crypto blog

FTX illustrated why banks need to take over cryptocurrency

FTX — the three letters on everyone’s lips in recent days. For those active in the crypto space, it has been a shattering blow as a tumultuous year for crypto nears an end. The repercussions are severe, with over a million people and businesses owed money following the collapse of the crypto exchange, according to bankruptcy filings. With investigations into the collapse ongoing, it will certainly push forward regulatory changes, either via lawmakers or through federal agencies. While regulators may feel relieved that the scandal didn’t occur under their supervision, it highlights that there simply hasn’t been enough action taken yet by regulators across the globe toward crypto exchanges, many of whom would welcome clear frameworks by those in power. Related: Bankman-Fried misguided ...

FTX bankruptcy filing details, Binance’s crypto industry fund and a U.S. CBDC pilot: Hodler’s Digest, Nov. 13-19

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week SBF received $1B in personal loans from Alameda: FTX bankruptcy filing Documentation related to FTX’s bankruptcy proceedings revealed the firm was mismanaged on multiple levels. FTX Group was reportedly composed of multiple companies categorized into four silos. A $1 billion personal loan was reportedly allocated to former FTX CEO Sam Bankman-Fried from one of those silos. The documentation also revealed many other holes and oddities relating to the function of FTX. Several regulators are reportedly looking in...

Binance CEO CZ begins working on Vitalik Buterin’s ‘safe CEX’ ideas

The collapse of numerous major crypto ecosystems in 2022 revealed the urgent need for revamping the way crypto exchanges operate. Ethereum co-founder Vitalik Buterin believed in exploring beyond “fiat” methods to ensure the stability of crypto exchanges, including technologies such as Zero-Knowledge Succinct Non-Interactive Argument of Knowledge (zk-SNARKs). Following a discussion with angel investor Balaji Srinivasan and crypto exchanges such as Coinbase, Kraken and Binance, Buterin recommended options for the creation of cryptographic proofs of on-chain funds that can cover investor liabilities when required, also known as safe centralized exchanges (CEX). Having a safe CEX: proof of solvency and beyondhttps://t.co/AKEweYZfj2 Big thanks to @balajis and staff from @coinbas...

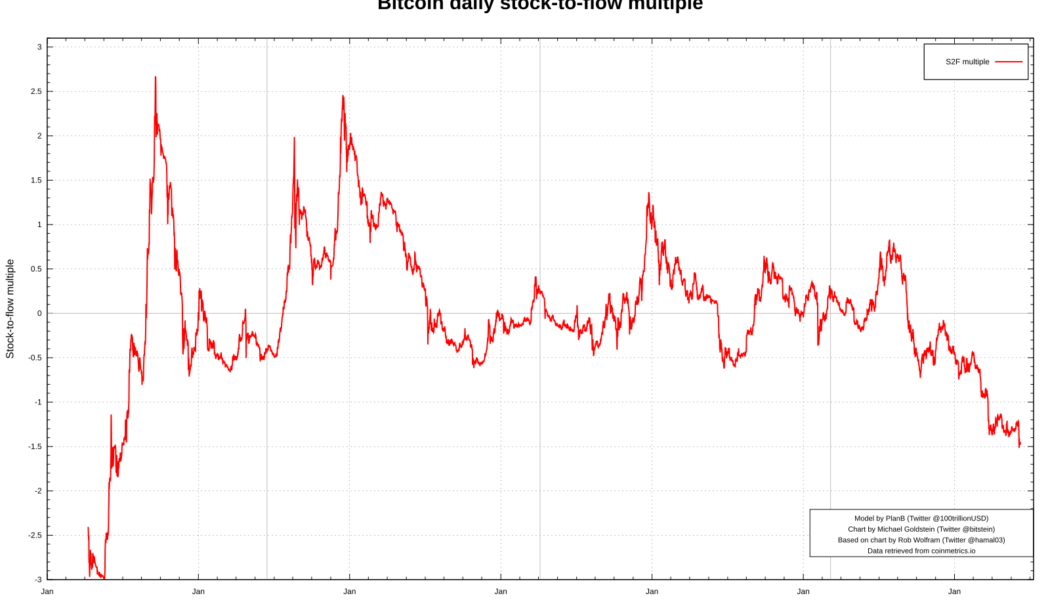

Bitcoin sees record Stock-to-Flow miss — BTC price model creator brushes off FTX ‘blip’

Bitcoin (BTC) is now further than ever from its target price according to the Stock-to-Flow (S2F) model. The latest data shows that BTC/USD has deviated from planned price growth to an extent never seen before. Stock-to-Flow sets grim new record With BTC price suppression ongoing in light of the FTX scandal, an already bearish trend has only strengthened. This has implications for many core aspects of the Bitcoin network, notably miners, but some of its best-known metrics are also feeling the heat. Among them is S2F, which is seeing its price forecasts come under increasing strain — and criticism. Enjoying great popularity until Bitcoin’s last all-time high in November 2021, the model uses block subsidy halving events as the central element in plotting exponential price growth through the ...

What are soulbound tokens (SBTs) and how do they work?

By creating an alternative financial system with extraordinary flexibility and innovation in less than ten years, Web3 has astounded the globe. Economic and cryptographic primitives such as smart contracts and consensus mechanisms have helped to create an open-source system to conduct and authorize financial transactions. However, the decentralized finance (DeFi) ecosystem cannot support straightforward contracts like an apartment lease because it lacks a native Web3 identity. This article aims to demonstrate how even modest advances toward social identity representation with soulbound tokens could circumvent these constraints and reroute Web3 to an authentic, more transformational path. What are soulbound tokens (SBTs)? Projects and use cases focusing on social identities and commun...

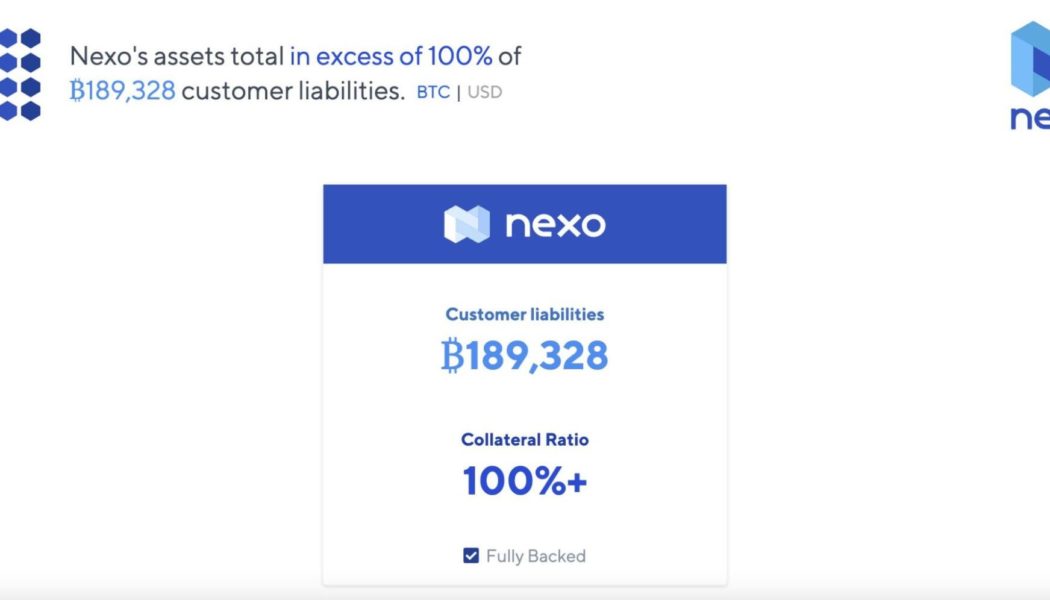

Proof-of-reserves: Can reserve audits avoid another FTX-like moment?

In the wake of the FTX collapse that came about as a result of the now-bankrupt cryptocurrency exchange funneling user funds to mitigate its own risks, crypto exchanges came up with a transparency solution called proof-of-reserves. A practice, which was recently endorsed by Binance CEO Changpeng Zhao, offers a way for exchanges to show provide transparency to users in the absence of clear regulations. All crypto exchanges should do merkle-tree proof-of-reserves. Banks run on fractional reserves. Crypto exchanges should not.@Binance will start to do proof-of-reserves soon. Full transparency. — CZ Binance (@cz_binance) November 8, 2022 Proof of reserves (PoR) is an independent audit conducted by a third party that seeks to ensure that a custodian holds the assets it claims to own on be...

Grayscale cites security concerns for withholding on-chain proof of reserves

Cryptocurrency investment product provider Grayscale Investments has refused to provide on-chain proof of reserves or wallet addresses to show the underlying assets of its digital currency products citing “security concerns.” In a Nov. 18 Twitter thread addressing investor concerns, Grayscale laid out information regarding the security and storage of its crypto holdings and said all crypto underlying its investment products are stored with Coinbase’s custody service, stopping short of revealing the wallet addresses. 6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure. — Grays...

FTX leadership pressed for information by US subcommittee chairman

The former and current CEOs of the bankrupt FTX cryptocurrency exchange have been pressed by the chair of a United States House subcommittee calling for documents relating to the exchange’s finances. “FTX’s customers, former employees, and the public deserve answers,” Raja Krishnamoorthi, Chairman of the Subcommittee on Economic and Consumer Policy wrote in a Nov. 18 letter addressed to both former FTX CEO Sam Bankman-Fried and the exchange’s current CEO John J. Ray III, who took over in the wake of FTX’s bankruptcy filings. Krishnamoorthi added the subcommittee was “seeking detailed information on the significant liquidity issues faced by FTX, the company’s abrupt decision to declare bankruptcy, and the potential impact of these actions on customers who used your exchange.” He...

South Korea seizes $104M from Terra co-founder suspecting unfair profits

While crypto exchange FTX stole the limelight from other fallen ecosystems, South Korean authorities continue their efforts to bring closure to the victims of the year’s first crypto crash — Terraform Labs. Nearly six months after the Terra (LUNA) blockchain was officially halted, South Korean authorities froze approximately $104.4 million (140 billion won) from co-founder Shin Hyun-seong based on suspicion of unfair profits. The decision to freeze Shin’s asset worth over $104 million was approved by the Seoul Southern District Court, which was based on a request from the prosecutors. The claim related to Shin’s involvement in selling pre-issued Terra (LUNA) tokens to unwary investors. Based on suspicion of profiting from unwarranted LUNA sales, the district court froze the allegedly stole...

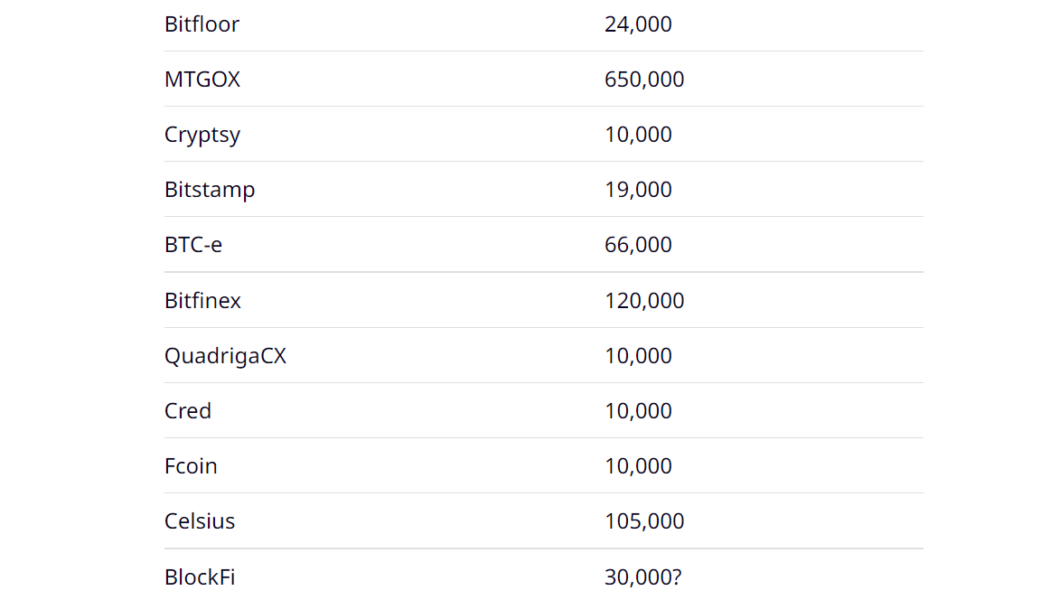

Bitcoin scarcity rises as bad exchanges take 1.2M BTC out of circulation

One of the biggest factors differentiating Bitcoin (BTC) from fiat currency and most cryptocurrencies is the hard limit of 21 million on its total circulating supply. However, the demise of numerous crypto exchanges over the last decade has permanently taken out at least 5.7% (1.2 million BTC) of the total issuable Bitcoin from circulation. The lack of clarity around a crypto exchange’s proof-of-reserves came out as the primary reason for their sudden collapses, as seen recently with FTX. Historical data around crypto crashes revealed that 14 crypto exchanges, together, were responsible for the loss of 1,195,000 BTC, which represents 6.3% of the 19.2 Bitcoin currently in circulation. Bitcoin lost due to defunct crypto exchanges. Source: Casa Blog An investigation conducted by Jameson ...

FTX collapse could trigger ‘appetite’ for harsher regulation, says Andrew Yang

Calls for harsher regulations around cryptocurrencies and digital assets will likely grow louder in the aftermath of FTX’s collapse — something former United States presidential candidate Andrew Yang said isn’t conducive to making America a hotbed for blockchain innovation. Speaking at the Texas Blockchain Summit in Austin on Nov. 18, Yang acknowledged that the bankruptcy of FTX and sister company Alameda Research would make common sense crypto regulation harder to pass in the short term. “I’ve always been in the camp that some intelligent regulation is a good thing. I think it would help the industry mature and make it more mainstream. But, unfortunately, we missed a beat — like a major beat,” he said, referring to the collective failures of FTX, FTX US and Alameda Research. “...

FTX is done — What’s next for Bitcoin, altcoins and crypto in general?

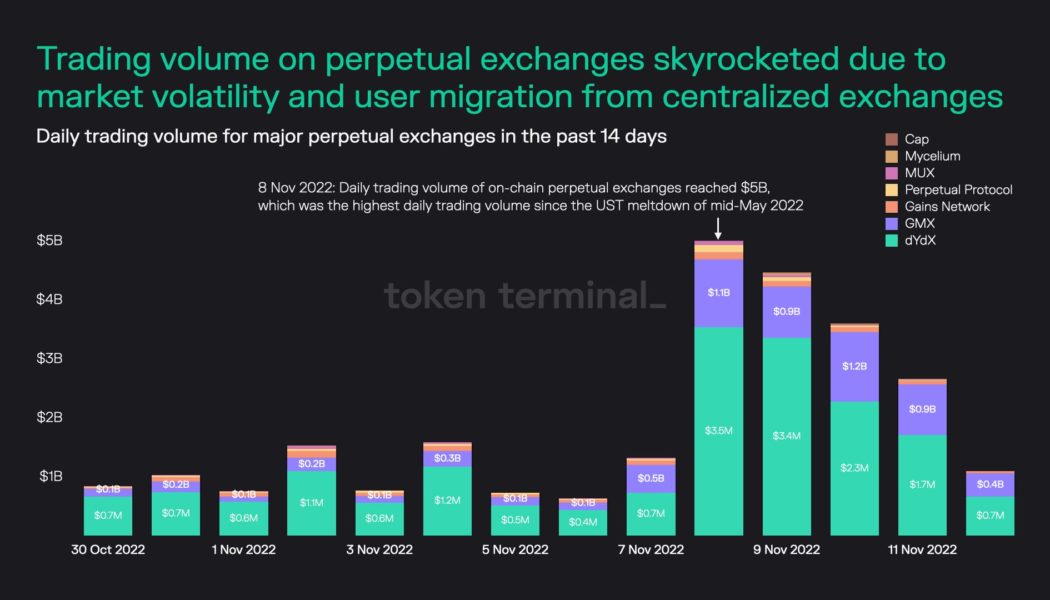

2022 was a tough year for crypto, and November was especially hard on investors and traders alike. While it was incredibly painful for many, FTX’s blowup and the ensuing contagion that threatens to pull other centralized crypto exchanges down with it could be positive over the long run. Allow me to explain. What people learned, albeit in the hardest way possible, is that exchanges were running fractional reserve-like banks to fund their own speculative, leveraged investments in exchange for providing users with a “guaranteed” yield. Somewhere across the crypto Twitterverse, the phrase “If you don’t know where the yield comes from, you are the yield!” is floating around. This was true for decentralized finance (DeFi), and it’s proven true for centralized crypto exchanges and platforms...