crypto blog

Nickel Digital, Metaplex and others continue to feel the impact of FTX collapse

Nickel Digital Asset Management is not the only company feeling the effects of FTX’s collapse and bankruptcy. NFT protocol Metaplex also laid off “several members of the Metaplex Studios team” due to the “indirect impact” from the collapse of crypto exchange FTX. The co-founder and CEO of Metaplex Studios, Stephen Hess, shared in a thread on Twitter: “While our treasury wasn’t directly impacted by the collapse of FTX and our fundamentals remain strong, the indirect impact on the market is significant and requires that we take a more conservative approach moving forward.” (3/7) While our treasury wasn’t directly impacted by the collapse of FTX and our fundamentals remain strong, the indirect impact on the market is significant and requires that we take a more conservative approach moving fo...

The fall of FTX and Sam Bankman-Fried might be good for crypto

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information,” new FTX CEO John Ray III said in a legal filing on Thursday. “From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” Ray, who oversaw Enron’s bankruptcy in 2001, stepped in as CEO shortly after founder Sam Bankman-Fried resigned (and reportedly tried to flee to Argentina, although he denies it). He is absolutely right that FTX was brought down by a complete failure of corporate controls, but in reality, the situation is far from unprecedented. And unless ...

Crypto self-custody a ‘fundamental human right’ but not risk-free: Community

The FTX debacle sparked an increase in calls for crypto self-custody this week, including Binance CEO Changpeng Zhao describing it as a “fundamental human right.” However, some warn that there are still risks involved when opting to hold your digital assets on your own. Vitalik Buterin, co-founder of Ethereum, highlighted on Twitter that while the decentralized finance and self-custody ethos were popular this week, there are still risks involved. According to the Ethereum co-founder, bugs in smart contract code are some of these risks. To avoid them, Buterin also mentioned some tips, such as keeping code simple, audits, formal verification and defense in depth. Apart from smart contract bugs, transferring crypto assets after death also became a topic on social media. Bruce Fento...

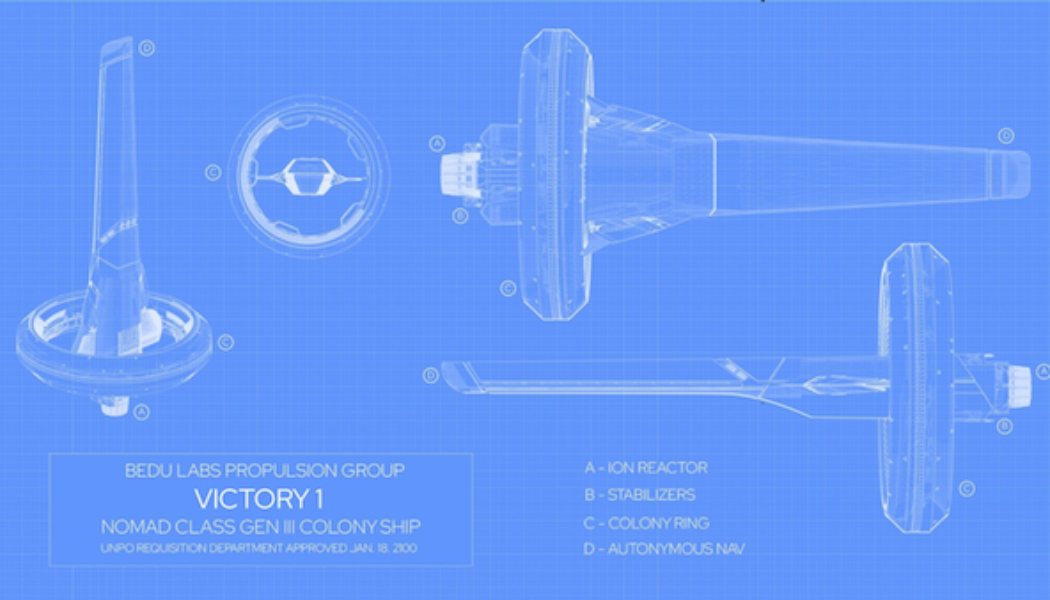

Designing the metaverse: Location, location, location

When it comes to designing a metaverse map, it’s more about the vibe than practicality. From space pods to jungle islands and celebrity neighbors, users want to feel like they are someplace special. What considerations go into designing a metaverse platform? Insiders explain that one key factor is that virtual worlds need to be created with features familiar to their human users — even if such elements, like beaches and nature preserves, offer no practical benefits in virtual reality. Old habits die hard, and people prefer spaces that are familiar and, ideally, neighboring a celebrity like Snoop Dogg. Alexis Christodoulou, a 3D architect who has been creating virtual spaces for 10 years and NFTs for two, recently got the job to design 2117, a space-themed metaverse platform imagining the U...

Bitcoin price may still drop 40% after FTX ‘Lehman moment’ — Analysis

Bitcoin (BTC) saw a fresh rejection at $17,000 on Nov. 18 as nervous markets weathered more FTX fallout. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC gets a $12,000 price target Data from Cointelegraph Markets Pro and TradingView showed BTC/USD failing to flip $17,000 to support — a trend in place for almost a week. The pair, like major altcoins, remained firmly tied down by cold feet over the FTX debacle and its knock-on effects for various crypto businesses. For analysts, the outlook remained just as grim, with already dismal forecasts worsening in light of recent events. “This underperformance of all crypto assets is here to stay until the bulk of uncertainly has cleared up — likely only near the turn of the new year,” trading firm QCP Capital wrote in its latest circ...

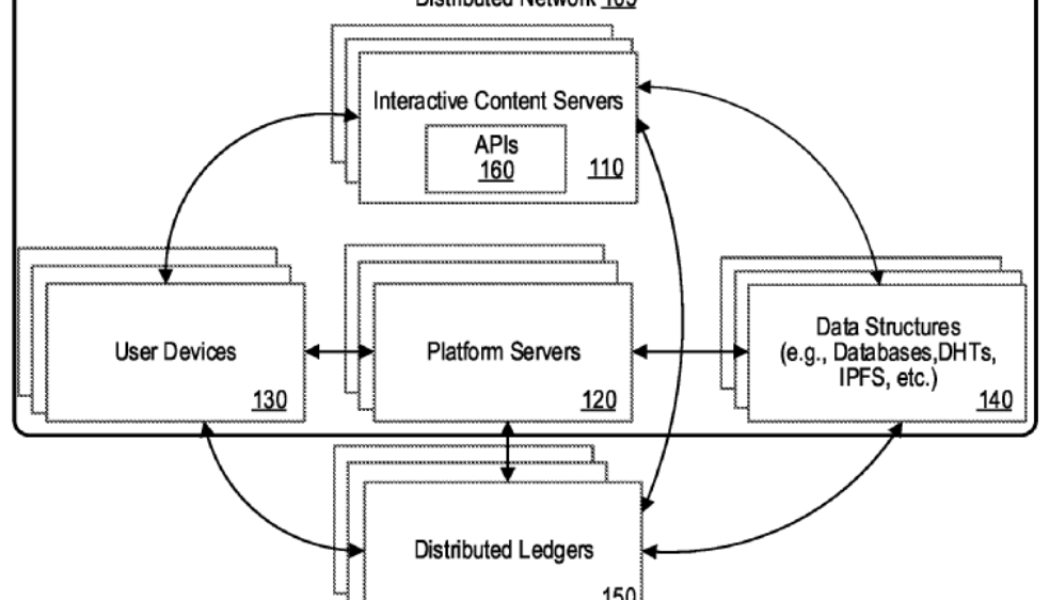

Banks still show interest in digital assets and DeFi amid market chaos

The cryptocurrency sector is the Wild Wild West in comparison to traditional finance, yet a number of banks are showing interest in digital assets and decentralized finance (DeFi). This year in particular has been notable for banks exploring digital assets. Most recently, JPMorgan demonstrated how DeFi can be used to improve cross-border transactions. This came shortly after BNY Mellon — America’s oldest bank — announced the launch of its Digital Asset Custody Platform, which allows select institutional clients to hold and transfer Bitcoin (BTC) and Ether (ETH). The Clearing House, a United States banking association and payments company, stated on Nov. 3 that banks “should be no less able to engage in digital-asset-related activities than nonbanks.” Banks aware of potential While ba...

Crypto scammers are using black market identities to avoid detection: CertiK

Crypto scammers have been accessing a “cheap and easy” black market of individuals willing to put their name and face on fraudulent projects — all for the low price of $8, blockchain security firm CertiK has uncovered. These individuals, described by CertiK as “Professional KYC actors” would, in some cases, voluntarily become the verified face of a crypto project, gaining trust in the crypto community prior to an “insider hack or exit scam.” Other uses of these KYC actors include using their identities to open up bank or exchange accounts on behalf of the bad actors. According to a Nov. 17 blog post, CertiK analysts were able to find over 20 underground marketplaces hosted on Telegram, Discord, mobile apps, and gig websites to recruit KYC actors for as low as $8 for simple “gigs” lik...

Metaverse ‘explosion’ will be driven by B2B, not retail consumers: KPMG partner

The Australian arm of Big Four accounting firm KPMG could soon be holding executive meetings and closing multi-million dollar deals with clients in the Metaverse, with the firm now exploring how the revolutionary technology can transform its business model. In a recent interview, KPMG’s James Mabbott, Partner in Charge at KPMG Futures said the firm sees real potential in the technology creating new and more efficient ways for businesses and consumers to interact with each other: “I think the really interesting applications are going to be in the business to business context […] And I think that I actually think that’s where the money is going to be [even] more so than the consumer driven participation.” Mabbott also stated that virtual interactions on Metaverse platforms could ...

Nifty News: Celebs lose big on BAYC, Meghan and Harry building a metaverse, and more.

Celebrities facing huge losses from BAYC NFTs The hype behind the Bored Ape Yacht Club (BAYC) over the last year resulted in many celebrities investing in the Ethereum-based nonfungible token (NFT) collection with many, such as singer Justin Bieber, paying top dollar. Bieber paid 500 Ether (ETH) for BAYC #3001 on Jan. 29, which at the time was valued at around $1.28 million, while the current top offer on the NFT cracks just over $69,500. According to data from NFT Price Floor, the floor price for the collection has fallen considerably since it peaked at 144.9 ETH on May. 1 this year, which at the time was worth around $396,760, to a current low of 48 ETH, valued at $58,589 at the time of writing. Many other celebs also rode the wave of hype that saw the Yuga Labs made NFTs become a “blue ...

Here’s how the CFTC could prevent the next FTX

FTX declared bankruptcy this month with $900 million in assets against $9 billion in liabilities. Its founder and former CEO, Sam Bankman-Fried, is being questioned by police in the Bahamas, and many customers are unable to withdraw their deposits. Its holdings of Serum’s SRM, a token Bankman-Fried developed, dropped from a value of more than $2 billion to less than $100 million. Things got worse over the weekend after FTX was apparently hacked, leading to the loss of an additional several hundred million. Some commentators are already calling it cryptocurrency’s “Lehman moment,” referring to the 2008 collapse of Lehman Brothers that signaled we were in a financial crisis. In the wake of this epic collapse, Congress should get its head out of the sand and pass the Digital Commodities...

US Sen. Warren and Durbin demand answers from Bankman-Fried and his successor at FTX

United States Senators Elizabeth Warren and Richard Durbin wrote to the former and current CEOs of FTX — Sam Bankman-Fried and John Jay Ray III, respectively — on Nov. 16 to ask for more information on the collapse of the cryptocurrency exchange. They made 13 requests for documents, lists and answers. “The public is owed a complete and transparent accounting of the business practices and financial activities leading up to and following FTX’s collapse,” the lawmakers wrote. They provided a summary of the major press coverage of the unfolding events and reconstructed a timeline from the media sources. Noting “the apparent lack of due diligence by venture capital and other big investment funds eager to get rich off crypto” among the issues they identified, they wrote: “These developments just...