crypto blog

Buying Bitcoin ‘will quickly vanish’ when CBDCs launch — Arthur Hayes

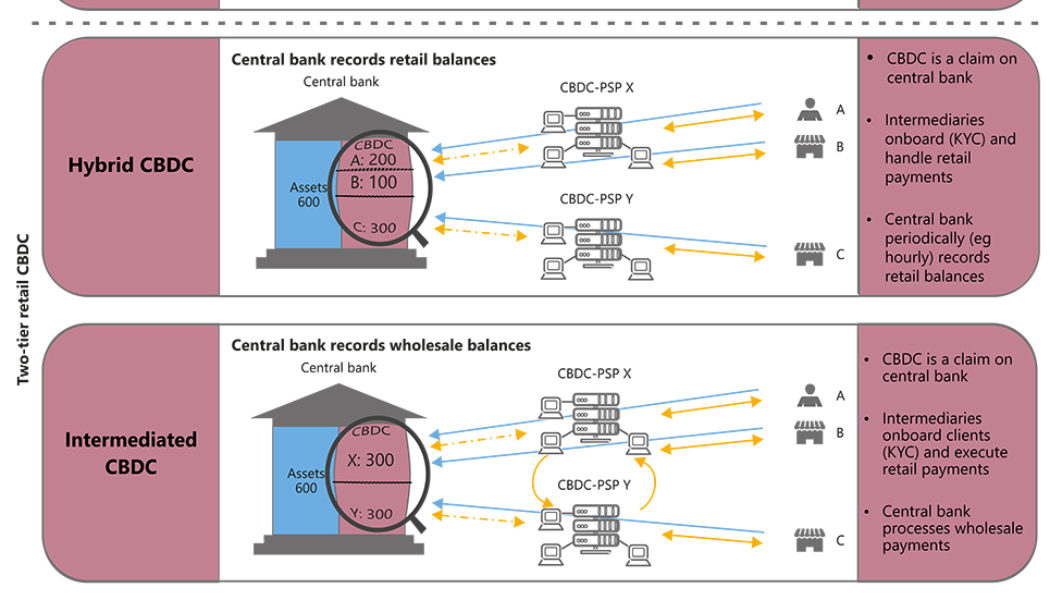

Bitcoin (BTC) holders looking to avoid Central Bank Digital Currencies (CBDCs) may have gained a surprise ally — banks. In his latest blog post, “Pure Evil,” Arthur Hayes, ex-CEO of crypto derivatives platform BitMEX, argued that banks may limit the impact of the CBDC “horror story.” Hayes: Bitcoiners and banks stand against CBDC “dystopia” CBDCs are currently in various stages of development worldwide. Fans of financial sovereignty naturally fear and even despise them, as they imply total government control over everyone’s money and purchasing power — “a full-frontal assault on our ability to have sovereignty over honest transactions between ourselves,” says Hayes. Among opponents of CBDCs are not only Bitcoiners, however. Sharing the cause will likely be the commercial banks ...

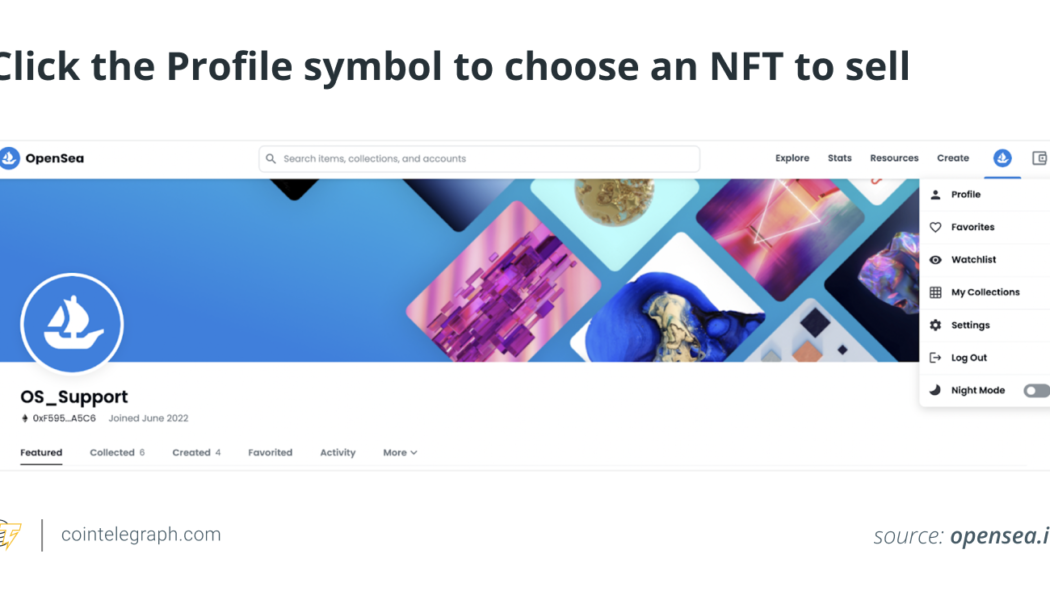

NFT pricing strategy: How to price your NFTs?

Early in 2021, markets for nonfungible tokens (NFTs) started to gain some notoriety, and by the end of March 2021, this new market for digital assets had a total lifetime traded volume of about $550 million. Any digital asset can be an NFT including collectibles, artwork, video game characters, virtual world objects and digitized sports. A blockchain, often one on the Ethereum network, is where an NFT’s ownership is recorded. However, the sale of this digital asset will result in ownership transfers and the blockchain recording of the crypto payment received. This isn’t to say that NFTs and cryptocurrencies are the same. In general, one of the fundamental properties of cryptocurrencies and fiat money is fungibility or interchangeability, whereas the nonfungibility characteristic of N...

Traders expect 200% upside from MATIC, but does Polygon network data support that?

In the past year, Polygon (MATIC) has focused on growing their list of high-profile partners which includes luminaries like Disney, Starbucks and Robinhood. The recent announcements of partnerships with both Instagram and JPMorgan have speculators pushing the token price up nearly 200%. In addition to partnerships, blockchain adoption through network usage is important to analyze. Blockchain adoption can be analyzed by looking into daily active users of the blockchain, protocols using the technology, number of transactions and total locked value. Total value locked on Polygon rises above $1B Total value locked (TVL) is one cryptocurrency indicator used to assess the market’s sentiment towards a particular blockchain. TVL on Polygon requires utilizing the MATIC blockchain and locking ...

Joe Biden unhappy with Elon Musk for buying a platform that “spews lies”

The relevance of social media platforms in swaying global politics was first highlighted with the rise of Facebook (rebranded later to Meta), which was accused of manipulating information based on user demographics. Twitter, which was recently acquired by Elon Musk, got the short end of the stick as US President Joe Biden accused the website of spewing lies. Biden attended a fundraising event in Chicago for upcoming elections, wherein he called out Elon Musk for purchasing Twitter. He stated: “Now what are we all worried about? Elon Musk goes out and buys an outfit that sends and spews lies all across the world.” While the Biden administration has previously clarified its stance to promote the suppression of hate speech and misinformation on social media platforms, the president highlighte...

Bitcoin could become the foundation of DeFi with more single-sided liquidity pools

For many years, Ethereum reigned supreme over the decentralized finance (DeFi) landscape, with the blockchain serving as the destination of choice for many of the most innovative projects serving up their take on decentralized finance. More recently, however, DeFi projects have started to crop up across multiple ecosystems, challenging Ethereum’s hegemony. And, as we look to a future in which the technical problem of interoperability is solved, one unlikely contender for the role of DeFi power player emerges — Bitcoin (BTC). In that future, Bitcoin plays potentially the most important role in DeFi — and not in a triumphalist, maximalist sense. Rather, Bitcoin can complement the rest of crypto as the centerpiece of multichain DeFi. The key to this is connecting it all together so that Bitco...

Bitcoin is now less volatile than S&P 500 and Nasdaq

Bitcoin (BTC) held gains above $21,000 into Nov. 5 as the U.S. dollar posted a rare major daily decline. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Dollar dives 2% as risk assets recover Data from Cointelegraph Markets Pro and TradingView showed BTC/USD building on prior strength to hit highs of $21,473 on Bitstamp — a new seven-week high. The pair had benefited from the latest United States economic data, while the dollar conversely suffered. The U.S. dollar index (DXY) lost 2% in a day for the first time in years, helping fuel a risk asset rally. U.S. dollar index (DXY) 1-day candle chart. Source: TradingView “And, just like that, Bitcoin took out all the highs, volume is increasing and it’s back above $21K,” Michaël van de Poppe, CEO and founder of trading firm Eig...

The market is hot, but Solana is not — Data explains why SOL price is lagging

Solana (SOL) has been in a steady downtrend for the past 3 months, but some traders believe that it may have bottomed at $26.80 on Oct. 21. Lately, there’s been a lot of speculation on the causes for the underperformance and some analysts are pointing to competition from Aptos Network. Solana price at FTX, USD. Source: TradingView The Aptos blockchain launched on Oct. 17 and it claims to handle three times more transactions per second than Solana. Yet, after four years of development and millions of dollars in funding, the debut of the layer-1 smart contract solution was rather unimpressive. It is essential to highlight that Solana presently holds an $11.5 billion market capitalization at the $32 nominal price level, ranking it as the seventh largest cryptocurrency when excluding sta...

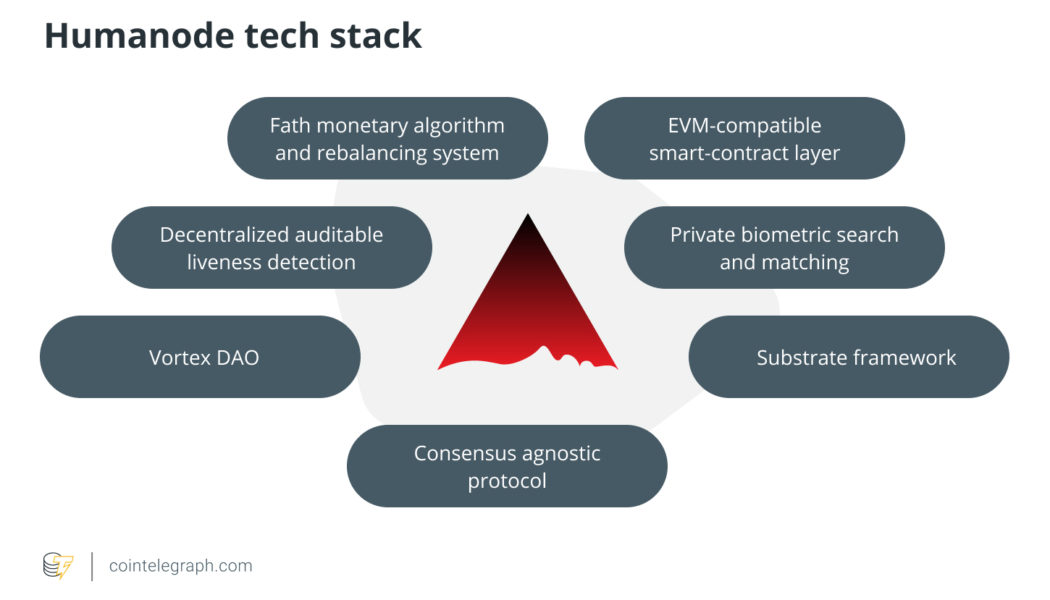

What is Humanode human-powered blockchain?

Humanode is a project that gracefully combines different technological stacks including blockchain and biometrics. Humanode tech encompasses a bunch of layers such as a blockchain layer represented by a Substrate module: a biometric authorization module based on cryptographically secure neural networks for the private classification of three-dimensional (3D) templates of users’ faces, a private liveness detection mechanism for identifying real human beings, a Vortex decentralized autonomous organization (DAO) and a monetary algorithm named Fath, where monetary supply reacts to real value growth and emission is proportional. Let’s look at them in more detail. Substrate framework Humanode is a layer-1 blockchain whose architecture lies on the Substrate open-sour...

Musk continues Twitter overhaul, Instagram to host NFT tools and JPMorgan makes public blockchain trade: Hodler’s Digest, Oct. 30-Nov. 5

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week JPMorgan executes first DeFi trade on public blockchain A cross-border currency swap was carried out on a public blockchain by JPMorgan as part of a pilot program involving the Monetary Authority of Singapore’s (MAS) Project Guardian, SBI Digital Asset Holdings, Oliver Wyman Forum and DBS Bank. The Polygon blockchain hosted the swap between tokenized deposits of the Japanese yen and the Singapore dollar, helped by smart contract technology from Aave. UnionBank of the Philippines launches Bitcoin and Ethereum t...

Automation opens up pathway to a simplified, more user-friendly DeFi

Few doubt the potential that DeFi has to redefine crucial aspects of finance for all. But, as it stands, using DeFi platforms and protocols is often time consuming and anything but easy. One of the biggest draws of DeFi are the yields users can earn on farming and staking protocols. However, the yields on offer are constantly changing, meaning crypto enthusiasts need to stay locked to their screens to ensure they aren’t missing out. Given the 24-hour nature of this fast-moving industry, keeping on top of things is often easier said than done. Some protocols are also pretty difficult to use, requiring users to monitor a plethora of different pools. And even when you find the best returns that the market has to offer, the process of manual compounding can be quite tedious. In search of...