crypto blog

FTX funds on the move as thief converts thousands of ETH into Bitcoin

According to blockchain analysis company Chainalysis, funds stolen from the FTX crypto exchange are now being converted from ETH into Bitcoin. On Nov. 20, Chainalysis took to Twitter to encourage exchanges to freeze these coins, should the thief attempt to convert them into fiat or further obfuscate the assets through other means. 1/ Funds stolen from FTX are on the move and exchanges should be on high alert to freeze them if the hacker attempts to cash out — Chainalysis (@chainalysis) November 20, 2022 Amid the controversial collapse and bankruptcy of FTX, news broke that an unknown actor had stolen 228,523 ETH from the exchange. The ownership of these coins, worth a whopping $268,057,479 USD at time of publication, currently rank the thief as one of the largest owners of ETH in the world...

Next Generation On-chain DEX Aggregator 3Route Launches on Tezos

Zug, Switzerland, 20th November, 2022, Chainwire Powered by the Tezos blockchain, 3Route enables cost-efficient and secure swap transactions across multiple liquidity sources 3Route enables users to cut costs by utilizing most of the Tezos DEXes’ liquidity in one secure swap 3Route, a decentralized exchange protocol launches a next generation on-chain DEX aggregator powered by the energy-efficient blockchain, Tezos. The leading-edge automated routing engine atomically optimizes trades across multiple liquidity sources. 3Route is positioned to provide users with the best rates and low slippages without any service fees. The 3Route algorithm identifies the best trading routes across more than 200 liquidity pools of Tezos supported DEXes including: Sirius DEX, QuipuSwap, Youves, Plenty, Vorte...

American CryptoFed registration at risk as SEC alleges filing anomalies

Disclaimer: The article has been updated based on an official response from American CryptoFed DAO. COO Xiaomeng Zhou explained why the SEC is not legally allowed to issue a stop order. American CryptoFed DAO, the first decentralized autonomous organization (DAO) to get legal recognition in the United States, is at risk of losing its registration after the U.S. Securities and Exchange Commission (SEC) dug up anomalies in the Form S-1 registration statement dated Sept. 17, 2021. The Wyoming Secretary of State’s office recognized American CryptoFed as a legal entity in July 2021, at a time when the organization’s CEO, Marian Orr, believed that “Wyoming is arguably the top blockchain jurisdiction in the world.” However, on Nov. 18, 2022, the SEC instituted administrative proceedings...

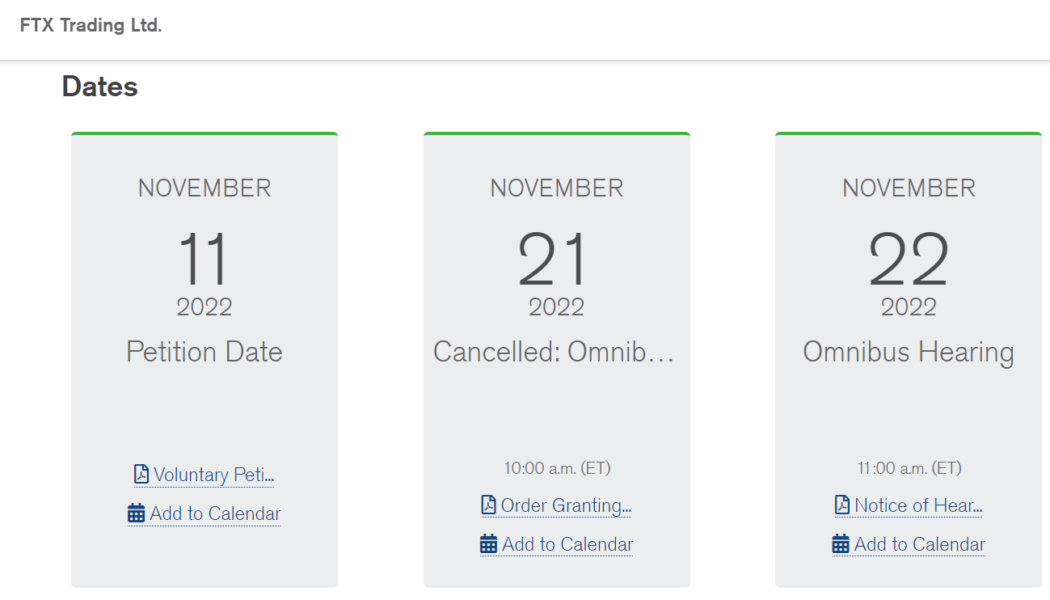

Bankrupt crypto exchange FTX begins strategic review of global assets

As part of the recent bankruptcy filing, the defunct crypto exchange FTX, along with 101 of the 130 affiliated companies, announced the launch of a strategic review of their global assets. The review is an attempt to maximize recoverable value for stakeholders. FTX, at the time led by CEO Sam Bankman-Fried (SBF), filed for Chapter 11 bankruptcy on Nov. 11 after being caught misappropriating user funds. The bankruptcy filing sought to cushion the losses of stakeholders connected to FTX and affiliated companies, a.k.a FTX debtors. 1/ Sharing a Press Release issued early today – FTX launches strategic review of its global assets. Text below (and link). https://t.co/wxz9MYnXrn — FTX (@FTX_Official) November 19, 2022 FTX debtors are in talks with financial services firm Perella Wein...

South Korea investigates crypto exchanges for listing native tokens

Native cryptocurrencies turned out to be the biggest factor contributing to the demise of numerous exchanges and ecosystems this year, most recently during the FTX collapse. Korea’s financial authority, Korea Financial Intelligence Unit (KoFIU), took notice of the same as it launched a probe into crypto exchanges in relation to listing their in-house, self-issued tokens. Crypto exchange FTX and its 130 affiliate firms recently filed for bankruptcy due to a price crash of its in-house token, FTX Token (FTT). While Korean crypto exchanges are barred from issuing native tokens, KoFIU’s probe into the same is to ensure regulatory adherence for investor’s safety, according to a local report. Initial investigations revealed that all crypto exchanges performed lawful operations across South...

GBTC Bitcoin discount nears 50% on FTX woes as investors stock up

The largest Bitcoin (BTC) institutional investment vehicle is coming under suspicion as it trades at a record discount. The Grayscale Bitcoin Trust (GBTC) is the latest Bitcoin industry entity to feel the heat from the debacle over defunct exchange FTX. FTX woes see Coinbase pledge trust in GBTC owner With contagion and fears over a deeper market rout everywhere in Bitcoin and altcoins at present, misgivings are impacting even the best-known — and trusted — crypto industry names. In recent days, it was the turn of GBTC, the long-embattled Bitcoin investment fund, amid problems at a related crypto firm, Genesis Trading. As Cointelegraph reported, parent company Digital Currency Group (DCG), as well as operator Grayscale itself, swiftly sought to reassure investors and the market that its fl...

Decentralization index from Cardano builder, U of Edinburgh will help users understand assets

The University of Edinburgh and Input Output Global (IOG), the builder of the Cardano network, have teamed up to create a blockchain decentralization index, IOG announced on its blog. The new service is the first of its kind and will use a “research-based” methodology developed at the university. The Edinburgh Decentralization Index (EDI) has been in development for several months and was introduced in Edinburgh on Nov. 18, but it is not yet operational, according to IOG: “The first step for the tracker is the creation of research papers detailing decentralization metrics and a considered methodology for compiling them into an index, created by researchers at the University of Edinburgh. It will then operate in the same way as other industry indexes.” When launched, the EDI will...

I predicted FTX’s collapse a month before it happened

The collapse of FTX has shown that where there’s smoke, there’s fire. In a year filled with jaw-dropping unveilings, none compare to the bewildering fall of Sam Bankman-Fried’s FTX exchange. While many were stunned, there were a few tell-tale signs that may have indicated not everything was peachy-perfect over at FTX headquarters. These issues began to compound and, on Oct. 5, I published a detailed commentary about my decision to begin pulling funds out of FTX and short FTT. Im taking all of my capital out of @FTX_Official and going short $FTT FTX has been swinging and missing all year long on so many activations AND Something shady is going on at FTX. Here’s 12 reasons why I’m completely out on the FTX mafia and @SBF_FTX: [1/20] pic.twitter.com/ECrhQn5Rjx — Ishan B (@Ishanb22...

Ripple to consider deals for FTX assets: Brad Garlinghouse

Ripple CEO Brad Garlinghouse is reportedly interested in buying certain parts of collapsed crypto exchange FTX. On the sidelines of Ripple’s Swell conference in London — was held on Nov. 16 and 17 — Garlinghouse told The Sunday Times that former FTX CEO Sam Bankman-Fried called him two days before the company filed for bankruptcy as he sought to round up investors to rescue the business. Our 6th annual #RippleSwell is underway! I took the stage this morning with @cnbcKaren to discuss all things Ripple, crypto utility, macroeconomic factors affecting crypto, and much more. A thread… pic.twitter.com/EDHW3nyka8 — Brad Garlinghouse (@bgarlinghouse) November 16, 2022 The Ripple CEO said that during the call, the two discussed if there were FTX-owned businesses that Ripple “would want to own.” “...

FTX collapse won’t impact everyday use of crypto in Brazil: Transfero CEO

The crumbling of the FTX crypto empire may have damaged Brazilian retail and institutional sentiment toward crypto. However, its impact won’t affect everyday citizens — who will still use crypto for cross-border transactions. Reflecting on the recent fall of FTX, Thiago César, the CEO of fiat on-ramp provider Transfero Group said that the exchange’s fall, like in many countries around the world, has hurt confidence around centralized crypto exchanges and crypto in general. Transfero Group is tied in closely with the Brazilian crypto ecosystem and FTX as it was the fiat on-and-off-ramp provider for the exchange and is also the issuer of Brazilian Stablecoin BRZ, which was listed on the now-defunct exchange. César told Cointelegraph that the collapse of the exchange had removed a...

Singapore police warn investors against FTX phishing scams: Report

The Singapore Police Force has warned investors to be weary of fake websites claiming they can help them recover funds from the now-bankrupt cryptocurrency exchange FTX. On Nov. 19, the police issued a warning about a website claiming to be hosted by the United States Department of Justice that prompts FTX users to log in with their account credentials, local news agency Channel News Asia reported. The website, which was not identified, targets local investors affected by the FTX collapse, claiming that customers “would be able to withdraw their funds after paying legal fees.” The police said the website was a phishing scam designed to fool unsuspecting users into giving away their private information. Local authorities have also warned against fake online articles that promote crypt...

Crypto community reacts to mainstream media coverage of FTX’s implosion: criticism, misogyny and more

The crypto community on Twitter is heavily criticizing the mainstream media for its poor and biased coverage of the collapse of cryptocurrency exchange FTX. In a piece published on Nov. 18 by Forbes Magazine, the CEO of FTX’s affiliate company Alameda Research, Caroline Ellison, has been dubbed “Queen Caroline.” The magazine attempts to portray Caroline Ellison in a neutral light by simply calling her “a math whiz who loves Harry Potter and taking big risks.” The magazine paints her as “a new darling of the alt-right,” which many are simply calling false since former FTX CEO Sam Bankman-Fried and the FTX establishment have allegedly been known as the second-largest donor to the Democrats after billionaire George Soros. Alameda Research CEO Caroline Ellison is a math whiz who loves Ha...