crypto blog

Polygon Studios’ Ryan Watt talks Web3’s core principles and fairer internet

The year 2022 in crypto was eventful in many ways. However, the negative impacts of a bear market dampened the excitement around the blockchain upgrades that significantly brought crypto ecosystems closer to the future of finance. For Bitcoin, it was the Taproot soft fork upgrade, which was aimed at improving the scripting capabilities and privacy of the Bitcoin network. Ethereum underwent the Merge upgrade to transition from a proof-of-work to a proof-of-stake (PoS) consensus mechanism. Leading decentralized Ethereum scaling platform Polygon kicked off the year with mainnet upgrades based on Ethereum Improvement Proposal (EIP)-1559, otherwise known as the London hard fork. The upgrade was accompanied by Polygon (MATIC) token burning and better fee visibility. On Jan. 25, Ryan Wyatt joined...

What is crypto copy trading and how does it work?

Cryptocurrency trading is a complex skill requiring extensive knowledge of fundamental and technical analysis and the cryptocurrency ecosystem as a whole. As most traders lack the capability to develop a winning trading strategy, they struggle to learn a multitude of skills needed to be a successful investor (who knows how to swim through the steep tides of the waters). Do amateur traders have no hope, then? Are they left to fend for themselves, speculating about the prices and taking to stride the sharp ups and downs of the cryptocurrency industry? Thankfully, there are tools that help such traders explore the potential of the cryptocurrency industry, simplifying over-complex cryptocurrency trading by following expert traders. This article discusses what cryptocurrency copy trading is, ho...

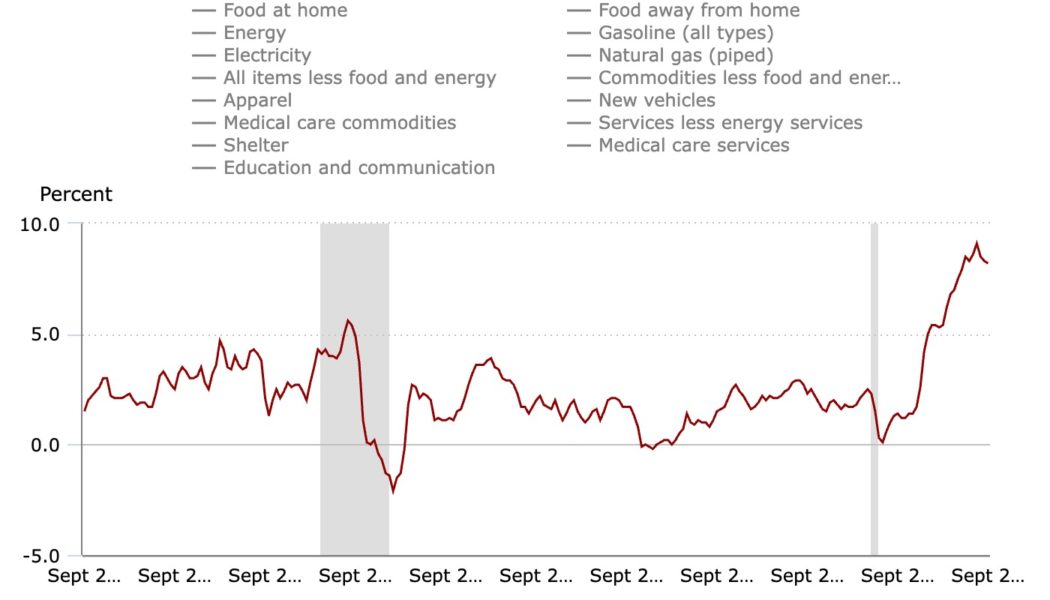

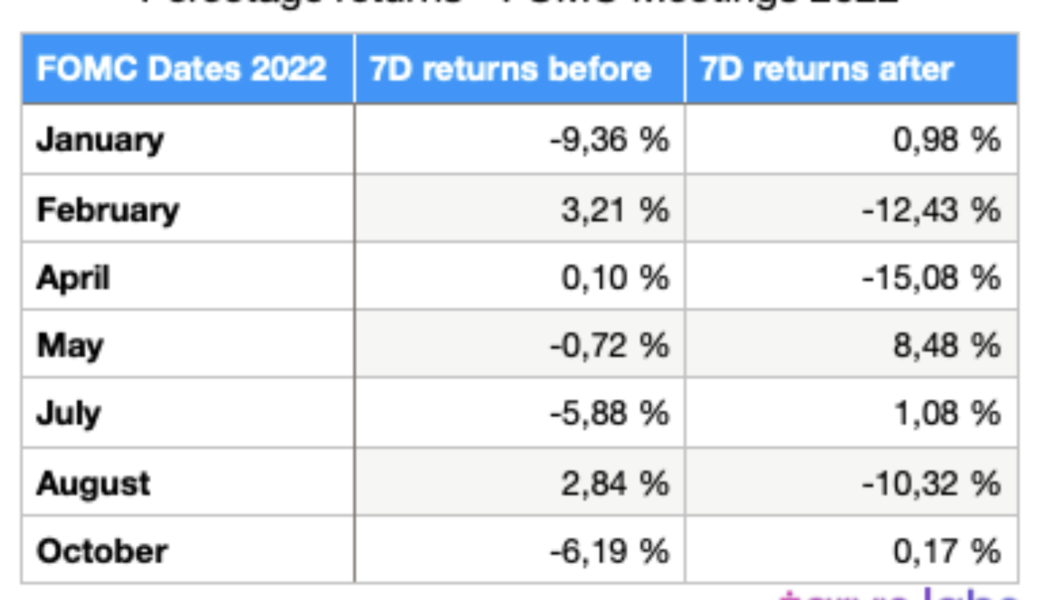

Inflation is killing us; cryptocurrency alone cannot beat it

Much like a pandemic, inflation has spread throughout the world, clouding the future with dark uncertainty. Disagreement over how to best manage soaring prices in the United Kingdom nearly caused its economy to collapse and subsequently led to the resignation of Prime Minister Liz Truss after just 44 days in office. Currently, at least 10 emerging economies are hyperinflationary, with more expected to follow. And the Federal Open Market Committee (FOMC), the part of the U.S. Federal Reserve responsible for keeping prices stable, just announced higher interest rate hikes in the midst of a return to positive gross domestic product — signaling continuing inflation troubles ahead. The worldwide struggle to reduce inflation is tangible evidence that yesterday’s central bank tools are inad...

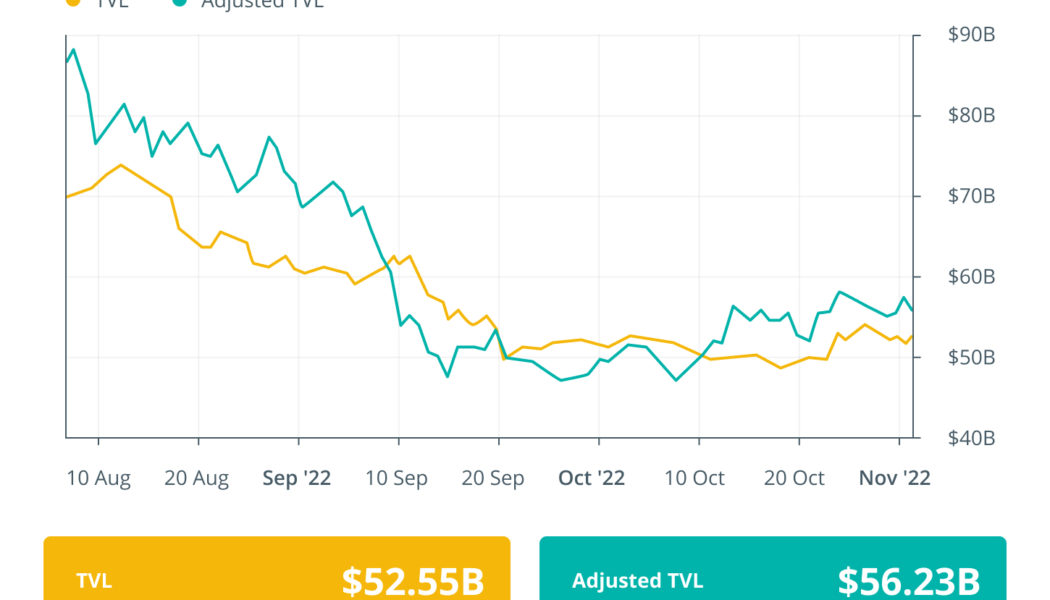

JPMorgan executes first DeFi trade on a public blockchain: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The first week of November saw the institutionalization of DeFi markets as major international banks and financial institutions executed and completed their first DeFi transactions. The global financial giant JP Morgan completed its first-ever cross-border transaction using DeFi on a public blockchain with the help of the Monetary Authority of Singapore’s (MAS) Project Guardian. DBS Bank started a trading test of foreign exchange (FX) and government securities using permissioned DeFi liquidity pools. Apart from JPMorgan and DBS Bank, the Bank for International Settlements also said that automated market-making tec...

FX spot settlement in 10 seconds: NY Fed releases results of wholesale CBDC research

The Federal Reserve Bank of New York Innovation Center has released a report on the first phase of its Project Cedar wholesale central bank digital currency (wCBDC) Nov. 4. The Fed still has no plans to issue a CBDC, NY Fed executive vice president and head of markets Michelle Neal said at a presentation in Singapore, but it has investigated foreign exchange spot settlement “from the perspective of the Federal Reserve.” Its prototype wCBDC, intended for use by financial institutions rather than the public, was able to implement transactions dramatically faster and more securely than the current standard. A foreign exchange spot transaction was chosen as the use case for the 12-week first phase of Project Cedar because of its relative simplicity and that type of transaction is often used as...

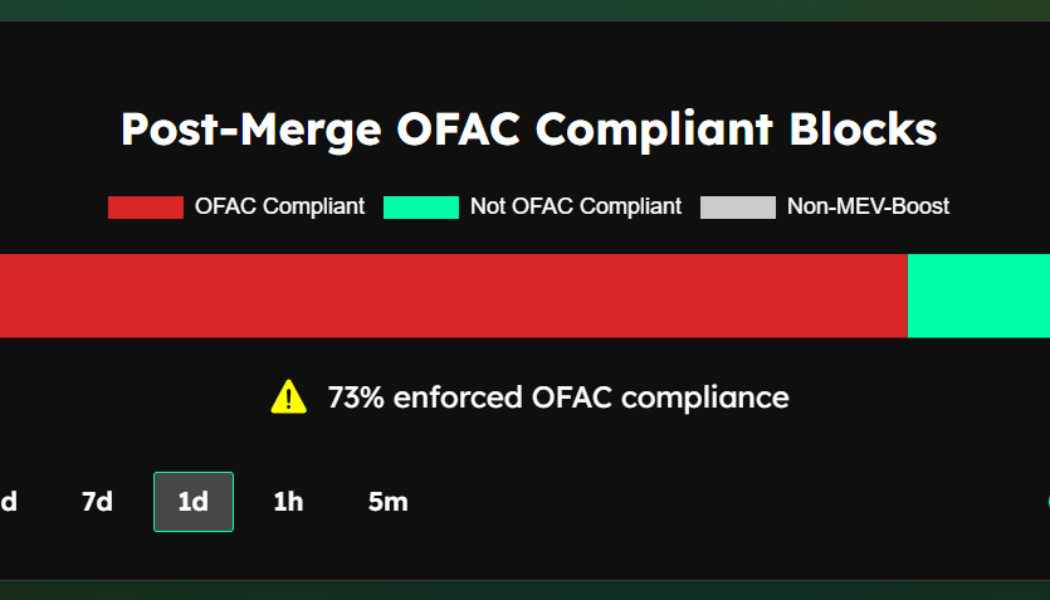

Ethereum inches even closer to total censorship due to OFAC compliance

Considering that protocol-level censorship is deterrent to the crypto ecosystem’s goal of highly open and accessible finance, the community has been keeping track of Ethereum’s growing compliance with standards laid down by the Office of Foreign Assets Control (OFAC). Over the last 24 hours, the Ethereum network was found to enforce OFAC compliance on over 73% of its blocks. Ethereum sporting 73% OFAC-compliant blocks. Source: mevwatch.info In Oct. 2022, Cointelegraph reported on the rising censorship concerns after 51% of Ethereum blocks were found compliant with OFAC standards. However, data from mevWatch confirmed that the minting of OFAC-compliant blocks on a daily basis has grown to 73% as of Nov. 3. Ethereum’s PFAC compliance trend. Source: mevwatch.info Some MEV-Bo...

OCC makes its staff available for fintech-related discussions

The United States Office of the Comptroller of the Currency, or OCC, has announced its representatives will be available on a one-to-one basis to discuss financial technology. In a Nov. 3 announcement, the OCC said entities considering fintech products and services, partnerships with banks, or concerns “related to responsible innovation in financial services” have the opportunity for one-hour meetings with its staff between Dec. 14-15. The government office said it will screen requests and proposed topics of discussions and announce virtual meeting times. The OCC announcement followed the department saying it planned to establish an Office of Financial Technology starting in 2023 in an effort to gain a “deep understanding of financial technology and the financial technology landscape.” The...

CBDCs are a declaration of war against the banking system claims economist

CBDCs are a declaration of war against the banking system, Richard Werner — development economist and professor at De Montfort University — told Cointelegraph at Web Summit on Nov. 4. Known for his quantitative easing theory, published almost 30 years ago, Werner is an advocate for a decentralized economy. In an exclusive interview with Cointelegraph’s editor-in-chief Kristina Lucrezia Cornèr, he discussed the challenges that surround decentralization, the role of central banks, and how blockchain can help promote transparency in economies. This interview was part of Cointelegraph’s extensive coverage at Web Summit in Lisbon — one of the world’s leading tech conferences. Cointelegraph: Do you think that a decentralized financial system is actually possible? Richard Werner:...

Web3 Foundation makes bold claim to SEC: ‘DOT is not a security. It is merely software’

The entity supporting research and development of Polkadot as well as overseeing fundraising efforts for the blockchain has argued that the United States Securities and Exchange Commission should not consider the DOT token a security under its regulatory purview. In a Nov. 4 blog post, the Web3 Foundation Team’s chief legal officer Daniel Schoenberger said Polkadot’s native token (DOT) had “morphed” and was “software” rather than a security. Schoenberger said the claim was “consistent with the views” it had shared with the SEC following discussions it began in November 2019. “While the Polkadot vision had not contemplated that the blockchain’s native token would be a security, we understood that the SEC’s view was likely to be that the to-be-delivered token would be a security, at least at...

WeSleep Unveils its ‘Sleepie’ NFTs

Vilnius, Lithuania, 4th November, 2022, Chainwire Web3 app WeSleep has launched with the promise of daily rewards for users who pursue a healthy and active lifestyle. Dubbed a sleep-to-earn app, WeSleep utilizes clever tokenomics to incentivize positive behaviors. WeSleep is a sleep-to-earn Web3 app that incentivizes users to pursue a healthy and active lifestyle on a daily basis. • A Sleepie is a unique NFT that can be bought to allow rewards, in the form of $ZZZ tokens, to be passively generated while asleep. These tokens can be swapped to $BUSD using the in-app swap system. Or a user may choose to invest his earnings inside a staking pool to generate additional rewards. • Users can augment their earnings by leveling up their Sleepies or their profile itself. To level up a profile, a cer...