crypto blog

Get ready to bet on World Cup with crypto

As the world gathers around Qatar to begin one the most spectacular events in the world’s history, the question is, are you ready to follow where the ball leads? Now is the time for the biggest football event in the world. Not only can you watch spectacular matches, but you can also profit from your passion for football by betting with crypto. Why You Should Bet With Crypto The 2022 World Cup will be historic as the first World Cup to be played in the Arab world, and it opens more doors to what you can do to have a fantastic experience this winter. Online gambling can give you that unique experience you have been craving. Today online gambling is even better, with access to choices that give you more opportunities and advantages over betting with the usual fiat currencies. Cryp...

FTX hacker dumps 50,000 ETH, still among top 40 Ether holders

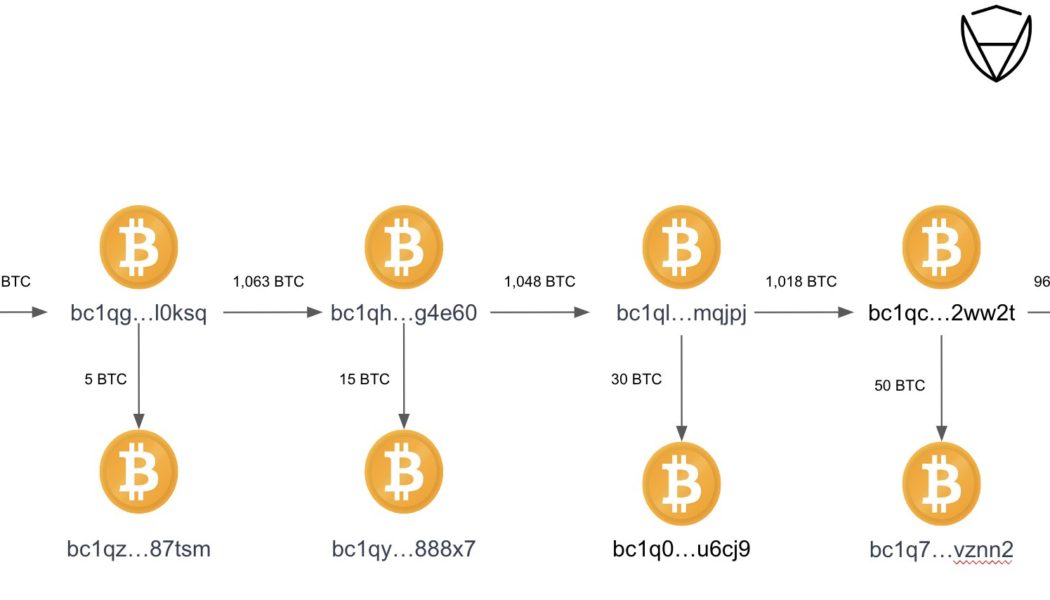

The hacker behind the bankrupt cryptocurrency exchange FTX started transferring their Ether (ETH) holding to a new wallet address on Nov. 20. The FTX wallet drainer was the 27th largest ETH holder after the hack but dropped by 10 positions after the weekend ETH dump. The FTX hacker drained nearly $447 million out of multiple FTX global and FTX US exchange wallets just hours after the crypto exchange filed for Chapter 11 bankruptcy on Nov. 11. Majority of the stolen funds were in ETH, making the exploiter the 27th largest ETH whale. On Nov. 20, the FTX wallet drainer 1 transferred 50,000 ETH to a new address, 0x866E. The new wallet address then swapped the ETH for renBTC (ERC-20 version of BTC) and bridged to two wallets on the Bitcoin blockchain. One of the wallets bc1qvd…gpedg held 1,070 ...

GBTC next BTC price black swan? — 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week still replaying November 2020 after its lowest weekly close in two years. The largest cryptocurrency, just like the rest of the crypto industry, remains highly susceptible to downside risk as it continues to deal with the fallout from the implosion of exchange FTX. Contagion is the world on everyone’s lips as November grinds on — just like the Terra LUNA collapse earlier this year, fears are that new victims of FTX’s giant liquidity vortex will continue to surface. The stakes are decidedly high — the initial shock may be over, but the consequences are only just beginning to surface. These include issues beyond just financial losses, as lawmakers attempt to grapple with FTX and place renewed emphasis on urgent Bitcoin and crypto regulation. With that, it is n...

FTX-owned Liquid exchange pauses all trading after withdrawal halt

Liquid has suspended all trading operations on its platform in line with instructions from FTX Trading, the firm announced on Twitter on Nov. 20. The statement indicates that Liquid exchange paused “all forms of trading” because of the operation of the Chapter 11 process in the Delaware courts. “We have since done so while we assess the situation. We are working through these issues and will endeavor to give a fuller update in due course,” Liquid added. Liquid’s operational halt comes five days after the exchange suspended all withdrawals on its platform, citing compliance with the requirements of voluntary Chapter 11 proceedings. Japan’s Financial Services Agency previously also requested another FTX’s local subsidiary, FTX Japan, to suspend business orders on Nov. 10. As previously repor...

Celsius bankruptcy victims get proof-of-claim deadline from US court

The ongoing case of the Celsius bankruptcy continues as the United States Bankruptcy Court in the southern district of New York State approved a new filing deadline. According to an official document, a deadline has been set for those filing any claims against the former digital assets lender. Any person or entity – which covers individuals, partnerships, corporations, joint ventures and trusts – who wishes to do so must submit a proof of claim by Jan. 3, 2023, 5:00 pm Eastern Time. Celsius itself made a thread on Twitter, informing its former users of the recent court deadline approval, along with step-by-step information as to how claims are filed: We created this video to help explain the claims process: https://t.co/jXmL1VQNxg — Celsius (@CelsiusNetwork) November 20, 2022 T...

FTX fiasco means coming consequences for crypto in Washington DC

On Nov. 11, while the rest of the country was celebrating Veteran’s Day, Sam Bankman-Fried announced that FTX — one of the world’s largest cryptocurrency exchanges by volume — had filed for bankruptcy. Lawmakers and pundits quickly latched onto the rapid disintegration of FTX to call for more regulation of the crypto industry. “The most recent news further underscores these concerns [about consumer harm] and highlights why prudent regulation of cryptocurrencies is indeed needed,” said White House Press Secretary Karine Jean-Pierre. It remains unclear what exactly transpired at FTX. Reports indicating that between $1 billion and $2 billion of customer funds are unaccounted for are deeply troubling. Widespread consumer harm and indications of corporate impropriety only increase the likelihoo...

FTX owes over $3 billion to its 50 biggest creditors: Bankruptcy filing

According to a court filing on Nov. 20, FTX Trading LTD owes its top 50 creditors over $3 billion USD. The document, which was submitted through the United States bankruptcy court for the district of Delaware, was filed as part of the company’s Chapter 11 bankruptcy proceedings. FTX discloses its top 50 creditors are owed $3.1 billion. The largest creditor is owed $226 million. All names were redacted. pic.twitter.com/JGeddvMB7w — Tom Dunleavy (@dunleavy89) November 20, 2022 The filing indicated that FTX owes the top individual alone in excess of $226 million USD, with all others owed sums approximately ranging between $21 million and $203 million. The creditors’ identities are unknown, and their locations undisclosed. The document explained: “The Top 50 List is based on the Debtors’...

Getting funds out of FTX could take years or even decades: Lawyers

While investors are eager to know when they will be able to get their funds back from the now-bankrupt crypto exchange FTX, insolvency lawyers warn it could take “decades.” The crypto exchange, along with 130 affiliates filed for Chapter 11 bankruptcy protection in the United States on Nov. 11. Insolvency lawyer Stephen Earel, partner at Co Cordis in Australia said it will be an “enormous exercise” in the liquidation process to “realize” the crypto assets then work out how to distribute the funds, with the process potentially taking years, if not “decades.” This is due to the complexities that come with cross-border insolvency issues and competing jurisdictions, he said. Earel said unfortunately FTX users are in the queue with everyone else including other creditors, investors and venture ...

Crypto sleuth debunks 3 biggest misconceptions about the FTX hack

On-chain sleuth ZachXBT has shared his findings on what he sees as the three most common misconceptions about the FTX hack — taking to Twitter to correct a “ton of misinformation” about the event and the possible culprits. In a lengthy Nov. 20 post on Twitter, the self-proclaimed “on-chain sleuth” debunked speculation that Bahamian officials were behind the FTX hack, that exchanges knew the hacker’s true identity, and that the culprit is trading memecoins. 1/ I have seen a ton of misinformation being spread on Twitter and in the news about the FTX event so let me debunk the three most common things I’ve seen “Bahamian officials are behind the FTX hack”“Exchanges know who the hacker is”“FTX hacker is trading meme coins” pic.twitter.com/IAtHnpJI44 — ZachXBT (@zachxbt)...

Spain for the win? Top 3 fan tokens to watch during the FIFA World Cup

The FIFA World Cup in Qatar is boosting the value of national soccer team fan tokens despite the cryptocurrency bear market. World Cup Qatar hype boosts fan token prices These digital fan tokens are currently rallying despite the cryptocurrency market downturn, securing up to 170% gains from the Nov. 10 lows. At the core of the massive uptrend is the World Cup, which will be held from Nov. 20 to Dec. 18 in Qatar. Fan tokens are cryptocurrencies that enable fans to engage with and participate in their favorite team’s decisions. Moreover, they create new sponsorship opportunities for sports clubs and national squads outside of traditional revenue sources. Here’s a brief overview of the top gainers in the fan token sector, alongside their technical outlook during th...

SBF’s lawyers terminate FTX representation due to conflicts of interest

Paul, Weiss, the law firm backing FTX CEO Sam Bankman-Fried (SBF) amid bankruptcy, renounced representing the entrepreneur, citing a conflict of interest. The decision to withdraw from representation after SBF’s tweets were found to disrupt the law firm’s reorganization efforts. Starting Nov. 14, SBF published a series of tweets that amassed extensive attention across Crypto Twitter. The move, however, sparked speculations that the cryptic tweets were used to distract bots from noticing concurrently deleted tweets. While no ill-intent could be concluded, Paul, Weiss attorney Martin Flumenbaum believed that SBF’s “incessant and disruptive tweeting” was negatively impacting the reorganization efforts: “We informed Mr. Bankman-Fried several days ago, after the filing of the FTX bankruptcy, th...

Is DOGE really worth the hype even after Musk’s Twitter buyout?

2022 continues to be a year of surprises, with one of the biggest so far being Elon Musk’s decision to acquire social media juggernaut Twitter for a whopping $44 billion. While the takeover has set into motion a whole host of debates — particularly those pertaining to Big Tech censorship — it has also called into question the future of Dogecoin (DOGE), a digital currency of which the billionaire has been a big proponent over the last couple of years. To put things into perspective, just hours before Musk tweeted that “the bird is freed” on Oct. 27, the price of DOGE was hovering around $0.07. However, by Nov. 1, it had surged to $0.16, bringing the total market capitalization of the so-called memecoin to a sizable $21 billion. And while DOGE is currently trading close to $0.08, its 30-day ...