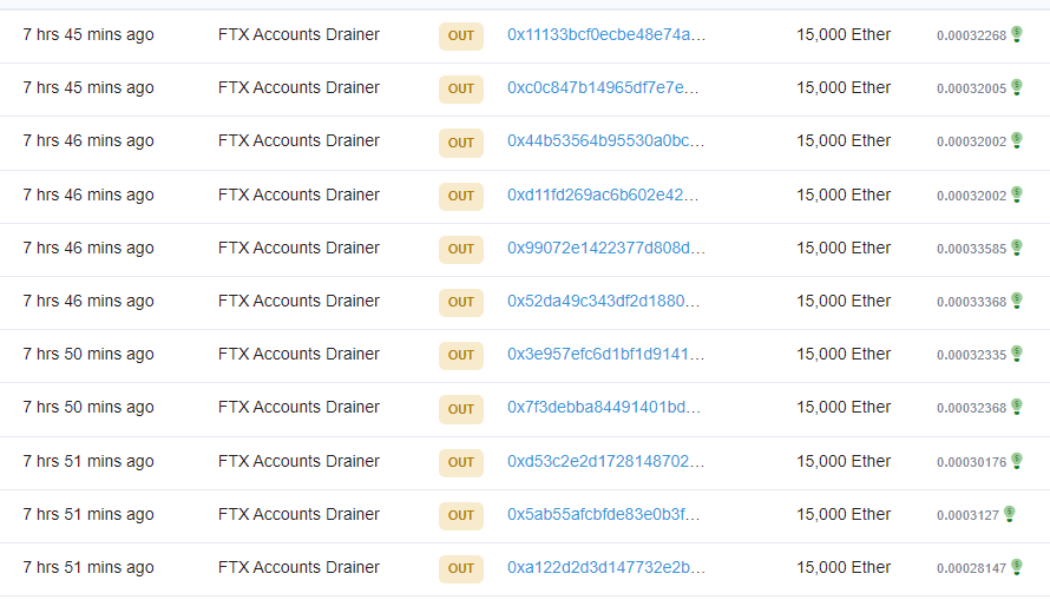

On the move: FTX hacker splits nearly $200M in ETH across 12 wallets

The hacker behind the theft of more than $447 million of crypto from the crypto exchange FTX has been again spotted moving their ill-gotten funds. According to Etherscan data, between 4:11 to 4:17 pm UTC on November 21, the attacker moved a total of 180,000 Ether (ETH) across 12 newly created wallets — each receiving 15,000 ETH. The total amount moved totaled $199.3 million at current prices. Recent transactions from wallet labeled “FTX Accounts Drainer” — Source: Etherscan At the time of publication, the ETH has not moved from any of the 12 wallets. Some in the crypto community suggest the attacker may be planning to subdivide it into smaller and smaller amounts in order to confuse investigators, a process known as “peel chaining,” or they may be planning to use a mixing...

Genesis denies ‘imminent’ plans to file for bankruptcy

Cryptocurrency lending company Genesis has refuted speculation that it is planning an “imminent” bankruptcy filing should it fail to cover a $1 billion shortfall caused by the fall of crypto exchange FTX. The firm has reportedly faced difficulties raising money for its lending unit and told investors it would have to file for bankruptcy, according to a Nov. 21 Bloomberg report citing people familiar with the matter. A spokesperson for Genesis told Cointelegraph that there were no plans to file for bankruptcy “imminently” and that it continued to have “constructive” discussions with creditors. “We have no plans to file bankruptcy imminently. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. G...

WAHED Announces Strategic Partnership With The Creator’s Group

Cranfield, England, 21st November, 2022, Chainwire WAHED is delighted to announce a brand new partnership with Creator’s Group. Bringing years of experience in the real estate and property management sector, the Creators Group can look forward to enjoying a number of advantages that the blockchain can add to this industry. Established by CEO Eng. Ali Al Salman in Riyadh, Saudi Arabia in 2016, Creators Group has established itself as a leader both in local markets and overseas. Serving the best interests of investors, homeowners, corporate clients, developers and landlords, the Creator’s group streamlines investment activities for all those looking to get involved in real estate. Creator’s Group offers the following services to clients in Saudi Arabia and abroad Buy and selling of land and ...

Candy Club Offers 100,000 Candy-USDT Reward for World Cup Celebration

Hong Kong, Hong Kong, 21st November, 2022, Chainwire With over 100,000 candy-USDT in prizes, Candy Club World Cup extravaganza will turn up the heat with crypto winter and give crypto fans a much needed cause for celebration over the next 28 days. Throughout the 4 week tournament in Qatar, Candy Club will give out over 100,000 Candy-USDT to players who sign up and play. With bonuses given out for wager sizes, parlays, pick the winner and more, this is the biggest web3 prize pool to showcase crypto’s love for the world game. From moneylines, totals, proposition bets to world cup futures, Candy Club will offer the widest and most exotic World Cup wager options for the 64 games. As a premier online social crypto gaming platform, Candy Club opens the world of slots, blackjack, roulette, bacarr...

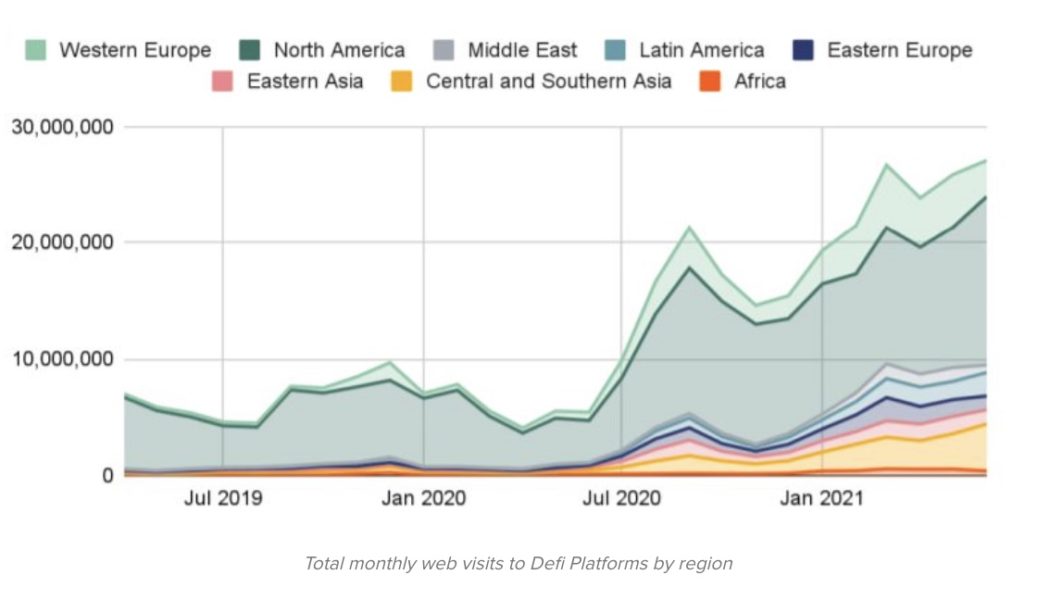

FTX showed the value of using DeFi platforms instead of gatekeepers

The rapid implosion of FTX has led general investors and crypto believers alike to question the validity of crypto and, indeed, predict its end. But, an understanding of history points not to crypto’s demise but rather a move toward new technology and growth. Financial markets move, as Willie Nelson once said, in phases and stages, circles and cycles. Companies develop ideas, grow quickly, ignite unwarranted investor euphoria and then implode — only to seed the ground for the next company, the next idea and the next growth phase. Crypto is no different. In 2010, an unknown person famously used Bitcoin (BTC) to buy pizza. After its initial launch, market capitalization grew to more than $12 billion when Mt. Gox’s 2014 hack and bankruptcy precipitated crypto’s first bear market. The ma...

Bitcoin price levels to watch as traders bet on sub-$14K BTC

Bitcoin (BTC) held steady at the Nov. 21 Wall Street open following a weekly close at levels not seen since late 2020. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering above $16,000 after dipping below the level overnight. Sentiment remained on a knife edge as rumors over crypto business conglomerate, Digital Currency Group (DCG) continued to swirl. Concerns focused on the $10.5 billion investment vehicle, the Grayscale Bitcoin Trust (GBTC), with unsubstantiated talk of possible liquidity problems surfacing across social media. Coinbase, the GBTC custodian, reportedly confirmed its Bitcoin holdings — over 635,000 BTC — were safe and present on the day. GBTC was just one of multiple potential victims...

FTX Japan plans to resume withdrawals by 2023: Report

Crypto exchange FTX’s subsidiary in Japan, FTX Japan, reportedly plans to resume withdrawals by the end of 2022. According to a Nov. 21 report from Japan-based news outlet NHK, FTX Japan has been making preparations to resume withdrawals. Japan’s Financial Services Agency, or FSA, requested the exchange suspend business orders on Nov. 10 prior to FTX Group declaring bankruptcy in the United States for more than 130 associated companies, including FTX Japan Holdings, FTX Japan, and FTX Japan Services. On Nov. 11, the FSA announced that it had taken administrative actions against FTX Japan amid reports its parent company was “facing credit uncertainties.” The orders required FTX Japan to suspend over-the-counter derivatives transactions and related margins as well as new deposits from users ...

My story of telling the SEC ‘I told you so’ on FTX

“I hate to say I told you so” is a phrase oft-repeated but rarely sincere. It’s a delightful feeling to claim credit for warning about a problem in advance. That’s a liberty I’m taking with federal financial regulators at the United States Securities and Exchange Commission. In January of this year, while serving as a member of the SEC Investor Advisory Committee that advises SEC Chairman Gary Gensler on crypto and other matters, I filed a petition with the SEC. I asked them to open a formal public comment about unique issues presented by crypto and other digital assets. I pointed to crypto custody and intermediary conflicts of interest as key issues the SEC should address. I called this fresh start a “Digital Asset Regulation Genesis Block” that would help the SEC improve crypto regulatio...