crypto blog

FTX’s new CEO John Ray coldly addresses SBF’s erratic tweets

The new CEO and chief restructuring officer for the bankrupt FTX cryptocurrency exchange, John Ray, has icily responded to the erratic series of tweets from former CEO and founder Sam Bankman-Fried. The official Twitter account of FTX on Nov. 16 tweeted a statement from Ray addressing Bankman-Fried’s recent public statements, reiterating he “has no ongoing role at [FTX], FTX US, or Alameda Research Ltd. and does not speak on their behalf.” (3/3) Mr. Bankman-Fried has no ongoing role at @FTX_Official, FTX US, or Alameda Research Ltd. and does not speak on their behalf. — FTX (@FTX_Official) November 16, 2022 On Nov. 14 Bankman-Fried began a strange Twitter thread that — over the course of 40 or so hours — eventually spelled out “What HAPPENED” across nine tweets, he then went on to claim he...

Esports team TSM suspends $210M sponsorship deal with FTX

Professional esports organization Team SoloMid (TSM) (previously TSM FTX) has suspended its $210 million sponsorship deal with the now-bankrupt FTX crypto exchange “effective immediately” following the cryptocurrency trading platform’s shock collapse last week. The United-States-based esports organization made the announcement in a Nov. 16 tweet to its 2.2 million followers, adding that the decision was made after “monitoring the evolving situation and discussing internally.” We’ve suspended our partnership with FTX effective immediately. pic.twitter.com/u8vQSWnAbX — TSM (@TSM) November 16, 2022 The $210 million deal was put to paper in Jun. 2021, which resulted in the renaming of TSM to TSM FTX. At the time of the deal, the esports organization said it would allocate its new re...

Sam Bankman-Fried says he regrets filing for bankruptcy: Report

The former CEO of FTX Sam Bankman-Fried has expressed deep regret over filing for Chapter 11 bankruptcy last week, calling it his “biggest single fuckup.” In a wide-ranging interview with VOX which was published on Nov. 16, Bankman-Fried reportedly answered questions on a number of topics such as the Nov. 11 Chapter 11 bankruptcy filing, his thoughts on regulators, ethics, how FTX and Alameda “gambled with customer money,” and the FTX hack. According to screenshots of the Twitter conversation between VOX reporter Kelsey Piper and Sam Bankman-Fried, the former FTX CEO said that although he has made multiple mistakes, the biggest one was listening to what people told him to do and filing for Chapter 11 bankruptcy. “I fucked up big multiple times,” Bankman-Fried wrote. “you know what wa...

Bahamian liquidators reject validity of FTX’s US bankruptcy filing

Brian Simms, the court-appointed provisional liquidator overseeing the bankruptcy proceedings of FTX Digital Markets in The Bahamas, has called into question the validity of a Chapter 11 bankruptcy filing by subsidiary FTX Trading and 134 other affiliates in a Delaware court on Nov. 14. In the Nov. 15 document, Simms filed for Chapter 15 Bankruptcy in the United States Bankruptcy Court in the Southern District of New York, which is used when a foreign representative of the debtor seeks recognition in the U.S. for a pending foreign insolvency proceeding. In the filing Simms notes FTX Digital is not part of the Delaware Petition, and says as the provisional liquidator he is the only one, “authorized to take any act including, but not limited to, filing the Delaware Petition,” add...

Ethereum price weakens near key support, but traders are afraid to open short positions

Ether (ETH) has been stuck between $1,170 to $1,350 from Nov. 10 to Nov. 15, which represents a relatively tight 15% range. During this time, investors are continuing to digest the negative impact of the Nov. 11 Chapter 11 bankruptcy filing of FTX exchange. Meanwhile, Ether’s total market volume was 57% higher than the previous week, at $4.04 billion per day. This data is even more relevant considering the collapse of Alameda Research, the arbitrage and market-making firm controlled by FTX’s founder Sam Bankman-Fried. On a monthly basis, Ether’s current $1,250 level presents a modest 4.4% decline, so traders can hardly blame FTX and Alameda Research for the 74% fall from the $4,811 all-time high reached in November 2021. While contagion risks have caused investors to drai...

Terra Labs, Luna Guard commission audit to defend against allegations of misusing funds

The Luna Foundation Guard (LFG) and Terraform Labs (TFL) commissioned a technical audit of their efforts to defend the price of TerraUSD (UST) between May 8 and 12, 2022. The audit was intended to answer “allegations posed in social media” about the fate of funds transferred during efforts to defend the UST dollar peg, according to the LFG blog. The audit found that LFG spent 80,081 Bitcoins (BTC) and $49.8 million in stablecoins (about $2.8 billion at the time) to defend the UST peg. That was consistent with what LFG indicated in its tweets on May 16. In addition, TFL spent $613 million to defend the peg. The audit was conducted by U.S. consulting firm JS Held. LFG concluded that the audit results show there was no misuse of funds and no funds were used to benefit insiders. Furthermo...

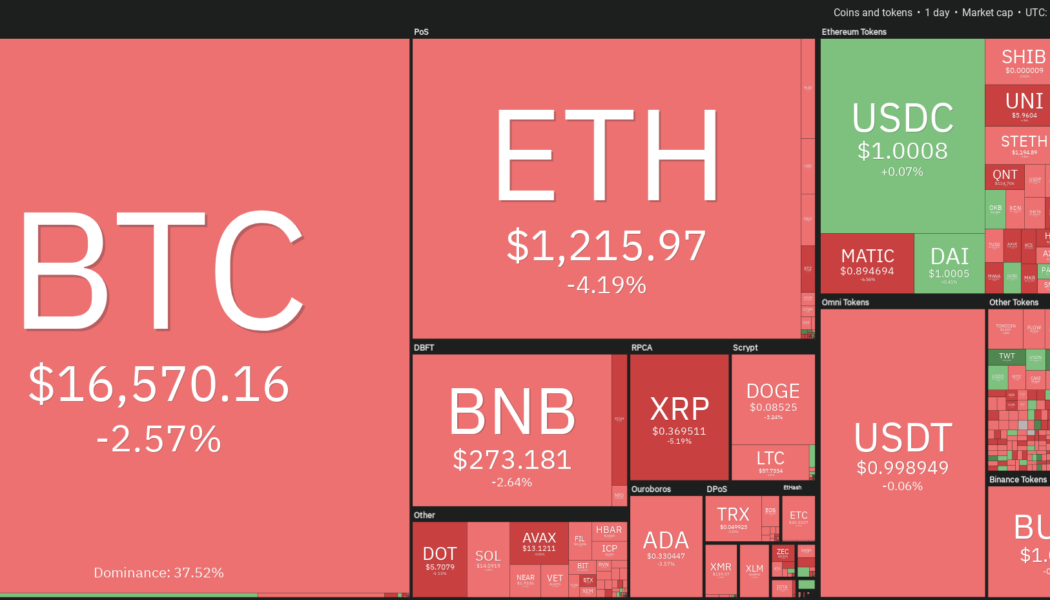

Price analysis 11/16: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, UNI, LTC

The collapse of FTX cryptocurrency exchange has created a liquidity crisis in the crypto space, which could extend the crypto winter through the end of 2023, according to a research report by Coinbase. According to analysts, the FTX implosion could keep the institutional investors at bay because they are even more likely to tread cautiously for some time. The crisis has negatively impacted several crypto-focused companies who have assets stuck on FTX following the company’s bankruptcy filing on Nov. 11. Investors also fear the contagion could spread, causing further damage to the cryptocurrency ecosystem. Daily cryptocurrency market performance. Source: Coin360 Although several investors were rattled by the collapse of FTX, billionaire venture capitalist and serial blockchain in...

Bybit releases reserve wallet addresses amid calls for transparency

Crypto exchange Bybit publicly released the addresses of its largest crypto wallets on Nov. 16. This came on the heels of FTX’s collapse and calls within the industry for greater transparency. Bybit listed the addresses in a press release. Nansen also produced a dashboard of Bybit’s wallets which indicated that over $1 billion of the exchange’s assets are in BTC, USDT, ETH, and USDC. In the press release, the company claimed that these assets represent over 85% of the total cryptocurrency held by the exchange. 1) Disclosing Bybit main users asset wallets (excluding other assets and non consolidated wallets are too many to list ~+20%). Around $1.9B. Bybit is also working on POR solutions such as Merkel Tree on UID level. https://t.co/fAszQVKNJF — Ben Zhou (@benbybit) November 16, 2022 The c...

UAE regulator adopts blockchain to speed up commercial judgments

A judicial authority established by the United Arab Emirates (UAE) Federal Decree has adopted blockchain technology to save time and costs related to the enforcement of commercial judgments. ADGM Courts, an authority that supports the financial regulator Abu Dhabi Global Markets (ADGM), has implemented blockchain technology to help save significant time for the parties in the judicial process. Commercial judgments involve assessing various financial risks and dealing with commercial issues in business. Digitization through blockchain technology will allow courts and parties to immediately access commercial judgments — a move aimed at easing judicial processes for international trade and commerce. Explaining the new development, Linda Fitz-Alan, the registrar and CEO of ADGM Courts, highlig...

Bitcoin miners send less BTC to exchanges since 2020 halving despite FTX

Bitcoin (BTC) miners may be sending more BTC to exchanges this month — but overall, their sales have crashed since 2020. Data from on-chain analytics platform CryptoQuant confirms that daily miner transfers to exchanges have decreased by two thirds or more. Miners cool BTC exchange sales after FTX spike After BTC/USD lost 25% in days last week, existing concerns over miner solvency have heightened. Given their cost basis and rising hash rate, commentators warned that many mining participants may not be able to make ends meet — block subsidies and fees would not be enough to cancel out expenses, chiefly electricity. Network fundamentals, however, tell a curious story — hash rate continues to circle all-time highs and not fall significantly, indicating that at least certain miners are mainta...

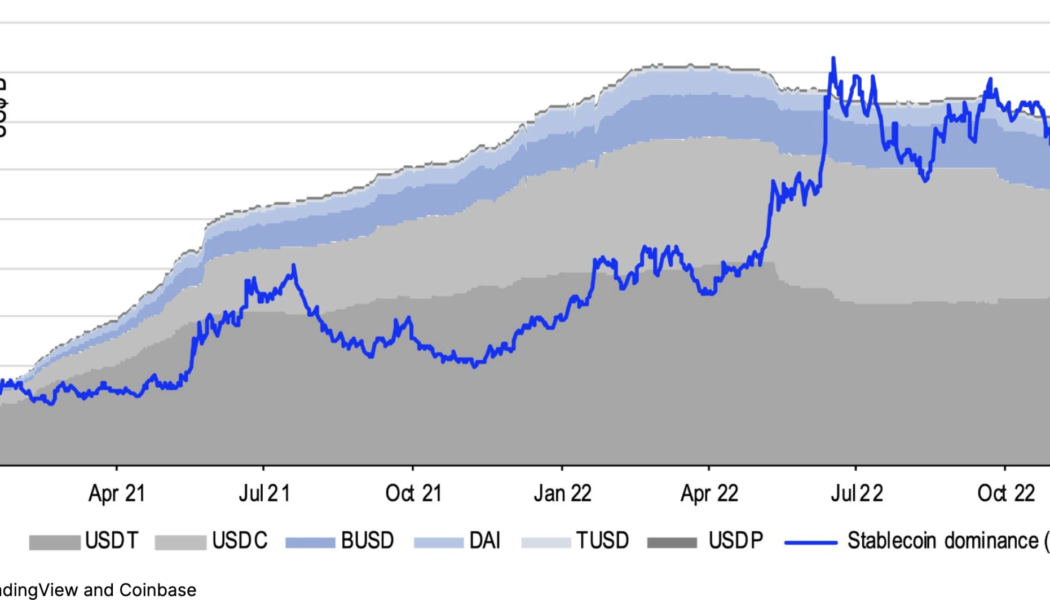

FTX crisis could extend crypto winter to the end of 2023: Report

The FTX crisis has deterred investor confidence and created a liquidity crisis in the crypto market, which could very well extend the crypto winter until the end of 2023, according to a new report. A research report from Coinbase analyzing the fallout in the crypto ecosystem in the wake of the FTX collapse noted that the implosion of the world’s third-largest crypto exchange has created a liquidity crisis that may contribute to an extended crypto winter. Many institutional investors in FTX had their investments stuck on the platform after it filed for bankruptcy on Nov. 11. The FTX implosion has also deterred investors and large buyers away from the crypto ecosystem. Coinbase highlighted that the stablecoin dominance has reached a new high of 18%, indicating that the liquidity crisis might...